Archive for November, 2011

-

Morning News: November 17, 2011

Eddy Elfenbein, November 17th, 2011 at 5:22 amGreece Turns to Budget After Confidence Vote Win

Widening Split in Europe on the Virtue of Austerity

U.S. Airline Group Looks to Block Air India Funding

Japan Restricts Fukushima Rice Shipments After Radiation Found

U.S. Banks Face Contagion Risk From European Debt: Fitch

Thai Baht Weakens as Fitch Says Europe Crisis a Threat to U.S. Banks

Oil Climbs to Five-Month High in New York as Supplies Counter Debt Concern

Gold Top Pick at Morgan Stanley as Europe Debt Spurs Demand

As New Graduates Return to Nest, Economy Also Feels the Pain

Why Wall Street’s Layoffs Are More Serious Than You Think

Reform Adds More Twists to a Convoluted Derivatives World

With MF Global Money Still Lost, Suspicions Grow

SABMiller Runs Into Tough Trading in Europe and U.S.

Branson’s Virgin Money to Acquire Northern Rock From U.K. for $1.2 Billion

Cullen Roche: 5 Misconceptions About Peak Oil

Phil Pearlman: The Markets and The Deep Layer of Chronic Diffuse Anxiety

Be sure to follow me on Twitter.

-

Inflation Continues to Chill Out

Eddy Elfenbein, November 16th, 2011 at 10:31 amIt’s rather amusing how many people are predicting the imminent return of hyper-inflation. On these matters, I prefer to be a realist. We haven’t had much inflation and it doesn’t appear that we will any time soon.

The Labor Department reported this morning that inflation actually fell by 0.1% last month. Economists were expecting no change. The core rate, which excludes food and energy, rose by 0.1% and that matched expectations.

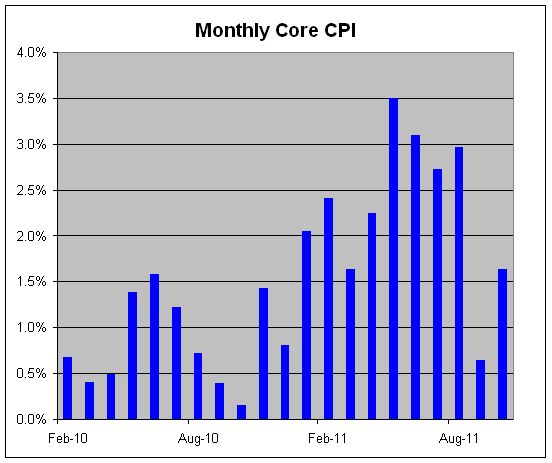

Here’s my preferred way of looking at inflation. This is the monthly core rate which is seasonally adjusted and annualized:

My point is that you can see a clear rising trend of inflation. We’re not so concerned with one or two outliers, but a trend tells us something. That trend, however, peaked in May at 3.5%. Since then, inflation has gradually crept back down. In September, it dropped to 0.66% and last month, it was 1.64%.

What does this mean for stocks? Lately, the stock market tends to move in alliance with inflation expectations. But expectations of inflation and inflation aren’t the same thing. Historically, the stock market isn’t much concerned with inflation that’s below 5.3%.

-

Sysco Raises Dividend

Eddy Elfenbein, November 16th, 2011 at 9:51 amIn our last CWS Market Review, I said that I expected Sysco ($SYY) would soon raised its quarterly dividend by a penny per share:

Here’s the important part: Sysco has raised its quarterly dividend for the last 41 years in a row, and I expect to see #42 very soon. However, the increase will probably be very modest. My guess is that the board will bump up the quarterly dividend from 26 cents to 27 cents per share. That would give the shares a yield of close to 4%. In this environment, that’s not bad. Sysco is a good buy up to $30 per share.

Sure enough, I got it right. Sysco just announced that it’s raising its dividend by a penny to 27 cents per share. Going by yesterday’s close and the new dividend, the current yield comes to 3.92%.

-

Morning News: November 16, 2011

Eddy Elfenbein, November 16th, 2011 at 5:29 amEuro Falls To Fresh 1-Month Low On Debt Woes

JPMorgan Joins Goldman Keeping Italy Debt Risk in Dark

European Union Softens Bid to Rein in Ratings Agencies

Bank of Japan Cuts Economic View as Europe Crisis Becomes Growing Risk

China Foreign Investment Rises at Faster Pace

Spain Set to Purge Banks of Property Hangover

Spared in War, Libya’s Oil Flow Is Surging Back

Iraqi Cabinet Approves Royal Dutch Shell’s Natural Gas Contract

Crude Futures Fall; Europe Bond Yields Hurt Sentiment

Gold Trades Flat, Euro Jitters Help Recoup Losses

Obama Warns Market Turmoil to Continue Over Europe

Wal-Mart Profit Below Wall Street Despite Better Sales

Exile on Wall Street Author Mike Mayo on Pundit Review Radio

Edward Harrison: David McWilliams on Irish (and Italian) Euro Exit

Joshua Brown: Morningstar Launches New Forward-Looking Fund Ratings

Be sure to follow me on Twitter.

-

Buy List Year to Date

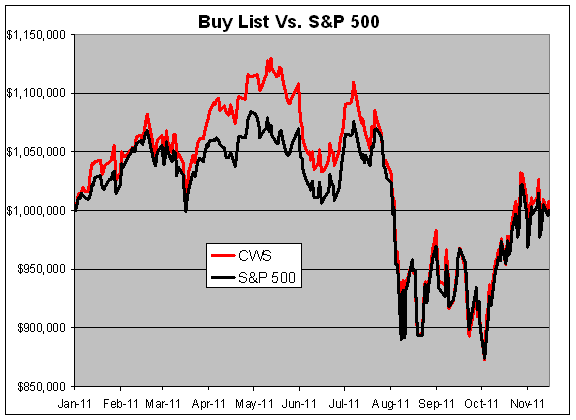

Eddy Elfenbein, November 15th, 2011 at 10:22 pmOur Buy List has beaten the S&P 500 for the last four years in a row and we’re just barely ahead this year as well. It looks like it may come down to the wire. Through today’s trading, the S&P 500 is up 0.01% while our Buy List is up 0.79%. That doesn’t include dividends.

We started off the year strongly. By early May, our Buy List was leading the S&P 500 by more than 5.8%. But our lead collapsed during July and at one point in mid-September, we trailed the index by more than 1%.

We’ve held a slight lead for most of the past few months but any sudden move from one of our stocks can change things very quickly.

-

Reynolds American Announces $2.5 Billion Share Buyback

Eddy Elfenbein, November 15th, 2011 at 11:43 amI sometimes think these announcements are done specifically to annoy me. Reynolds American ($RAI) just announced a $2.5 billion share repurchase plan. To be more specific, the plan is “up to” $2.5 billion so that includes other numbers…such as $0. Also, this isn’t all at once. The program will last for two-and-half years.

Basically, this news is released so the company can claim that it’s releasing good news.

I really like RAI a lot and I especially like the dividend. A little over a year ago, RAI raised its quarterly dividend from 45 cents per share to 49 cents per share. Then in February, they raised it again — this time to 53 cents per share.

A $2.5 billion share buyback program works out to $4.30 per share which is 11% of the current stock price. I think RAI shareholders would much rather have that in cash than the hope that it will boost the share price that much.

The company is also making an accounting change that will alter their reported earnings.

Reynolds American generally analyzes its pension and post-retirement plan performance annually as of the end of the year. Under the change, any actuarial gains or losses outside a 10 percent range will be recognized during the fourth quarter as a mark-to-market adjustment included in pension and post-retirement expenses.

The accounting change will be applied retrospectively to prior periods.

As a result of the change, Reynolds American expects adjusted full-year earnings of $2.77 to $2.82 per share. Using the company’s previous accounting methodology, Reynolds American had expected $2.63 to $2.68 a share. Analysts surveyed by FactSet had expected $2.64 per share, on average.

-

The Federal Reserve Probably Paid More to the U.S. Treasury than the Bottom Two-Thirds of Taxpayers Combined

Eddy Elfenbein, November 15th, 2011 at 10:11 amHere’s a follow-up to an arresting stat I uncovered earlier this year. Bear with me, I need to explain this fully.

In 2010, the Federal Reserve made a profit of $81.7 billion. Only a very small portion of that is distributed to the Fed’s shareholders which are the member banks. The rest goes to the U.S. Treasury and last year that totaled $79.3 billion.

Technically, this payment isn’t a tax but a rebate. To quote David Merkel, “The Fed doesn’t pay taxes; they remit excess seigniorage revenue to the Treasury, which they gather through punishment of savers.”

It’s just about impossible for a central bank to lose money so if you’re ever offered the chance to become one, my advice is to do it.

How does the Fed’s contribution compare to what Americans paid in taxes?

That’s hard to say exactly. The Tax Foundation has the most recent numbers available which are from 2009 so we’re not comparing the same data. Please note that I’m aware of this.

Using some very rough interpolation, we can see how much the lower two-thirds of taxpayers paid. According to the 2009 numbers, the bottom 50% of taxpayers paid a total of $19.5 billion in income taxes. The third quartile (between 50% and 25%) paid $90.4 billion in taxes. Two-thirds of that is roughly $60 billion. In fact, it’s almost certainly less due to the progressive nature of the tax code.

One we add that to the lower half, we have a very good estimate of what the bottom two-thirds paid to Uncle Sam.

As I said, this isn’t an exact comparison but we can assume it’s a very good estimate of what taxpayers said in 2010. Those figures probably won’t be available for another 12 months.

-

Morning News: November 15, 2011

Eddy Elfenbein, November 15th, 2011 at 5:19 amMonti Faces Political Resistance on Italy Cabinet

German, French GDP Grew in Q3 on Spending

Lending a Hand to Banks, but Not to Nations

Bank of America Sale Highlights End of Era for Foreign, China Banks

Tighter Oversight of China Bank Risk Needed: IMF

Thai Floods May Shift Japan Investment to Indonesia, Vietnam

Crude Oil Settles -85c At $98.14 On Europe Worries

Buffett’s Stake in Century-Old IBM Bolsters Berkshire’s Economic Defenses

Earnings Swooned 44% at Lowe’s in Latest Quarter

Google’s Android Tops 50% of Smartphone Sales

MF Global and the Problems With Murky Accounting

Barclays Capital Rises, ‘Big-Boy Checkbook’ in Hand

UBS Names Ermotti Permanent CEO

Anadarko Raises Colorado Oil Tally

Roger Nusbaum: Not Much In The Way Of Innovative Thinking

Paul Kedrosky: Just Spell My Ticker Right

Be sure to follow me on Twitter.

-

Good Interview With Buffett

Eddy Elfenbein, November 14th, 2011 at 10:07 pm -

More Troubles From Europe

Eddy Elfenbein, November 14th, 2011 at 10:13 amThe stock market is down slightly this morning on more concerns from Europe that Mario Monti, the interim Prime Minister of Italy, is trying to form a government. The government held a bond auction today that didn’t go very well. When you’re in the bond market’s doghouse, there’s not much you can do. The auction of a billion euros’ worth of five-year notes went off at a yield of 6.29%.

The other news this morning is that Berkshire Hathaway ($BRKA) has bought a $5.5 billion stake in IBM ($IBM). Warren Buffett also said that he strayed from his usual method of selecting stocks:

Buffett, in a CNBC interview, said he bought about 64 million shares of IBM, which cost around $10.7 billion. Berkshire started buying the shares in March with a goal to build a $10 billion position, he said.

Buffett also said IBM did not know that he was building a stake, and that the company was finding out about his investment for the first time as he said it on CNBC.

The legendary investor said he has always looked at IBM’s annual report — his preferred method of identifying companies to invest in — but this year, “I read it through a different lens.”

Buffett said follow-on conversations with various technology executives throughout the Berkshire conglomerate convinced him to start building the stake.

Last month I pointed out that IBM has grown 18-fold over the last 18 years which is nearly 18% annualized.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His