Archive for October, 2011

-

The VIX Breaks Below 30

Eddy Elfenbein, October 14th, 2011 at 12:16 pmMore evidence that the Fear Trade is unwinding. The Volatility Index ($VIX) just broke below 30.

The VIX hasn’t closed below 30 since August 3rd.

-

Google Smashes Earnings

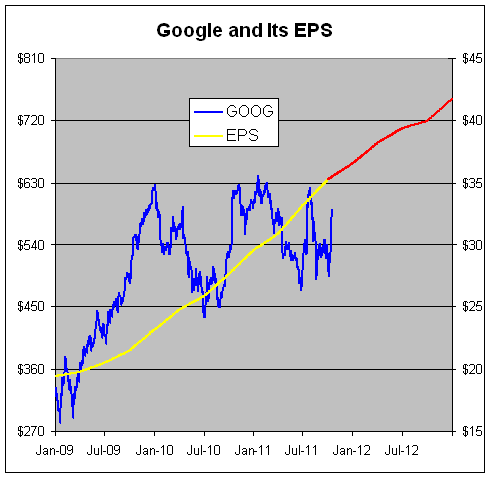

Eddy Elfenbein, October 14th, 2011 at 11:26 amAfter the close yesterday, Google ($GOOG) reported very strong third-quarter earnings. The company earned $9.72 per share which was 98 cents better than estimates. The stock has gapped up as much as 7.2% this morning and it nearly came close to piercing $600 per share.

Here’s a look at Google’s stock along with its earnings-per-share. The share price is the blue line (left scale). The earnings is the gold line and it follows the right scale. The red line is Wall Street’s forecast.

I scaled the two axes at a ratio of 18-to-1 which means that the P/E Ratio is exactly 18 whenever the lines cross. (Note: Please don’t take 18 as my valuation of Google. I just thought the chart looks more readable using that ratio.)

From early 2010 to this summer’s low, Google’s P/E Ratio has been nearly cut in half. Here are two ifs — if Wall Street’s earnings forecast is correct and if Google trades at 18 times that, then the stock will be at $750 by the end of 2012. That’s a 27% gain over the next 14-and-a-half months.

-

Strong Retail Sales Last Month

Eddy Elfenbein, October 14th, 2011 at 9:15 amMore evidence that there’s no Double Dip at hand. The Commerce Department reported that retail sales rose by 1.1% last month. The number for August was also revised to show a 0.3% gain.

Higher food and energy prices crimped purchasing power earlier this year, while the debt ceiling crisis along with stock market losses undermined confidence. Recent data, meanwhile, showed that incomes fell in August, the first drop in nearly two years. That forced Americans to dig into their savings in order to maintain their living standards.

But September’s broad-based retail spending gains indicate a degree of optimism.

Friday’s data showed a 3.6% jump for auto and parts sales. Excluding cars, overall retail sales were up 0.6%. Economists had expected retail sales excluding autos to climb 0.4%.

Restaurant, furniture, clothing, department store and non-store retail sales–a category that includes the internet–all posted gains. Gasoline station sales also showed another increase.

-

CWS Market Review – October 14, 2011

Eddy Elfenbein, October 14th, 2011 at 8:19 amIn last week’s CWS Market Review, I mentioned that we could be seeing the start of a prolonged rally. I’m happy to see that the stock market extended its gains this week. On Monday, the S&P 500 broke above its 50-day moving average. Then on Wednesday, the index came very close to hitting its highest close since August 3rd.

Despite how well the market has done, I’m not a full-fledged believer just yet. I’ll feel a lot better once the market clears its 200-day moving average, but we have another 6% to go for that to happen. Historically, stocks perform much better when the S&P 500 is above its 200-DMA.

I’m pleased to see investors are gravitating towards the kind of high-quality stocks we favor. Since Monday before last, our Buy List is up 10.29% which is 79 basis points more than the S&P 500. Over that same time span, shares of Ford ($F) and Wright Express ($WXS) are both up 21% and shares of boring little Deluxe ($DLX) are up close to 24%. Best of all, Deluxe still yields close to 4.5%.

The fact is clear: for the first time in several weeks, investors are seeking safety in stocks, not bonds. Over the last three weeks, investors have quietly sold their bonds and yields have ticked higher. The 30-year Treasury dropped for six days in a row which was its longest slide in four years. The 10-year note recently crossed 2% and I think it could head to 2.5%.

Until three weeks ago, investors had been massively piling into gold and bonds, seeking shelter from whatever weekly disaster was happening in Europe. The latest (tentative) news from Europe is hopeful and gold has taken its biggest drop in three years. This is part of the Fear Trade unwinding. It’s still too early to declare victory, but the bears are clearly walking back some of their risk-averse positions.

Make no mistake, the European banks are far from healthy and S&P just downgraded Spain; but it looks like the authorities are starting to realize how bad things are. It’s as if everyone in Europe is waiting for a “Lehman” moment, which may never come. Instead, we’re watching a slow erosion of investor confidence. According to Barclays, the problems in Europe have erased $13 trillion of wealth since July 1st. I should add that I’ve been impressed by how strong the comments have been from officials in Europe. It looks like the next big meeting will be on November 3rd-4th when the G-20 assembles in Cannes.

Here in the U.S., the next few weeks will be dominated by earnings reports. I expect this earnings season to be good but it won’t be as impressive as previous seasons have been. Overall, our stocks should continue to post good numbers and that’s probably giving us a lift. Earlier this week, Reynolds American ($RAI) hit a new 52-week high. Don’t let these conservative value stocks fool you. Reynolds is one of our best performers so far this year. The recent good news from Europe has also been positive for AFLAC ($AFL). Since September 23rd, the stock is up 28%. I’m expecting another solid earnings report in two weeks.

Looking around at other stocks on our Buy List, I see that Bed, Bath & Beyond ($BBBY) is also near its 52-week high. Sometime within the next few weeks, I expect to see Becton, Dickinson ($BDX) increase its dividend for the 39th year in a row. I still like Oracle ($ORCL) a lot. In fact, I’m going to raise my buy price for it. Three weeks ago, I said Oracle was a good buy up to $30. I’m now raising that to $33. That’s a very good stock.

I mentioned last week that the big story for us this week would be JPMorgan Chase’s ($JPM) earnings report. On Thursday, the bank reported earnings of $1.02 per share which was ten cents more than estimates. The stock fell after the earnings report but I think this was a decent report, though not a great one.

Bear in mind that Wall Street has been slashing estimates for all the major banks for this earnings season. To give you an example, a few weeks ago the analyst community was expecting Goldman Sachs ($GS) to report earnings of more than $3 per share. Now that’s down to 27 cents per share. In fact, Goldman could post a loss. For JPM, the downgrades weren’t nearly as harsh. Estimates fell from around $1.20 per share to 92 cents per share (which they beat anyway). The story for JPM is that the capital markets side of the business is rather weak but traditional retail banking is doing fine.

All told, JPM is still doing well despite a more challenging environment. By most reasonable metrics, the shares are cheap. In my opinion, the most important factor to watch with JPM is the dividend. The quarterly dividend is currently at 25 cents per share which gives the stock a yield of 3.16%. That’s about what a 30-year Treasury gets now. But more importantly, JPM can easily raise its dividend by 30% or more.

The next earnings report from a Buy List stock will be Johnson & Johnson ($JNJ), which reports on Tuesday, October 18th. Wall Street expects Q3 earnings of $1.21 per share which is too low. That would actually be a decrease of two cents per share from one year ago. My analysis shows that JNJ can deliver earnings of $1.25 per share.

In July, JNJ reiterated its full-year EPS forecast of $4.90 to $5. I think there’s a very good chance that they’ll raise both ends of their forecast by, say, five cents per share. The bottom line is that JNJ is the ultimate in blue chip safety. Unlike the United States of America, JNJ has a AAA credit rating. The stock currently yields 3.55%. Johnson & Johnson is a good buy up to $67 per share.

On Wednesday, October 19th (the 24th anniversary of the ’87 Crash), Stryker ($SYK) will report earnings after the close. For the first and second quarters, the company earned 90 cents per share, so let’s go with that figure for the third quarter as well (the Street expects 89 cents). Stryker has said it expects full-year earnings of $3.65 to $3.73 per share. Stryker is a very good company but I’d like to see the stock a little lower than where it is right now before I feel confident calling it a very strong buy. As it is, Stryker is a good buy at $50 but I’d like it a lot more at $45.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: October 14, 2011

Eddy Elfenbein, October 14th, 2011 at 5:18 amG-20 Mulls Boosting IMF Lending Power

China’s Zhu Says G20 Ministers Discussed More Credit for Europe

China Inflation Ticks Lower, Policy on Pause

Spain’s Credit Rating Cut by S&P on Weaker Growth Outlook

Brent Crude Oil Rises Near $112 as China Inflation Cools

Oil Firms Face Liability Protection Challenges

Hurting at Home, U.S. Ranchers Find Markets in Russia for Their Beef, on the Hoof

Bank Rules That Serve Two Masters

Wall Street Protests Planned in London, Tokyo

Google Gains After Advertising Demand Helps Sales Top Estimates

UBS Rating Cut, Fitch Says More Than Dozen Banks May Follow

Unilever to Buy Russia’s Kalina in $694M Deal

News Corp. Hits a Bump as Investors Prepare to Meet

Phil Pearlman: xxxx Recommends Caution Into Google Earnings

Edward Harrison: Hockett Says Restructure Debt and Invest in Infrastructure

Be sure to follow me on Twitter.

-

JPMorgan Chase Earns $1.02 Per Share

Eddy Elfenbein, October 13th, 2011 at 10:50 amFrom Bloomberg:

JPMorgan Chase & Co. (JPM), the second-largest U.S. bank, reported an approximately 33 percent profit decline excluding a $1.9 billion accounting benefit as earnings from investment banking and trading slumped.

Third-quarter earnings fell to about $3.1 billion, or 73 cents a share, not including the 29-cent accounting gain, from $4.71 billion on the same basis a year earlier. Net income was $4.26 billion, or $1.02 a share, compared with the average per- share estimate for adjusted earnings of 92 cents in a survey of 30 analysts by Bloomberg, the New York-based company said today.

Revenue at the investment-banking unit fell 13 percent from the second quarter as concern that Greece would default and U.S. lawmakers would fail to raise the debt ceiling roiled markets. The firm said the division will face similar market conditions for the rest of the year. The retail business fared better, with mortgage fees and related income gaining 25 percent from the second quarter and credit-card revenue up 7 percent.

The debt-valuation gain, “does not relate to the underlying operations of the company,” Chief Executive Officer Jamie Dimon, 55, said in a statement. Dimon said on a conference call with journalists that the after-tax effect of the accounting change was about 60 percent of the total gain for the quarter.

-

Q3 Projected to Be Lower than Q2

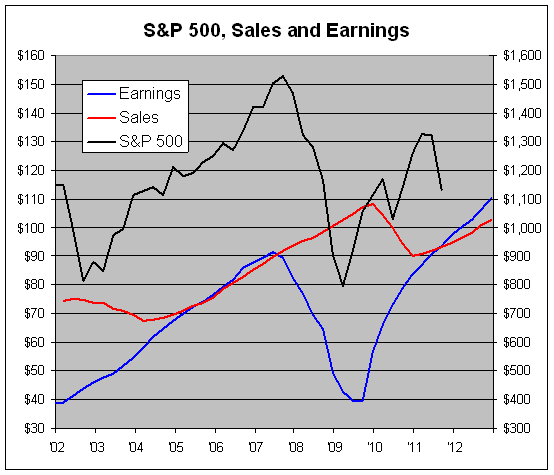

Eddy Elfenbein, October 13th, 2011 at 10:10 amAs earnings season begins to heat up, Wall Street thinks that earnings for the S&P 500 will be lower in the third quarter than they were in the second.

For the record, the S&P 500 earned $24.86 in the second quarter which was an all-time record. Wall Street currently expects Q2 earnings to come in at $24.29 which is a drop of 2.29%.

Don’t be too alarmed — this is still a projected increase of 12.66% from one year ago. Wall Street expects earnings growth to accelerate to close to 17% in the fourth quarter, which seems too optimistic to me. The Street also expects earnings growth of 13.18% in 2012, which is again probably too high.

Sales for the S&P 500 are projected to fall sequentially from $258.76 to $263.31. That’s a drop of 1.73%. Since earnings are projected to fall more than sales, that means operating margins are expected to fall slightly — from 9.44% to 0.39%.

The operating margin market of 9.44% in Q2 was the highest since the 9.60% mark reached in the third quarter of 2006. The lesson is that earnings can’t continue to rise thanks to higher margins — sales need to rise as well.

To give you an idea of how powerful the margin story has been, sales growth from Q2 of 2009 to Q2 of 2011 was almost 18%. Earnings growth, however, was 80%. Margins increased from 6.19% to 9.44%.

-

Stock Market Report – 101 Years Ago

Eddy Elfenbein, October 13th, 2011 at 10:02 amThe Morning Leader

Regina, Saskatchewan

January 15, 1910Genuine liquidation was evident today in a demoralized stock market. However strange it may appear to those who believe the president’s campaign of legislation is in the interests of the stockholders, it is a fact that the world in general seems alarmed at what President Taft proposes to do. Selling was undoubtedly precipitated by the Rock Island affair, and professionals took advantage of the uneasiness, thus causing the public to get worried. The public, not understanding the technical condition of the market, has believed something fundamental is wrong.

The selling of stock is now from the hands of the real owners. It is not a Wall Street protest, but a protest from small investors. There is little doubt that it will be listened to by the powers at Washington, and the chances are that the politicians, when they see out of what quarter the wind is blowing, will trim their course accordingly, and head off all legislation whatever.

Many well meaning persons believe that the government is going too far in assuming control and management of the railroads and manufacturing industries of the country. Those who believe that such control would be of great advantage to the stockholders and to the public are apparently in the minority, and must bow to the will of the great opposition that has made itself manifest through the selling of investment stocks.

It can be said on the highest possible authority that the great financiers of Wall Street are in favor of closer control by the government. They have been preaching cheerfulness and higher prices in the past two weeks, and they have made their words good by heavy purchases in the stock market. There is no doubt, for instance, that the Morgan following has bought steel freely, every fraction down. Right now they are advising its purchase without reserve. Those closest to the Harriman throne are buying Union Pacific and Southern Pacific and are telling every enquirer that they must certainly dismiss the suit against the Union Pacific.

-

Morning News: October 13, 2011

Eddy Elfenbein, October 13th, 2011 at 5:46 amChina Exports Slow on ‘Severe Challenges’

IMF: Japan Must Do More To Cut Debt, Secure Fiscal Confidence

EU Barroso: Greece Must Reduce Debts If It Is To Succeed

Europe Tells Its Banks to Raise New Capital

German Institutes Cut 2012 Growth Forecast

Protesters to ‘Occupy’ London Stock Exchange

Congress Ends 5-Year Standoff on Trade Deals in Rare Accord

Divisions Grow on Federal Reserve’s Policy Committee

Fed Signals Next Move May Link Stimulus to Economic ‘Mileposts’

Buffett’s Son Defends Occupy Wall Street

U.S. Treasury Didn’t Review Solyndra Rescue Effort, Memo Shows

Retail Giant Carrefour Warns on Profit as Europeans Cut Back

Rolls Shares Surge on Profit Boosting Engine-Venture Exit

Liz Claiborne Rises Most in 24 Years on Brand Sale to Penney

For BlackBerry Maker, Crisis Mounts

Jeffrey Carter: Government Reports, Market Volatility and Big Government

Stone Street: Dude, Where’s MY Bailout???

Be sure to follow me on Twitter.

-

Ford Continues to Thrive

Eddy Elfenbein, October 12th, 2011 at 11:55 amI want to say a few words about Ford Motor ($F). I was very optimistic for this stock at the beginning of the year. However, a number of problems have hindered the company and the stock has plunged.

As a result, Ford has been near the top of my list for stocks to ditch for next year’s Buy List. But Ford is now so cheap that it’s a good bargain. The selling has been very overdone.

Also, there’s been some good news at Ford recently. Moody’s said that it’s considering raising the company’s credit rating which is currently in the toilet. The catalyst is the recent deal agreed to by Ford and the UAW. Obviously labor costs are a major issue for the company to remain competitive. (Ford and the union aren’t quite there since one of the locals just rejected the deal.)

Ford borrowed a ton of money before the financial crises. The company has worked to pay off their debt but there’s still a long way to go. An improved credit rating will help alleviate some of their interest costs.

The company also had a strong sales month for September. It was their best September since 2004. The company’s car sales aren’t strong but the trucks and utility models are doing very well.

The Dearborn, Mich.-based auto maker said its total U.S. sales increased 8.9% last month to 175,199 units. Ford-brand sales leaped 14.4% to 168,181, while its struggling Lincoln unit suffered a 6.6% decline to 7,018 vehicles.

Ford’s growth was highlighted by a 41% jump in Escape sales and a 204% surge in Explorer sales.

The company also sold 15% more trucks, including its best month of F-Series sales of the year at 54,410 units sold.

SUV sales climbed 35%, posting their best month at Ford since 2004. Ford’s hot-selling Escape vehicle has set internal monthly sales records seven out of nine months and is up 32% to 187,850 year-to-date.

“Ford continues to deliver strong sales results in a dynamic marketplace with a broad portfolio of fuel-efficient, high-quality products,” Ken Czubay, vice president for U.S. marketing sales and service, said in a statement. “This is further proof that Ford is offering the vehicles – with the fuel economy and technologies – that people truly want and value.”

Last week, the stock dropped to $9.05 which is 4.7 times this year’s earnings. Ford has been as high as $11.77 today.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His