Archive for 2011

-

Target Vs. TJX Companies

Eddy Elfenbein, May 24th, 2011 at 2:34 pmI really don’t have anything profound to say with this post but I was struck by the large divergence between Target ($TGT) and TJX Companies ($TJX).

Normally, companies in the same industry tend to track each with some minor variation — and these companies did until about three years ago. Since then, TJX has raced ahead of Target, and the gap has grown even larger this year.

Target still has a larger market cap than TJX does ($34 billion to $21 billion). TJX’s stock dropped earlier this month after missing earnings by two cents per share. That broke an impressive streak of meeting or beating. Meanwhile, Target had a good earnings report last week although it hasn’t experienced the profit growth recently that TJX has.

TJX now has a distinct valuation premium over Target. Target currently goes for 11.74 times Wall Street’s consensus for this year’s earnings, and 10.88 times next year’s. TJX goes for 13.69 times this year’s estimate and 12.24 times next year’s.

This is a good example of the lesson I’ve told investors many times — don’t concentrate so much on what a company does. Instead, focus on how well they do it. I can’t tell you how many times investors ask me about some stock that’s supposed to be the next “fill in the blank.”

TJX isn’t the next anything, but they executed their business very well and the stock has been handsomely rewarded.

-

Putting LinkedIn’s Price Into Context

Eddy Elfenbein, May 24th, 2011 at 2:01 pmHow expensive are shares of LinkedIn ($LNKD)?:

Surging demand for social-media stock and a comeback in venture-capital IPOs propelled LinkedIn to a high of $122.70 in its first day of trading from an initial price of $45. With a market value of $8.45 billion, the company must boost revenue by 148 percent a year, twice its growth rate since 2009, to bring its price-sales ratio in line with the Dow Jones Internet Services Index by 2013, Bloomberg data show.

“This is not something we even consider investing in,” said Haverty, who helps oversee $35 billion in Rye, New York. “This is a sideshow. It’s a magic show,” he said. “The only question for the investor is how soon they should sell.”

I think when most people say “this time is different,” they really mean, “this time is different because now I own the stock.”

-

Medtronic Misses Earnings

Eddy Elfenbein, May 24th, 2011 at 11:21 amThis morning, Medtronic ($MDT) reported earnings of 90 cents per share for their fiscal Q4 which was two cents below the Street’s consensus (though some sources said the consensus was 93 cents per share). Quarterly revenue came in at $4.29 billion which matched consensus.

Worldwide sales of cardiac rhythm management products, including ICDs and pacemakers, fell 7 percent to $1.32 billion. Spine device sales fell 1 percent to $875 million.

Cardiovascular device sales, including stents to treat clogged arteries, rose 16 percent to $879 million. Neuromodulation device sales, which include pain treatments, rose 5 percent to $432 million, and diabetes device sales rose 11 percent to $368 million.

For fiscal 2012, Medtronic forecast earnings of $3.43 to $3.50 a share, below analysts’ expectations, on overall revenue growth in a range of 1 percent to 3 percent. It characterized its outlook as cautious, reflecting expected continued weakness in its key device markets.

For the year, Medtronic earned $3.37 per share on revenue of $15.993 billion. During the past several months, Medtronic has gradually lowered its 2011 earnings estimates. The 2011 EPS range went from $3.45 to $3.55, to $3.40 to $3.48, to $3.38 to $3.44, to $3.38 to $3.40 per share.

As I’ve said many times, I really like it when companies provide guidance and when they update that guidance throughout the year. Ultimately, Medtronic fell short of their guidance by one penny per share. That’s not what I wanted to see, but I’m still pleased with Medtronic’s development.

Medtronic’s fiscal year ends in April, so their FY 2012 just started. The company also provided its first guidance for 2012. Medtronic sees full-year earnings-per-share ranging between $3.43 and $3.50. The Street has been expecting $3.62 per share.

The stock is currently down about 1.5% this morning. Here’s a look at Medtronic’s quarterly results for the past several years:

Quarter EPS Sales in Millions Jul-01 $0.28 $1,456 Oct-01 $0.29 $1,571 Jan-02 $0.30 $1,592 Apr-02 $0.34 $1,792 Jul-02 $0.32 $1,714 Oct-02 $0.34 $1,891 Jan-03 $0.35 $1,913 Apr-03 $0.40 $2,148 Jul-03 $0.37 $2,064 Oct-03 $0.39 $2,164 Jan-04 $0.40 $2,194 Apr-04 $0.48 $2,665 Jul-04 $0.43 $2,346 Oct-04 $0.44 $2,400 Jan-05 $0.46 $2,531 Apr-05 $0.53 $2,778 Jul-05 $0.50 $2,690 Oct-05 $0.54 $2,765 Jan-06 $0.55 $2,770 Apr-06 $0.62 $3,067 Jul-06 $0.55 $2,897 Oct-06 $0.59 $3,075 Jan-07 $0.61 $3,048 Apr-07 $0.66 $3,280 Jul-07 $0.62 $3,127 Oct-07 $0.58 $3,124 Jan-08 $0.63 $3,405 Apr-08 $0.78 $3,860 Jul-08 $0.72 $3,706 Oct-08 $0.67 $3,570 Jan-09 $0.71 $3,494 Apr-09 $0.78 $3,830 Jul-09 $0.79 $3,933 Oct-09 $0.77 $3,838 Jan-10 $0.77 $3,851 Apr-10 $0.90 $4,196 Jul-10 $0.80 $3,773 Oct-10 $0.82 $3,903 Jan-11 $0.86 $3,961 Apr-11 $0.90 $4,295 -

Morning News: May 24, 2011

Eddy Elfenbein, May 24th, 2011 at 7:51 amGreek Worries Halt Euro’s Rally

Greek Opposition Leader Rejects New Austerity Plan

HK Shares Pare Losses To End Flat; China Mobile Gains

Analysis: Asia’s Reticence Costs It A Shot At IMF Power

Goldman Finding Third Time a Charm in Russia

An Interesting Change In German And Spanish Markets

Obama Says Ireland’s Resilience Will Drive Recovery

Commodities Gain as Goldman Advises Buying

U.S. Sues to Stop H&R Block Deal for Rival

Liberty’s Greg Maffei Says Barnes & Noble Stores Can Drive Digital Sales

Yandex Said to Raise $1.3 Billion as Public Offering Prices Above Range

Why LinkedIn’s Price May Have Been Right

Glencore Stuck Below Offer Price on Day One

Delta Ups LaGuardia Push Amid N.Y. Competition

Todd Sullivan: Jamba Turns The Corner…

Joshua Brown: The Barrel Bounce

Paul Kedrosky: Serial Bubble-Callers R Us

Be sure to follow me on Twitter.

-

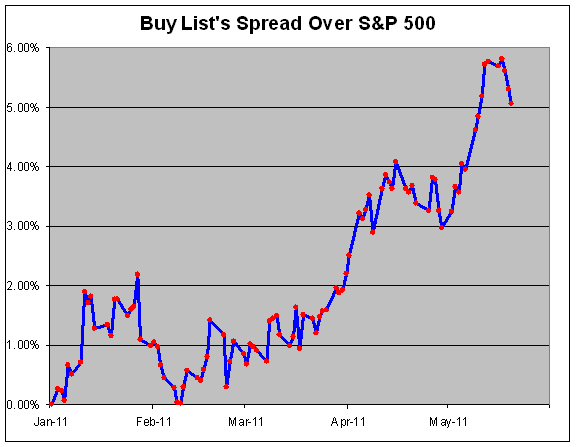

Our Buy List Is Well Ahead of the S&P 500

Eddy Elfenbein, May 23rd, 2011 at 12:46 pmWe’re just over halfway through Q2 and our Buy List is holding up well against the broader market. Through Friday, the Buy List is up 11.08% while the S&P 500 is up 6.01%. That’s a lead of 507 basis points.

Both the Buy List and the S&P 500 are down today. Due to further weakness in the cyclicals, we should outperform the S&P 500 again today. Here’s a look at the Buy List’s spread over the S&P 500 this year.

-

Put Those Rate Hike Expectations on Hold

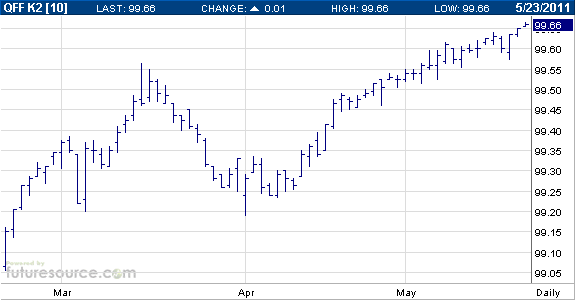

Eddy Elfenbein, May 23rd, 2011 at 9:54 amI had been expecting the Federal Reserve to hike interest rates before most people expected. Now I think it’s time for me to change that outlook (and yes, we always want to change our market views based on new information — you never want to be tied to a thesis).

First, check this out. It’s from the Cleveland Fed and shows the market’s take on a Federal Reserve rate hike at the next few FOMC meetings. The lesson is that the market overwhelmingly expects the Fed to keep rates unchanged at near 0%.

Here’s a look at May 2012 futures contract for the Fed Funds rate. This is a full year away and the market has turned decidedly against any major move from the central bank.

-

LinkedIn and the Winner-Take-All

Eddy Elfenbein, May 23rd, 2011 at 8:43 amWith the success of LindedIn’s ($LNKD) IPO, I want to discuss one of the reasons, in my opinion, why Internet stocks have caused such a frenzy for a little over a decade.

One of the popular ideas that swept thinking circles in the mid-1990s was the impact of what economists call “natural monopolies.” The idea was also known as “the first mover advantage.” Robert Frank’s book, “The Winner-Take-All Society,” also touched on these themes.

The general idea is that if a company is the first to unveil a certain type of product, it becomes “the standard.” This is crucial because it’s in everyone’s interest to recognize it as the standard.

Probably the best example is Microsoft’s ($MSFT) Windows. Once Windows was established as the standard, so the idea goes, no one could knock it off and the company enjoyed an enormous competitive advantage. There’s no need to for two operating systems. Similarly, there was no need for VHS and Betamax to exist. (In econo-speak, a natural monopoly has very high fixed costs relative to its variable costs.)

Likewise, when one company is established on the Internet, say selling pet supplies as advertised by a sock puppet, it will hold a near-monopoly over the entire industry. As a result, the normal metrics of valuing a company need not apply. Or so we were told.

I remember how often I was told that some Internet stock was going to be huge and that it all had to do with the QWERTY keyboard. This was the easy way to explain the first-mover advantage. The story is that the QWERTY keyboard was established in the 19th century even though it’s an inefficient layout. The reason it won out, and is still around today, is that it became enthroned as the standard. QWERTY became the winner, and it took all.

The takeaway is that the better mousetrap didn’t win the race (I’m mixing metaphors; deal). The worse keyboard board won only because it was first. Again, so we were told.

It’s hard to emphasize strongly enough how widespread these ideas were. In Bill Clinton’s re-election campaign, he often warned voters about the emergence of the winner-take-all society. In 1998, there was even a new tech magazine called The Industry Standard.

Today, LinkedIn potentially holds a similar winner-take-all grip over the resume market. Why bother being listed some place? The problem with the winner-take-all thesis is that it doesn’t always hold. Industry standards do get knocked out. It may take time, but it can happen.

By the way, not all the stories we told we true. In typing contests, for example, QWERTY has held its own as an efficient layout. The biggest threat to natural monopolies comes, not from a competitor, but from innovation. As a result, these standards can be far more vulnerable than we realize. That’s why I’m so suspicious of the elevated price for LinkedIn.

One more thing: in 2001, the The Industry Standard went bankrupt.

-

Morning News: May 23, 2011

Eddy Elfenbein, May 23rd, 2011 at 7:45 amGreece Readies Crisis-Fighting Steps

EU Approves Restructuring of Greece’s ATE Bank

Lagarde is Front-Runner to Head IMF

China’s Yuan Snaps Four-Day Rally as Greek Debt Crisis Worsens

Moody’s Warns Japan Recession is Negative for Rating

Crude Oil Falls In Asia; Greece Concerns, China Data Weigh

Fed Focusing on Inflation Expectations

Toyota, Salesforce.com To Create Social Media Network For Vehicles

Sony Sees Annual Net Loss of $3.2 Billion

Hyundai, Kia See Output Loss Of 50,000 Units On Parts Shortage

India Mahindra Satyam Posts Q4 Loss on Charge

Commerzbank to Issue $7.4 Billion in New Shares

Jimmy Choo Sold to Labelux for About $800 Million

Watch Out, The Infamous Sotheby’s Indicator Is Flashing A Huge Red Flag

Jeff Miller: Weighing the Week Ahead: Keeping Turmoil in Perspective

Be sure to follow me on Twitter.

-

Goldman Sachs Closes Below $135

Eddy Elfenbein, May 20th, 2011 at 6:04 pmFor the first time since last July, Goldman Sachs ($GS) closed below $135 per share — $134.99 to be exact.

I don’t think Goldman’s problems are over. The stock is now going for just 5.5 times 2007’s earnings. Goldman is trading at nearly exactly its book value of $133.94 per share.

In 2009, Goldman earned $22.13 per share and that dropped to $13.18 per share last year. Their earnings will be probably be around $14 or $15 per share for this year.

-

CWS Market Review – May 20, 2011

Eddy Elfenbein, May 20th, 2011 at 8:59 amFor several weeks now, I’ve warned investors that cyclical stocks are due to underperform the broader market. My favorite cyclical gauge, the Morgan Stanley Cyclical Index ($CYC), reached its peak against the S&P 500 in mid-February, but only recently has it started to lag the market badly.

To give you an example of how the market’s mood has changed, on Tuesday the S&P 500 lost just 0.04% while the CYC dropped 1.51%. Investors are clearly flocking out of cyclical names for safe shelter in defensive stocks. Don’t weep for cyclical stocks—they’ve had an amazing two-year run. If the Dow Jones had kept pace with the CYC since its March 2009 low, it would be over 25,000 today.

I strongly encourage investors to tilt their portfolios away from cyclical stocks. I think we’re in for a multi-year period of cyclical underperformance. That’s how these cycles usually work. Outside of a small number of cyclical stocks like Ford ($F), your portfolios will be best served by quality stocks in defensive sectors like healthcare and consumer staples.

Fortunately, our Buy List is already light on cyclicals and our defensive issues have been helping us outpace the market. In fact, we’ve nearly doubled the market so far this year. We’re on pace toward beating the S&P 500 for the fifth year in a row. Through Thursday, our Buy List is up 12.14% for 2011 compared with just 6.84% for the S&P 500.

Healthcare is the single-largest component of our Buy List, and it’s the top-performing market sector this year. Several of our healthcare stocks, like Abbott Labs ($ABT), Becton Dickinson ($BDX), Johnson & Johnson ($JNJ) and Medtronic ($MDT), have hit new 52-week highs in recent days—and Stryker ($SYK) looks to hit a new high any day now. Also, many of our consumer stocks look very strong. Reynolds American ($RAI) is a 21% winner on the year and Jos. A. Banks ($JOSB) is up over 40% for us.

I should point out that we’re starting to see some signs of the bull maturing. An obvious example is the huge post-IPO surge for LinkedIn ($LNKD). The stock soared 109% on its first day of trading which reminds me of the kind of investor frenzy we saw during the Tech Bubble. We’re also seeing analysts on Wall Street analysts paring back their earnings estimates for this year and next. It’s not a lot so far but it may signal that most of the easy gains are already gone.

What I find amazing is that investors still craze short-term bond maturities. I can’t decide which is more detached from reality—investors paying several hundred times earnings for LinkedIn or that the yield on the two-year Treasury note is now down to just 0.55%.

There’s still plenty of good news for patient investors. Q1 earnings season was a good one for the market although the earnings “beat rate” was down a lot from previous quarters. I was pleased to see that sales growth for the S&P 500 topped 10% for the first time in five years. There are also some positive technical signs. For example, the put-to-call ratio is at a two-month high.

After breaking 1,370 on May 2nd, the stock market has been in a slight down trend for most of this month. This past Tuesday, the S&P 500 dropped below 1,320 for the first time in one month. Recently, however, the bulls have started to reassert themselves. On Wednesday, the S&P 500 had its biggest rally in three weeks. The market rallied again on Thursday thanks to the jobless claims report beating expectations.

I still believe this is a market that will be friendly towards investors in high-quality stocks like our Buy List. The yield curve is very wide and that’s historically bullish for stocks. Plus, yields on many of our Buy List stocks are very competitive with what’s being offered in the bond market. Abbott Labs ($ABT) currently yields 3.34%, Deluxe ($DLX) yields 3.75% and Sysco ($SYY) is at 3.12%. Even a blue chip like J&J ($JNJ) yields 3.25%.

I also wanted to comment on AFLAC ($AFL) since I’ve recommended it so highly this year. The stock got hit for a 6.31% loss on Wednesday and I want you to know exactly what’s happening. Most importantly, I still like this stock a lot and I don’t see any reason to sell.

What happened is that AFLAC held a meeting with some Wall Street analysts. Most of what they had to say was good news. The company is “de-risking” its portfolio and they reiterated their earnings guidance for this year. But what everyone focused on was Dan Amos’ comments that AFLAC will grow its earnings by 0% to 5% next year.

That’s not great news, but it’s hardly awful news. First off, 2012 is still a long way away and this forecast strikes me as overly conservative. But even if it’s not, AFLAC is still a solid company going for a very attractive price.

Let’s puts our emotions aside and look at the facts. AFLAC has already said that it expects operating earnings-per-share for this year to range between $6.09 and $6.34. Some of this will obviously depend on the exchange and that’s been working in our favor recently.

The current yen/dollar exchange rate puts AFLAC on track to earn $6.28 per share for all of 2011. Bear in mind that this isn’t my forecast or Wall Street’s. This is coming straight from AFLAC itself, and we know their guidance has been very reliable (and usually conservative).

Thursday’s closing price is almost exactly eight times this year’s earnings estimate. Even if they show 0% growth next, AFLAC is still a bargain. Furthermore, the shares currently yield 2.38% and AFLAC said they’re aiming to raise the dividend by as much as 10% this year and next. The company has raised its dividend for the last 28 years in a row.

The other good news is that AFLAC is ditching some of their assets held in problem spots around the world like Ireland. They had already dumped much of their Greek investments. This has obviously been freaking out a lot of investors.

The bottom line is that the 2012 forecast wasn’t good news and I don’t want to pretend otherwise. But considering AFLAC’s overall high-quality, recent earnings trend, decline risk and depressed valuation, the stock is still a very compelling buy.

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His