Archive for 2011

-

Morning News: October 18, 2011

Eddy Elfenbein, October 18th, 2011 at 5:34 amEuro Leaders’ Crash Crisis Campaign Bogs Down

France Risks Losing Top Grade on Bailout Fund

Chinese Company Scandals Are Spurring Due Diligence In HK -HK Exchanges Exec

Banks to Mimic Bank of America With New Fees

Farmers Facing Loss of Subsidy May Get New One

Energy Deals See an Upswing as Bargains Abound

Fed Officials at Odds on Inflation Threat

Citigroup and Wells Fargo Shares Fall on Lower Quarterly Revenue

Danone 3Q Sales Euro 4.81 Billion Vs. Euro 4.35 Billion; Confirms 2011 Targets

An Investor Creates a Tempest in a Coffee Cup

The Missed Red Flags on Groupon

Accounting Board Criticizes Deloitte’s Auditing System

Porsche Made in Leipzig Lowers Labor Costs

Joshua Brown: And the Men Who Hold High Places…

Paul Kedrosky: Traders Warn of Market Cracks

Be sure to follow me on Twitter.

-

The Current Mind of the Market

Eddy Elfenbein, October 17th, 2011 at 1:36 pmHere’s another table that explains the point I’ve been trying to make — namely that the stock market is currently being pulled in two different directions by competing theses.

On one hand, you have the view that everything’s fine and the market will rally higher. This will help the cyclical stocks plus the financials. On the other hand, you have the bearish view that only the defensive stocks will thrive.

As a result, each day we get one or the other. Either the financials lead a cylical rally, or the financials get pounded and the cyclicals swoon. The down days are generally worse than the up days.

The following table shows the average move of each S&P sector group based on the last 59 trading days (29 down, 30 up).

Sector Up Days Down Days Financials 2.15% -2.83% Industrials 1.84% -2.33% Materials 1.81% -2.41% Energy 1.79% -2.39% Discretionary 1.69% -1.92% Tech 1.59% -1.70% S&P 500 1.58% -1.92% Healthcare 1.24% -1.53% Telecom 1.00% -1.20% Utilities 0.97% -0.98% Staples 0.93% -1.04% This is the source of the market’s recent volatility. It’s not about risk. Instead, it reflects the market’s internal tug-of-war.

-

Breaking Down the Bear

Eddy Elfenbein, October 17th, 2011 at 11:42 amSince the market topped on April 29th, the S&P 500 has lost 10.2%. What’s interesting is that the losses have not been spread out equally. Here’s a look at the losses by each sector.

Utilities 2.50%

Staples -1.85%

Tech -1.85%

Discretionary -4.64%

Healthcare -6.66%

Telecom -7.32%

S&P 500 -10.20%

Energy -16.70%

Industrials -17.04%

Materials -17.22%

Financials -22.94%Outside of the Financials and the major cyclical groups, the market hasn’t been that bad.

Here’s an interesting stat: The Financials have been either the best- or worst-performing sector for 30 of the last 50 trading days. The Financials ended Friday also at exactly one-third of their all-time high (169.901 versus 509.553, a loss of 66.657%).

The Consumer Staples are only down 4.55% from their all-time high reached in May. The Techs are down 4.41% from a 10-year high (they still have a looong way to go to make an all-time high).

-

Bed Bath & Beyond Hits New 52-Week High

Eddy Elfenbein, October 17th, 2011 at 10:07 amThe stock market is down a bit this morning but we’re still holding on to most of the gains we made from Friday’s big push. The S&P 500 is currently down about 5.5 points.

The market is being helped by Citigroup’s ($C) earnings report which was quite good. The bank earned 84 cents per share which was two cents better than estimates.

Citi’s losses from bad loans fell 41 percent during the quarter to $4.5 billion as defaults fell from its credit card loans for Citi-branded cards. That allowed Citi to add $1.4 billion to its earnings from credit reserves it set aside for deeper losses.

The bank’s international consumer business increased 10 percent due to growth in Asia and Latin America. Its North American consumer business fell 9 percent from a year ago due mainly to lower average balances on its credit cards. Revenue in the card business also fell due to regulations that limit the ways banks can increase interest rates and fees.

Citi said its stock and bond trading business was hurt by uncertainty in financial markets due to the debt crisis in Europe and a downgrade of the U.S. government’s credit rating in August.

It could have been a lot worse. A lot. The shares are currently up about $1.

I was very impressed by the recent fall in the $VIX and I suspect that to continue. Earlier this year, the $VIX had dropped below 15 and I think that will happen again over the next few months.

On our Buy List, Bed Bath & Beyond ($BBBY) just broke out to another new 52-week high. The stock has been as high as $61.69 today.

The other good news is that the UAW rank-and-file seem to favor the recent deal with Ford Motor ($F).

UAW members at Ford went from voting 53 percent against the proposed contract on the morning of Oct. 14 to 62 percent in favor by yesterday at 8:30 p.m. New York time. The union said 14,845 members at Ford had cast ballots in favor of the labor deal while 9,076 voted against. Ford’s 40,600 U.S. hourly workers will conclude balloting tomorrow.

If the deal wasn’t approved, there was a chance that Ford could have faced its first nationwide strike in 35 years. One analyst said the strike would have cost Ford $71 million per day.

-

Morning News: October 17, 2011

Eddy Elfenbein, October 17th, 2011 at 5:14 amG-20 Gives EU One Week to Fix Debt Crisis

Bunds Fall, Wait for Policymakers to Deliver

Bankers Balk at EU Push for Bigger Greek Losses

Chinese Banks Increase Mortgage Rates as Property Prices Decline

Oil Rises to Highest in a Month on Europe Debt Rescue Efforts

Volcker Rule Divides Regulators

Ex-AIG CEO Greenberg Says U.S. Senate Bill on Yuan a ‘Dumb Idea’

Kinder Morgan to buy El Paso Corp. for $20.7 Billion

G4S Acquires ISS For GBP 5.2 Billion, Creating Giant

Amazon Signs Up Authors, Writing Publishers Out of Deal

BP Says Anadarko to Pay $4 Billion to Settle Gulf Spill Claims

Wal-Mart China Chief Resigns as Retailer Faces Pork Probe

Olympus Shares Plunge 24% Following Chief Ouster

Philips’ TV Deal at Risk, Plans 4,500 Job Cuts

Jeff Miller: WEIGHING THE WEEK AHEAD: ESCAPE FROM THE TRADING RANGE?

Howard Lindzon: Screw Diversification…and The Amazon Starve Wall Street Palooza

Be sure to follow me on Twitter.

-

S&P 500 = 1,224.58

Eddy Elfenbein, October 14th, 2011 at 4:29 pmAnother strong day! The S&P 500 closed at 1,224.58 today which is the highest close since August 3rd. The market is now up 11.4% since October 3rd.

This has been a pretty snappy run. Who knew October would be so good? The S&P 500 has now risen for seven of the past nine days. It’s 4.44% above its 50-DMA and we only need a push of 4.2% more to cross the 200-DMA.

From the market top on April 29th to the October 3rd close, the S&P 500 lost 19.39%. The past nine days have basically cut that in half. We’re now 10.2% below our 2011 high.

Interestingly, October may be a popular time for market turns. Of course, there were the events of 1929 and 1987. But the market marked an important low on October 9, 2002 and it peaked exactly seven years later on October 9, 2007.

Perhaps October 3rd of 2011 marked another important low.

-

The VIX Breaks Below 30

Eddy Elfenbein, October 14th, 2011 at 12:16 pmMore evidence that the Fear Trade is unwinding. The Volatility Index ($VIX) just broke below 30.

The VIX hasn’t closed below 30 since August 3rd.

-

Google Smashes Earnings

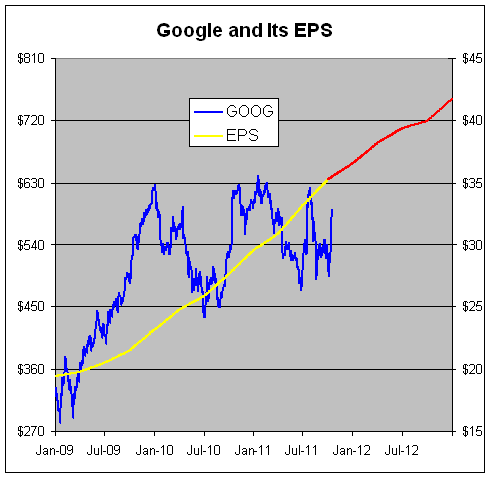

Eddy Elfenbein, October 14th, 2011 at 11:26 amAfter the close yesterday, Google ($GOOG) reported very strong third-quarter earnings. The company earned $9.72 per share which was 98 cents better than estimates. The stock has gapped up as much as 7.2% this morning and it nearly came close to piercing $600 per share.

Here’s a look at Google’s stock along with its earnings-per-share. The share price is the blue line (left scale). The earnings is the gold line and it follows the right scale. The red line is Wall Street’s forecast.

I scaled the two axes at a ratio of 18-to-1 which means that the P/E Ratio is exactly 18 whenever the lines cross. (Note: Please don’t take 18 as my valuation of Google. I just thought the chart looks more readable using that ratio.)

From early 2010 to this summer’s low, Google’s P/E Ratio has been nearly cut in half. Here are two ifs — if Wall Street’s earnings forecast is correct and if Google trades at 18 times that, then the stock will be at $750 by the end of 2012. That’s a 27% gain over the next 14-and-a-half months.

-

Strong Retail Sales Last Month

Eddy Elfenbein, October 14th, 2011 at 9:15 amMore evidence that there’s no Double Dip at hand. The Commerce Department reported that retail sales rose by 1.1% last month. The number for August was also revised to show a 0.3% gain.

Higher food and energy prices crimped purchasing power earlier this year, while the debt ceiling crisis along with stock market losses undermined confidence. Recent data, meanwhile, showed that incomes fell in August, the first drop in nearly two years. That forced Americans to dig into their savings in order to maintain their living standards.

But September’s broad-based retail spending gains indicate a degree of optimism.

Friday’s data showed a 3.6% jump for auto and parts sales. Excluding cars, overall retail sales were up 0.6%. Economists had expected retail sales excluding autos to climb 0.4%.

Restaurant, furniture, clothing, department store and non-store retail sales–a category that includes the internet–all posted gains. Gasoline station sales also showed another increase.

-

CWS Market Review – October 14, 2011

Eddy Elfenbein, October 14th, 2011 at 8:19 amIn last week’s CWS Market Review, I mentioned that we could be seeing the start of a prolonged rally. I’m happy to see that the stock market extended its gains this week. On Monday, the S&P 500 broke above its 50-day moving average. Then on Wednesday, the index came very close to hitting its highest close since August 3rd.

Despite how well the market has done, I’m not a full-fledged believer just yet. I’ll feel a lot better once the market clears its 200-day moving average, but we have another 6% to go for that to happen. Historically, stocks perform much better when the S&P 500 is above its 200-DMA.

I’m pleased to see investors are gravitating towards the kind of high-quality stocks we favor. Since Monday before last, our Buy List is up 10.29% which is 79 basis points more than the S&P 500. Over that same time span, shares of Ford ($F) and Wright Express ($WXS) are both up 21% and shares of boring little Deluxe ($DLX) are up close to 24%. Best of all, Deluxe still yields close to 4.5%.

The fact is clear: for the first time in several weeks, investors are seeking safety in stocks, not bonds. Over the last three weeks, investors have quietly sold their bonds and yields have ticked higher. The 30-year Treasury dropped for six days in a row which was its longest slide in four years. The 10-year note recently crossed 2% and I think it could head to 2.5%.

Until three weeks ago, investors had been massively piling into gold and bonds, seeking shelter from whatever weekly disaster was happening in Europe. The latest (tentative) news from Europe is hopeful and gold has taken its biggest drop in three years. This is part of the Fear Trade unwinding. It’s still too early to declare victory, but the bears are clearly walking back some of their risk-averse positions.

Make no mistake, the European banks are far from healthy and S&P just downgraded Spain; but it looks like the authorities are starting to realize how bad things are. It’s as if everyone in Europe is waiting for a “Lehman” moment, which may never come. Instead, we’re watching a slow erosion of investor confidence. According to Barclays, the problems in Europe have erased $13 trillion of wealth since July 1st. I should add that I’ve been impressed by how strong the comments have been from officials in Europe. It looks like the next big meeting will be on November 3rd-4th when the G-20 assembles in Cannes.

Here in the U.S., the next few weeks will be dominated by earnings reports. I expect this earnings season to be good but it won’t be as impressive as previous seasons have been. Overall, our stocks should continue to post good numbers and that’s probably giving us a lift. Earlier this week, Reynolds American ($RAI) hit a new 52-week high. Don’t let these conservative value stocks fool you. Reynolds is one of our best performers so far this year. The recent good news from Europe has also been positive for AFLAC ($AFL). Since September 23rd, the stock is up 28%. I’m expecting another solid earnings report in two weeks.

Looking around at other stocks on our Buy List, I see that Bed, Bath & Beyond ($BBBY) is also near its 52-week high. Sometime within the next few weeks, I expect to see Becton, Dickinson ($BDX) increase its dividend for the 39th year in a row. I still like Oracle ($ORCL) a lot. In fact, I’m going to raise my buy price for it. Three weeks ago, I said Oracle was a good buy up to $30. I’m now raising that to $33. That’s a very good stock.

I mentioned last week that the big story for us this week would be JPMorgan Chase’s ($JPM) earnings report. On Thursday, the bank reported earnings of $1.02 per share which was ten cents more than estimates. The stock fell after the earnings report but I think this was a decent report, though not a great one.

Bear in mind that Wall Street has been slashing estimates for all the major banks for this earnings season. To give you an example, a few weeks ago the analyst community was expecting Goldman Sachs ($GS) to report earnings of more than $3 per share. Now that’s down to 27 cents per share. In fact, Goldman could post a loss. For JPM, the downgrades weren’t nearly as harsh. Estimates fell from around $1.20 per share to 92 cents per share (which they beat anyway). The story for JPM is that the capital markets side of the business is rather weak but traditional retail banking is doing fine.

All told, JPM is still doing well despite a more challenging environment. By most reasonable metrics, the shares are cheap. In my opinion, the most important factor to watch with JPM is the dividend. The quarterly dividend is currently at 25 cents per share which gives the stock a yield of 3.16%. That’s about what a 30-year Treasury gets now. But more importantly, JPM can easily raise its dividend by 30% or more.

The next earnings report from a Buy List stock will be Johnson & Johnson ($JNJ), which reports on Tuesday, October 18th. Wall Street expects Q3 earnings of $1.21 per share which is too low. That would actually be a decrease of two cents per share from one year ago. My analysis shows that JNJ can deliver earnings of $1.25 per share.

In July, JNJ reiterated its full-year EPS forecast of $4.90 to $5. I think there’s a very good chance that they’ll raise both ends of their forecast by, say, five cents per share. The bottom line is that JNJ is the ultimate in blue chip safety. Unlike the United States of America, JNJ has a AAA credit rating. The stock currently yields 3.55%. Johnson & Johnson is a good buy up to $67 per share.

On Wednesday, October 19th (the 24th anniversary of the ’87 Crash), Stryker ($SYK) will report earnings after the close. For the first and second quarters, the company earned 90 cents per share, so let’s go with that figure for the third quarter as well (the Street expects 89 cents). Stryker has said it expects full-year earnings of $3.65 to $3.73 per share. Stryker is a very good company but I’d like to see the stock a little lower than where it is right now before I feel confident calling it a very strong buy. As it is, Stryker is a good buy at $50 but I’d like it a lot more at $45.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His