Archive for October, 2011

-

Morning News: October 25, 2011

Eddy Elfenbein, October 25th, 2011 at 6:29 amSpain Slipping on Deficit Increases Chances of Contagion

EU Signals Fund Leverage Needs More Talks

Trichet Urges Euro Finance Ministry

Vatican Calls for Oversight of the World’s Finances

Oil Rises to 12-Week High as Demand Signals Spur Bull Market

In Cautious Times, Banks Flooded With Cash

Deutsche Bank Beats Estimates on Consumer Banking

UBS Reports 39% Drop in Quarterly Profit After Trading Loss

Netflix’s Quarterly Loss of Subscribers Worse Than Forecast; Shares Plunge

Texas Instruments Profit Falls as Demand Slumps

Car Carriers Profit on Record Demand

Cigna Agrees to Buy Healthspring to Expand Medicare Business

The Divergent Fortunes of Saab and Volvo

Joshua Brown: Jeff Benjamin on the Absolute Return Scam

Paul Kedrosky: Today in Not Being Bullish Enough

Be sure to follow me on Twitter.

-

S&P 500 = 1,253

Eddy Elfenbein, October 24th, 2011 at 3:11 pmThis is turning into a very good day for the market. The S&P 500 has been as high as 1,256.55 which is another post-August 3rd high. The index’s 200-DMA is well within sight.

The cyclicals are leading today’s rally. I think the good news from Caterpillar ($CAT) helped the entire sector. The Morgan Stanley Cyclical Index ($CYC) is up more than 2.8% bringing it back over 900. The Consumer Index ($CMR), by contrast, is barely positive.

Smaller stocks tend to be more weighted with cyclicals and we’re seeing the small-stock indexes doing much better than their larger-cap cousins today. The Russell 2000 ($RUT) is up more than 3.28% while the Russell 1000 ($RUI) is up just 1.61%.

Our Buy List is now in positive territory for the year. Bed Bath & Beyond ($BBBY) hit another 52-week high. Deluxe ($DLX) and Wright Express ($WXS) have also been very strong. The only weak spots are Abbott Labs ($ABT) whose position is probably due its strength from last week, and Reynolds American ($RAI) which is losing ground after competitors delivered some disappointing earnings reports.

Notice how strong small-caps have been (the black line is the Russell 2000) compared with the large-caps (Russell 1000 in gold) since the middle of the day on Thursday:

-

Best Months for the Dow of the Last 50 Years

Eddy Elfenbein, October 24th, 2011 at 10:06 amWe still have a week to go in October but this is shaping up to be the best month for the Dow in ten years, and one of the best in the last 50 years:

Jan-76 14.41%

Jan-75 14.19%

Jan-87 13.82%

Aug-82 11.47%

Oct-82 10.65%

Oct-02 10.60%

Apr-78 10.56%

Apr-99 10.25%

Nov-62 10.09%

Aug-84 9.78%

Oct-98 9.56%

Oct-74 9.48%

Dec-91 9.47%

Jul-89 9.04%

Feb-86 8.79%

Apr-01 8.67%

Jul-09 8.58%

Nov-01 8.56%

Oct-11 8.55%

Apr-68 8.51% -

Oracle Buys RightNow for $1.43 Billion

Eddy Elfenbein, October 24th, 2011 at 9:40 amHere’s interesting news from Oracle ($ORCL). The company is making a move into the cloud computing market by buying RightNow for $1.43 billion.

The deal calls for Oracle to pay RightNow ($RNOW) shareholders $43 per share. This is interesting because not that long ago, Larry Ellison dismissed cloud. This is Oracle biggest acquisition since picking up Sun Micro more than two years ago.

So what does RightNow do?

RightNow’s primary product is its CX Suite, a platform that allows companies to engage with their customers through the Web, social media and contact centers. For instance, with its “cloud monitor,” businesses can track and manage conversations on Twitter, YouTube and Facebook related to their brand. RightNow, based in Bozeman, Mont., has nearly 2,000 clients.

-

Morning News: October 24, 2011

Eddy Elfenbein, October 24th, 2011 at 5:42 amGreek Bank Stocks Plunge 13% on Haircut Fears

Sarkozy Yields on ECB Crisis Role, Pressure on Italy

EU Ramps Up Pressure On Italy To Push Reform Agenda

UBS, Deutsche Bank May Speed Cuts as Earnings Prospects Dim

China Flash PMI Rebounds to Ease Hard-Landing Fears

Currency Market Braces for Japanese Intervention: Japan’s Minister Promises ‘Action’

Japanese Stocks Rise Most in Two Weeks as Commodity Traders Advance

Swiss Banks Said Ready to Pay Billions to U.S.

Rio Tinto: Fall in Iron Ore Prices Accelerating Shorter Pricing Methods

Jobs Plan Stalled, Obama to Try New Economic Drive

TomTom Shares Rally as Profits Surge

Volkswagen May Beat Toyota to Top Spot

Jim Beam Inviting $11 Billion Liquor Takeover

2 Japanese Bankers at Heart of Olympus Fee Inquiry

Marc Chandler: France Appears to Have Conceded to German-ECB Position on Bailout Fund

Jeff Miller: Weighing the Week Ahead: Real Progress in Europe?

Be sure to follow me on Twitter.

-

Reynolds American Earnings Preview

Eddy Elfenbein, October 22nd, 2011 at 1:59 pmFrom the AP:

Reynolds American Inc., the second-biggest U.S. cigarette company and the maker of Camel brand products, is expected to report rising profit despite lower revenue when it releases its third-quarter results before the stock markets open Thursday.

Americans are continuing to buy fewer cigarettes as they face rising taxes and greater smoking bans, health concerns and social stigma.

WHAT TO WATCH FOR: Investors will be looking for signs that growth in Reynolds American’s Pall Mall brand will continue.

The company, based in Winston-Salem, N.C., has promoted Pall Mall as a longer-lasting and more affordable cigarette. It says half the people who try the brand continue using it as they weather the weak economy and high unemployment. Most tobacco companies have raised prices and cut costs to bolster profits as declining demand cuts into cigarette sales.

Pall Mall’s second-quarter volume grew 15 percent, and its share of the U.S. market increased 1.5 percentage points to 8.5 percent. Camel volume fell 3 percent during the quarter, and its share of the cigarette market remained stable 7.8 percent. But the company’s other brands are dragging down overall volume, which fell 4.4 percent in the third quarter.

Complicating cigarette shipments, the nation’s largest tobacco companies also cautioned last quarter that third-quarter cigarette volume comparisons will be hurt because wholesalers stocked up more than usual in that period last year.

Reynolds American also sells Natural American Spirit cigarettes, and Kodiak and Grizzly smokeless tobacco.

Analysts pay close attention to the company’s smokeless tobacco products — a segment of the tobacco industry that’s growing and becoming increasingly competitive as companies fight the decline in cigarette sales. Reynolds’ smokeless volumes grew 3.6 percent last quarter, and its market share grew 1.5 points to 31.3 percent of the U.S. market.

WHY IT MATTERS: Reynolds American’s results will help reveal key tobacco industry trends in the U.S.

Continued strength from Pall Mall could mean smokers are still switching to cheaper brands to save money, and those who tried the brand during the recession are remaining loyal. But if volumes of premium brands like Camel are rebounding, that could signal consumers are adjusting to higher prices on cigarettes following federal and state tax hikes.

WHAT’S EXPECTED: Analysts expect Reynolds American to report earnings of 73 cents per share on revenue of $2.16 billion, according to FactSet.

LAST YEAR’S QUARTER: Reynolds American reported earnings of 65 cents per share. Its revenue was $2.24 billion, excluding excise taxes.

-

Wicked Cool

Eddy Elfenbein, October 21st, 2011 at 7:02 pm -

S&P Upgrades Ford

Eddy Elfenbein, October 21st, 2011 at 6:43 pmThanks to the deal Ford recently reached with its unions, Standard & Poor’s raised their credit rating two notches. It’s now only one away from investment grade. The company’s debt has been in junk land since 2005.

Standard & Poor’s Ratings Services raised Ford two levels to “BB+” from “BB-,” saying the agreement will allow its North American operations to remain profitable.

Ford Motor Co. shares rose 48 cents, or 4 percent, to $12.19 in early afternoon trading.

The agency said strong performance in North America has helped Ford generate global profits in the past two years. The new 4-year contract with the United Auto Workers “will allow for continued profitability and cash generation in North America,” it said.

The union, which represents 41,000 Ford employees, approved the contract Wednesday. It includes signing bonuses but no annual pay increases, and it will let Ford hire more workers at lower wages.

Ford executives said it will raise labor costs by less than 1 percent each year — $280 million this year and $80 million a year after that. Fitch Ratings upgraded Ford on Thursday, also to within one level of investment-grade status.

Moody’s Investor Service has also said it’s reviewing its below-investment grade ratings for the automaker.

-

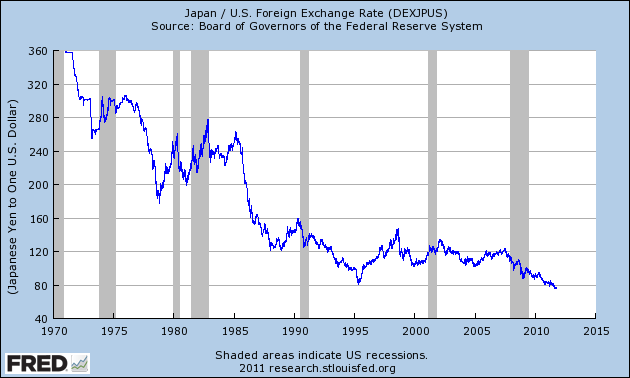

Dollar Hits Record Low Against the Yen

Eddy Elfenbein, October 21st, 2011 at 12:08 pmIn 1971, one yen was worth a measly 0.3 cents. Since then, it’s done very well.

By 1978, the yen got to half a penny. In 1987, it reached three-quarters of a cent. In 1994, we finally broke the penny mark.

Today the yen got as high as 1.32 cents.

-

CWS Market Review – October 21, 2011

Eddy Elfenbein, October 21st, 2011 at 8:15 amThe stock market continues to improve albeit in a hesitating manner. Last week, the S&P 500 broke above its 50-day moving average and this past Tuesday, the index closed at its highest level in two-and-a half months.

So has the bear finally left us alone? Unfortunately, it’s too early to say. The market is stronger than it was but there are still plenty of hidden—and not-so-hidden—risks out there. The problems in Europe are still bad but at least the authorities finally realize that they can no longer drag their lederhosen. For now though, all eyes are on the third-quarter earnings season which is now in full swing.

In this issue of CWS Market Review, we’ll take a closer look at earnings season. So far, all four of our Buy List stocks that have reported have topped expectations. I’m happy to report that our Buy List is leading the rebound. In the last 13 trading days, our Buy List has gained more than 11.3%. If this keeps up, 2011 will be our fifth-straight year of beating the overall market. As usual, prudence and patience have served us well.

Now let’s look at the most exciting news this week which was the break-up announcement of Abbott Labs ($ABT). The company stunned Wall Street on Wednesday when they said that they’re breaking themselves into two separate companies: a drug business and a medical devices business. I’ve long been a fan of ABT. This company throws off tons of cash and has a solid balance sheet.

The problem for Abbott (and what attracted me to it) is that the market is clearly wary of giving their drug business a decent valuation. Humira, Abbott’s blockbuster rheumatoid arthritis drug, will rack $6.5 billion in sales this year. But there are fears that competitors will move into that space and knock the legs out from under Humira.

Due to these worries, the entire company’s valuation has suffered. But as I’ve noted before, Abbott is much more than Humira. They have a strong business in medical devices which hadn’t been getting the market love it deserves. So Abbott did the logical step and announced the break-up. Interestingly, it’s the medical devices business that will keep the Abbott name. That probably tells you where the priorities lie.

The spin-off will happen sometime next year so it won’t impact this year’s Buy List. As a general rule I like spin-offs, especially when good companies do them. What often happens is that a highly profitable division feels that it has to “carry the weight” of a larger organization. Once the division is unmoored from its parent company, it’s able to be more flexible and find new areas of growth.

Also on Wednesday, Abbott reported third-quarter earnings of $1.18 per share which was a penny more than estimates. Abbott narrowed their full-year guidance from $4.58 – $4.68 per share to $4.64 – $4.66 per share. That means the stock is going for 11.6 times this year’s earnings which is less than the overall market. The full-year range implies a Q4 range of $1.43 to $1.45 per share which is a nice jump over the $1.30 per share from last year’s Q4.

Shares of Abbott responded positively to the break-up news and the stock currently yields a healthy 3.55%. For the year, Abbott is a 12.82% winner for us which is a lot better than the market’s loss of 3.36%. I congratulate Abbott on their bold move and I rate the stock a strong buy up to $58 per share.

Two other healthcare companies of ours reported earnings this past week. On Tuesday, Johnson and Johnson ($JNJ) reported earnings of $1.24 per share. This beat Wall Street’s consensus by three cents per share but was a penny less than my forecast. The bottom line is that this was another solid quarter for J&J.

In last week’s CWS Market Review, I said that JNJ could raise both ends of their full-year forecast by five cents per share. Well, I was half right. The company raised the low end of its forecast by a nickel per share. The new EPS range for 2011 is $4.95 – $5.00 per share which implies a Q4 range of $1.08 – $1.13.

The share price dropped a bit on the news but not too badly. JNJ continues to do well. This is a very well-run firm; Johnson & Johnson is a good buy up to $67 per share.

The other healthcare stock to report was Stryker ($SYK). After the close on Wednesday, the company reported earnings of 91 cents per share which was two cents better than estimates; plus Stryker raised their full-year guidance. The new guidance is $3.70 – $3.74 per share which is up from $3.65 – $3.73 per share. That implies a Q4 range of $1 – $1.04 per share.

Last week, I wrote that I like Stryker but that it would be better at a cheaper price. Sure enough, the stock dropped on the good earnings report. Stryker closed Thursday at $48.28 which is a decent price (less than 13 times this year’s earnings). However, if you’re able to get Stryker below $45, you’ve gotten a very good deal.

The upcoming week will be a very busy week for us; we have five Buy List stocks reporting earnings. On Tuesday, Reynolds American ($RAI) reports. Then on Wednesday, AFLAC ($AFL) and Ford ($F) are due to report. Finally on Thursday, Deluxe ($DLX) and Gilead Sciences ($GILD) will report.

The one I’ll be watching most eagerly is AFLAC ($AFL). Simply put, the selling of AFLAC shares reached ridiculous levels over the last several weeks. At one point, the stock was trading at $31.25 though the company has told us repeatedly that it expects to earn between $6.09 and $6.34 per share in operating earnings this year.

Well, Wednesday will be the time of reckoning. In the last earnings report, AFLAC said that it expects Q3 operating earnings to range between $1.54 and $1.60 per share. My numbers say that’s too low. I think AFLAC can easily make $1.64 per share. They may also have good things to say about next year as well. I’m going to raise my buy price for AFLAC to $43 per share.

Three months ago, Reynolds upset Wall Street when it missed earnings by four cents per share (which I suspected would happen). That was pretty unusual for Reynolds but the stock has recovered very nicely. The current estimate for Q3 is for 73 cents per share which seems about right.

The other earnings report to watch will be from Ford. The company is fundamentally very sound despite the stock’s poor performance this year. I’m also pleased to see that the latest union contract has been approved. Wall Street currently expects Ford’s third-quarter earnings to come in at 45 cents per share which is below the 48 cents per share from the year before. I think there’s a good chance here for a large earnings beat.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His