Archive for 2011

-

Morning News: December 22, 2011

Eddy Elfenbein, December 22nd, 2011 at 7:06 amGreece’s Creditors Resist Push From IMF for More Losses

European Bank in Strong Move to Loosen Credit

S&P Downgrades Hungary to Junk

Trieste Threatens Hamburg as Port Exploits Rail

Carbon Emission Fees for Flights Upheld

Oil Rises for Fourth Day as U.S. Supplies Drop Most in a Decade

Signs Point to Economy’s Rise, but Experts See a False Dawn

U.S. Faces Fitch AAA Downgrade By End of 2013 Unless Deficit Cuts Made

After a Year of Disasters, Toyota Sees Record Sales

Yahoo to Consider Sale of Asian Assets

Countrywide Will Settle a Bias Suit

BA Bags Lufthansa’s BMI, Heathrow Slots, With $271 Million Deal

Finding Success in a Lifelong Passion for Fighting Monopolies

Edward Harrison: On The ECB’s Long-Term Refinancing Operation and 2012 Macro Ideas For Investors

Be sure to follow me on Twitter.

-

Target Price for Ford = $18

Eddy Elfenbein, December 22nd, 2011 at 12:02 amBarron’s carries a buy rating on Ford ($F) by Sterne, Agee & Leach.

In 2010, Ford was the fifth-largest vehicle manufacturer in the world, producing 5.0 million units globally and generating $119 billion in revenue. Through its 100% owned subsidiary, Ford Motor Credit, the company generated an additional $8 billion in revenue from vehicle financing.

In 2006, the company initiated a corporate restructuring aimed at operating profitably at lower demand levels. The plan included capacity and headcount reductions, the elimination of noncore divisions, and the acceleration of new products. Ford issued $20 billion of secured debt to fund the actions and was able to work through the industry recession without turning to the courts for protection.

As the industry started to recover in 2009 and into 2010, financial performance improved. Pretax income totaled $8.3 billion in 2010 compared with a loss of $6.8 billion in 2008, and in 2011, the company repaid the remaining portion of the financing needed for the restructuring.

We believe Ford’s cost- and revenue-restructuring actions since 2007 have positioned the company to be a prime beneficiary from improving industry demand on a global basis, producing record financial results over the next few years.

In the near term, concerns in Europe, in our view, continue to weigh on the stock but North American Auto has been operating at near-record levels despite below-trend demand totals. In addition, Ford’s balance-sheet restructuring has been completed, the board reinstated the dividend for common shareholders in December, and expectations for additional cash generation should provide flexibility in the coming years.

We expect earnings per share of $1.60 in 2011, $1.80 in 2012, and $2.20 in 2013. The low end of our targeted multiple ranges applied to 2013 estimated EPS supports our $18 target price.

In our view, the market will more fully value Ford’s financial performance with signs of stability or a pending solution in Europe.

-

Bed Bath & Beyond Earns 95 Cents Per Share

Eddy Elfenbein, December 21st, 2011 at 5:05 pmAfter the bell, Bed Bath & Beyond ($BBBY) reported outstanding fiscal Q3 earnings of 95 cents per share. This is a 28% increase over last year’s Q3 result of 74 cents per share. Wall Street had been expecting 89 cents per share. Three months ago, the company told us to expect earnings between 82 and 87 cents per share.

The only weakness is that net sales rose 6.8% to $2.344 billion which was just shy of Wall Street’s forecast of $3.5 billion. Comparable store sales rose by 4.1%.

The best news is that BBBY said that it now sees earnings for 2012 coming in between $3.86 and $3.92 per share. The earlier range was $3.74 to $3.84 per share. This the third time BBBY has raised its full-year forecast.

For the first three quarters, the company has netted $2.60 per share so the full-year forecast implies a Q4 result of $1.26 to $1.32 per share. Wall Street had been expecting $1.30 per share.

Here’s a look at BBBY’s quarterly numbers for the past few years:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Nov-11 $2,343,561 $958,693 $357,020 $228,544 $0.95 -

Oracle’s Q3 Guidance

Eddy Elfenbein, December 21st, 2011 at 1:52 pmFrom Seeking Alpha:

We remain committed to returning value to our shareholders through technical innovation, strategic acquisitions, stock repurchases and prudent use of debt and dividends. This quarter, we repurchased 33 million — 33.1 million shares for a total of $1 billion. We have received an additional $5 billion in authorization for our stock buyback program, and the board again declared a dividend of $0.06 per share.

Now to guidance. As you remember, we had an absolutely stunning third quarter last year, with new license up 29% and non-GAAP EPS up 40% and GAAP EPS up 75%. Regardless, the fundamentals of the business remained strong, with pipelines growing significantly.

Now I do read the daily financial news, so I’m going to take that into account for this quarter’s guidance. With currency bouncing around, I’m going to give you constant currency guidance, and as a convenience for you, I’ll give what our U.S. dollar rates from the past few days. That currently amounts to about a negative 2% currency effect on license growth rates and on total revenue growth rates, but rates remained very volatile.

Our guidance for Q3 is as follows: new software license revenue growth is expected to range from 2% to plus 12%, so that’s from positive 2% to positive 12% in constant currency and 0% to 10% in U.S. dollars. Hardware product revenue growth rate — growth is expected to range from negative 4% to negative 14% in constant currency or negative 5% to negative 15% in U.S. dollars, and that does not include the hardware support revenue.

Total revenue growth on a non-GAAP basis is expected to range from 3% to 7% in constant currency and 1% to 5% in U.S. dollars. On a GAAP basis, we expect total revenue growth from 4% to 7% in constant currency and 2% to 5% in U.S. dollars.

Non-GAAP EPS is expected to be $0.56 to $0.59 in constant currency and $0.55 to $0.58 in U.S. dollars, up from $0.54 last year. GAAP EPS is expected to be $0.44 to $0.47 in constant currency and $0.43 to $0.46 in U.S. dollars, up from $0.41 last year. This guidance assumes a GAAP tax rate of 26% and a non-GAAP tax rate of 26.5%. Of course, it may end up being different.

-

Breaking Down Oracle’s Earnings

Eddy Elfenbein, December 21st, 2011 at 1:40 pm -

Why I Love the Stock Market

Eddy Elfenbein, December 21st, 2011 at 1:39 pmDo yourself a favor and go to Google Finance and check out the long-term stock chart for RLI Corp. ($RLI). I’d embed the chart if I knew how.

Ever heard of RLI? Don’t worry, you’re not alone. It’s a property and casualty insurer based in Illinois. RLI has 670 employees. Now check out how often the stock is discussed at the Yahoo Finance message boards or at StockTwits. It might as well not exist.

RLI has been an outstanding stock for three decades yet it’s still nearly unknown. I may have to apologize to some readers when I say that insurance has been known to be one of the less-sexy businesses. Yet investors should know that the best insurance companies have often been some of the best investments. RLI is certainly in that category.

This is why I love the stock market. You can find overlooked gems that have richly rewarded investors and yet no one knows about them. So much of the financial media focuses on the superstar stocks like Google ($GOOG) and Apple ($AAPL). I almost feel guilty telling people that Google has performed about as well as the market over the last four years.

RLI has done so well recently that the company announced a special $5 per share dividend in addition to the regular 30-cent quarterly dividend. When they announced this, the stock was at $70 per share, so that was a nice gift for shareholders.

-

Oracle and CR Bard

Eddy Elfenbein, December 21st, 2011 at 10:03 amThe market is down about 0.5% this morning but there’s some rough news for our Buy List.

Oracle‘s ($ORCL) earnings report wasn’t what I expected and it also fell short of what the company told us. That’s a very bad move on their part. Their shares are getting hacked this morning. Oracle has been as low as $25 per share this morning which is a 14% haircut.

As disappointed as I am in Oracle, I think a three-penny miss shouldn’t translate into a 400-penny sell-off. Today’s selling is very overblown but this is what you get when you mislead the Street.

The other news is for one of our new stocks for 2012, CR Bard ($BCR). In the company’s analyst call yesterday, they lowered their forecast for 2012 due to the impact of buying Lutonix:

Without the impact of Lutonix our guidance would have been 7% to 8% adjusted EPS growth. As our press release noted today’s transaction will dilute the 2012 adjusted EPS by about $0.25 or 400 basis points of growth. So our 2012 all-in guidance is for between 3% and 4% EPS growth excluding items that affect comparability. I would also note that the lack of the R&D tax credit in 2012 cost us about a point of EPS growth.

Bard should earn about $6.38 per share for 2011. So today’s news means that they should earn between $6.57 to $6.63 per share.

-

Morning News: December 21, 2011

Eddy Elfenbein, December 21st, 2011 at 7:05 amECB Lends Banks EU489B for Three Years, Exceeding Forecast

British Tax Office Assailed for ‘Cozy’ Ties With Big Companies

Successful Spanish Debt Auction

Japan Posts Another Trade Shortfall

Top EU Court Says Carbon Airline Law Valid

Senate Starts Debate on Monti Budget as Italy Sees Recession

China Hackers Hit U.S. Chamber

Wall Street Revenue Falls as ‘Year to Forget’ Ends

Oracle Sales, Profit Miss Estimates

Tokio Marine to Buy Delphi Financial for $2.7 Billion

Baidu Removed From U.S. ‘Notorious Markets’ Piracy List After Music Pact

Japan Picks Lockheed to Build Its Next Fighter Jet

E-Mail Clues in Tracking MF Global Client Funds

The Benefits of Incorporating Abroad in an Age of Globalization

Cullen Roche: There’s Still No Recession on the Horizon

Joshua Brown: Dear Jamie Dimon,

Be sure to follow me on Twitter.

-

Oracle Earns 54 Cents Per Share

Eddy Elfenbein, December 20th, 2011 at 4:14 pmA horrible earnings report from Oracle ($ORCL). The company just reported fiscal Q2 earnings of 54 cents per share which was below the company’s range of 56 to 58 cents per share. The Street had been expecting 57 cents and I was expecting at least 60 cents.

Oracle Corporation today announced fiscal 2012 Q2 GAAP and non-GAAP total revenues were up 2% to $8.8 billion. Both GAAP and non-GAAP new software license revenues were up 2% to $2.0 billion. Both GAAP and non-GAAP software license updates and product support revenues were up 9% to $4.0 billion. Both GAAP and non-GAAP hardware systems products revenues were down 14% to $953 million. GAAP operating income was up 12% to $3.1 billion, and GAAP operating margin was 35%. Non-GAAP operating income was up 3% to $3.9 billion, and non-GAAP operating margin was 45%. GAAP net income was up 17% to $2.2 billion, while non-GAAP net income was up 6% to $2.8 billion. GAAP earnings per share were $0.43, up 17% compared to last year while non-GAAP earnings per share were up 6% to $0.54. GAAP operating cash flow on a trailing twelve-month basis was $13.1 billion.

“Non-GAAP operating margins increased to 45% in Q2,” said Oracle President and CFO, Safra Catz, “and we expect those margins to keep growing. Operating cash flow over the last twelve months grew to $13.1 billion; that’s up a remarkable 45% compared to the preceding twelve month period.”

“We have expanded our worldwide sales capacity by adding over 1,700 sales professionals in the first half of this fiscal year,” said Oracle President, Mark Hurd. “We believe that this increase in our field organization combined with innovative new products like Fusion Cloud ERP and Cloud CRM will enable solid organic growth in the second half of this year.”

“Sales of our engineered systems accelerated in Q2,” said Oracle CEO, Larry Ellison. “Exadata growth was well over 100% compared to last year, and Exalogic grew more than 100% on a sequential basis. We shipped our first SPARC SuperCluster in Q2 and expect to begin deliveries of our Exalytics system and the Oracle Big Data Appliance in Q3.”

This report is just ugly. Oracle told investors to expect new software license sales to grow by 6% to 16%. Instead, it was 2%. I knew hardware was going to be rough. Oracle said to expect 0% to -5% sales. Instead, hardware sales dropped by 14%. The stock is down about 8% after hours.

-

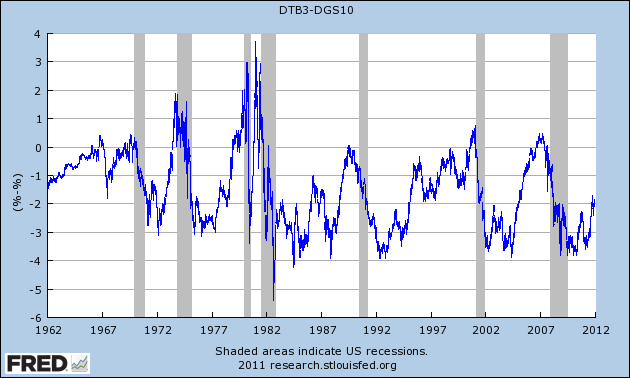

The Power of the Yield Curve

Eddy Elfenbein, December 20th, 2011 at 11:47 amThis is from Wikipedia:

All of the recessions in the US since 1970 (up thru 2011) have been preceded by an inverted yield curve. Over the same time frame, every occurrence of an inverted yield curve has been followed by recession as declared by the NBER business cycle dating committee.

I knew it was a strong relationship but I didn’t realize it was that strong. I went to FRED and dug up a chart, and sure enough, it is that strong.

A few years ago I found that the entire capital gain of the S&P 500 from 1962 to 2007 came when the yield curve has been wider than 65 basis points. Anything less than that has added up to zero.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His