Archive for 2011

-

Amazon Way Overpriced

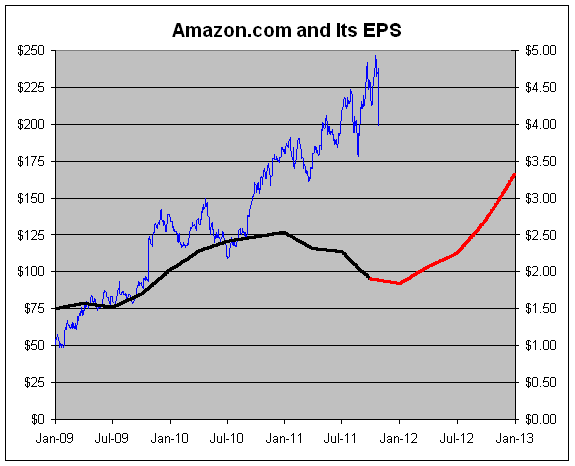

Eddy Elfenbein, October 27th, 2011 at 6:20 amShares of Amazon.com ($AMZN) got body slammed yesterday for a 12.7% loss after the company reported terrible earnings. For the third quarter, Amazon earned just 14 cents per share which was 10 cents below Wall Street’s forecast. For comparison, Amazon netted 51 cents per share in the same quarter one year ago.

I think this is just the beginning of Amazon’s sell-off. Even after the big drop, the stock is very richly priced. Three months ago, Wall Street thought Amazon could earn $2.40 per share for this year. Now they’ll be lucky if they can earn $1.80 per share. Similarly, Wall Street had been expecting the company to earn $3.80 per share next year. I think those estimates will soon be pared back to less than $3 per share.

The stock closed yesterday at $198.40 which is down from the high of $246.71 from just two weeks ago. Amazon is currently going for 62 times forward earnings, which is an elevated multiple for an estimate that’s plunging.

My advice is to steer clear of Amazon.com.

Here’s a chart of Amazon’s stock (in blue, left scale) and its earnings-per-share (black line, right scale). The two lines are scaled at a ratio of 50-to-1 which means that the P/E Ratio is exactly 50 when the lines cross. The red line represents Wall Street’s forecast.

-

Europe Agrees to Agree on Plan to Rescue the Euro

Eddy Elfenbein, October 27th, 2011 at 5:55 amThe stock market is poised to soar on the news:

European leaders, in a significant step toward resolving the euro zone financial crisis, early Thursday morning obtained an agreement from banks to take a 50 percent loss on the face value of their Greek debt.

The agreement on Greek debt was crucial to assembling a comprehensive package to protect the euro, which has been keeping jittery markets on edge.

The accord was reached just before 4 a.m. after difficult bargaining. The severe reduction would bring Greek debt down by 2020 to 120 percent of that nation’s gross domestic product, a figure still enormous but more sustainable for an economy driven into recession by austerity measures.

The leaders agreed on Wednesday on a plan to force the Continent’s banks to raise new capital to insulate them from potential sovereign debt defaults. But there was little detail on how the Europeans would enlarge their bailout fund to achieve their goal of $1.4 trillion to better protect Italy and Spain.

After all the buildup to this summit meeting, failure here would have been a disaster. While the plan to require banks to raise new capital was generally approved without difficulty — banks will be forced to raise about $150 billion to protect themselves against losses on loans to shaky countries like Greece and Portugal — the negotiations over the Greek debt were difficult.

“The results will be a source of huge relief to the world at large, which was waiting for a decision,” President Nicolas Sarkozy of France said.

Chancellor Angela Merkel of Germany said: “I believe we were able to live up to expectations, that we did the right thing for the euro zone, and this brings us one step farther along the road to a good and sensible solution.”

-

Morning News: October 27, 2011

Eddy Elfenbein, October 27th, 2011 at 5:42 amEU Sets 50% Greek Writedown, $1.4 Trillion in Rescue Fund

Europe Agrees to Basics of Plan to Resolve Euro Crisis

Bank of Japan Expands Stimulus as EU Crisis Boosts Yen

Bank Race for Capital to See Pay, Dividends Cut

American Gas Gets Boost From Cheniere

Boeing Posts Strong Profit but Cuts Delivery Forecast

Chemicals Giant BASF’s Third-Quarter Profit Beats Estimates

Taiwan Semiconductor’s Net Profit Down 35%

Volkswagen Quarterly Profit Surges on Audi A6, Tiguan SUV Demand

Nintendo Slashes Forecast Again to Just Break Even

Sprint Reports Smaller Loss and a Gain in Subscribers

Sony to Buy Ericsson Share of Sony Ericsson

A Stunning Fall From Grace for a Star Executive

Lance Roberts: The Key To The Next Recession – The Consumer

Stone Street: Analyzing the Popular Proposals for Mortgage Principal Writedowns, Part I

Be sure to follow me on Twitter.

-

AFLAC Earns $1.66 Per Share, Raises Dividend By 10%

Eddy Elfenbein, October 26th, 2011 at 4:29 pmAFLAC ($AFL) just released their third-quarter earnings report and the company earned $1.66 per share in operating profit.

This was a great report. In last week’s CWS Market Review, I said the company could easily earn $1.64 per share which was higher than Wall Street’s consensus ($1.60) and higher than the company’s guidance ($1.54 to $1.60). Even my optimistic forecast wasn’t high enough.

AFLAC also raised their quarterly dividend from 30 cents to 33 cents per share which is a 10% increase.

The best news is that AFLAC raised their 2011 guidance. The company said, assuming a stable yen/dollar exchange rate, that they expect to earn between $1.45 and $1.52 per share in Q4. For all of 2011, they expect to earn between $6.30 and $6.37 per share. Until now, the 2011 guidance was for $6.09 to $6.34 per share so this is good news.

For next year, the company reiterated its forecast of operating earnings growth of 2% to 5%.

Commenting on the company’s third quarter results, Chairman and Chief Executive Officer Daniel P. Amos stated: “We are pleased with our overall results in the third quarter of 2011. Aflac Japan sales greatly exceeded our expectations, largely because of our ability to develop relevant products such as WAYS that appeal to banks and Japanese consumers alike. We are proud of Aflac Japan’s remarkable results, especially following two years of exceptional sales growth and the challenges in 2011 resulting from the most devastating natural disaster in Japan’s history. Our outstanding sales results in 2011 will create difficult comparisons in 2012.

“We were also pleased that Aflac U.S. continued to generate strong sales results, despite the continued weakness in the U.S. economy. Strategic coordination between our sales and marketing areas, which are more closely aligned than ever, continues to benefit our sales results. On the product side, sales have benefited significantly from the addition of group products to our Aflac U.S. product portfolio and strategic, coordinated sales and marketing efforts. On the distribution side, Aflac U.S. has continued to generate significant recruiting gains, which we believe benefited from targeted advertising activities that promote the Aflac sales opportunity. As a result of our positive performance in both Japan and the U.S., we posted strong consolidated financial results.

“As we have communicated over the past several years, maintaining a strong risk-based capital, or RBC ratio, remains a top priority for us. Although we have not yet completed our statutory financial statements for the third quarter, we estimate our RBC ratio will be within the range of 500% and 540% at the end of September. Our strong capital position has enabled us to increase our cash dividend for the 29th consecutive year. I am very pleased with the action by the board of directors to increase the quarterly dividend by 10.0%, effective with the fourth quarter of 2011. Our objective is to grow the dividend at a rate that’s in line with or somewhat better than earnings-per-share growth.

“With three quarters of the year complete, we continue to believe we are positioned for another year of solid financial performance. Throughout the year, both Aflac Japan and Aflac U.S. have continued to do a very good job managing our operations, including expense control. As we have stated previously, our expectation was to increase spending in the last half of the year, particularly on marketing and IT initiatives in the fourth quarter. Despite our expectation for higher spending in the fourth quarter, I am confident we will achieve our 2011 objective of growing operating earnings per diluted share at 8%, excluding the impact of the yen. If the yen averages 75 to 80 to the dollar for the last three months of the year, we would expect reported operating earnings for the fourth quarter to be in the range of $1.45 to $1.52 per diluted share. Under that exchange rate assumption, we would expect full year operating earnings of $6.30 to $6.37 per diluted share.

“Looking ahead, I want to reiterate our expectation that 2012 operating earnings per diluted share will increase 2% to 5% on a currency neutral basis. Furthermore, once the effects of our proactive investment derisking program and low interest rates have been integrated into our financial results, we believe the rate of earnings growth in future years should improve.”

-

My Forecast for Nicholas Financial’s Earnings

Eddy Elfenbein, October 26th, 2011 at 3:43 pmTomorrow Nicholas Financial ($NICK) is due to report earnings for their fiscal second quarter. I continue to believe this is a remarkably undervalued company.

Let’s go over their business. NICK makes loans for the used car market. Unfortunately, investors seem to think that NICK is just another subprime lender, hence the dirt-cheap valuation.

This view is simply incorrect. NICK is very well run and the company doesn’t dump off its loans but instead holds them to maturity.

I have some concerns about NICK’s business but they’re not due to the quality of the company’s portfolio. That still remains very high. The issue going forward is really about growth. It’s going to get much harder for them to get originations. Competition is heating up.

The good news, and there’s lots of it, is that NICK should still churn out the profits. The company can borrow very cheaply (LIBOR +300) and lend out at 25% or more. Receivables are running at about $270 million or so and debt is around $120 million. That should translate into revenue of roughly $17 million, give or take, for the quarter.

By my numbers, NICK should report earnings of 44 or 46 cents per share tomorrow. That would mean the company has earned 88 to 90 cents per share in the first half of their fiscal year, and $1.66 to $1.68 for the last four quarters. That’s outstanding.

I’ve said that NICK could earn as much as $1.70 per share for this calendar year. Now I think NICK can earn $1.75 per share for this calendar year. If so, this means that NICK is going for 5.76 times this year’s earnings which is less than half the multiple for the S&P 500.

I think NICK is at least a $17 stock that’s currently going for $10.

I should add that management also seems concerned about NICK’s ability to grow rapidly and that may be the reason behind the 10-cent quarterly dividend. I can’t say I’m a huge fan of it, but neither am I opposed to it. There’s nothing wrong with handing out some profits. NICK is an excellent stock.

-

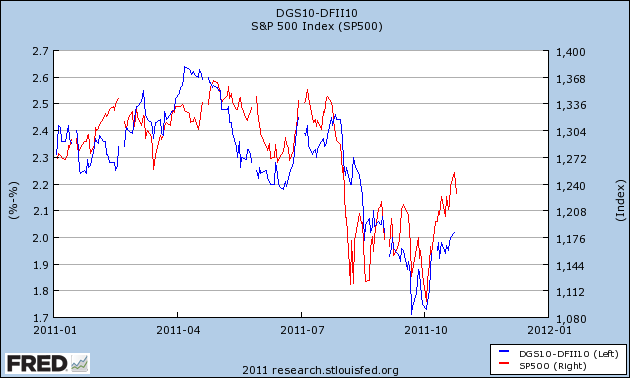

I Don’t Care What Anyone Says, This Graph Still Freaks Me Out

Eddy Elfenbein, October 26th, 2011 at 2:57 pmThe S&P 500 alongside the 10-year TIPs spread:

Stocks continue to like inflation expectations.

-

IBM’s Misguided Share Repurchase

Eddy Elfenbein, October 26th, 2011 at 1:54 pmI think these things are specifically done to annoy me.

IBM ($IBM) has been doing very well lately. The stock recently made an all-time high. The company just reported earnings that beat expectations by six cents per share. They also announced another 75-cent dividend.

Technology company International Business Machines Corp. said Tuesday that its board authorized an additional $7 billion for the company’s stock repurchase program.

That’s on top of about $5.2 billion remaining in a prior buyback program at the end of September.

IBM plans to ask its board for additional repurchase authorization at a board meeting in April.

I loathe share buybacks and this is an excellent example of why. IBM’s program comes to $12.2 billion which is more than $10 per share. Of course, that’s just what’s announced. We don’t know what will be implemented.

My view is simple: just give that money to shareholders! It’s theirs!

I think most shareholders would much rather have $10 in hand than have the hope that company purchases will push the shares up by $10. Plus, shareholders are watching their money buy a stock that’s already near an all-time high.

Just give them the money as a dividend and if they want to buy more stock, they can. The current dividend comes to $3 per year which is only 22% of this year’s estimated earnings.

A better idea would be for the board to ditch the buybacks and chose a target, say 30% of full-year earnings to pay out as dividends. For next year that would be a dividend of $1.10 per share.

I should add that I’d like to see the U.S. tax laws changed so it doesn’t make a difference how shareholders get their own money.

-

Q3 Earnings Update

Eddy Elfenbein, October 26th, 2011 at 12:41 pmHere are the latest numbers from S&P (which are slightly different from Bloomberg’s, don’t ask me why).

For the S&P 500; 214 companies have reported so far, 145 beat estimates, 45 missed and 24 were inline.

Earnings are tracking at $24.91 which is a 15.5% increase over last year. It’s also a 0.2% increase over the $24.86 from Q2.

The estimate for Q4 is $25.15 which translates to $97.48 for all of 2011. Since most of the data is in, we can assume that’s pretty accurate.

Going further out, that’s hard to say. The current estimate is $108.75 for 2012 which I think is too high.

Here’s an odd fact: The earnings for third-quarter are on track to be more than 75% higher than those of the third quarter in 2000. Yet the S&P 500 is down 10% from 11 years ago today. As I said, multiple contraction ain’t much fun.

-

Ford’s Earnings: Good But Could Be Better

Eddy Elfenbein, October 26th, 2011 at 10:06 amFord Motor ($F) reported earnings this morning of 46 cents per share. That was two cents better than Wall Street’s consensus. This is their tenth-straight quarter of profitability.

Fundamentally this was a solid report, but there were a few weak spots. Let’s go over some of the details. For the quarter, the company netted $1.65 billion which was slightly less than the $1.69 billion from last year’s third quarter. Last year’s per-share result was 48 cents.

Ford’s sales jumped to $33.1 billion which is a 14% increase over last year. That’s a really good number. Wall Street was expecting $30.5 billion. Their share of the U.S. market ticked up to 16.8%. The problem, however, is with profit margins. Due to the plunge in commodity prices, particularly for copper, Ford said that its margins may fall to 5.7%. For me, the key stat is that if you strip out Ford’s losses on copper hedging, their profits rose by 12%.

The odd thing about Ford’s business is that they borrowed a ton of money before the economy fell apart. The good news is that they had the cash to withstand the recession. The bad news is that they still have a ton of debt. The good part, again, is that they’ve been able to pay that down. Ford now has $12.7 billion of automotive debt.

Ford was also hurt by an operating loss in Europe of $306 million. The company also said that it’s not going to start paying a dividend just yet which is probably a smart move.

Overall, I like this report. The basics of Ford’s business are doing well. They were hurt by problems in Europe and by commodity prices, neither of which they can control. Now that the union deal is done and their credit has been upgraded, Ford has shown that it can deliver earnings.

The stock is down today which is probably due to the warnings of lower margins, but that’s not a long-term issue. Ford continues to be a very good buy.

Stay tuned for AFLAC ($AFL) after the close.

-

Morning News: October 26, 2011

Eddy Elfenbein, October 26th, 2011 at 5:41 amEU Banks Warn of Credit Drought Amid Push to Raise Capital

Italy Keeps Europe on Tenterhooks Over Reform

China Offers Case Against Rapid Yuan Rise

Yen Boosted as Smaller Volatility Lures Investors: Japan Credit

Wall St. Giants Seek a Piece of Nigeria’s Sovereign Fund

Crude Oil Settles Up 2.1% On Supply Concerns

Floods Ruining Thai Rice Erases Global Glut

Amazon Profit Plunges 73% As Costs Mount

Netflix’s Growth-Over-Profit Strategy Threatens Cash Levels

Amazon’s Apple War Costs Investors $20 Billion

3M Lowers Year Outlook on Slowing Global Growth

Olympus President, Chairman Kikukawa Resigns

Goldman Board’s Gupta to Face Criminal Charges

I.B.M. Names Virginia Rometty as New Chief Executive

Epicurean Dealmaker: You’re Doing It Wrong

Phil Pearlman: Might This Be a Massive Double Top In Bonds?

Howard Lindzon: Pin a Price on Netflix…No Different than 130…Time to Avoid.

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His