Archive for 2011

-

Minutes from the Fed’s June Meeting

Eddy Elfenbein, July 12th, 2011 at 3:53 pmThe Federal Reserve just released the minutes from its June meeting. By the way, the Fed’s Board has seven members but there are currently two vacancies. That means that even inside the Fed, unemployment is running at 28%.

Here’s a part of the minutes:

Most participants expected that much of the rise in headline inflation this year would prove transitory and that inflation over the medium term would be subdued as long as commodity prices did not continue to rise rapidly and longer-term inflation expectations remained stable. Nevertheless, a number of participants judged the risks to the outlook for inflation as tilted to the upside. Moreover, a few participants saw a continuation of the current stance of monetary policy as posing some upside risk to inflation expectations and actual inflation over time. However, other participants observed that measures of longer-term inflation compensation derived from financial instruments had remained stable of late, and that survey-based measures of longer-term inflation expectations also had not changed appreciably, on net, in recent months. These participants noted that labor costs were rising only slowly, and that persistent slack in labor and product markets would likely limit upward pressures on prices in coming quarters. Participants agreed that it would be important to pay close attention to the evolution of both inflation and inflation expectations. A few participants noted that the adoption by the Committee of an explicit numerical inflation objective could help keep longer-term inflation expectations well anchored. Another participant, however, expressed concern that the adoption of such an objective could, in effect, alter the relative importance of the two components of the Committee’s dual mandate.

At the same time, the Fed released its revised economic forecast which you can see here.

In response to today’s Fed minutes, gold for August delivery closed at $1,562.30 after getting as high as $1,574.30.

-

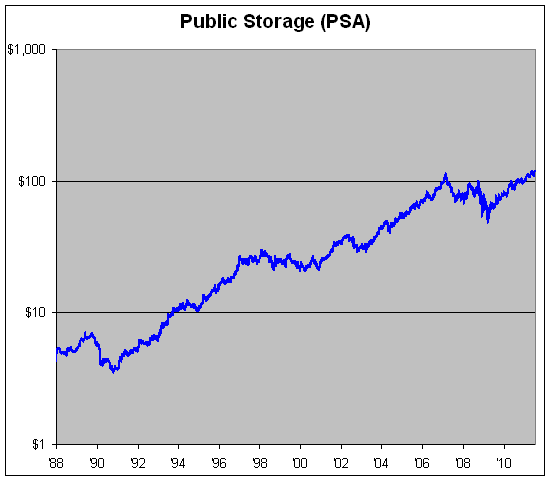

Public Storage +2,350% in 20 Years

Eddy Elfenbein, July 12th, 2011 at 12:25 pmHere’s a look at Public Storage ($PSA) which is one of those quiet stocks that have been amazing performers over the last few decades. Here’s a company description from Hoovers:

If the attic or garage runneth over, Public Storage can help. The real estate investment trust (REIT), is one of the largest self-storage companies in the US. It operates more than 2,100 storage facilities comprising some 135 million sq. ft. of storage space both at home and in Europe (through its Shurgard Europe affiliate). The firm’s self-storage properties, located in densely populated areas, generate some 90% of the company’s sales. Public Storage, which was founded in 1980, also rents trucks, and sells moving supplies such as locks, boxes, and packing supplies. It owns 41% of publicly traded PS Business Parks, an office building REIT.

Over the last 20 years, the stock is up 2,350% and that doesn’t include dividends. The stock currently yields 3.2%.

-

Alcoa’s Earnings Fall Short

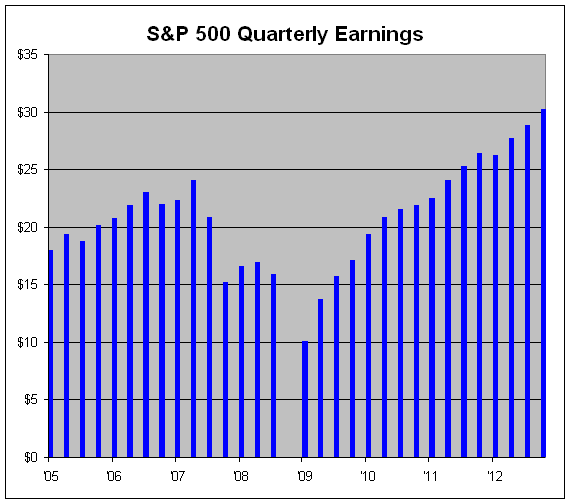

Eddy Elfenbein, July 12th, 2011 at 10:56 amAlcoa ($AA) kicked off earnings season after the close yesterday when it reported Q2 earnings of 32 cents per share. Although that more than doubled last year’s result, it was a penny shy of Wall Street’s forecast. What’s most troubling is that Wall Street’s forecasts had been drifting lower over the past several weeks, and Alcoa still fell short.

This may be a harbinger of a weaker-than-expected earnings season. So far, Alcoa’s stock is holding up in today’s market (it’s basically unchanged). The problem in looking at the earnings trend of a company like Alcoa is that so much of the business is tied to the direction of aluminum prices.

Alcoa isn’t representative of the broader economy. Companies like UPS ($UPS) are much better for that kind of analysis. But Alcoa’s weakness could point to weakness in other cyclical stocks.

Here’s a look at the trend in the S&P 500’s earnings. In the second quarter of 2007, the S&P 500 earned $24.06 which was its all-time peak. For Q2 of 2011, Wall Street expects $24.12 which will be a new record. (Note: The S&P 500 lost $0.09 in Q4 of 2008.)

-

Morning News: July 12, 2011

Eddy Elfenbein, July 12th, 2011 at 8:01 amWorries Over Italy’s Debt Drag Down Markets

Italy Sells 6.75 Billion Euros of Treasury Bills as Borrowing Costs Climb

China Bank Lending Quickens; Fans Rate Risk

China Premier Wen: Stabilizing Prices Continues to Be Main Priority

Bank of Japan Upgrades View of Economy

Shares Needed as Cambodia Gets a Stock Exchange

Gold Declines for First Day in Seven as Europe’s Debt Crisis Lifts Dollar

Department of Energy Awards Strategic Petroleum Reserve Oil to 15 Companies

U.S. Stock-Index Futures Slump on Italy Debt-Crisis Concern; Alcoa Plunges

Wall Street Set to Tumble as Global Markets Roiled

Murdoch Buys Time on Hacking Scandal With BSkyB Review

Analysts Cut BSkyB As News Corp Deal Seen Dragging Into Next Year

Bank’s Deal Means More Will Lose Their Homes

Cisco May Cut as Many as 10,000 Jobs to Buoy Profit

Howard Lindzon: Uncapped Convertible Notes…Barf!

Be sure to follow me on Twitter.

-

Yes, Arnold, Stock Returns Can Outpace Economic Growth Indefinitely

Eddy Elfenbein, July 11th, 2011 at 3:11 pmOne of my favorite economic bloggers, Arnold Kling, recently wrote:

Every few years, I have this argument with a new round of commenters.

The ratio of stock prices to earnings is P/E.

The ratio of earnings to GDP is E/Y.

The ratio of stock prices to GDP is P/Y, which equals P/E times E/Y.

(Note that the basic math here uses stocks that turn all of their earnings into capital gains, paying none as dividends. Including dividend payouts makes the story more complex, but does not change the economic analysis.)

For stock prices to grow faster than GDP, either prices have to grow faster than earnings or earnings have to grow faster than GDP.

Stock prices certainly can rise faster than GDP for long but finite periods. If the P/E ratio starts at about 5 and gradually rises to about 25, that will do it. Something like that happened in the 20th century. Also, if earnings of shareholder-owned companies start at less than 10 percent of GDP, then they can grow faster than GDP for a long time.

Looking forward from today, which do you think is going to happen? Is the P/E ratio going to go up, because people become more willing to hold stocks? Or is the share of national income that goes to shareholder-owned companies going to go up? If you have a good story for one of those two happening, let me know.

(For example, one story is that U.S. firms will earn increasing profits overseas. I do not think that this will be a big enough effect over a sufficiently long period of time to drive earnings growth much above GDP growth. Still, it is an empirical issue.)

But if you think that stock returns will be higher than GDP growth without either ratio increasing, then one of us is incapable of doing simple algebra, and I am going to guess that it’s not me.

Arnold, I’m afraid it’s you. But the good news is that it’s not your algebra.

The reason I highlight this is because it gets to the heart of what it means to invest in stocks. Returns to stock investors can remain higher than economic growth indefinitely (even leaving aside the issue of equity valuations). This is a crucial point. The problem is, it’s hard to explain easily.

There are lots of good explanations in the comments of Arnold’s post, but I’ll try to make it as basic as I can: when you buy a stock, you’re buying all of its future cash flow. Economic growth impacts the growth of that cash flow.

When you buy stocks, what you’re buying is the future cash flow. Think of it like buying a river. All that water that passes though, is yours to keep.

Economic growth would determine how much the river expands or contracts — even though water is still flowing. If economy expands (metaphorically, our river widens) then even more water flows through. The growth of the economy is not the same as what accrues to the shareholder.

The size of the river can’t expand than the economy forever, but the stream owner keeps all which passes through.

-

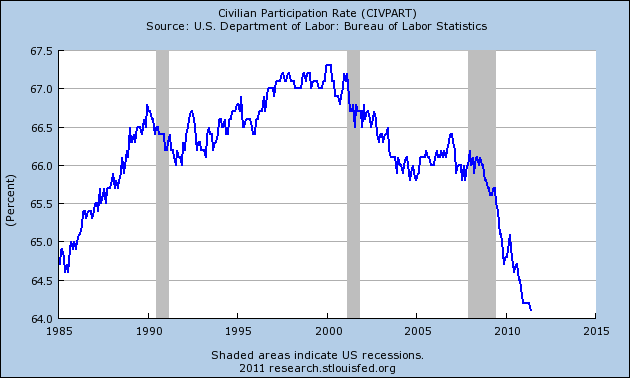

The Shrinking Labor Market

Eddy Elfenbein, July 11th, 2011 at 10:49 amOne of the most depressing aspects of the current jobs market is how many Americans have simply dropped out of the labor market. After growing for decades, the labor market participation rate lost all of its gains over the last 25 years.

Over the last 11 years, the civilian population has grown by 27 million, but the labor force has only grown by 10.8 million and the number of employed has grown by just 2.4 million.

-

Italy Drags Us Down

Eddy Elfenbein, July 11th, 2011 at 9:07 amThe stock market looks to open sharply lower today. Through Thursday, the S&P 500 was having a nice rally but concerns about Europe have again pushed equity prices lower.

Now traders are worried about the financial condition of Italy. Reuters notes that the cost of insuring Italian debt has risen to a five-year high. Now, some Italian politicians are blaming “speculators” which is a near-universal sign that it’s all the politicians’ fault.

We’re also at the start of the second-quarter earnings season. Alcoa ($AA) will be the first major company to report earnings when it reports after today’s close. The company has a good shot of reporting a doubling of its profit.

-

Morning News: July 11, 2011

Eddy Elfenbein, July 11th, 2011 at 8:13 amBest Currency Forecasters Say Dollar Slump Over

China June Trade Surplus Widens to $22.27 Billion

China Yuan Down Late On Expectations Inflation Has Peaked

Italy Moves to Rein in Short-Selling Amid Market Jitters

Italian, Spanish, Portuguese Bonds Slump

OECD Warns Europe to Agree Greece Deal Quickly

Crude Oil Falls As Concerns Over China, EU Weigh

A Top British Leader Urges Murdoch to Drop TV Deal

Quick Action Helps Google Win Friends in Japan

Alcoa Profit May Double on Aluminum Demand

Nestle Buys 60% of Chinese Candymaker for $1.7 Billion

Elpida Memory to Raise Nearly $1 Billion From Issuances

Howard Lindzon: The Stocktwits Hall of Fame…Miracles and Shame on Wall Street

Epicurean Dealmaker: In Praise of the Outsider

Be sure to follow me on Twitter.

-

June NFP = +18,000

Eddy Elfenbein, July 8th, 2011 at 10:00 amThe June jobs report came out this morning and it was a disaster. The economy created just 18,000 jobs last month and the unemployment rate rose to 9.2%.

Wall Street was expecting a gain of 105,000 jobs which isn’t that strong to begin with. On top of that, the number of jobs created in May was revised down to 25,000.

Factory payrolls rose by 6,000 in June after a 2,000 decline in the previous month.

Employment at service-providers increased 14,000 in June, the least since a decline in September. Construction employment fell 9,000 workers and retailers added 5,200 employees.

Government payrolls declined by 39,000 in June, the eighth straight decline. Employment at state and local governments declined by 25,000.

Average hourly earnings fell 1 cent to $22.99, today’s report showed. The average work week for all workers dropped to 34.3 hours, from 34.4 hours the prior month.The so-called underemployment rate — which includes part- time workers who’d prefer a full-time position and people who want work but have given up looking — increased to 16.2 percent from 15.8 percent.

-

Morning News: July 8, 2011

Eddy Elfenbein, July 8th, 2011 at 7:17 amGerman Exports Increased More Than Forecast

Offshore Yuan Clearing Bank to Buy China Bonds

Geithner Doesn’t Think Obama Has The Constitutional Authority To Ignore Debt Ceiling

Elizabeth Warren’s Dream Becomes a Real Agency She May Never Get to Lead

Behind the Gentler Approach to Banks by U.S.

Dim Sum Market Stirs U.S. Borrowers

To Slow Piracy, Internet Providers Ready Penalties

News Corp.’s BSkyB Bid Facing Delay on Review

JPMorgan Settles Bond Bid-Rigging Case for $211 Million

Target, Limited Sales Beat Estimates in June Amid Discounts

S.Korea’s SK Telecom, STX Battle for $2.3 Billion Hynix Stake

Buffett Donates $1.5 Billion in Annual Gates Foundation Gift

James Altucher: 7 Unusual Things I Learned from Louis Armstrong

Brian Shannon: Stock Market Analysis & Ideas for 7/8/11

Phil Pearlman: Drudge Is The Master

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His