Archive for 2011

-

Income Tax Poll

Eddy Elfenbein, October 25th, 2011 at 10:48 pm

-

Netflix -37%

Eddy Elfenbein, October 25th, 2011 at 11:21 amHere’s an important lesson in investing.

We come at this with all these fancy tools and numbers to try and make sense of something that is, at root, almost purely chaotic.

As investors, we try desperately to rationalize something that’s as solid as the breeze.

You can be slowly wrong, wrong, wrong for a long time and then suddenly be right.

The words on a memorial to Sigmund Freud read, “The voice of reason is small, but very persistent.”

-

Ford May Bring Back Dividend

Eddy Elfenbein, October 25th, 2011 at 10:09 amFord Motor ($F) progressively cut its quarterly dividend from 30 cents per share to 10 cents to 5 cents, and it finally ditched it all together five years ago.

Thanks to the recent credit upgrades and union deal, the dividend may make a comeback. In my opinion the dividend isn’t why the stock is a good value, but it reflects the company’s remarkable turnaround.

My guess is that any dividend will start out pretty modest, perhaps eight or ten cents per share. Brian Johnson at Barclay’s Capital thinks it could be eight cents per share.

“Ford is doing all the right things and they sure haven’t gotten any credit for it from the Street,” said Gary Bradshaw, a fund manager at Hodges Capital Management in Dallas, who recently purchased 50,000 shares below $10 to increase his Ford holding to 250,000 shares. “That’s ridiculously cheap for a company whose outlook is improving.”

-

Third-Quarter Earnings Season Update

Eddy Elfenbein, October 25th, 2011 at 9:45 amBloomberg has all the numbers.

Of the 500 companies in the S&P 500, 147 have reported so far.

Of those, 103 or 70.1% have beaten estimates.

14 or 9.5% have been inline

30 or 20.4% have missed estimates

Earnings are tracking at $24.45 which is up 11.85% from last year’s third quarter.

-

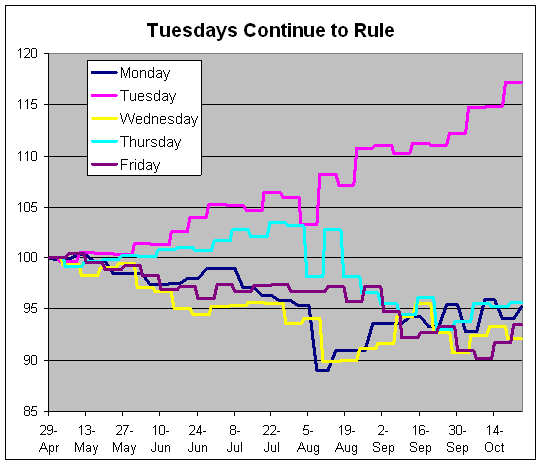

The Tuesday Rally Lives

Eddy Elfenbein, October 25th, 2011 at 8:17 amSince the stock market topped on April 29th, the S&P 500 is down by 8.02%. Yet there’s been an odd exception to the market’s downward trend: the market has done very well, on average, on Tuesdays.

Since April 29th, the market has been open on 25 Tuesdays. Combined, the S&P 500 is up 17.16% on those days. No other day comes close.

My guess is that it’s because the recent sell-off has largely been political in nature which explains why the important news has come over the weekend. In response, Mondays have been down while Tuesdays have been weighted with relief rallies.

Day Gain/Loss Std. Dev. Count Monday -4.73% 2.10% 23 Tuesday 17.16% 1.49% 25 Wednesday -7.86% 1.64% 25 Thursday -4.34% 1.96% 25 Friday -6.50% 1.29% 25 Reynolds American Earns 70 Cents Per Share

Eddy Elfenbein, October 25th, 2011 at 8:09 amReynolds American ($RAI) just posted Q3 earnings of 70 cents per share which was three cents below estimates. The company also narrowed its full-year EPS range to $2.63 – $2.68 per share which impies a Q4 range of 67 – 72 cents per share.

Reynolds has also raised its quarterly dividend from 53 cents per share to 56 cents per share. That makes the annual dividend $2.24 per share which comes to a yield of 5.69% based on yesterday’s close.

“Reynolds American continues to deliver solid financial results in this challenging environment, while our transformation strategy shapes the business for long-term success,” said Daniel M. Delen, RAI’s president and chief executive officer. “This performance once again demonstrates our ability to overcome near-term challenges while continuing to position our business for future growth.”

RAI’s board of directors has also approved a 5.7 percent increase in the company’s dividend, demonstrating confidence in the operating companies’ businesses going forward, and the company’s commitment to returning value to shareholders.

Third-quarter results benefited from growth-brand gains at R.J. Reynolds, and strong volume and share growth at American Snuff. In addition, Santa Fe Natural Tobacco Company, Inc. again delivered excellent results, with higher volumes, share and earnings.

“Even with a difficult economic and competitive environment, RAI and its operating companies remain focused on delivering sustainable growth, while driving innovations throughout our businesses,” Delen said. “As we continue to focus on key-brand equity building and identifying additional opportunities for growth, we believe our transformation strategy will sustain the company well into the future.

Morning News: October 25, 2011

Eddy Elfenbein, October 25th, 2011 at 6:29 amSpain Slipping on Deficit Increases Chances of Contagion

EU Signals Fund Leverage Needs More Talks

Trichet Urges Euro Finance Ministry

Vatican Calls for Oversight of the World’s Finances

Oil Rises to 12-Week High as Demand Signals Spur Bull Market

In Cautious Times, Banks Flooded With Cash

Deutsche Bank Beats Estimates on Consumer Banking

UBS Reports 39% Drop in Quarterly Profit After Trading Loss

Netflix’s Quarterly Loss of Subscribers Worse Than Forecast; Shares Plunge

Texas Instruments Profit Falls as Demand Slumps

Car Carriers Profit on Record Demand

Cigna Agrees to Buy Healthspring to Expand Medicare Business

The Divergent Fortunes of Saab and Volvo

Joshua Brown: Jeff Benjamin on the Absolute Return Scam

Paul Kedrosky: Today in Not Being Bullish Enough

Be sure to follow me on Twitter.

S&P 500 = 1,253

Eddy Elfenbein, October 24th, 2011 at 3:11 pmThis is turning into a very good day for the market. The S&P 500 has been as high as 1,256.55 which is another post-August 3rd high. The index’s 200-DMA is well within sight.

The cyclicals are leading today’s rally. I think the good news from Caterpillar ($CAT) helped the entire sector. The Morgan Stanley Cyclical Index ($CYC) is up more than 2.8% bringing it back over 900. The Consumer Index ($CMR), by contrast, is barely positive.

Smaller stocks tend to be more weighted with cyclicals and we’re seeing the small-stock indexes doing much better than their larger-cap cousins today. The Russell 2000 ($RUT) is up more than 3.28% while the Russell 1000 ($RUI) is up just 1.61%.

Our Buy List is now in positive territory for the year. Bed Bath & Beyond ($BBBY) hit another 52-week high. Deluxe ($DLX) and Wright Express ($WXS) have also been very strong. The only weak spots are Abbott Labs ($ABT) whose position is probably due its strength from last week, and Reynolds American ($RAI) which is losing ground after competitors delivered some disappointing earnings reports.

Notice how strong small-caps have been (the black line is the Russell 2000) compared with the large-caps (Russell 1000 in gold) since the middle of the day on Thursday:

Best Months for the Dow of the Last 50 Years

Eddy Elfenbein, October 24th, 2011 at 10:06 amWe still have a week to go in October but this is shaping up to be the best month for the Dow in ten years, and one of the best in the last 50 years:

Jan-76 14.41%

Jan-75 14.19%

Jan-87 13.82%

Aug-82 11.47%

Oct-82 10.65%

Oct-02 10.60%

Apr-78 10.56%

Apr-99 10.25%

Nov-62 10.09%

Aug-84 9.78%

Oct-98 9.56%

Oct-74 9.48%

Dec-91 9.47%

Jul-89 9.04%

Feb-86 8.79%

Apr-01 8.67%

Jul-09 8.58%

Nov-01 8.56%

Oct-11 8.55%

Apr-68 8.51%Oracle Buys RightNow for $1.43 Billion

Eddy Elfenbein, October 24th, 2011 at 9:40 amHere’s interesting news from Oracle ($ORCL). The company is making a move into the cloud computing market by buying RightNow for $1.43 billion.

The deal calls for Oracle to pay RightNow ($RNOW) shareholders $43 per share. This is interesting because not that long ago, Larry Ellison dismissed cloud. This is Oracle biggest acquisition since picking up Sun Micro more than two years ago.

So what does RightNow do?

RightNow’s primary product is its CX Suite, a platform that allows companies to engage with their customers through the Web, social media and contact centers. For instance, with its “cloud monitor,” businesses can track and manage conversations on Twitter, YouTube and Facebook related to their brand. RightNow, based in Bozeman, Mont., has nearly 2,000 clients.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His