Archive for June, 2011

-

Inflation Hits Four-Year High

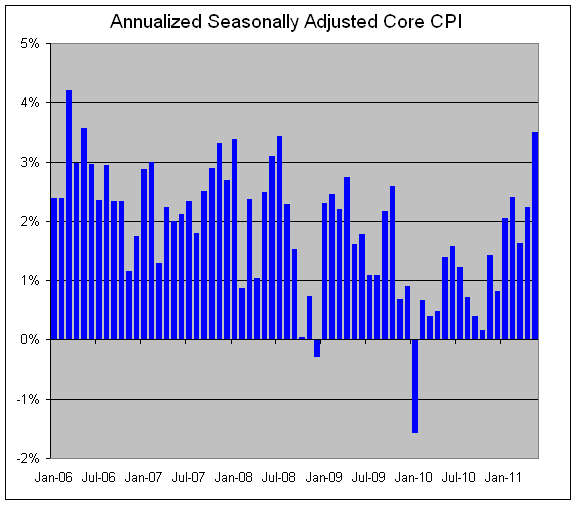

Eddy Elfenbein, June 15th, 2011 at 8:14 pmToday’s CPI report showed that inflation rose by 0.2% in May which was 0.1% ahead of expectations. The core rate, which excludes food and energy prices, rose by 0.3% which was also 0.1% ahead of expectations.

Breaking down the numbers, I took the monthly seasonally-adjusted core rates and annualized them. It turns out that May’s increase was the most in exactly four years. The seasonally adjusted core rate for May rose by 0.29%. Annualized, that comes to 3.50%. The last time it was higher was May 2006 when it rose by 3.57%.

-

Larry Called It

Eddy Elfenbein, June 15th, 2011 at 2:08 pmAfter $HPQ’s board fired Mark Hurd (or forced him to resign), Larry Ellison sent an e-mail to the New York Times:

Lawrence J. Ellison, the chief executive of Oracle, denounced Hewlett-Packard’s directors on Monday for forcing the resignation of the H.P. chief executive, Mark V. Hurd, who is a friend of Mr. Ellison’s.

Mr. Hurd stepped down Friday after a sexual harassment inquiry found that he had filed inaccurate expense reports.

In an impassioned e-mail sent to The New York Times, Mr. Ellison chided H.P.’s board for what he said was a grave mistake.

“The H.P. board just made the worst personnel decision since the idiots on the Apple board fired Steve Jobs many years ago,” Mr. Ellison wrote. “That decision nearly destroyed Apple and would have if Steve hadn’t come back and saved them.”

That was 10 months ago. Yep, I think Larry was right.

-

Louis Navellier’s E-Letter

Eddy Elfenbein, June 15th, 2011 at 11:56 amI want to give a shout-out to my good friend Louis Navellier. He has a great (and free) e-letter that you can sign up for here. I highly recommend it.

Louis is one of Wall Street’s legends. He’s one of the original “quant guys.” Nowadays, Wall Street is full of number crunchers, but Louis was doing this kind of work long before everyone else was. Not only that, but he has an amazing track record to boot.

His e-letter always has some interesting insight or take on the market that you can’t find anywhere else. If you want to see a sample, here’s his latest where he names beverage stocks that “bring in the bucks.”

To sign up, just follow this link.

-

Why Oracle Is a Good Value

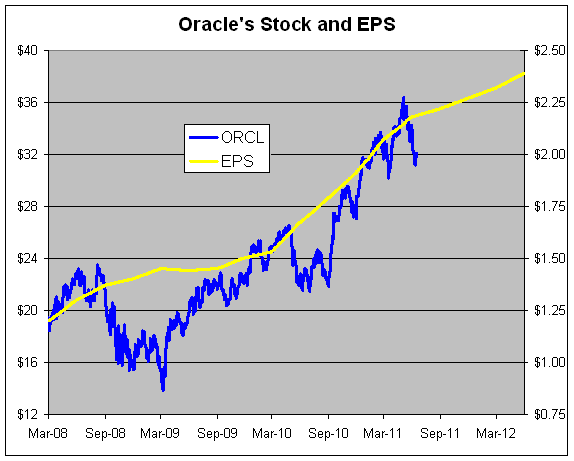

Eddy Elfenbein, June 15th, 2011 at 9:54 amOracle‘s ($ORCL) fiscal Q4 earnings report comes out next week and I wanted to pass along this chart of the stock along with its earnings-per-share trend.

As I usually do, I put the share price in blue and it follows the left scale while the EPS is in gold and it follows the right scale. The two lines are scaled at a ratio of 16 to 1 which means that the P/E Ratio is exactly 16 whenever the lines cross. The future part of the earnings line represents Wall Street’s consensus.

The chart makes a few important points more clearly in graphic form than I could explain verbally. The first is that Oracle’s valuation is still rather subdued. The stock’s P/E Ratio is almost exactly the same as the S&P 500’s even though its earnings have fared much better than the overall market. As you can see, the earnings line was barely impacted by one of the worst recessions of the last 70 years. The rest of Corporate America, in contrast, saw its earnings plunge and we still haven’t made record earnings yet.

The other point is that you can see how tepid Wall Street’s earnings projections are. If the future earnings projection is correct, it would be a dramatic deceleration of earnings growth (slowing of growth).

I understand the need for conservative estimates and that’s most likely the sounder strategy, but I wanted to show you precisely what that means. If Oracle’s stock keeps tracking its earnings, I think it’s very likely that the stock will hit $36 before the end of the year. That’s about a 13% jump from yesterday’s close.

Oracle likes to the play the “set-the-bar-low-and-guide-higher” game, and they play it very well. In March, for example, Oracle “shocked” Wall Street when it said it was expecting fiscal Q4 earnings to range between 69 cents and 73 cents per share.

I think it’s interesting that Oracle was willing to give us this news when the quarter wasn’t even one month old. At the time, the Street was expecting 66 cents per share. Now the consensus is up to 71 cents per share.

The company also gave us a 20% dividend increase recently. (Well…it was from five cents to six cents.) Look for a modest earnings beat, say, 73 cents per share. I’ll be interested to hear any guidance for the August quarter. Wall Street currently expects earnings of 46 cents per share.

-

Morning News: June 15, 2011

Eddy Elfenbein, June 15th, 2011 at 7:43 amGreek Bailout Talks Deadlock as Pressure Mounts

Greek Unions Stage Strike Against Austerity

European Industrial Output Unexpectedly Increased in April

China Moves Closer to Letting Foreign Banks Underwrite Yuan Bonds

Oil Trades Near Three-Day High on U.S. Retail Sales; Stockpiles Decline

Asia Grain Outlook: Japan Buys Wheat; Demand Subdued Elsewhere

Stock Futures Slip After Rebound, CPI, Factory Data Due

Bernanke Calls Debt Limit ‘Wrong Tool’ for Forcing Budget Cuts

Fed Officials Discuss Explicit Inflation Target

Shuttle’s End Leaves NASA a Pension Bill

Mortgage Applications See Biggest Gain in 3 Months: MBA

J.C. Penney Nabbing Johnson From Apple Sets ‘Huge Expectation’

Pandora Prices Its I.P.O. at $16 Per Share

Chevron Bets on Volcanoes in Indonesia

Paul Kedrosky: Global Oil Crosses Into Structural Deficit

Phil Pearlman: Examining the Open Cloud w GigaOM Pro

Be sure to follow me on Twitter.

-

StockTwits TV Ad

Eddy Elfenbein, June 14th, 2011 at 10:10 pmThis is so cool.

Phil Pearlman asks “Can Twitter beat the stock market?“

-

The Market’s P/E Is at a Nine-Month Low

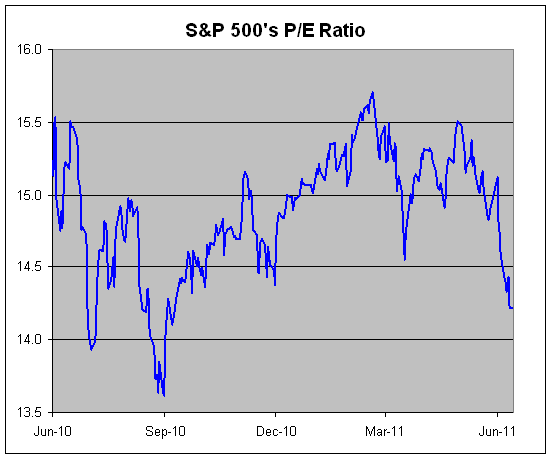

Eddy Elfenbein, June 14th, 2011 at 2:25 pmHere’s a look at the P/E Ratio for the S&P 500 going back to last June. The market’s P/E is the lowest it’s been in nine months (though today’s rally will change that).

What’s interesting to note is that the market’s rally hasn’t been due to higher multiples but rather mostly been driven by earnings. In fact, at 14.22 times earnings, the market’s earnings multiple is still fairly modest.

Put it this way: the S&P 500 averaged an earnings multiple of 16.94 from 2004 through 2007. Applying that multiple to the Wall Street’s earnings forecast for 2012 gives us an S&P 500 of 1,891.

There’re a lot of ifs involved in reaching that number, but I wouldn’t say that they’re unreasonable. The market continues to be overly worried about the future.

-

FactSet Down On Earnings Guidance

Eddy Elfenbein, June 14th, 2011 at 1:03 pmI’m a big fan of FactSet Research Systems ($FDS). The stock was on my Buy List for a few years but I decided to ditch it after 2009.

I often tell investors not to worry about stocks you used to own after you sell them. I’m going to break that rule for a moment because I’d love to add it back to the Buy List.

Unfortunately, FDS had a very good 2010 so it was a bad move on my part. But I truly thought the shares were too expensive and I’ve been waiting for a pullback ever since.

Today the company reported earnings and the results matched what the company told us to expect. The guidance for the current quarter, however, did not impress Wall Street.

FactSet Research Systems Inc.’s fiscal third-quarter earnings rose 12%, at the high end of the company’s estimates, amid continued growth in revenue and customers.

The board of the provider of data and services to investment managers authorized a $200 million expansion of FactSet’s buyback program, bringing the total to $226 million. The company recently had a market capitalization of about $4.8 billion.

FactSet has posted steady growth in recent quarters as the financial industry continues to recover. The company’s customer base grew by 800 to 45,600 in the quarter, while client count rose to 2,187, up 26.

For the quarter ended May 31, FactSet reported a profit of $43.3 million, or 92 cents a share, up from $38.7 million, or 81 cents a share, a year earlier. Revenue jumped 15% to $183.6 million.

The company in March had projected 90 cents to 92 cents a share, topping estimates at the time, on revenue of $181 million to $184 million.

Operating margin fell to 33.7% from 34.7%.

For the current quarter, FactSet projected per-share earnings of 93 cents to 95 cents on revenue of $187 million and $191 million. Analysts polled by Thomson Reuters most recently expected 95 cents and $190 million, respectively.

Uh oh! You can’t say 93 to 95 cents per share when the Street expects 95 cents.

This is a great example of how investing works. If you give people a reason to sell, even if it’s not a great reason, they’ll take it — and that’s what’s happening to FDS today.

FactSet is a great company and I’m keeping a close eye on it. But it will have to come down a lot for me to be interested in adding it back to the Buy List.

-

About That Six-Week Losing Streak….

Eddy Elfenbein, June 14th, 2011 at 11:17 amThe financial media has seized on the fact that the stock market has dropped for six weeks in a row. This has only happened a handful of times.

While this fact is correct, let’s take a step back and look at how small some of those losses have been:

Friday S&P 500 Weekly Gain 29-Apr-11 1363.61 1.96% 6-May-11 1340.20 -1.72% 13-May-11 1337.77 -0.18% 20-May-11 1333.27 -0.34% 27-May-11 1331.10 -0.16% 3-Jun-11 1300.16 -2.32% 10-Jun-11 1270.98 -2.24% Of course if we have more days like today, the streak will by done this week.

-

The TED Spread and Equity Returns

Eddy Elfenbein, June 14th, 2011 at 10:25 amDuring the financial crisis, the TED Spread got a lot of attention. Officially, the TED Spread is the interest rate difference between the U.S. Treasury bills and the eurodollar market.

In short, it’s the risk premium that lenders demand in the short-term credit market. The TED spread is followed closely because it’s a good measure of the health of the credit.

In normal times, the TED Spread is usually around 20 and 50 (meaning, 0.2% to 0.5%). But during the height of the financial crisis, the TED Spread jumped to 465.

As the TED Spread started to ease up, the stock market took off. I wanted to see what the relationship between the two was, so I collected all of the data from 1992 through a few days ago. I resorted the day’s stock gain by rising TED Spread and separated the data in 10 deciles.

Here are my results. To read the table, the Wilshire 5000 lost a total 21.32% whenever the TED Spread was below 0.09. Since I used deciles and a 20-year period, each line represents about two years’ time.

High End of Range Low End of Range Stock Market Gain Under 0.09 -21.32% 0.14 0.09 54.89% 0.19 0.14 0.30% 0.24 0.19 40.01% 0.28 0.24 28.07% 0.34 0.28 21.57% 0.41 0.34 24.76% 0.50 0.41 2.98% 0.94 0.5 42.28% Over 0.94 -0.92% I’m not surprised that a high TED Spread is bad for the market, but I didn’t expect that a low reading would be even worse. The current reading is at 0.1995.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His