Archive for June, 2011

-

Morning News: June 28, 2011

Eddy Elfenbein, June 28th, 2011 at 7:31 amGreek Unions Strike as Papandreou Seeks Support

Rescue Measures for Greece Advance as French Offer to Ease Debt

China Signs £1.4 Billion in UK Trade Deals

Women Break Down Barriers in Mideast Finance

Tokyo Electric Power Defeats Shareholders’ Efforts to Exit Nuclear Business

Gold Advances for First Time in Four Days on European Sovereign-Debt Woes

Crude Oil in New York Rises From Near Four-Month Low; Brent Premium Widens

U.K. Banking Giant Standard Chartered Sees Double-Digit Growth

Nike 4Q Net Up 14%; North America, China Sales Surge

Siemens Cautions on Slower Growth After Buoyant Q3

TomTom Slumps As Profit Shrinks

PepsiCo Wakes Up and Smells the Cola

Todd Sullivan: Florida Casinos

Robert Sinn via Josh Brown: Searching For and Finding an Edge

Be sure to follow me on Twitter.

-

WSJ: Private Sleuths for Investors in Chinese Companies

Eddy Elfenbein, June 27th, 2011 at 8:07 pm -

Our Buy List Is Up 3.82% YTD

Eddy Elfenbein, June 27th, 2011 at 8:29 amThursday will be the final day of trading for the first half of this year. Despite the market’s ups and downs, our Buy List is on track to beat the S&P 500 for the fifth-straight year.

Through Friday, our Buy List is up 3.82% for the year compared with 0.86% for the S&P 500 (dividends not included).

-

Gas Prices Fall

Eddy Elfenbein, June 27th, 2011 at 8:16 amFor the last six weeks, gas prices have pulled back. Gas is still pretty expensive compared with recent history but it’s just a little bit less expensive. Gas is still more than twice where it was during the financial crisis.

-

Larry Kudlow on Dow 50,000

Eddy Elfenbein, June 27th, 2011 at 8:09 amThink of the Internet as an economic freedom metaphor for our time. The Internet empowers ordinary people and disempowers government. The Internet creates wealth, expands growth, produces jobs and spreads prosperity. Standing behind the Net is the political power of well over 100 million investors and asset owners.

Because of this, I believe the future economy will outperform all expectations. The stock market will head toward 15,000 in a few years, then 30,000, then 50,000 and higher. Believe it or not, the Internet is more important than the Fed.

-

Morning News: June 27, 2011

Eddy Elfenbein, June 27th, 2011 at 6:42 amEuropean Banks May Need More Capital After Basel

Spain Can Finance Itself Despite Rising Yields – Finance Minister

South African Rand Slides to Lowest This Month Against Dollar on Investor Risk Aversion

Germans Becoming Resigned to Messy Euro Divorce

China Is Long-Term Investor in EU Bonds: Premier Wen

France’s Lagarde Poised to Become Next IMF Chief

Crude Falls In Asia; Stronger Dollar, Weak Sentiment Weigh

Average Price for U.S. Gas Falls to $3.63

Behind Veneer, Doubt on Future of Natural Gas

Nissan Outlines Growth Strategy Focusing On Emerging Markets

Stanley Black & Decker Agrees to Buy Niscayah for $1.2 Billion

Companies Are Erecting In-House Social Networks

Goldman Sachs: This Is The Best Stock For This Point In The Cycle

Howard Lindzon: Amazon (AMZN) to Buy Twitter (TWIT) ….The Monday Headline We Need!

Jeff Miller: Weighing the Week Ahead: Big News and Low Volume = High Volatility

James Altucher: Politics is a Scam – Why I Will Never Vote Again

Be sure to follow me on Twitter.

-

NICK’s Volume Surge

Eddy Elfenbein, June 26th, 2011 at 5:56 pmOn Friday, 1,284,100 shares of Nicholas Financial ($NICK) exchanged hands. That isn’t merely heavy volume; it’s off the scales.

Put it this way, until fairly recently, a day with one-hundredth as much volume as Friday’s would be considered a busy day. Friday’s volume was greater than the entire volume for the first nine months of 2009.

Friday’s volume represents more than 10% of all of NICK’s outstanding shares and more than 20% of the float.

So what’s going on? I have no idea. Volume in NICK started to grow shortly before the last earnings report came out. The shares very briefly surged over $13 per share but have slowly pulled back.

If someone is busy accumulating shares, they haven’t told me.

Update: A reader informs me of a fact I had forgotten, NICK’s volume surge is due to Russell’s rebalancing. NICK was added to their Global index.

-

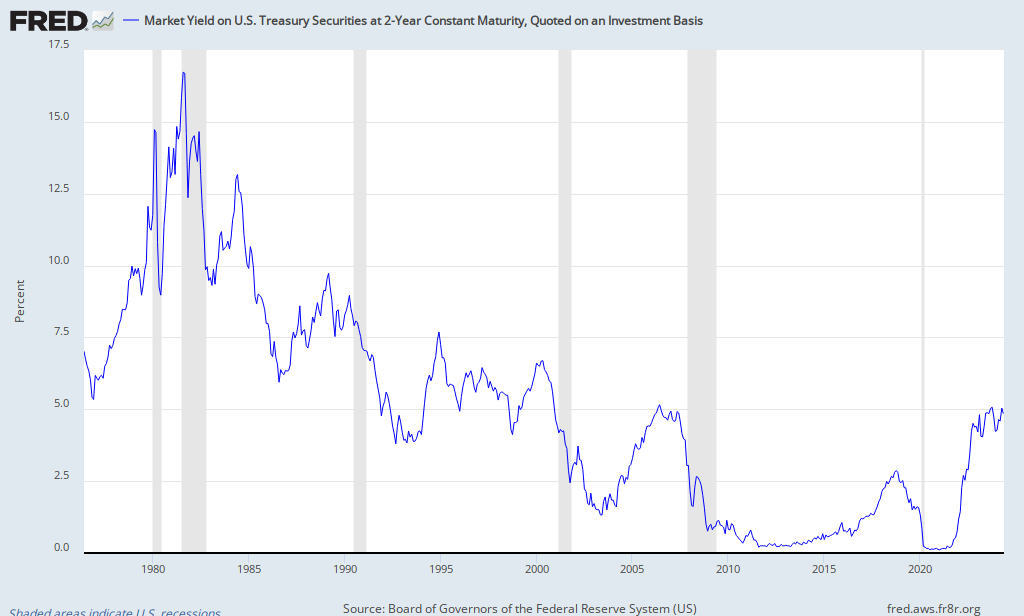

Two-Year Close to All-Time Low Yield

Eddy Elfenbein, June 24th, 2011 at 10:20 amThanks to the madness in Europe, investors have flocked to U.S. Treasury debt. The yield on the two-year has dropped to 0.35% which is only four basis points above the all-time low from last November.

-

This Monday Marks the Beginning of the Traditional Summer Rally

Eddy Elfenbein, June 24th, 2011 at 7:45 amWe’re coming up on one of the best times of the year to buy stocks. Not only is the start of the year good for stocks, but so is the start of the second half of the year (as is the turn of the month).

A few years ago, I calculated all of the Dow’s closings from 1896 to 2007 and found that July 1, July 3 and July 6 are all among the 25 best days for the Dow.

Historically, the market has gained an average of 4.17% from June 27 to September 6. That’s more than half of the average annual gain even though it covers just ten weeks.

-

CWS Market Review – June 24, 2011

Eddy Elfenbein, June 24th, 2011 at 7:03 amIn our CWS Market Review issue from two weeks ago, I said that I was keeping a close eye on the S&P 500’s 200-day moving average. Apparently, I’m not alone; Mr. Market seems to be paying very close attention as well.

Consider that last Thursday, June 16th, the S&P 500 performed a near-perfect intra-day bounce off its 200-DMA. It’s almost as if traders were following it oh-so-closely. That bounce prompted a nice four-day rally which fizzled out on Wednesday.

So the S&P 500 repeated itself on Thursday by performing another near-perfect bounce off its 200-DMA. This time, we got a cool 1.63% rally going into Thursday’s close. According to Bespoke, that was our biggest intra-day climb following a 1% down move in nearly a year. That’s some bounce. That makes two tries so far to pierce the 200-DMA but we still haven’t closed below it. The last time we did was back on September 10th of last year.

So what does this mean? Unfortunately, we shouldn’t draw too much from this. But I will say that the market often goes in for three “tests” of these support levels. If we pass all three, then the trend, whether up or down, has a habit of continuing onward. Historically, the data is unambiguous—the S&P 500 has performed much better when it’s above its 200-DMA compared with when it’s below it. The good news is that we’re still above it.

But make no mistake: The problems in Europe have clearly rattled stock investors here. It got so bad that the yield on short-term Treasuries actually turned slightly negative on Thursday. That means that investors were willing to pay the government to borrow their own money. Now that’s fear!

This week, I want to review some recent good news from our Buy List stocks. The best news came from Bed Bath & Beyond ($BBBY). The company gave us a great earnings report on Wednesday, plus it guided higher for the year. Few things please me more than the sweet sounds of the “beat-and-raise” choir.

Let me give you the back story: A few months ago, BBBY told us to expect Q1 earnings to range between 58 cents and 61 cents per share. I knew that was a low-ball projection. I said in last week’s issue that I was expecting a “modest” earnings surprise, around 63 cents per share. Well, I was very pleased to see that the results came in at 72 cents per share. BBBY also said that it’s forecasting Q2 earnings of 77 cents to 82 cents per share. (I was expecting a little more, and honestly, I still think I’ll get it.)

Let me reiterate that this was a very strong earnings report. BBBY’s sales typically slow down in the quarter following the holidays, but they’re still doing a brisk business. Earlier, BBBY told us to expect earnings to grow by 10% to 15% for this fiscal year which ends in April. Now, they’ve upped that range to 15% to 20%.

Let’s do some math: For 2010, the company earned $3.07 per share which means the new range comes to $3.53 to $3.68 per share. Personally, I think $3.70 per share is very doable. Thanks to the good earnings news, the stock jumped by more than 5.3% on Thursday to close at $56.93. I’m raising my buy price on BBBY from $55 to $58.

Now let’s move on to Oracle ($ORCL) which reported very good earnings after the close on Thursday. For their fiscal Q4, Oracle earned 75 cents per share which topped Wall Street’s consensus by four cents per share. I was very happy with ORCL’s numbers, but let me explain this in a little more detail because traders got spooked in the after-hours market and the shares dropped sharply. (I’m writing this before Friday’s open.)

Early in the quarter, Oracle gave us a guidance range of 69 cents to 73 cents per share. The Street was only at 66 cents per share. What struck me was how early Oracle was willing to go public with this optimistic guidance. But the Street was still skeptical and their consensus rose only to 71 cents per share. Because Oracle’s guidance was so strong, I wasn’t expecting a big earnings surprise (I had said I was looking for about 73 cents per share.)

In Thursday’s after-hours market, shares of Oracle traded about 7% lower which I think was completely nuts. I saw some grumbling about weakness in Oracle’s hardware business. It’s true, it is weak, but it’s only about 10% of Oracle’s overall revenue. On the conference call I heard what I really wanted to hear—guidance for Q1. Oracle said that it projects earnings between 45 and 48 cents per share for its first quarter. Yep, another low ball. My view is that if they’re saying that, they really mean “at least 50 cents per share.”

I have to stress that Oracle’s business is a cash-flow machine. The company is sitting on close to $29 billion in cash. Oracle continues to be a great stock. Don’t let any short-term volatility scare you. I think it’s very likely that ORCL will be at $36 before the end of the year. I’m keeping my buy price at $34 per share.

In February, I said to expect another dividend increase from Medtronic ($MDT) in June. Fortunately, the company proved me right on Thursday when they announced an 8% increase to their quarterly dividend. This is their 34th-straight yearly dividend increase. Not many stocks can say that.

The new dividend is 24.25 cents per share so that comes to 97 cents for the year. Going by Thursday’s close that comes to a yield of 2.53%. Medtronic is coming off a tough year which included a slew of earnings downgrades. In retrospect, though, the earnings weren’t nearly as bad as the share price indicated.

Medtronic recently gave us full-year earnings guidance of $3.43 to $3.50 per share. I think they got stung last year by having to lower their guidance more than once, and that’s why I think this latest guidance is on the low side. Even if we take the mid-point of this guidance, that means the shares are going for 11 times this year’s earnings. Plus we now have a dividend that yields nearly as much as a 10-year Treasury. This is a good company that hit a rough patch. I’m lowering my buy price for Medtronic to $45 per share.

That’s all for now. Next week is the final week of Q2. It’s also the week before the three-day July 4th weekend, so I think Wall Street will be fairly quiet. All the big shots will be running off to their summer pads at the Hamptons or Martha’s Vineyard.

Be sure to keep visiting the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His