Archive for 2011

-

Moog Earns 73 Cents Per Share

Eddy Elfenbein, July 29th, 2011 at 11:38 amMoog ($MOG-A) beat by three cents and they raised guidance. They see earnings coming in for this year (ending September 2011) at $2.85 per share, and at $3.25 per share for next year.

Moog Inc.bizWatch Moog Inc. Latest from The Business Journals M&T, Moog, Try-It juiced by NYPATripathi, Zemsky to head area economic panelMoog set to work on Boeing project Follow this company reported third-quarter earnings improved 14 percent as the space and defense manufacturer upped its guidance for 2011.

Net income climbed to $33.8 million, or 73 cents per share, compared to $29.2 million, or 64 cents per share, last year.

Third-quarter sales rose 9 percent to $583 million from last year’s $537 million.

Analysts had anticipated EPS of 70 cents on revenue of $569.4 million.

East Aurora-based Moog (NYSE: MOG.A, MOG.B), which operates segments in commercial aircraft, space and defense, industrial systems, components and medical devices, adjusted its annual sales to $2.3 billion, with net earnings of $132 million and earnings per share of $2.85, up 21 percent from last year.

-

Q2 GDP Growth = 1.3%

Eddy Elfenbein, July 29th, 2011 at 9:04 amIt was another bad quarter for the economy. For the second three months of the year, the economy grew by just 1.3% in real terms. On top of that, growth for the first quarter was revised down to just 0.4%.

The first estimate of the economy’s benchmark indicator for the second quarter showed growth was supported largely by business investment and exports.

But consumer spending, a big engine for the U.S. economy, made a much smaller contribution to growth. Spending edged up by an annualized rate of 0.1% in April through June, the weakest it has been in two years, after a 2.1% gain in the first quarter.

Americans have had to spend more for gasoline amid higher prices, leading them to cut purchases for other things. Sales last month by U.S. retailers excluding car and parts dealers were unchanged, with declines reported by furniture stores; electronics and appliances stores; restaurant and bars; health care stores; and sporting goods, hobby, book, and music stores.

Also restraining consumers is a high jobless rate. Big companies have been announcing job reductions. At Delta Air Lines Inc., for instance, more than 2,000 staff have accepted voluntary redundancy job cuts. The carrier, stung by fuel prices, announced a 58% drop in second-quarter earnings.

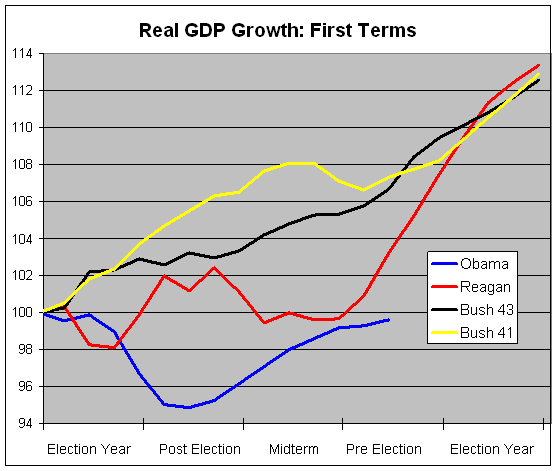

Here’s a look at real GDP growth during the first term of some recent presidents. Note that the line is extended back to include the election year preceding the presidential term.

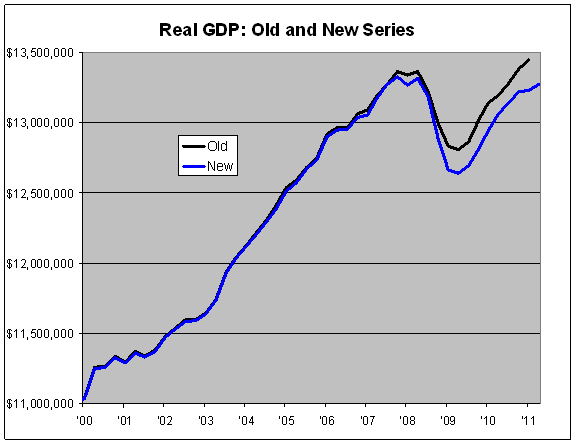

The government also revised the quarterly GDP series. Here’s what the old and new series look like side-by-side. We still haven’t surpassed the previous GDP peak.

-

CWS Market Review – July 29, 2011

Eddy Elfenbein, July 29th, 2011 at 8:37 amAs I write this on Friday morning, Wall Street is still very worried about the debt ceiling debate. The S&P 500 has dropped four days in a row and the index finished Thursday at its lowest level in a month.

What’s especially disturbing is that the market has been routinely weak going into the closing bell. For the last seven-straight sessions, stocks have fallen in the last hour of trading. This tells me that traders are terrified of holding stocks overnight when any unexpected political news may break.

I had hoped that Congress would have been spurred to action by constituents who have seen their retirement portfolios dwindle due to this political bickering. I still believe that this impasse is similar to the NFL lockout—there’s simply too much money at stake not to reach a deal.

The problem is that even though this mess started out as political theater, it’s now having a real world impact. The U.S. dollar, for example, is getting a super-atomic wedgie on world markets. The greenback is near a post-war low against the Japanese yen and it’s at an all-time low against the Swiss franc. Consider that forty years ago, one Swiss franc was worth 25 U.S. cents. Ten years ago, it had climbed to 57 cents. Today, it’s worth $1.25.

Even our Buy List companies are starting to make noises. Alan Mulally said that the debt ceiling fight will impact Ford’s ($F) business. AFLAC’s ($AFL) CFO said on the company’s conference call, “We gotta get the stupid debt deal done in the U.S., for one thing.” I couldn’t agree more. Companies should be focused on making money, not worrying about Congressional votes. As crazy as this sounds, even Dunkin’ Doughnuts ($DNKN) referenced the debt ceiling debate when it discussed its IPO pricing. This is getting out of hand.

Investors around the world are clearly concerned. Bloomberg notes that credit-default swaps that insure one-year U.S. Treasuries have risen from 23 basis points at the beginning of the year to 46 basis points last week and to 80 basis points today. On top of that, gold hit an all-time record high of $1,631.20 on Wednesday. So far this year, the Gold ETF ($GLD) is up 13.4% which is four times the S&P 500.

The $VIX, the Volatility Index, closed Thursday at 23.74. That’s the highest level since mid-March during the most intense period of the Libyan Uprising. Just three weeks ago, the $VIX was under 16. This is clear evidence of investors’ growing uncertainty.

What’s especially frustrating is that corporate earnings continue to be very good. Sixty percent of the companies in the S&P 500 have now reported second-quarter results. So far, 71.3% of the reports have beaten estimates, 10.9% have reported inline and just 17.8% have missed estimates. These are impressive numbers. The S&P 500 is on track to report earnings of $24.78 for the second quarter which will be an all-time record. Full-year earnings of $100 looks very possible, and that means the S&P 500 is going for 13 times this year’s earnings. Those are strong factors in favor of equities.

However, the most important phenomenon impacting the market lately has been the wide divergence between winners and losers. Simply put: A rising tide is not lifting all boats. In fact, not only is the tide drifting out to sea but it’s capsizing a lot of boats along the way and only a select few are doing well.

Over a recent 20-day stretch, barely more than one-third of stocks were beating the overall market. This is the anti-Wobegon market—most stocks are below average. The only gains are concentrated in just a few areas. Cyclicals and financials have been getting slapped silly but tech stocks have been doing very well. Since June 20, Apple ($AAPL) and Google ($GOOG) are both up 25%. My take is that this widening gap between winners and losers reflects Wall Street’s impatience with the market. I share this impatience but I refuse to abandon my game plan of sticking with high-quality stocks.

Now let’s take a look at some of the recent earnings reports from the stocks on our Buy List. AFLAC ($AFL) reported second-quarter earnings of $1.56 per share which was less than I was expecting but it was more than Wall Street’s consensus and it was within the company’s range. Best of all, the market liked what it saw. At one point, shares of AFLAC were up over 7% on Thursday.

Despite all the worries that the market had about AFLAC (European debt, Japanese earthquake) the company came through with another strong quarter. This really shouldn’t be a surprise because it’s exactly what they told us to expect. AFLAC should have little trouble hitting its full-year earnings forecast of $6.09 to $6.34 per share.

AFLAC also raised its growth target for next year from 0% – 5% to 2% – 5%. That’s not a lot but the low end is still more growth than you’d get from a five-year Treasury. I can’t say when this stock will rally but the facts are that their business is doing well and the stock is cheap. AFLAC is an excellent buy up to $50 per share.

I’ve often said that Nicholas Financial ($NICK) is one of my favorite stocks on the Buy List. As far as I know, I’m the only one who follows it. The company once again had a very good earnings report. For the second quarter (the first of their fiscal year), NICK earned 44 cents per share. All the numbers look good here. I think NICK can easily earn $1.70 for this calendar year which means the stock is going for less than eight times earnings. The company has said that it’s open to an acquisition but I wouldn’t support any buyout less than $17 per share. NICK is a truly excellent value.

In last week’s issue of CWS Market Review, I said that Wall Street’s earnings forecast for Reynolds American ($RAI) was probably too high. I was right; the company reported earnings of 67 cents per share which was four cents shy of forecasts. But I didn’t expect the stock to get dinged like it did. Well…the silver lining is that the dividend (which is very safe) now yields 6%. Despite the earnings miss, Reynolds bumped up the low-end of its full-year earnings forecast. This is a very good stock for investors looking for income.

By the way, I always pay close attention to the direction of full-year forecasts. Bear in mind that companies aren’t required to do this. Bespoke Investment Group points out that the number of companies who refuse to provide any sort of guidance has grown dramatically this quarter. Again, I think this reflects companies’ lack of visibility for the next few quarters.

Deluxe Corp. ($DLX), one of our quieter stocks, had an especially good earnings report on Thursday. The company topped its own forecast, plus it raised its full-year guidance. Unfortunately, DLX has been one of the many stocks left behind recently. Even after surging 3.5% on Thursday, shares of DLX still yield 4.2%. Deluxe is a good value below $25.

Fiserv ($FISV) reported earnings of $1.13 per share which was five cents more than Wall Street’s consensus. The company also reiterated its full-year forecast of $4.42 to $4.54 per share. This is a solid stock. Fiserv is a good buy up to $62 per share.

Gilead Sciences ($GILD) was one of the stocks I had become most concerned about. The company missed earnings by 10 cents per share three months ago. This time around, Gilead reported earnings of $1 per share which was one penny more than estimates. The company reiterated its full-year sales goal of $7.9 billion to $8.1 billion. I’m happy to see that shares of Gilead have rebounded lately but I don’t think this one is worth chasing. GILD isn’t worth buying unless it falls below $38 per share.

I was anticipating a big quarter from Ford ($F). The company earned 65 cents per share which was five cents more than where the Street was. Still, I thought it could have been as high as 70 cents per share. Ford is continuing to improve and I like that it’s paying down debt. This is one of the few purely cyclical stocks that I like. Unfortunately, Ford is swimming against a strong anti-cyclical tide. At this price, however, Ford is a good buy.

That’s all for now. The big GDP report is due out later today. Plus, earnings reports from Wright Express ($WXS) and Becton, Dickinson ($BDX) are due out next week. Be sure to keep visiting the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

Best – Eddy

-

Morning News: July 29, 2011

Eddy Elfenbein, July 29th, 2011 at 8:33 amGreece to Get September Bailout From Bilateral Loans

Spain Placed on Downgrade Review by Moody’s

Bunds Up as Euro Zone Crisis Focus Shifts to Spain

Euro Zone Inflation Falls, May Help Pause Rate Hikes

U.S. House Bids to Salvage Boehner Debt Bill

Debt Ceiling Impasse Rattles Short-Term Credit Markets

Treasuries Advance as Political Budget Deadlock Spurs Demand for Refuge

U.S. Balance Now Less Than Apple Cash

BSkyB Plans Share Buyback and Higher Dividend

Merck 2Q Profit Surges On Tax Benefit, To Cut More Positions

Starbucks Posts 34% Profit Jump

Total Hit by Weaker Production

Stone Street: The Best Laid Plans of Mice & Men: YOKU Summary Thesis Update

Todd Sullivan: A $10 Billion “Disappointment”

Be sure to follow me on Twitter.

-

Q2 Earnings Season at the Midway Point

Eddy Elfenbein, July 28th, 2011 at 11:12 amBloomberg has a summary of earnings season. Of the 500 companies in the S&P 500, 252 have reported so far.

Breaking it down, 72.6% have beaten expectations, 11.1% came inline and 16.3% missed earnings. Earnings are tracking for $24.93 which is a 15.79% increase over the $21.53 the S&P 500 earned in the second quarter of 2010.

-

AFLAC Up 6.3%

Eddy Elfenbein, July 28th, 2011 at 11:00 amAs it turns out, what AFLAC ($AFL) had been telling us (repeatedly) for the past few months was indeed correct — the company isn’t going under. The earthquake in Japan failed to have a major impact on their business. Also, the company has gradually separated itself from the problems in Europe.

The shares are currently up 6.3% today. I don’t see why this stock is going for less than $50. Of course, markets have been known to be irrational.

-

Deluxe Earns 75 Cents Per Share

Eddy Elfenbein, July 28th, 2011 at 8:48 amThe earnings reports are still coming in. Deluxe ($DLX) just reported adjusted quarterly earnings of 75 cents per share. Quarterly revenue dropped 0.5% to $346.3 million which was slightly better than Wall Street’s forecast. The company hed been expecting EPS to range between 66 cents and 71 cents per share. Wall Street was expecting 71 cents per share.

For the third quarter, Deluxe expects adjusted earnings of 71 cents to 77 cents per share on revenue of $353 million to $361 million.

Deluxe also raised their full-year outlook from $2.90 – $3.10 per share to $3.00 – $3.15 per share. Currently, Wall Street’s full-year forecast is at $3.03 per share.

Here are some second-quarter highlights from the earnings report:

Revenue for the quarter was $346.3 million compared to $348.0 million during the second quarter of 2010 with growth in Small Business Services partially offsetting declines in Financial Services.

Gross margin was 65.1 percent of revenue compared to 65.0 percent in 2010. Favorable impacts from price increases and the Company’s continued cost reduction initiatives were offset by increased material costs and delivery rates.

Selling, general and administrative (SG&A) expense decreased $3.2 million in the quarter compared to 2010. Increased SG&A expense associated with acquisitions, brand awareness campaigns, and investments in revenue generating initiatives were more than offset by benefits from continuing to execute against cost reduction initiatives.

Operating income in 2011 was $64.0 million compared to $63.2 million in the second quarter of 2010. Restructuring and transaction-related costs were $5.0 million in 2011 versus $2.7 million in 2010. The 2011 costs were primarily attributable to the Company’s on-going cost reduction initiatives and the April Banker’s Dashboard acquisition. Operating income was 18.5 percent of revenue compared to 18.2 percent in the prior year.

Reported diluted EPS increased $0.03 from the prior year driven by improved operating performance and a lower effective tax rate primarily from lower state taxes in 2011.

This is a very good earnings report. The stock is going for less than eight times earnings and the current dividend yield is 4.33%.

-

Morning News: July 28, 2011

Eddy Elfenbein, July 28th, 2011 at 8:07 amGold Steadies as Dollar Firms, U.S. Debt Talks Eyed

Stocks, Treasuries Slide on U.S. Debt Concern; Dollar Rallies

House Debt-Limit Vote Sets Stage for Showdown

Treasury to Weigh Which Bills to Pay

Investors, Worried About Debt Talks, Look for Havens

Japan’s Tech Firms Face Weak TV Demand, Keep Forecasts

Sony Slashes Annual Profit Forecast After Posting Quarterly Loss

DuPont Raises Forecast as Profit Beats Estimates

Visa Beats Estimates as Spending Increases

Time Warner Cable Profit Jumps 23%

C.Suisse Sees Robust CoCo Market Despite FSB Snub

Thomson Reuters Markets Revenue Inches Up in Q2

Alcatel-Lucent Shares Fall On Mixed Results

Starwood 2Q Net Climbs 15% As Revenue Measure Rises; Raises Year Forecast

Conoco’s Empire Builder Rips It Apart

Phil Pearlman: Juniper Networks and Cisco Systems In the Same Boat After All

James Altucher: Mouse in the Salad

Be sure to follow me on Twitter.

-

AFLAC Earns $1.56 Per Share of Operating Earnings

Eddy Elfenbein, July 27th, 2011 at 4:26 pmAFLAC ($AFL) just reported second-quarter operating earnings of $1.56 per share which is two cents more than Wall Street’s consensus. That’s a 15.6% increase over last year’s second quarter. For the first half of 2011, AFLAC has earned $3.19 per share in operating profits.

AFLAC reiterated its full-year EPS guidance of $6.09 to $6.34. The company also gave third-quarter guidance of $1.54 to $1.60 per share.

The best news however, is that the company expects earnings next year to rise by 2% to 5%. If you recall, in May AFLAC had said that it expected earnings to grow between 0% and 5% in 2012. It’s not a big increase but it is in the right direction.

-

General Cannabis Joins OTCQX

Eddy Elfenbein, July 27th, 2011 at 3:38 pmToday’s best press release:

NEW YORK, July 26, 2011 /PRNewswire/ — OTC Markets Group Inc. (OTCQX: OTCM), the company that operates the world’s largest electronic marketplace for broker-dealers to trade unlisted stocks, today announced that General Cannabis, Inc. (OTCQX: CANA), a technology-based internet marketing services company, is now trading on the OTC market’s highest tier, OTCQX®.

(Logo: http://photos.prnewswire.com/prnh/20110118/MM31963LOGO )

General Cannabis began trading today on the OTC market’s prestigious tier, OTCQX U.S. Investors can find current financial disclosure and Real-Time Level 2 quotes for the Company on www.otcqx.com and www.otcmarkets.com.

“Investors prefer the quality-controlled admission process on OTCQX which identifies the segment of OTC companies focused on valuation and transparency,” said R. Cromwell Coulson, President and Chief Executive Officer of OTC Markets Group. “We are pleased to welcome General Cannabis to OTCQX.”

The Lebrecht Group, APLC will serve as General Cannabis’ Designated Advisor for Disclosure (“DAD”) on OTCQX, responsible for providing guidance on OTCQX requirements.

About General Cannabis, Inc.

General Cannabis, Inc. (OTCQX: CANA) trades in the United States on OTCQX under the symbol “CANA”. General Cannabis is a rapidly growing, technology driven company that is defining the multi-billion dollar cannabis industry. The wholly owned subsidiaries of General Cannabis include WeedMaps Media, Inc., General Health Solutions, Inc., General Merchant Solutions, Inc. and US Cannabis, Inc. Each subsidiary plays a vital role in the ongoing success of General Cannabis and the industry itself.

There shares are currently at $3. How many sell orders at $4.20 do you think there are?

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His