Archive for September, 2011

-

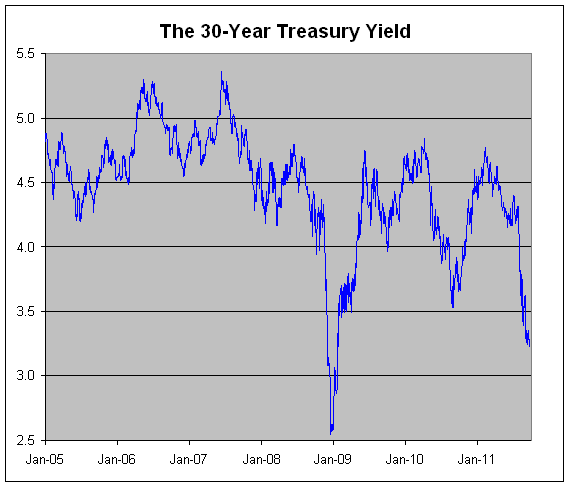

The 30-Year Yield Is Close to Multi-Year Low

Eddy Elfenbein, September 19th, 2011 at 12:05 pmThe yield on the 30-year Treasury bond hit 3.2% today. That’s just above the 3.19% from September 6th which was the lowest yield in 32 months. On July 26th, the yield was at 4.34%.

-

The Risks at AFLAC

Eddy Elfenbein, September 19th, 2011 at 10:52 amAt Seeking Alpha, Thomas Lott shares his thoughts on AFLAC ($AFL):

Book per share today is $25.65. Compared to a $36 stock price, that is a 1.4x price to book ratio. Historically going back to 2001, the price to book has averaged around 2.6x. That does make AFL seem somewhat cheap. I think my problem as pointed out above is that bank losses have probably hurt the balance sheet since June 30th. AFLAC has begun to derisk, and the smart play for management is to sell down European bank bonds they own. Let’s just assume that their $706mm in losses is $1BB now, and that their capital gains have been cut in half (roughly $1BB of capital gains). That would imply a hit of around $2 per share to book to around $23.65. With the stock at $36, that is a price to book multiple of 1.5x.

Read the whole thing. On balance, Lott likes the stock although he thinks there’s a chance it could fall to $22 if there’s a full panic in Europe. On the plus side, he calls it a buy below $30 per share and says it could hit $60 within two years. However, he’s curious as to why the company is so invested in Europe.

-

Larry Summers: “The world must insist that Europe act”

Eddy Elfenbein, September 19th, 2011 at 10:18 amIn the Financial Times:

At every stage of this process, from the first signs of trouble in Greece, to the spread of problems to Portugal and Ireland, to the recognition of Greece’s inability to pay its debts in full, to the rise of debt spreads in Spain and Italy, the authorities have played out the stalemate machine. They have done just enough beyond euro-orthodoxy to avoid an imminent collapse, but never enough to establish a sound foundation for a resumption of confidence. Perhaps inevitably, the gaps between emergency summits grow shorter and shorter.

The process has taken its toll on policymakers’ credibility. As I warned European friends quite some time ago, authorities who assert in the face of all evidence that Greece can service on time 100 per cent of its debts will have little credibility when they later assert that the fundamentals are sound in Spain and Italy, even if their view on the latter point is a reasonable one. After the spectacle of European bank stress tests that treat assets where credit default swaps exceed 500 basis points as riskless, how can markets do otherwise than to ignore regulators’ assertions about the solvency of certain key financial institutions?

Personally, I’m not so concerned with preserving the credibility of policymakers.

-

Netflix Separates Its DVD and Streaming Business

Eddy Elfenbein, September 19th, 2011 at 10:09 amA customer backlash truly works — or perhaps I should say that a customer and investor backlash truly works. Netflix ($NFLX) has announced today that it’s separating its online streaming and DVD-by-mail service. The new division will be called “Qwikster” (who thinks of these names?).

The streaming business will continue to be called Netflix. Members who subscribe to both services will have two entries on their credit card statements. Instead of Netflix, the distinctive red envelopes will now say Qwikster.

The stock fell from a high of $304 on July 13 to $154 last Friday. The company has been on the defensive ever since they announced a controversial price increase this summer.

The problem was that the stock was enormously over-priced so any disruption could cause the shares to plunge. Last week, Netflix had to lower its Q3 subscriber forecast and that caused even more pain for the stock.

Reed Hastings, the CEO, finally took hold of the issue and publicly said that they made a mistake:

Acknowledging that he “messed up,” Hastings said he “slid into arrogance based upon past success” when he did not adequately explain the reasons behind the plan separation and effective price hike. He said the reason is that instant streaming and DVD-by-mail are becoming “two quite different businesses, with very different cost structures, different benefits that need to be marketed differently, and we need to let each grow and operate independently.”

Explaining the reasons behind the plan change “wouldn’t have changed the price increase, but it would have been the right thing to do,” Hastings wrote.

Hastings said the DVD service will be the same as ever, “just a new name.” But customers will see a video games upgrade option for game rentals on the Qwikster website. Andy Rendich, who has been working on Netflix’s DVD service for 12 years, and leading it for the past four years, will be the CEO of Qwikster.

The real Qwikster, of course, is the stock market and how quickly it turned against Netflix. This apology may help in the short-term but the stock is still vastly overpriced.

-

Greece Hits U.S. Stocks Again

Eddy Elfenbein, September 19th, 2011 at 9:53 amAfter rising every single day last week, the stock market is sharply lower today. The S&P 500 rose from 1,154 to 1,216 last week and we’ve been as low as 1,193 this morning, so we’ve given some of our gains back but not all of them.

As you might expect, investors are again worried about Europe. Again. Now we’re being told that it might take until October for a bailout plan to be in place. This is a repeat of the similar pattern we saw over the summer when stocks fell sharply on Monday due to the political uncertainty created over the weekend.

Greece’s 10-year yield rose 163 basis points to 22.82 percent while two-year notes added 513 basis points to 60.0 percent. The notes rose for the first week in two months last week as traders trimmed bets for a pending default after the leaders of Germany and France signaled a commitment to keeping Greece in the euro area. They had climbed above 80 percent for the first time on Sept. 14 amid speculation the country wouldn’t be able to meet its obligations to investors.

The policymakers seem to think they can solve this matter by an endless series of half-steps — just enough to claim that they’re doing something but not enough to truly change course.

President Obama has introduced his plan to cut the deficit by over $3 trillion over the next ten years. The proposal includes tax increases and a New York Times article indicates that the president will veto any plan that relies on spending cuts alone.

Under Mr. Obama’s proposal, $800 billion of the $1.5 trillion in tax increases would come from allowing the Bush-era tax cuts to expire. The other $700 billion, aides said, would come from a combination of closing loopholes and limiting deductions among individuals making more than $200,000 a year and families making more than $250,000.

Mr. Obama’s plan will hover over Congressional budget-cutting negotiations that are under way over the next two months. A bipartisan Congressional committee is charged with coming up with its own cuts by Nov. 23; unless passed by Congress by Dec. 23, $1.2 trillion in cuts to defense and entitlement programs will go into effect automatically in 2013.

Mr. Obama, however, is challenging the Congressional committee to go well beyond its mandate. “He’s showing them where they could find the savings,” one administration official said.

This seems to be setting up Congress and the White House for another showdown, except this one will happen closer to an election.

-

Morning News: September 19, 2011

Eddy Elfenbein, September 19th, 2011 at 5:14 amBerlin Election Deals Blow to Merkel Coalition

IMF’s Traa Says Additional Effort Needed to Cut Greek Deficit

Greece Under Scrutiny for Next Aid Payment

Italian Cuts Negative for Local Governments, Moody’s Says

China to Limit Stimulus in Slump: Deutsche Bank

Crude Drops to One-Week Low on Outlook

Obama Plan to Cut Deficit Will Trim Spending by $3 Trillion

Bernanke Joins King Tolerating Inflation

Fed Runs Risk of Doing Less Than Investors Expect

Moody’s Stays Negative on States, Local Governments

UBS Trading Loss Was $2.3 Billion; Gruebel Stays as Chief

Lloyds Director Departs for Resolution

Payless Poised for Buyout at 76% Discount

Jeff Miller: Weighing the Week Ahead: Expecting Magic from the Fed?

Todd Sullivan: August Industrial Production

Be sure to follow me on Twitter.

-

Morning News: September 16, 2011

Eddy Elfenbein, September 16th, 2011 at 5:43 amIndia Raises Rates, Breaks Ranks With BRICs

UK’s Brown: Euro Area Cannot Survive In Present Form

NYSE Owners Lose Big on German Embrace

China Consolidates Grip on Rare Earths

5 Central Banks Move to Supply Cash to Europe

UBS Trader Gets No Miracle as Loss Leads to Arrest

Geithner Presses Euro Zone to Leverage Bailout Fund

Delta One Desks Are Big Moneymakers

Goldman to Close Global Alpha Hedge Fund

Barclays to Open London Precious Metals Vault

Citic IPO to Raise Up to $1.94 Billion; ManU Scores Singapore Listing Approval

Esprit Shares Tumble 20% After Dismal Earnings

Air France Splits $12 Billion Order Between Airbus, Boeing

Silver Lake Is Said to Weigh Buying Yahoo

Paul Kedrosky: Taleb: People Kept Telling Me I Was an Idiot

James Altucher: Ten Scams You Encounter Every Day

Be sure to follow me on Twitter.

-

Morning News: September 15, 2011

Eddy Elfenbein, September 15th, 2011 at 5:36 amGreece Is to Remain in Euro: Sarkozy, Merkel

European Stocks Gain on Backing for Greece

China Ties Aiding Europe to Its Own Trade Goals

Italy Gives Final Approval to Austerity Plan

Crude Oil a Tad Lower; US Stocks Data, Euro Woes Weigh

Europe Won’t Allow a Lehman-Like Collapse, Geithner Says

Supercommittee to Get Push From Senators to Increase Savings

Automakers and U.A.W. Still Talking

US Orders Bank Of America To Pay $930,000 To Fired Whistleblower

UBS Says It Had $2 Billion Loss From Unauthorized Trading

Groupon Back on Track for Its IPO

Toys R Us Holiday Mantra: In Exclusives We Trust

Jeff Miller: Finding the Best Information about Europe

Stone Street: Financial Regulation: One Step Forward, Twelve Steps Back – FINRA’s Bid for More Power

Be sure to follow me on Twitter.

-

Benford’s Law and Greece

Eddy Elfenbein, September 14th, 2011 at 9:17 amI’ve written about Benford’s Law before. The law predicts the frequency at which first numbers ought to appear in a random distribution. The law has been used to catch folks who have fudged their data.

Tim Harford highlights some researchers who have turned Benford’s Law on Greece’s economic data:

Manipulated data often fail to satisfy Benford’s Law. A manager who must submit receipts for expenses over £20 may end up filing claims for lots of £18 and £19 expenses – and the data will then contain too many ones, eights and nines. A forensic accountant can easily check this, and while not an infallible check (fraudster Bernard Madoff filed Benford-compatible monthly returns), it’s an indicator of possible trouble.

Which brings us back to the data Greece submitted to the European statistics agency. According to Rauch and his colleagues, Greek data are further from the Benford distribution than that of any other European Union member state. Romania, Latvia and Belgium also have abnormally distributed data, while Portugal, Italy and Spain have a clean bill of health.

Would a Benford-style analysis have helped spot Greece’s problems? In principle, yes. In practice, one wonders whether politics would have trumped statistics. A shame: according to Benford’s Law, Greece’s data were particularly odd in 2000, just before it joined the euro.

(H/T: Jason Zweig)

-

Retail Sales Unchanged

Eddy Elfenbein, September 14th, 2011 at 8:58 amThe futures indicate that the market will open higher this morning. The surprising news of this morning is that the Democrats lost the by-election to replace Anthony Weiner in New York’s ninth congressional district. This was seen as a relatively safe seat for the Democrats.

The retail sales report for August was unchanged from July. Wall Street was expecting an increase of 0.3% so this was a bit of a surprise. Some economists are concerned that the summer swoon had a larger impact on consumer spending than was first realized. Also, the initial retail sales report for July showed an increase of 0.5%. That was revised down to 0.3%.

The PPI report showed that wholesale inflation was flat last month which is welcome news for inflation hawks. The “core rate” rose by just 0.1%.

There’s more bad news for French banks this morning. These banks had the most exposure to the problems in Greece. Moody’s has downgraded the long-term debt of two major French banks, Société Générale and Crédit Agricole. Additionally, BNP Paribas is under review for a downgrade. Actually, some investors think Moody’s action could have been harsher.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His