Archive for 2011

-

Peter Brandt on My Gold Model

Eddy Elfenbein, August 23rd, 2011 at 10:47 amPeter Brandt, who knows basically everything there is to know about commodities trading, recently had some very kind words for my gold model:

This past week I read a blog post that nearly knocked my socks off. It was a huge déjà vu moment. It was one of the best postings I have read in years.

Each morning I briefly cruise through the posts made the previous day by the StockTwits blogging community, plus a half dozen other blogs I really like.

For the most part the verb “cruise” is very accurate. I am a very selected consumer of the opinions of others. I have little time for a regurgitation of the news of the day. I mainly look for original research, sophisticated insight into risk management protocols, bold and original thinking and unique market perspectives.

This past week one post led me to a post from October 2010 that knocked my socks off. It was profound. Let me explain.

On Thursday I read a blog post by @EddyElfenbein (Crossing Wall Street), titled Updating the Gold Model. BTW, Crossing Wall Street is one of my favorite blogs. However, this was not the post that captivated me. But, this post led me to a post from October 6, 2010 by Eddy, titled, “A possible model for the price of gold“.

-

Medtronic Earns 79 Cents Per Share, Reiterates Full-Year Guidance

Eddy Elfenbein, August 23rd, 2011 at 9:03 amMedtronic ($MDT) just reported fiscal first-quarter earnings of 79 cents per share which matched Wall Street’s estimate. The best news is that the company reiterated its full-year earnings guidance of $3.43 to $3.50 per share.

That’s good to see because the stock has fallen and the company doesn’t see any major changes in their business outlook for the coming year. Taking the mid-point of that guidance, Medtronic is going for just nine times earnings.

Analysts surveyed by FactSet expected, on average, earnings of 79 cents per share on revenue of $3.98 billion. Analysts typically exclude one-time items from their estimates.

Medtronic has struggled to maintain earnings growth amid sluggish sales of its two leading products: heart defibrillators and spinal implants. Sales for implantable cardioverter defibrillators, or ICDs, fell 8 percent on a constant currency basis to $697 million, as procedure volumes fell in the United States. ICDs treat rapid heartbeats.

Sales from the company’s spinal business fell to $825 million from $829 million, even though international sales in that segment grew 7 percent. That business took a big publicity blow earlier this year when a medical journal alleged that Medtronic downplayed the risks of its InFuse spinal repair protein and failed to disclose millions of dollars in payments to the authors who wrote the initial studies of the product.

Medtronic’s total costs and expenses also climbed 11 percent to $3.03 billion.

The company said international sales accounted for 46 percent of its revenue, and emerging markets sales grew 30 percent as reported or 25 percent on a constant currency basis to $408 million.

Medtronic reaffirmed the fiscal 2012 forecast it made in May. The company expects earnings of $3.43 to $3.50 per share on revenue growth of 1 to 3 percent, or to $16.1 billion to $16.41 billion.

Analysts expect, on average, $3.46 per share on revenue of $16.57 billion.

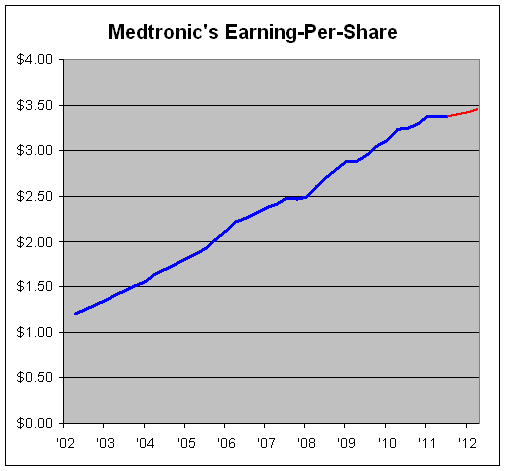

Here’s a look at Medtronic’s quarterly results for the past several years:

Quarter EPS Sales in Millions Jul-01 $0.28 $1,456 Oct-01 $0.29 $1,571 Jan-02 $0.30 $1,592 Apr-02 $0.34 $1,792 Jul-02 $0.32 $1,714 Oct-02 $0.34 $1,891 Jan-03 $0.35 $1,913 Apr-03 $0.40 $2,148 Jul-03 $0.37 $2,064 Oct-03 $0.39 $2,164 Jan-04 $0.40 $2,194 Apr-04 $0.48 $2,665 Jul-04 $0.43 $2,346 Oct-04 $0.44 $2,400 Jan-05 $0.46 $2,531 Apr-05 $0.53 $2,778 Jul-05 $0.50 $2,690 Oct-05 $0.54 $2,765 Jan-06 $0.55 $2,770 Apr-06 $0.62 $3,067 Jul-06 $0.55 $2,897 Oct-06 $0.59 $3,075 Jan-07 $0.61 $3,048 Apr-07 $0.66 $3,280 Jul-07 $0.62 $3,127 Oct-07 $0.58 $3,124 Jan-08 $0.63 $3,405 Apr-08 $0.78 $3,860 Jul-08 $0.72 $3,706 Oct-08 $0.67 $3,570 Jan-09 $0.71 $3,494 Apr-09 $0.78 $3,830 Jul-09 $0.79 $3,933 Oct-09 $0.77 $3,838 Jan-10 $0.77 $3,851 Apr-10 $0.90 $4,196 Jul-10 $0.80 $3,773 Oct-10 $0.82 $3,903 Jan-11 $0.86 $3,961 Apr-11 $0.90 $4,295 Jul-11 $0.79 $4,049 Check out Medtronic’s EPS trend. This is what I like to see: a clean strong upward line. The red is based on the company’s forecast. As you can see, MDT is still very profitable, but the earnings will be flat for a time.

-

Morning News: August 23, 2011

Eddy Elfenbein, August 23rd, 2011 at 4:56 amChina Details Yuan Use Offshore

Hong Kong’s ‘Scary’ 7.9% Inflation May Fuel Wages Even as Recession Looms

Europe Failure With Bank Crisis Haunts Markets

The Scramble for Access to Libya’s Oil Wealth Begins

Gold Even Reigns On Stock Market

Treasurys Rally May Hit Wall At Jackson Hole If Fed Disappoints

Standard & Poor’s President to Step Down

Douglas Peterson to Become President of S&P

Audi Defies Market Slump, Boosts A8 Production

Boeing’s 787 Inventory Glut Casts $16.2 Billion Cloud Over FAA Approval

McGraw-Hill Shareholders Seek to Split Company

Motley Fool: Confessions of an ADD Investor

Paul Kedrosky: Buy Stocks Until 2011, Then ….

Phil Pearlman: 20 Year SP500 Fibonacci Analysis

Be sure to follow me on Twitter.

-

Bashing Stock Buybacks

Eddy Elfenbein, August 22nd, 2011 at 4:39 pmI agree 100% with my pal Josh Brown on share buybacks.

-

Valuing the Market By Dividend Yield

Eddy Elfenbein, August 22nd, 2011 at 2:02 pmWhen we try to value a stock or the entire market, we never want to look at just one method. Instead, we want to look at as many as we can because every method has some flaw.

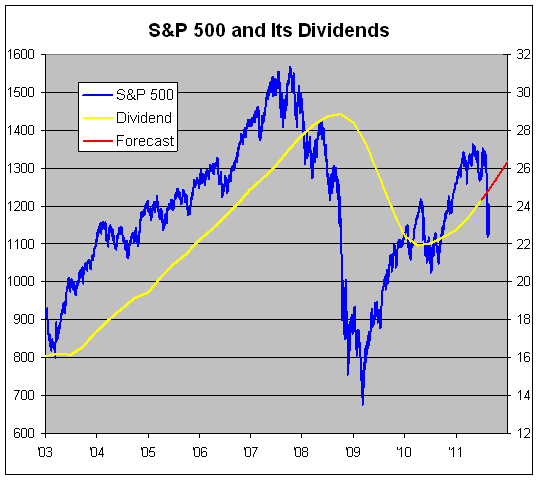

Trying to value the S&P 500 by going by the dividend yield has been a surprisingly reliable indicator for the past few years and this is despite the historic movement of market interest rates. I especially like this method because dividends tend to be very stable (note the clear trends of the yellow line on the graph).

The graph below shows the S&P 500 in blue and it follows the left scale. The dividend is in yellow and it follows the right scale. The two axes are scaled at a ratio of 50-to-1 which means that the S&P 500’s dividend yield is exactly 2% whenever the lines cross.

I asked Larry Silverblatt, the brilliant analyst at S&P, what his projection for full-year dividends are and he said $26.33, so that’s the red line. That’s probably a very shrewd call because the trend of the red line seems perfectly consistent with where we’ve been.

Now here’s the chart that caught my attention — the dividend yield of the S&P 500 (in other words, the yellow line divided by the blue).

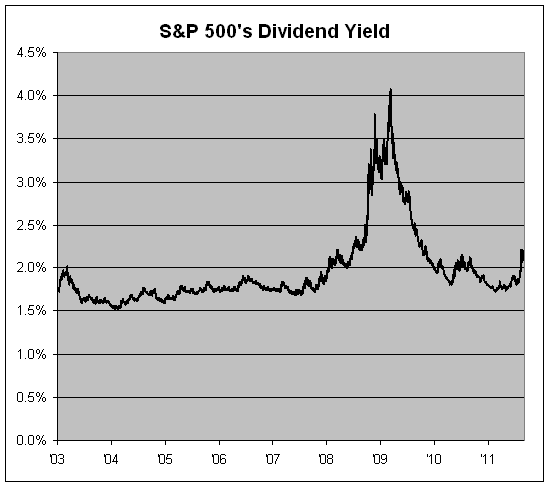

Except for the depths of the financial crisis, note how narrow the range is that the yield stayed in. Of course, you might say that that’s one hell of an exception. But still, once the worst of the financial crisis passed, the market’s dividend came right back to that 1.6% to 1.9% range.

The S&P 500’s dividend yield is currently 2.2%. Since 2003, the S&P 500’s dividend ranged between 1.6% and 1.9% more than 62% of the time. That’s pretty darn narrow. If Silverblatt’s forecast is correct and we use the 1.6% to 1.9% range, that implies a year-end target for the S&P 500 of 1,385 to 1,645.

The dividend yield chart is a good expression of “tail risk,” meaning what can happen when everything goes kablooey. Most of the time, things are by definition, normal. If we’re still in normal times, stocks are very cheap.

But to give you an example of how far things can go wrong, if the S&P 500’s dividend yield decides to match the peak yield from two-and-a-half years ago, punching in Silverblatt’s dividend estimate gives us a year-end S&P 500 of 646.

-

The Cyclical-to-S&P 500 Ratio

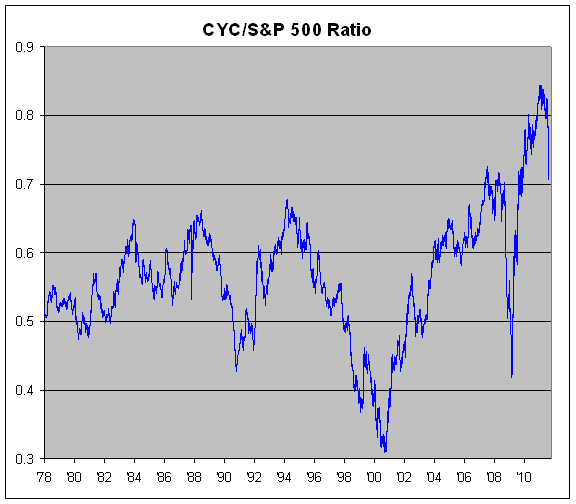

Eddy Elfenbein, August 22nd, 2011 at 1:20 pmI’ve often talked about the under-performance of cyclical stocks. Here’s a look at the Morgan Stanley Cyclical Index (^CYC) divided by the S&P 500. When the line is rising, cyclicals are out-performing. When the line is falling, cyclicals are trailing the market.

The ratio has plunged from 0.844 on February 11th to 0.705 on August 19th.

-

Bloomberg: Wall Street Aristocracy Got $1.2 Trillion From Fed

Eddy Elfenbein, August 22nd, 2011 at 11:04 amGreat article from Bloomberg. Here’s a snippet:

Citigroup Inc. (C) and Bank of America Corp. (BAC) were the reigning champions of finance in 2006 as home prices peaked, leading the 10 biggest U.S. banks and brokerage firms to their best year ever with $104 billion of profits.

By 2008, the housing market’s collapse forced those companies to take more than six times as much, $669 billion, in emergency loans from the U.S. Federal Reserve. The loans dwarfed the $160 billion in public bailouts the top 10 got from the U.S. Treasury, yet until now the full amounts have remained secret.

Fed Chairman Ben S. Bernanke’s unprecedented effort to keep the economy from plunging into depression included lending banks and other companies as much as $1.2 trillion of public money, about the same amount U.S. homeowners currently owe on 6.5 million delinquent and foreclosed mortgages. The largest borrower, Morgan Stanley (MS), got as much as $107.3 billion, while Citigroup took $99.5 billion and Bank of America $91.4 billion, according to a Bloomberg News compilation of data obtained through Freedom of Information Act requests, months of litigation and an act of Congress.

“These are all whopping numbers,” said Robert Litan, a former Justice Department official who in the 1990s served on a commission probing the causes of the savings and loan crisis. “You’re talking about the aristocracy of American finance going down the tubes without the federal money.”

-

Medtronic’s Earnings Preview

Eddy Elfenbein, August 22nd, 2011 at 10:03 amMedtronic ($MDT) reports tomorrow. This will be a key test for the new CEO, Omar Ishrak. Here’s an earnings preview from the AP:

Ishrak said Medtronic must communicate why its new products not only benefit patients, but also save health systems money. As one example he points to the company’s Revo pacemaker, the first such device that is compatible with MRI scanning. Older devices would often malfunction when exposed to the magnetized imaging technique.

Not only will patients benefit from better care, he says, but providers will save money because doctors will spot health problems before they grow into more catastrophic, costly problems.

“If there’s value there, we’ll get paid for it — but that’s not the point,” Ishrak said. “I want to make sure everything we do is geared to have the right economic impact on health care and on customers.”

With Medtronic trailing competitors in developing new versions of stents, heart valves and other key products, analysts hope Ishrak will focus on cost controls, restructuring and selling off underperforming business units.

WHAT’S EXPECTED: Analysts polled by FactSet expect earnings of 80 cents per share on revenue of $3.98 billion, on average.

LAST YEAR’S QUARTER: In the first quarter last year Medtronic earned 80 cents per share excluding one-time items on $3.77 billion in revenue.

-

So Long Moammar, Wall Street Rallies

Eddy Elfenbein, August 22nd, 2011 at 9:36 amThanks to the good news coming out of Libya, the stock market looks to rally strongly this morning. Wall Street is focused on two events coming this Friday. The first is that the government will revise its report on second-quarter GDP growth. The initial report said that the economy expanded by just 1.3% for the second three months of the year. Wall Street expects that to be pared to 1.1%.

The other even is that Ben Bernanke will be giving a speech at the Fed’s annual shindig in Jackson Hole, Wyoming. This is where one year ago Bernanke announced the Fed’s plans for the second round of quantitative easing. Some analysts think this is the time he’ll unveil a third program to buy Treasury bonds (i.e., QE3).

Personally, I doubt that will happen although there could be a sort of extra buying announced. The reality is that the long-term bond market is vastly overstretched. Either the bond market thinks we’re going into a recession or they’re expect more Fed bond purchases. Still, I find myself looking at a third option which is that the bond market is just plain wrong on this. In deference to Jimmy McMillan, bond prices are too damn high and stock prices are too low.

One mistake that investors often make is that a lower price doesn’t necessarily mean that a stock is a good buy. It only means that the stock is cheaper than where it was. Earlier this year, shares of Hewlett-Packard ($HPQ) got chopped from $48 to $41 after the company announced poor earnings guidance. I got a lot of email asking me if HPQ was a good buy. According to the numbers, the answer was “yes,” but my answer was “no, HPQ is a sell.”

That’s a good example of when we have to see the numbers for what they are. They’re only a reflection of business reality, not business reality itself. When we take a closer look at what’s happening at HPQ, we can see that things haven’t been going well.

This is what I wrote six months ago in a post called, “Hewlett-Packard Is Cheap, For Good Reason.”

Since Hurd left HPQ, I’ve been down on the stock and fortunately I look smart today by telling investors to stay away six months ago. My concern is that the company’s aggressive acquisition plans may be doing more harm than good. HPQ has been going after IBM’s business in a big way and they’ve been shelling out major bucks to do it. I hated the 3Com purchase and the Palm acquisition still gives me nightmares. At the time, I gave Hurd the benefit of the doubt. Now that he’s gone, that benefit is also gone.

It boils down to the question: “Can new CEO Léo Apotheker engineer a turnaround from the previous turnaround?”

I say all of this in the context of last week’s earnings report. Hewlett-Packard reported earnings of $1.36 per share which was seven cents more than Wall Street’s forecast. Wall Street responded by tossing the shares in the garbage. The shares dropped nearly 10% on Wednesday. Since the stock is a Dow component, the plunge distorted the entire index.

What freaked out Wall Street so much? Let’s dig into the numbers. The hitch was that quarterly revenue rose only 4% to $32.30 billion from $32.96 billion. Wall Street had been expecting $32.96 billion. In the wider scope of things, that’s really not a big miss, so what else was going on?

Hewlett-Packard also gave guidance for Q2 and the entire year. For this quarter, HPQ said it expects revenues between $31.4 billion and $31.6 billion, and earnings-per-share between $1.19 and $1.21. Wall Street didn’t like that at all. The consensus was for revenues of $32.6 billion and earnings of $1.25 per share.

HPQ’s full-year forecast (their fiscal year ends in October) was for total revenues between $130 billion and $131.5 billion. The consensus on Wall Street was for $132.91 billion. HPQ said it expects full-year earnings to range between $5.20 and $5.28 per share. The Street was expecting $5.23 per share, so I suppose that’s inline. HPQ has traditionally issued conservative forecasts so they can raise them later. Perhaps they’re doing that now to mask the poor Q2 guidance.

So this seems odd. It appears that HPQ gave lousy near-term guidance but the long-term guidance is still what the Street expects. Yet the stock’s popularity is somewhere between Kim Jong-il and Diphtheria. (Did Hurd get out at the right time? Sure looks like it.)

According to the company’s guidance, the stock is selling for just eight times earnings. The good sign is that their enterprise storage, servers and networking division saw its revenues increase by 22%. Also, the gross margins are up 1.5% to 23.4%.

The stock is tempting, but I’m still steering clear.

HPQ has a few problems to work through. They’re experiencing weakness in consumer PCs and services. I’m also not a big fan of the quality of their earnings. Always be wary when a company grows too much through acquisition. That’s often a sign of trouble. A company should be focused on making earnings not buying them.

When I wrote that, the shares were at $43. Now they’re at $23.

-

Morning News: August 22, 2011

Eddy Elfenbein, August 22nd, 2011 at 6:40 amMerkel Says She’ll Resist Pressure for Euro Bond

Italy’s Debt May Swell as Austerity Chokes Growth

Yen, Franc Weaken Amid Speculation Japan, Switzerland Ready to Intervene

China Yuan Down Late On Import Settlements

Oil Slips $2 Towards $106 on Libya End-game

Wheat Rises to Two-Month High as U.S. Drought May Curb Sowing; Corn Gains

S&P: ‘No Math Error’ In US Rating Cut, No Qualms about More Actions

For Bernanke, No Summer Fun at Jackson Hole

Wall Street Aristocracy Got $1.2T in Loans

China Construction Bank Net Profit Jumps 31%

United Continental Spruces Up Cabins

Smacked by Big Market Swings, Investors Should Alter Their Outlook

James Altucher: How to Be a Human

Epicurean Dealmaker: The Devil’s Book of Aphorisms: Part 1

The Big Lebowski Live Cast Reunion

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His