Archive for October, 2011

-

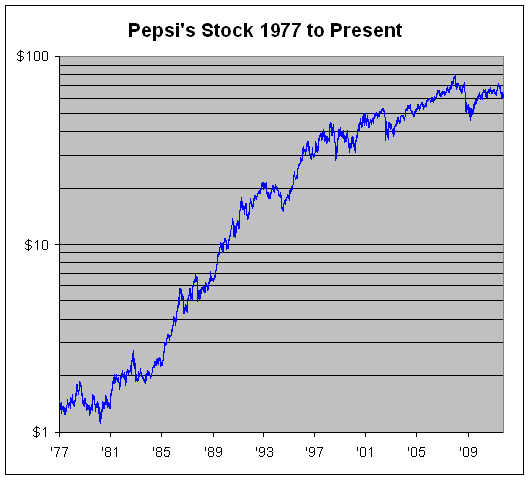

Pepsi Beat Earnings

Eddy Elfenbein, October 12th, 2011 at 9:53 amPepsi ($PEP) isn’t on my Buy List but it’s a stock I like a lot. The company has raised its dividend for the last 39 years in a row. Also, Pepsi is a lot more than soft drinks. Close to half of its sales come from snacks.

Pepsi just reported third-quarter earnings that were one penny better than expectations:

PepsiCo Inc., the world’s largest snack-food maker, reported a 4.1 percent rise in third-quarter profit, helped by price increases and sales of snacks in Latin America.

Net income advanced to $2 billion, or $1.25 a share, from $1.92 billion, or $1.19, a year earlier, Purchase, New York- based PepsiCo said today in a statement. Profit excluding some items totaled $1.31 a share, beating the $1.30 average of 14 analysts’ estimates compiled by Bloomberg.

-

Morning News: October 12, 2011

Eddy Elfenbein, October 12th, 2011 at 5:33 amEurope Stocks Erase Losses as Carmakers, Chemical Companies Gain

Germany’s Schaeuble Confident Slovakia Will Ratify EFSF

As Greece Avoids a Default, Recapitalization Plans Emerge for European Banks

China Shares End Sharply Higher On Policy Loosening Hopes

Textile Makers Fight to Be Heard on South Korea Trade Pact

U.K. Unemployment Jumps to Highest in 15 Years

Gold Gains in London as European Debt Concerns Spur Demand

Senate Blocks Obama’s $447 Billion Job Creation Plan

Wall Street Sees ‘No Exit’ From Financial Woes

Painful Job Cuts Coming to Wall St.

Alcoa Profit Misses Estimates as Europe Cuts Aluminum Orders

99 Cents Stores Agrees To $1.55 Billion Offer From Ares, Canada Pension

European Semiconductor Equipment Giant ASML Forecasts Sales Rise in Fourth Quarter

Roger Nusbaum: Forget About Stocks?

Paul Kedrosky: Benford’s Law and the Decreasing Reliability of Accounting Data

Be sure to follow me on Twitter.

-

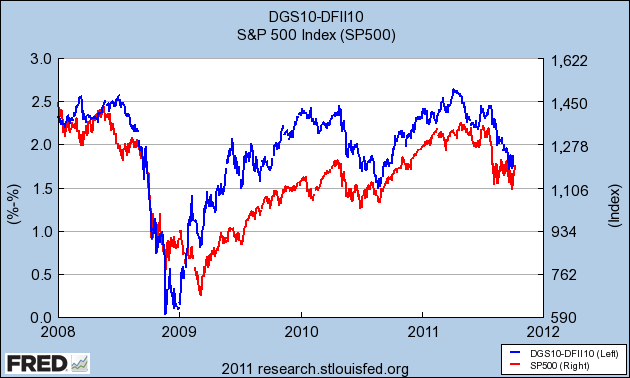

Stocks Mirroring Inflation Expectations

Eddy Elfenbein, October 11th, 2011 at 3:43 pmI’ve run this chart before but I think it captures a fascinating aspect of this market. Stock prices seem to move with inflation expectations.

The red line is the S&P 500 and it follows the right scale. The blue line is the difference between the 10-year Treasury yield and the 10-year TIPs, and it follows the left scale.

The relationship isn’t perfect–few financial comparisons are–but this one looks pretty darn good. In fact, the correlation seems to be getting stronger in recent months.

Correlation, of course, doesn’t mean causation. The two phenomena could be responding to a third. Or perhaps, the relationship is purely illusionary.

But if the chart is to be believed, then Mr. Market is a major inflation dove.

-

Netflix Is Down $200 in Three Months

Eddy Elfenbein, October 11th, 2011 at 12:13 pmEighteen months ago, I called Netflix ($NFLX) “The Absolute Worst Stock to Buy Right Now.” Ugh; not one of my better calls. The posting even caused the CEO to send me a snippy email.

This was part of my post:

Last year, Netflix made $115.9 million of sales of $1.67 billion. That works out to earnings of $1.98 a share. The stock, however, is currently around $86 or 43 times trailing earnings. The shares were overpriced at the start of the year and they’re up another 55% since then.

When the fourth-quarter earnings came out in January, Netflix said that it expects full-year earnings-per-share for 2010 to range between $2.28 and $2.50. So even going by the top end of forward earnings, NFLX is still trading with a P/E ratio of around 35 which is more than twice the S&P 500. That’s just crazy.

Seems reasonable, but it was one of the worst calls I’ve ever made. At the time, the stock was at $87. Three months ago, NFLX hit $304.79.

To be fair, I continued to call the stock horribly overpriced. For example, when it hit $110 or when it hit $188 or when it hit $230 or when it hit $267. Hey, at least I’m consistent.

To be a good investor, you need to look at your mistakes. So why was I so off about Netflix? I think my analysis was right but I was wrong on just how irrational the market can be — and how long it be irrational for. In the end the facts win, but that can take awhile.

Today, shares of Netflix hit $103.13 which is a loss of $201.66 in just three months. I don’t believe that Netflix is down so much because they upset their customers and made some bad moves at damage control. Of course, that’s part of the move but that alone doesn’t cause a company to lose two-thirds of its value in a matter of weeks.

Instead, the severe drop was due to a vastly inflated share price. The price issue was merely a catalyst for the momentum investors to get out. And they did.

-

The Market Is Down on News from…Slovakia?

Eddy Elfenbein, October 11th, 2011 at 9:38 amThe stock market looks to open lower this morning. Once again, investors are looking at events in Europe. Each country needs to approve a deal to increase the size of the European bailout fund. The only country left is Slovakia. I can’t remember the last time investors in the U.S. were concerned about events in Slovakia, but here we are.

After today’s close, Alcoa ($AA) will be the first major company to report earnings. Wall Street expects 22 cents per share compared with nine cents one year ago.

Interestingly, while many large “capital markets” banks are feeling the squeeze, many retails banks are doing quite well. Goldman Sachs ($GS) may report a quarterly loss in a few days, but banks like Wells Fargo ($WFC) are thriving. Every stock in the KBW Bank Index ($BKX) is down for the year.

On Thursday, JPMorgan Chase ($JPM) will report its third-quarter earnings. Here are some interesting comments from Bloomberg:

The split between Wall Street businesses and other types of banking will be demonstrated by JPMorgan, the second-biggest U.S. bank by assets. The New York-based company will report 95 cents of earnings per share for the quarter, just 6 percent lower than a year earlier, according to the average estimate of 30 analysts surveyed by Bloomberg.

Those earnings, the lowest in six quarters, may reflect gains in consumer lending and credit-card revenue as well as declines at the investment bank. James Staley, 54, who runs the investment bank, said at an investor presentation on Sept. 13 that “markets revenue” will decline about 30 percent from the second quarter and that fees from investment banking will be about $1 billion.

-

Morning News: October 11, 2011

Eddy Elfenbein, October 11th, 2011 at 5:48 amSlovak PM: EFSF Vote To Be Linked To Confidence Vote

Euro Declines From Three-Week High Versus Dollar Before Slovakia EFSF Vote

Trichet Sees ‘Systemic’ Danger as Greek Writedowns Divide EU

Bank Indonesia Surprises With Rate Cut

Chinese Banks Rally After Huijin Begins Increasing Holdings

Japan Courts the Money in Reactors

Currency Forecasters Say Best Over for Dollar

Regulators to Set Forth Volcker Rule

Netflix, in Reversal, Will Keep Its Services Together

Advisory Firm Urges Ouster Of Murdoch and His Sons

Goldman Sachs Earnings Collapse, Wells Fargo Thrives

Wal-Mart China Staff Detained in Probe

Paulson Clients Said to Pull Less Than 10% From Two Hedge Funds

Groupon: ‘Transparent About Our Lack of Transparency’

Cullen Roche: The 5 Most Likely EMU Scenarios

James Altucher: How to Use Gratitude to Get Rich

Be sure to follow me on Twitter.

-

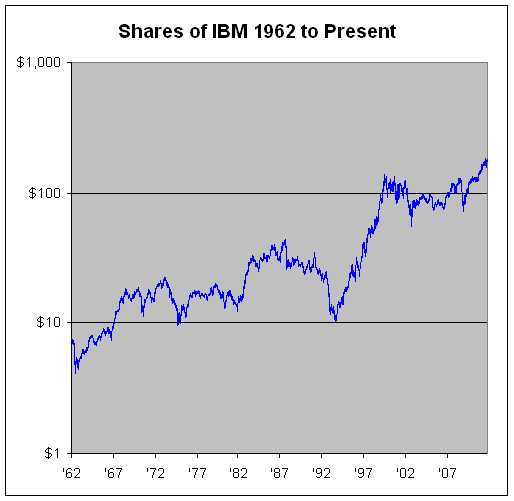

IBM Hits New All-Time High

Eddy Elfenbein, October 10th, 2011 at 3:32 pmShares of IBM ($IBM) broke out to a high of $186.37 today which is a new all-time high. In the summer of 1993, the stock reached a split-adjusted low of $10.25. That’s a growth of 18-fold in 18 years. Annualized, that’s close to 18%.

Below is a 50-year look at the stock. I Don’t think IBM gets the props it deserves.

IBM was the glamor stock of the go-go 1960s. Due to its rapid growth and relatively few splits, the nominal share price was often over $500.

IBM was removed from the Dow in 1939 and put back in 1979. In those 40 years, the stock gained an astounding 22,000%. If IBM had been in the index, the Dow would have broken 1,000 in 1961 instead of 1972. By my rough estimate, the index would be over 4,000 points higher today.

IBM reached an out-performance peak in January 1970. For the next 16 years, IBM was mostly a market performer, perhaps slightly below average. Then the bottom fell out and IBM was a sell until September 1993. Since then, the stock has been a top performer.

-

The S&P 500 Breaks Above Its 50-DMA

Eddy Elfenbein, October 10th, 2011 at 10:54 amFor the first time since July 28th, the S&P 500 broke above its 50-day moving average.

-

The S&P 500 Breaks 1,190

Eddy Elfenbein, October 10th, 2011 at 10:48 amThe stock market is getting another bump this morning. The S&P 500 has been as high as 1,190.15 so far which is an 8.27% rally from last Monday’s close.

The cyclicals are in charge today as the Energy, Financial and Materials sectors are doing the best. On Thursday of this week, JPMorgan Chase ($JPM) will be the first of the major banks to report earnings. The shares got as low as $27.85 last week. Today it’s the top-performing stock on our Buy List. This earnings report will probably tell us a lot about where banks earnings stand for this earnings season. I’m pleased to see that both AFLAC ($AFL) and Ford ($F) are strong today.

Bloomberg sums up the good news:

German Chancellor Angela Merkel and French President Nicolas Sarkozy said yesterday they will deliver a plan to recapitalize European banks and address the Greek debt crisis by the Nov. 3 Group of 20 summit. Belgium said today it will buy part of Dexia SA and provide security for depositors as part of a plan to rescue the lender.

-

Happy Sixth Birthday to Abnormal Returns!

Eddy Elfenbein, October 10th, 2011 at 10:39 amToday marks the sixth birthday for the great blog, Abnormal Returns, which is the home of the indefatigable Tadas Viskanta.

If you’re not familiar with Abnormal Returns, Tadas does a daily linkfest — though I’m hesitant to use that word since what he does is so much more — he captures the best of the financial blogosphere.

The entire staff here at Crossing Wall Street congratulate Tadas on his success. Josh Brown at the Reformed Broker gathered a collection of praise from all across the world of financial blogs.

Here’s a sample:

Howard Lindzon (StockTwits): “Tadas has style. He loves curating and sharing and understands the link economy and the social web. We are lucky to have him in the financial blogosphere.”

Mebane Faber (World Beta): “Tadas is a must read at our shop, and I’d pay more to subscribe to his site than to any newspaper.”

JC Parets (All Star Charts): “It’s the best stuff out there. Plain and simple. If you want to know what’s going on – look no further. I tell this to everyone.”

Eli Radke (Trader Habits): “Abnormal Returns has impacted me and countless others, that impact is measured by the inability to remember what life was like before. Meeting Tadas will only make you a bigger fan.”

Felix Salmon (Reuters): “Abnormal Returns ROCKS. Happy blog-birthday, Tadas!”

Justin Paterno (ZeroBeta): “Abnormal Returns is the motivating force of the financial blogosphere. If you write a blog post, you can’t wait to see if Tadas picks you up – not for the traffic but to see if what you wrote was worth linking to.”

Mark Gongloff (WSJ MarketBeat): “Abnormal Returns is so important to my daily blogging life that I named my first child “Abbie Normal.” My wife of course had other ideas, but I told her ‘Ritholtz’ was a terrible name for a baby girl.”

Joe Weisenthal (Business Insider): AR is awesome. In many ways, I consider Tadas a blog soulmate, as he started AR right around the same time I started my first financial blog, TheStalwart.com. Before anyone else he sensed that this financial blogging thing would be big, and since then that sense has served him identify and aggregate exactly what needs to be read right at any given time.

TED (The Epicurean Dealmaker): “Abnormal Returns is an essential component of my toolkit for rapine, pillage, and world domination. Without Tadas, I’m sure I would be a hemp-wearing, dreadlocked slacker getting pepper-sprayed on Broad Street.”

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His