Archive for April, 2011

-

The Truth About JPM’s Dividend Plans

Eddy Elfenbein, April 14th, 2011 at 10:26 amSometimes I’m simply baffled by what gets reported in the news. Yesterday, JPMorgan Chase ($JPM) reported good earnings and at one point, the stock got over $47 per share.

The shares, however, slid during the rest of the day and close at $46.25. The stock is down close to $1 today.

The media reported that the stock fell after Jamie Dimon said not to expect another dividend increase. Here’s what the FT had to say:

Shares in the group were initially up 1.4 per cent, but retreated after Jamie Dimon, the chief executive, said the company would see no further dividend increases for several quarters. The shares finished 0.8 per cent lower at $46.25.

Let’s make something perfectly clear — there was absolutely nothing negative in what Dimon had to say. JPM has historically increased its dividend for Q1, and that’s exactly what they did. They raised the dividend from five cents per share to 25 cents per share.

Dimon said they need approval for another increase. He didn’t at all say it had to do with a lack of profits. Also, whether they pay the dividend or not has zero baring on the stock’s return to investors.

The only reason for the stock to be down is if there was some reason to believe that the profits would be down, and Dimon said nothing like that.

This is from TheStreet:

“I wouldn’t look for a dividend increase the next couple of quarters,” Dimon said on the earnings call, in response to an analyst question. “We would have permission to do a little bit more on the dividend, but we would have to ask regulators for an increase in this environment.”

That’s it. That’s all he said. If you knew nothing about JPM but its dividend history, you wouldn’t expect another dividend increase so soon. But you’d probably expect one a year from now. How could anyone read something negative into that? I have no idea but sometimes on Wall Street, the rule is sell first and ask questions later.

-

The Cyclicals Are Trailing Again

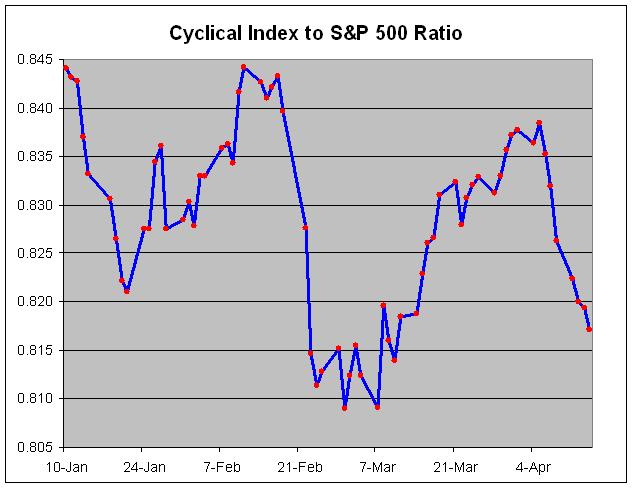

Eddy Elfenbein, April 14th, 2011 at 10:11 amI often talk about looking at the relative performance of cyclical stocks versus the rest of the market. I think this is an important indicator of what the market is thinking.

The ratio of the Morgan Stanley Cyclical Index ($CYC) to the S&P 500 reached a top in early January and another in mid-February. The CYC is trailing the market for the seventh day in a row.

This is very important because these cycles tend to last for years once they get started. If the Dow had kept pace with the CYC since the March 2009 low, it would be close to 25,000 today.

-

Ford Expands Recall of F-150

Eddy Elfenbein, April 14th, 2011 at 9:47 amShares of Ford ($F) are down again today. The company just announced that it’s expanding its recall of F-150 trucks due to problems with the airbag.

The recall covers trucks from the 2004 through 2006 model years. Ford’s F-Series pickup is the top-selling vehicle in America.

The company in February agreed to recall more than 150,000 of the trucks. But on Thursday U.S. safety regulators said that Ford will add to the recall because the trucks’ air bags can go off unexpectedly and injure drivers.

-

2010 Leucadia Shareholder Letter

Eddy Elfenbein, April 14th, 2011 at 9:17 amThe latest shareholder letter is out. If you own shares of LUK, I recommend giving it a read. Cumming and Steinberg lay out what they’ve been up to in an easy-to-follow way.

-

Morning News: April 14, 2011

Eddy Elfenbein, April 14th, 2011 at 7:32 amBRIC Leaders Say Increasing Commodity Prices Pose Threat to Global Growth

Yuan Advances to 17-Year High on Speculation Tightening Likely

Greek Debt Pressured by Restructuring Speculation

U.S. Commodities Day Ahead: Gold Gains on Japan, Libya, Prices

Obama Sets Deadline for Deficit Deal in Challenge to Republicans

U.S. Economy: Retail Sales Rise for Ninth Straight Month

To Sweeten Deal, NYSE Considers a Dividend

Goldman Sachs Misled Congress After Duping Clients: Sen. Levin

Vows of Change at Moody’s, but Flaws Remain the Same

Glencore Starts $11 Billion IPO as Goldman Sachs Says Abandon Commodities

ProLogis to Make Bid for PEPR Valuing Fund at $1.7 Billion

Roche Sales Fall 9% on Stronger Franc

Lower Reserves Drive J.P. Morgan Profit

Joshua Brown: Peak Fish and Other Insights from Agriculture 2.0

James Altucher: How I Helped Mark Cuban Make a Billion Dollars and 5 Things I Learned from Him

-

Putting the Budget Into Context

Eddy Elfenbein, April 13th, 2011 at 9:12 pmPhilip Greenspun puts the the budget deficit into easier-to-grasp context: just divide everything by 100,000,000:

We have a family that is spending $38,200 per year. The family’s income is $21,700 per year. The family adds $16,500 in credit card debt every year in order to pay its bills. After a long and difficult debate among family members, keeping in mind that it was not going to be possible to borrow $16,500 every year forever, the parents and children agreed that a $380/year premium cable subscription could be terminated. So now the family will have to borrow only $16,120 per year.

-

The Decline In Day-to-Day Correlation

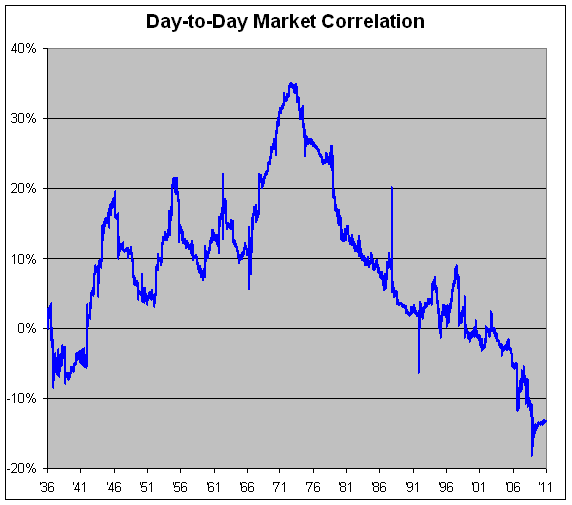

Eddy Elfenbein, April 13th, 2011 at 3:24 pmYesterday, I posted a round-up of some research I had done on Calendar Effects on the stock market.

I noted that I had been impressed by the correlation in the market’s day-to-day returns. In simple terms, what the market does on one day, it has been very likely to do on the next day.

This relationship, however, is more complicated than I thought. In the years just before World War II, the day-to-day correlation was absent. In fact, it was slightly negative. After the war, the correlation grew and it reached a high point between the Kennedy Assassination and the market plunge of 1973.

Here’s a look at the day-to-day correlation for changes in the S&P 500 for rolling periods of 1,000 trading days which is roughly four years (though it’s a little shorter before 1950 due to Saturday trading).

From mid-1968 to mid-1972, the correlation was an amazing 0.35. After that, things started to change and the correlation gradually sank. By the time of the 1987 crash, the day-to-day correlation was effectively zero.

Correlation hasn’t merely declined but it’s actually started to appear again, just headed in the other direction. From 2003 through 2010, the correlation has been -0.12.

-

General Electric’s Tax Payment Hoax

Eddy Elfenbein, April 13th, 2011 at 12:21 pmEarlier today, some media outlets picked up a hoax story that General Electric ($GE) was going to pay the government its $3.2 billion tax refund.

The hoax press release, which you can see here, claimed that GE CEO Jeffrey Immelt had informed the Obama administration that his company was returning $3.2 billion to the Treasury and “will furthermore adopt a host of new policies that secure its position as a leader in corporate social responsibility.”

The release included what seem to be some pretty obvious fake quotes, including this, attributed to Immelt: “All seven of our foreign tax havens are entirely legal. But Americans have made it clear that they deplore laws that enable tax avoidance. While we owe it to our shareholders to use every legal loophole to maximize returns – we also owe something to the American people. We didn’t write the laws that let us legally avoid paying taxes. Congress did. But we benefit from those laws, and now we’d like to share those benefits.”

The AP nonetheless ran a four-paragraph story that began, “Facing criticism over the amount of taxes it pays, General Electric announced it will repay its entire $3.2 billion tax refund to the US Treasury on April 18.”

The hoax was put out by some left-wing group. I honestly don’t understand what point they were trying to make. If anything, the idea of a company trying to buy the public’s affection with a tax payment needs to be spoofed as much as any corporate tax policy.

But let’s look past that and look at the numbers. A $3.2 billion check from GE would work out to about 30 cents per share. Meanwhile, GE’s stock has lost $40 per share (that’s 4,000 cents) over the last 10-and-a-half years.

-

“Credit Losses Were Down 27% Sequentially”

Eddy Elfenbein, April 13th, 2011 at 10:53 am -

JPMorgan Chase Earns $1.28 Per Share

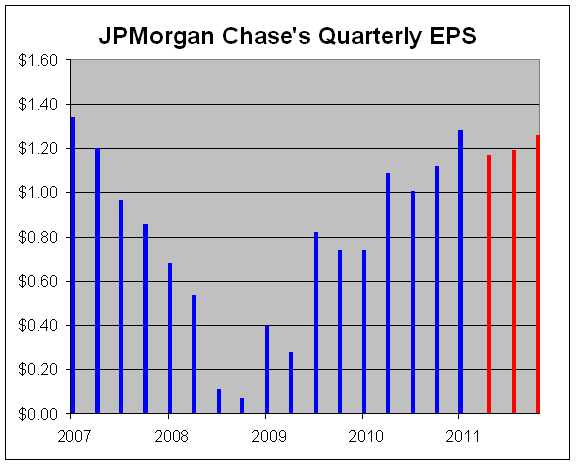

Eddy Elfenbein, April 13th, 2011 at 7:33 amJPMorgan Chase ($JPM) just reported Q1 earnings of $1.28 per share. Wall Street was expecting $1.16 per share. I said I was expecting $1.24 per share.

I have to explain something about bank earnings. When a bank calculates its profits, it has to estimate how many of its loans will turn out to be bad. That’s not so easy. If they over-estimate, then they need more loan loss reserves and that will decrease their current profit.

What we’ve been seeing from JPM is that they’ve been decreasing their loan loss reserves thanks to improvements in their assets. This is often criticized as somehow manipulating their bottom line. It’s not. This is how banking works. Unless you’re able to predict with perfect accuracy, you’re going to have to add or delete loan loss reserves.

J.P. Morgan Chase & Co.’s first-quarter profit jumped 67% as it set aside less for potential loan losses and revenue fell less than expected.

The first big bank reporting results, J.P. Morgan has seen earnings surge in recent quarters, largely because improving asset quality has led it to set aside less to cover loan losses. It has said loans are growing, and in the fourth quarter the bank saw revenue climb from year-earlier levels at operations tied to both Wall Street and Main Street.

In the latest period, the investment-banking arm’s profit slid 4.1% as net revenue dipped 1%. The retail financial-services business’ loss widened as revenue dropped 19%.

The company’s bottom line again benefited from it setting aside sharply less to cover potential loan losses. Many banks have seen lower reserves boost earnings amid signs of credit improvement. Credit-loss provisions were $1.17 billion, down from $7.01 billion a year earlier and $3.04 billion in the prior quarter.

J.P. Morgan reported a profit of $5.56 billion, or $1.28 a share, up from $3.33 billion, or 74 cents a share, a year earlier. The latest period included a net three cents in gains as a benefit from reduced credit-card loan loss reserves more than offset the impact of mortgage servicing rights asset adjustment and estimated expense of foreclosure-related matters.

Revenue on a managed basis, which excludes the impact of credit-card securitizations and is on a tax-equivalent basis, slid 8.5% to $25.79 billion.

Analysts polled by Thomson Reuters had most recently predicted earnings of $1.16 on $25.27 billion in revenue.

“The firm’s results reflected a strong quarter across the investment bank and solid performance from card services, commercial banking, treasury & securities services, and asset management,” Chief Executive James Dimon said.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His