Archive for May, 2011

-

Stock Returns and Record-Breaking Skyscrapers

Eddy Elfenbein, May 26th, 2011 at 10:05 amA new academic paper by Gunter Löffler of University of Ulm:

This papers shows that construction starts of record-breaking skyscrapers predict subsequent US stock returns. In the three to five years after the construction of a record-breaking new skyscraper began, per annum stock market returns are around 10 percentage points lower than in other years. The predictive ability is significant and relatively stable. It exceeds that of alternatives such as the prevailing historical mean, predictions based on dividend ratios, and recently suggested combination forecasts. The findings are robust against a wide range of specifications. Further analyses show that tower building also predicts international stock market returns. One explanation for these patterns is that tower building is indicative of over-optimism. Widespread over-optimism could lead not only to tower-building, but also to overvalued stock markets. The rational asset pricing explanation is that in periods of low risk aversion, financing of large-scale projects such as record-breaking towers is easier, and expected returns are lower. The explanations are difficult to separate empirically. There is no significant influence of financing conditions or sentiment on tower building. However, unlike in other models studied in the literature, imposing a non-negativity constraint on return forecasts does not increase predictive accuracy. This provides indirect evidence that the predictive content of tower building is at least partly related to overvaluation.

The idea is that the plans to build a monster new building are correlated with the mindset of a market bubble. The Woolworth Building opened in 1913 right as everything was falling apart. The Empire State Building was built during the depths of the Great Depression. The Petronas Towers in Kuala Lumpur were built just in time for the East Asian meltdown.

(HT: CXO Advisory)

-

Morning News: May 26, 2011

Eddy Elfenbein, May 26th, 2011 at 7:49 amECB May Have Leeway for Greek Restructuring

Euro Crisis Looms for Group of 8

Qaddafi Reportedly Stashes Billions in Western Institutions

Gold Knocked Off 3-week Peak by Silver Slide

S.E.C. Adopts Its Revised Rules for Whistle-Blowers

Lenovo’s Profit Triples on Corporate Demand

Sony Forecasts $975 Million Profit for Year

UBS Weighs Moving Investment Bank Out of Switzerland

Citigroup Lags in Debt Deals as Pandit Rebuilds

Tiffany Reports Strong First Quarter Results

Burberry more than doubles profit, revenue up 27%

The Yahoo Debate: Break Up or Not

Martha Stewart Living Seeks Buyer or Partner

Hedge Fund Star Calls for Microsoft CEO to Go

Paul Kedrosky: Oil Prices and Finger Monkeys

Todd Sullivan: ValuePlays TV 5/24/2011

Be sure to follow me on Twitter.

-

“Bond Yields Are So Low, There’s No Profit”

Eddy Elfenbein, May 25th, 2011 at 1:20 pmI often hear investors whine that since bond yields are already so low, there’s almost no room to profit.

Actually, there’s lots of room. If a perpetuity (a bond yield that never matures) sees its yield drop in half, that means the price doubled. That’s even true if the yield drops from 1% to 0.5% or even 0.0001% to 0.00005%. It’s always a double.

My point isn’t to suggest that you should expect perpetuities to double. Earlier today, Kelly Evans of the WSJ tweeted that it wouldn’t surprise her to see the 30-year T-Bond below 3%.

Right now, the 30-year is yielding about 4.25%. A move from 4.25% down to 3% equals a rise in price by about 25%. Don’t let the math fool you. Big gains can still be made from low yields — assuming yields continue going lower.

-

Stock Size and Exchange Rates

Eddy Elfenbein, May 25th, 2011 at 12:03 pmHere’s a post I’m aiming at new investors:

I’m a big fan of the St. Louis Fed’s economic data page. They have gobs of data and yet can customize your graphs.

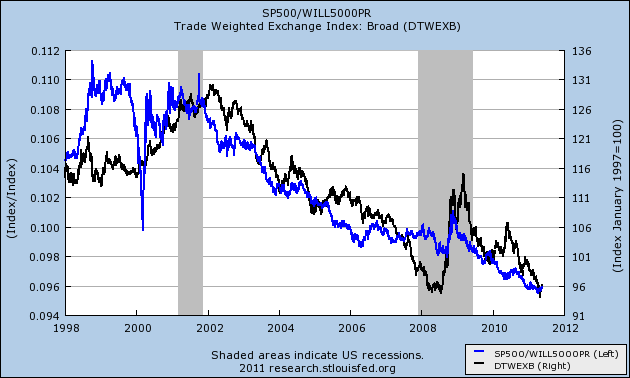

I made the one below and it shows the S&P 500 divided by the Wilshire 5000 which is the blue line and it follows the left axis. This shows the relative performance of large-cap stocks. When the blue line is rising, large-caps are leading the market. When it’s falling, as it has for several years now, that means that small-caps are leading.

The black line is the trade-weighted exchange rate index for the U.S. dollar and it follows the right axis.

I think this is an interesting graph because at first blush, it’s not obvious that these two data sets should be related. But they are.

Let me explain: Large-cap companies, especially the giants in the S&P 500, are heavily weighted toward the massive multinationals. The companies is the Wilshire 4500 (stocks in the Wilshire 5000 but not in the S&P 500) are much smaller, and by extension, have businesses that are more domestically focused. Of course, we’re talking about averages, not every stock.

When the U.S. dollar rises against foreign currencies, that makes U.S.-made products less competitive on the world market. American companies that already have a broad global reach — think, Disney ($DIS) or General Electric ($GE) — will tend to do well relatively speaking. Domestic manufacturing, however, will suffer. This is reflected in the under-performance of small-cap stocks.

It’s really not about size at all but rather something else: currencies. But size encompasses that bias. It’s also not a perfect match, but you can see that there’s a relationship that’s held up for ten years. While the lines aren’t dating, I think we can call them “it’s complicated.”

The takeaway is that a lot of variables go into the soup that makes up equity prices, and many of these currents you can’t easily see. Your stock is an asset just like any other, and it’s competing against every investment in the world for capital.

When the market makes a decision, it has its reason. It can be a terrible reason, but it’s a reason nevertheless.

-

RIP: Mark Haines

Eddy Elfenbein, May 25th, 2011 at 10:53 amSad news today. CNBC anchor Mark Haines has passed away at age of 65.

Veteran journalist Mark Haines, a fixture on CNBC for 22 years, died unexpectedly Tuesday evening. He was 65 years old.

Haines, founding anchor of CNBC’s morning show “Squawk Box,” was co-anchor of the network’s “Squawk on the Street” program, providing insight and commentary sometimes humorous and occasionally acerbic.

CNBC President Mark Hoffman called Haines a “building block” of the financial networks’ programming. Hoffman said Haines died at his home.

“With his searing wit, profound insight and piercing interview style, he was a constant and trusted presence in business news for more than 20 years,” Hoffman said in a statement to CNBC employees. “From the dotcom bubble to the tragic events of 9/11 to the depths of the financial crisis, Mark was always the unflappable pro.

“Mark loved CNBC and we loved him back. He will be deeply missed.”

I always loved Haines’ style. He refused to let guests bully him. Check out this classic clip when Barney Frank tried to bully Haines. Let’s just say Frank didn’t come out the winner:

-

Fastenal ($FAST) — A 299-Fold Winner

Eddy Elfenbein, May 25th, 2011 at 8:09 amHere’s another edition in our continuing series of great companies that no one’s heard of. Well…in this case, many people have heard of Fastenal ($FAST) but few realize how greatly this stock has performed.

Here’s the company description from Hoover’s:

Some might say it has a screw loose, but things are really pretty snug at Fastenal. The company operates more than 2,360 stores in all 50 US states as well as in Canada, Mexico, Puerto Rico, Asia, and Europe. Its stores stock about 690,000 products in about a dozen categories, including threaded fasteners (such as screws, nuts, and bolts). Other sales come from fluid-transfer parts for hydraulic and pneumatic power; janitorial, electrical, and welding supplies; material handling items; metal-cutting tool blades; and power tools. Its customers are typically construction, manufacturing, and other industrial professionals. Fastenal Company was founded by its chairman Bob Kierlin in 1967 and went public in 1987.

This week, FAST split its stock 2-for-1. This is the seventh split since it went public. The totals are six 2-for-1 splits and one 3-for-2 split which adds up to 96-for-1.

Shortly after the IPO and one week after the market crash in October 1987, shares of FAST closed at $10-3/8 (yuck…I hated those fractions). Adjusted for splits, that’s 10.81 cents per share. This year, the company will earn about that much each month.

FAST closed yesterday at $32.32 per share. So in less than 24 years, the stock is up 299-fold. An initial investment of $10,000 would be worth nearly $3 million today — and that doesn’t include dividends. Annualized, that works out to 26.8% per year for nearly a quarter of a century.

Last month, Fastenal said that Q1 profits rose 42% and revenue jumped 23%. The company earned 54 cents per share which was three cents better than estimates (those numbers aren’t adjusted for this week’s 2-for-1 split). Wall Street currently expects full-year earnings of $1.17 per share.

Here’s a look at the long-term chart. FAST has beaten the S&P 500 so badly that the index looks like a flat line in comparison.

-

Morning News: May 25, 2011

Eddy Elfenbein, May 25th, 2011 at 7:48 amFrench Minister to Seek Top I.M.F. Job

Why The BRIC Revolt At The IMF Is A Huge Deal With Devastating Implications

OECD Cuts Japan GDP Forecast Again, Urges Easy Monetary Policy

Greece Should Hold Referendum on Reform Program, SEV Head Says

China’s Utilities Cut Energy Production, Defying Beijing

South African Rand Slumps to Lowest Versus Dollar in More Than a Week on Risk Aversion

Gold May Climb as Concern About European Sovereign Debts Increases Demand

U.S. Suit Sees Manipulation of Oil Trades

Tumult? AIG’s ‘Re-IPO’ Remains on Go-Ahead

Russian Internet Firm Yandex Leads IPO Pack

Summary of Reported EPS for First Quarter of ’11 for S&P 500

Costco 3Q Profit Rose 6%; Sales Growth Offset Lower Margins

Toll Reports Second-Quarter Net Loss After ‘Disappointing’ Selling Season

Liberty Media Plans A Hands-Off Role At Barnes & Noble

An Econometric Approach to Tactical Asset Allocation

Brian Shannon: Stock Market Video Analysis 5/24/11

Stone Street: Goodbye Ruble Tuesday

Be sure to follow me on Twitter.

-

Target Vs. TJX Companies

Eddy Elfenbein, May 24th, 2011 at 2:34 pmI really don’t have anything profound to say with this post but I was struck by the large divergence between Target ($TGT) and TJX Companies ($TJX).

Normally, companies in the same industry tend to track each with some minor variation — and these companies did until about three years ago. Since then, TJX has raced ahead of Target, and the gap has grown even larger this year.

Target still has a larger market cap than TJX does ($34 billion to $21 billion). TJX’s stock dropped earlier this month after missing earnings by two cents per share. That broke an impressive streak of meeting or beating. Meanwhile, Target had a good earnings report last week although it hasn’t experienced the profit growth recently that TJX has.

TJX now has a distinct valuation premium over Target. Target currently goes for 11.74 times Wall Street’s consensus for this year’s earnings, and 10.88 times next year’s. TJX goes for 13.69 times this year’s estimate and 12.24 times next year’s.

This is a good example of the lesson I’ve told investors many times — don’t concentrate so much on what a company does. Instead, focus on how well they do it. I can’t tell you how many times investors ask me about some stock that’s supposed to be the next “fill in the blank.”

TJX isn’t the next anything, but they executed their business very well and the stock has been handsomely rewarded.

-

Putting LinkedIn’s Price Into Context

Eddy Elfenbein, May 24th, 2011 at 2:01 pmHow expensive are shares of LinkedIn ($LNKD)?:

Surging demand for social-media stock and a comeback in venture-capital IPOs propelled LinkedIn to a high of $122.70 in its first day of trading from an initial price of $45. With a market value of $8.45 billion, the company must boost revenue by 148 percent a year, twice its growth rate since 2009, to bring its price-sales ratio in line with the Dow Jones Internet Services Index by 2013, Bloomberg data show.

“This is not something we even consider investing in,” said Haverty, who helps oversee $35 billion in Rye, New York. “This is a sideshow. It’s a magic show,” he said. “The only question for the investor is how soon they should sell.”

I think when most people say “this time is different,” they really mean, “this time is different because now I own the stock.”

-

Medtronic Misses Earnings

Eddy Elfenbein, May 24th, 2011 at 11:21 amThis morning, Medtronic ($MDT) reported earnings of 90 cents per share for their fiscal Q4 which was two cents below the Street’s consensus (though some sources said the consensus was 93 cents per share). Quarterly revenue came in at $4.29 billion which matched consensus.

Worldwide sales of cardiac rhythm management products, including ICDs and pacemakers, fell 7 percent to $1.32 billion. Spine device sales fell 1 percent to $875 million.

Cardiovascular device sales, including stents to treat clogged arteries, rose 16 percent to $879 million. Neuromodulation device sales, which include pain treatments, rose 5 percent to $432 million, and diabetes device sales rose 11 percent to $368 million.

For fiscal 2012, Medtronic forecast earnings of $3.43 to $3.50 a share, below analysts’ expectations, on overall revenue growth in a range of 1 percent to 3 percent. It characterized its outlook as cautious, reflecting expected continued weakness in its key device markets.

For the year, Medtronic earned $3.37 per share on revenue of $15.993 billion. During the past several months, Medtronic has gradually lowered its 2011 earnings estimates. The 2011 EPS range went from $3.45 to $3.55, to $3.40 to $3.48, to $3.38 to $3.44, to $3.38 to $3.40 per share.

As I’ve said many times, I really like it when companies provide guidance and when they update that guidance throughout the year. Ultimately, Medtronic fell short of their guidance by one penny per share. That’s not what I wanted to see, but I’m still pleased with Medtronic’s development.

Medtronic’s fiscal year ends in April, so their FY 2012 just started. The company also provided its first guidance for 2012. Medtronic sees full-year earnings-per-share ranging between $3.43 and $3.50. The Street has been expecting $3.62 per share.

The stock is currently down about 1.5% this morning. Here’s a look at Medtronic’s quarterly results for the past several years:

Quarter EPS Sales in Millions Jul-01 $0.28 $1,456 Oct-01 $0.29 $1,571 Jan-02 $0.30 $1,592 Apr-02 $0.34 $1,792 Jul-02 $0.32 $1,714 Oct-02 $0.34 $1,891 Jan-03 $0.35 $1,913 Apr-03 $0.40 $2,148 Jul-03 $0.37 $2,064 Oct-03 $0.39 $2,164 Jan-04 $0.40 $2,194 Apr-04 $0.48 $2,665 Jul-04 $0.43 $2,346 Oct-04 $0.44 $2,400 Jan-05 $0.46 $2,531 Apr-05 $0.53 $2,778 Jul-05 $0.50 $2,690 Oct-05 $0.54 $2,765 Jan-06 $0.55 $2,770 Apr-06 $0.62 $3,067 Jul-06 $0.55 $2,897 Oct-06 $0.59 $3,075 Jan-07 $0.61 $3,048 Apr-07 $0.66 $3,280 Jul-07 $0.62 $3,127 Oct-07 $0.58 $3,124 Jan-08 $0.63 $3,405 Apr-08 $0.78 $3,860 Jul-08 $0.72 $3,706 Oct-08 $0.67 $3,570 Jan-09 $0.71 $3,494 Apr-09 $0.78 $3,830 Jul-09 $0.79 $3,933 Oct-09 $0.77 $3,838 Jan-10 $0.77 $3,851 Apr-10 $0.90 $4,196 Jul-10 $0.80 $3,773 Oct-10 $0.82 $3,903 Jan-11 $0.86 $3,961 Apr-11 $0.90 $4,295

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His