Archive for 2011

-

It’s Cheaper Now to Buy Than Rent

Eddy Elfenbein, August 16th, 2011 at 8:06 amCNN Money has an interesting article saying that it’s now cheaper to buy a home rather than renting one:

Home prices have taken such a beating and demand for rental units has increased so much that it’s now cheaper to buy a two-bedroom home than to rent one in most major U.S. cities.

According to real estate web site Trulia, buying was cheaper than renting in 74% of the country’s 50 largest cities in July. In just 12% of the cities, including New York, Seattle and San Francisco, renting was cheaper. In the remaining 14% of cities, renting was less expensive but close to the cost of buying.

In addition to a continuing decline in home prices, rock-bottom interest rates have added a lot of weight to the buy side of the scale. The overnight average rate for a 30-year fixed was just 4.19% on Monday, according to Bankrate.com. A 15-year fixed averaged just 3.43%.

-

Stocks on Sale

Eddy Elfenbein, August 16th, 2011 at 7:18 amAmid Warren Buffett’s call to raise taxes on himself, he also had fairly positive things to say about the economy. He even said that the economy might pick up faster than the Fed expects. That’s not all. The latest filings show that Buffett made his biggest bets of the year on August 8th as the stock market was falling.

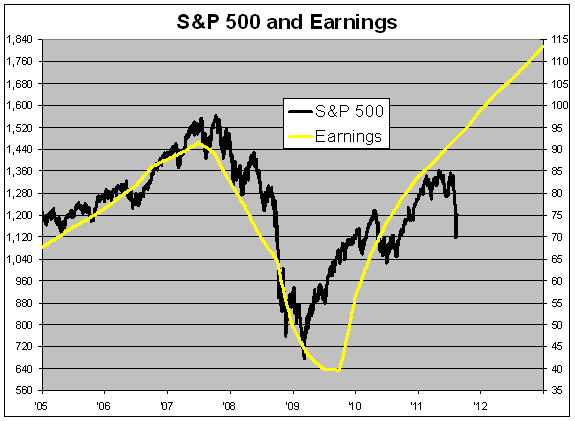

Clearly Buffett believes the market is cheap and the numbers back him up. According to the latest data, the Price/Earnings Ratio for the S&P 500 fell all the way down to 12.1 last week which is the lowest it’s been since May 1989.

Yet the latest earnings data showed that the second quarter was a very strong one for the S&P 500. With 94% of its companies reporting, the S&P 500 is on track to earn $24.88 for Q2. That surpasses the previous record of $24.06 from the second quarter of 2007.

Interestingly, Wall Street has only cut earnings estimates very slightly for the near future. For the third quarter, which we’re already halfway through, Wall Street expects earnings of $25.10. That represents growth of 16.4% over the third quarter of 2010.

For all of 2011, Wall Street expects the S&P 500 to earn $98.94, and another $113.47 for next year. It’s very possible that earnings estimates will fall, but for now, the S&P 500 is going for 10.6 times next year’s earnings. That’s pretty cheap.

-

Morning News: August 16, 2011

Eddy Elfenbein, August 16th, 2011 at 6:50 amEurope Q2 Expansion Slows More Than Forecast

Merkel, Sarkozy May Edge Toward Euro Bonds, Bofinger Says

India’s Inflation Rate May ‘Peak’ in August, Finance Ministry’s Basu Says

China Finance Ministry Said to Begin Yuan Bond Sale Tomorrow

Swiss Ponder Battle Over Runaway Franc

Oil Drops as Slowing German Economy Signals Demand May Falter

Gold Fever Gripping the Australian Outback

Freddie: Most Homeowners Used Fixed Rates To Refinance In 2Q

Home Depot Results Top Analyst Estimates

Is Google Turning Into a Mobile Phone Company? No, It Says

Asian Shares End Mixed; Google’s Motorola Buy Boosts Handset Makers

Qantas Overhauls With $9 Billion Fleet Order, 2 New Airlines

Cargill Will Acquire Provimi Group for $2.14 Billion

National Oilwell Pens $1.5 Billion Brazil Supply Deal

Howard Lindzon: Buddy Media is Going for It!

Brian Shannon: Stock Trading Ideas for 8/16/11

Be sure to follow me on Twitter.

-

QOTD

Eddy Elfenbein, August 15th, 2011 at 10:33 amFrom the Wall Street Journal:

“I’m sure there were some wealthy families who were drinking the Bernanke Kool-aid and got burned,” he said. “But I don’t know many families in that boat.

Via Paul Kedrosky

-

Sysco Drops on Mediocre Earnings

Eddy Elfenbein, August 15th, 2011 at 10:26 amSysco ($SYY) just reported earnings of 57 cents per share which was inline with analysts’ estimates. However, it was well below my estimate of 60 cents per share, plus or minus two cents.

“Looking at the overall business landscape, for some time now we have characterized the current economic recovery as slow, choppy, uneven and even fragile. Our fourth-quarter results and the events that have played out in Washington and in the financial markets over the past few weeks certainly support that outlook,” said Chief Executive Bill DeLaney on a conference call. “Nevertheless, we continue to believe that our industry will experience modest real growth over the long term.”

The company, which derives most of its sales from the restaurant industry, said its sales growth of 0.7% for the quarter was affected by inflation, acquisitions and currency translations, and that aside from these factors, its sales would have risen 1%. The company also said volume growth was positive for the quarter but remains at modest levels.”

Sysco is undergoing a major business-transformation project with a pilot in place at an Arkansas facility that it says will help drive growth and increase productivity. However, due to problems, such as the speed of taking and processing orders, it is delaying the wider rollout of the new system. It says it is still evaluating the financial impact of the delay.

Some analysts believe the delay is chalked up more to the company’s avoiding the capital spending on a full launch during such an uncertain economy. However, Sysco said that even with headwinds such as inflation not appearing to be letting up in the next couple quarters, it hasn’t come to that yet.

The stock dropped as much as 5.8% today, although it recovered some and finished 3.93% lower. With the lower price, the dividend yield is now 3.7%.

-

Google Buys Motorola Mobility

Eddy Elfenbein, August 15th, 2011 at 9:54 amWhen Motorola finally split itself into two separate companies, I said that Motorola Solutions ($MSI) was by far the smarter buy. I had been right up until today. Now Google ($GOOG) announced that it’s buying Motorola Mobility($MMI) for $12.5 billion.

The deal, which comes just eight months after the split of Motorola Inc., would give Google control of Motorola Mobility’s attractive patent portfolio after the Internet giant recently missed out on a bid for Nortel Networks Corp.’s (NRTLQ) portfolio. Google, which owns the fast-growing Android operating system used in millions of mobile phones, has a thin portfolio of wireless and telecommunications patents.

Google’s buyout price works out to $40 per share. On Friday, MMI closed at $24.47 so Google is offering a 63% premium. I have to wonder if Google is making the smart move here. Wall Street thinks MMI will earn $1.39 per share next year, so Google is paying 20.8 times that. If the S&P 500 were valued similarly, the index would be over 2,300.

Activist investor Carl Icahn, who is the company’s largest shareholder, had urged Motorola Mobility to explore options for its patent portfolio in the wake of the Nortel deal that attracted multiple bidders.

Following that defeat, Google had preliminary discussions with InterDigital Inc. (IDCC) about a possible acquisition of the wireless technology developer and licenser.

The smartphone and set-top box company split with its sister Motorola Solutions Inc. (MSI), which is focused on business and networking operations, at the beginning of the year. The separation made Motorola Mobility nimbler and more focused on its core operations, but it faces a highly competitive smartphone market, including a persistent threat from Apple Inc.’s (AAPL) iPhone.

Last month, Motorola reported a 28% rise in second-quarter revenue, thanks to strong tablet sales, but the device maker provided weak guidance for the current quarter because of delays in launching speedier 4G devices.

Meanwhile, Google’s second-quarter earnings rose 36% on record revenue as the Internet giant experienced strength in its core search business and gained traction with its newer operations.

-

Morning News: August 15, 2011

Eddy Elfenbein, August 15th, 2011 at 6:35 amSetbacks May Push Europe Into a New Downturn

Japan’s Economy Shrinks but Beats Expectations

Euro Zone Bond Debate Raises Pressure on Merkel

Middle East Oil Near Highest in a Week as Gasoil Profits Rebound

Sterling No Refuge as Bank of England Governor King Eyes Stimulus

Low Rates May Do Little to Entice Nervous Consumers

Ralcorp Rejects ConAgra’s Sweetened $5.2 Billion Bid

Time Warner Cable Said to Be Near $3 Billion Insight Deal

Transocean Announces $2.23 Bln Takeover Of Aker Drilling

Bright Nears Deal for 75% Stake in Manassen

Nestle Takeover in China Creates 23% Return

Israel’s Sewage-Eating Bacteria Lure GE Cash

Saab Customers Abandon Automaker as Swedes Fret

20 Valeurs Pour Battre Le Marché

Paul Kedrosky: Warren Buffett: Stop Coddling the Super-Rich

James Altucher: Nine Ways To Light Your Creativity ON FIRE

Epicurean Dealmaker: Investment Banks of the Plain

Be sure to follow me on Twitter.

-

The Carter Family: “Can the Circle Be Unbroken”

Eddy Elfenbein, August 12th, 2011 at 8:38 pm -

Consumer Confidence Plunges

Eddy Elfenbein, August 12th, 2011 at 12:36 pmIt’s been a long time since consumer confidence was this low. Let’s just say that you probably had an alligator on your shirt back then.

Confidence among U.S. consumers plunged in August to the lowest level since May 1980, adding to concern that weak employment gains and volatility in the stock market will prompt households to retrench.

The Thomson Reuters/University of Michigan preliminary index of consumer sentiment slumped to 54.9 from 63.7 the prior month. The gauge was projected to decline to 62, according to the median forecast in a Bloomberg News survey.

The biggest one-week slump in stocks since 2008 and the threat of default on the nation’s debt may have exacerbated consumers’ concerns as unemployment hovers above 9 percent and companies are hesitant to hire. Rising pessimism poses a risk household spending will cool further, hindering a recovery that Federal Reserve policy makers said this week was already advancing “considerably slower” than projected.

-

CWS Market Review – August 12, 2011

Eddy Elfenbein, August 12th, 2011 at 11:25 amAs dramatic as the markets were last week, things got even more frenetic this week. Over the past four days, the Dow closed down 634, up 429, down 519 and up 423. On Thursday, the S&P 500 closed at almost exactly the same level it closed at two days before. It’s like watching some crazy football play where the running back scampers all over the field only to wind up back at the line of scrimmage.

In this week’s issue of CWS Market Review, I want to break down what’s happening and why, but I also want to tell investors what’s the best strategy to do with their money. The silver lining in all this crazy volatility is that there are some impressive bargains right now on our Buy List.

The big story of this past week, outside the down/up/down/up market, was Tuesday’s Fed meeting. Over the past several months, these FOMC meetings have been snoozefests. After all, what can you do when interest rates are already at 0%? This time, however, the Fed actually made some news.

In the post-meeting policy statement, they added important new language:

The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

Bear in mind that central bankers are bred to speak in understated tones, so this statement is a pretty big deal. What Bernanke & Co. are saying is that the economy and inflation will be soft for at least two more years (which includes Election Day, by the way). Many folks in the market had suspected this was the case, but this is the first time we’ve heard the news right from Big Ben himself.

What’s happening is that S&P’s downgrade of our debt, while a bit silly in my opinion, is having major repercussions, though interestingly, not on the market for our debt. The S&P downgrade took the idea of further fiscal stimulus off the table. In other words, don’t expect Congress to act. More stimulus spending takes political will and that simply no longer exists.

Without the possibility of fiscal stimulus, all responsibility is placed on monetary policy—meaning the Federal Reserve. As a result we’ve been experiencing this odd combination of soaring Treasuries and soaring gold combined with weak and highly volatile stocks. Everyone is running for cover. Gold is soaring because it acts as a hedge against real short-term interest rates. As long as short-term rates are running below inflation, gold is poised to do well. It’s as if Bernanke gave commodity investors the green light—or perhaps the gold light.

What also made this past Fed meeting interesting is that there were three dissensions to the Fed policy statement. The Fed isn’t like the Supreme Court. They work very hard to get the effect of the broad consensus. If someone disagreed, then they really didn’t like the policy. The vote for the last policy statement was 7-3. There are currently two vacancies but we do have to wonder if it’s possible for Bernanke to be overruled at some point by the inflation hawks. That hasn’t happened to a Fed chair in 25 years.

What’s really stood out in my mind is the dramatic volatility of the past few days. I have a slightly different view of volatility than you often hear in the financial media. Volatility isn’t necessarily bad for the market. I think periods of high volatility reflect the violent clashing of multiple views on what’s driving the market. It’s as if two schools of thought are fighting for supremacy.

The bone-on contention is what shape the economy is in right now. Some investors think we’re headed right back for another recession. Personally, I think it’s too early to say. However, I do believe that it’s best for investors to lighten up on their economically-sensitive stocks. I also think we’ll see this crazy volatility begin to fade once traders get back from the beach after Labor Day.

Many financial stocks have come in for an especially severe pounding this month, but I think that’s become overdone, especially for the high-quality ones. In the CWS Market Review from four weeks ago, I said that I was “particularly leery” of financials like Citigroup ($C), Bank of America ($BAC) and Morgan Stanley ($MS). Since then, those three banks have fallen 22%, 28% and 14% respectively. As bad as they are, every stock has a price.

On our Buy List, I think financials like JPMorgan Chase ($JPM) and AFLAC ($AFL) are very good buys. Not only is Nicholas Financial ($NICK) a great buy but I think the recent Fed news actually helps them since short-term rates will continue to be very low for some time. NICK makes their money on the spread between short-term rates and what they lend out to their customers.

For investors, the important lesson is that when times get difficult, you always want to look at dividends. Accountants can do crazy things with a balance sheet, but dividends tend to be very stable. Even during the past recession, once you discount the financial sector, most dividends hung in there. That’s why I want to highlight some of the top yielders on the Buy List.

Abbott Labs ($ABT), for example, is now yielding 3.7%. Even Johnson & Johnson ($JNJ) is yielding close to 3.5%. AFLAC ($AFL) is over 3% and Medtronic ($MDT) isn’t far behind. Tiny Deluxe ($DLX) saw its yield come close to 5%. Most of these companies can easily cover their dividends, and a few have paid rising dividends for decades.

On Monday, Sysco ($SYY) will be our final earnings report of the second quarter. From what I see, the company is in pretty good shape. Wall Street expects earnings of 57 cents per share which is exactly what SYY earned a year ago. I think that’s a bit low. My numbers say that Sysco earned 60 cents per share, plus or minus two cents.

I think it’s interesting that the recent market pullback has impacted a non-cyclical stock like Sysco far less dramatically than it has the rest of the market. Even in this market, Sysco currently yields 3.6% which is a very good deal. The company has increased its dividend for the past 41-straight years and I think they’ll make it 42-straight in November, although it will probably be a one-cent increase. Still, that’s not bad in an environment where a 10-year Treasury goes for just over 2%.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His