Archive for February, 2012

-

Morning News: February 29, 2012

Eddy Elfenbein, February 29th, 2012 at 5:55 amECB’s Second Three-Year Loan May Be Last

Europe Delays Debt Talks After Signs of Uncertain Support

Papademos Gets Backing for $4.3B of Cuts

Swap Talks Over Greece Could Test the Market

France Says Google Privacy Plan Likely Violates European Law

Japan Industrial Output Beats Forecast

Jewelers Want Platinum for Asians After Gold Vaults

Taxpayers Win as Fed Wraps AIG Bond Sale

Apple Dividend May Return Part of $98 Billion Cash

A Record Buyout Turns Sour for Investors

CVC to Buy Nordic Group Ahlsell for $2.4 Billion

Standard Chartered Profit Climbs to Record

Charges Push First Solar Into the Red

Credit Writedowns: Miserable Wants Company

Joshua Brown: Kitchen Nightmares – Wall Street Style

Be sure to follow me on Twitter.

-

Morning News: February 28, 2012

Eddy Elfenbein, February 28th, 2012 at 5:32 amMerkel Wins Greek Aid Vote After Warning Lawmakers

S&P Downgrades Greece To Selective Default, Cites CACs

Greece Running Out of Alternatives: Krugman

Santander Agrees to Take Over Polish Bank

Spain’s Task Gets Tougher After Deficit Miss

“Big Four” Auditors Brace for Big Changes in China

Blueprint of China Reforms Leaves Role of Party Vague

A U.S. Boon in Low-Cost Borrowing

Bending the Tax Code, and Lifting A.I.G.’s Profit

U.S. Rule Set for Cameras at Cars’ Rear

Blackstone Makes $2 Billion Natural Gas Investment

Bayer Cuts Outlook as Plastics Disappoint

Panasonic Picks TV Head as New President, Record Loss Looms

Once Film-Focused, Netflix Transitions to TV Shows

Dividing Dimon? Analyst Offers Case for a JPMorgan Split

Cullen Roche: Understanding the Modern Monetary System

Stone Street: Why I’m Not Looking for a Weak NFP Number

Be sure to follow me on Twitter.

-

Warren Buffett’s 2011 Shareholder Letter

Eddy Elfenbein, February 27th, 2012 at 2:01 pmWarren Buffet just released his latest shareholder letter. It’s always an interesting read. I also like how Buffett is frank about his mistakes. Here’s a good sample:

Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong. We have five businesses whose results are significantly influenced by housing activity. The connection is direct at Clayton Homes, which is the largest producer of homes in the country, accounting for about 7% of those constructed during 2011.

Additionally, Acme Brick, Shaw (carpet), Johns Manville (insulation) and MiTek (building products, primarily connector plates used in roofing) are all materially affected by construction activity. In aggregate, our five housing-related companies had pre-tax profits of $513 million in 2011. That’s similar to 2010 but down from $1.8 billion in 2006.

Housing will come back – you can be sure of that. Over time, the number of housing units necessarily matches the number of households (after allowing for a normal level of vacancies). For a period of years prior to 2008, however, America added more housing units than households. Inevitably, we ended up with far too many units and the bubble popped with a violence that shook the entire economy. That created still another problem for housing: Early in a recession, household formations slow, and in 2009 the decrease was dramatic.

That devastating supply/demand equation is now reversed: Every day we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over. And while “doubling-up” may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.

At our current annual pace of 600,000 housing starts – considerably less than the number of new households being formed – buyers and renters are sopping up what’s left of the old oversupply. (This process will run its course at different rates around the country; the supply-demand situation varies widely by locale.) While this healing takes place, however, our housing-related companies sputter, employing only 43,315 people compared to 58,769 in 2006. This hugely important sector of the economy, which includes not only construction but everything that feeds off of it, remains in a depression of its own. I believe this is the major reason a recovery in employment has so severely lagged the steady and substantial comeback we have seen in almost all other sectors of our economy.

Wise monetary and fiscal policies play an important role in tempering recessions, but these tools don’t create households nor eliminate excess housing units. Fortunately, demographics and our market system will restore the needed balance – probably before long. When that day comes, we will again build one million or more residential units annually. I believe pundits will be surprised at how far unemployment drops once that happens. They will then reawake to what has been true since 1776: America’s best days lie ahead.

-

Greed Is No Longer Good

Eddy Elfenbein, February 27th, 2012 at 1:38 pm -

Mike Mayo: JPM Worth More If Split Up

Eddy Elfenbein, February 27th, 2012 at 12:47 pmJPMorgan Chase & Co. (JPM), the largest U.S. bank by assets, should consider breaking up and selling businesses because its parts are worth one-third more than its market value, according to Mike Mayo, an analyst at CLSA Ltd.

While JPMorgan’s stock has outperformed its peers, the New York-based company has trailed the leading firms in its individual businesses, Mayo wrote in a note e-mailed today. JPMorgan executives must make the case at tomorrow’s investor conference for why the firm shouldn’t be broken up, he wrote.

“At what point does the conglomerate discount become so great that it encourages the company to take action?” Mayo wrote. “The stock seems undervalued, but the question is how and when this value gets realized?”

Wall Street expects the bank to earn $4.66 per share which means it’s going for 8.2 times earnings. Warren Buffett owns JPM on his personal account.

-

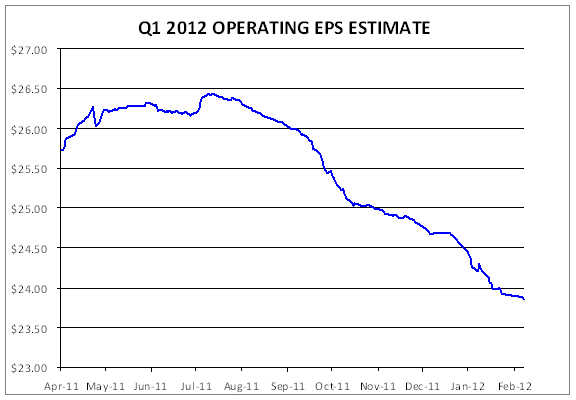

Declining Q1 Earnings Estimates

Eddy Elfenbein, February 27th, 2012 at 12:23 pmThis chart comes courtesy of Standard & Poor’s. It shows Wall Street’s evolving estimate for Q1 earnings.

In late-July, Wall Street was expecting Q1 earnings of $26.43. That’s now down to $23.86. That would be an increase of just 5.76% from the first quarter of 2011.

The almost-final numbers for Q4 show earnings of $23.76 which is an increase of 8.34% over Q4 from 2010. Q4 earnings were 6.05% below those from Q3.

-

Half a Trillion Watch

Eddy Elfenbein, February 27th, 2012 at 11:50 amI’m officially putting shares of Apple ($AAPL) on my “Half a Trillion Watch.” By my math, once the stock gets to $536.27 per share, the market value will be $500 billion. We’re getting pretty close; shares of Apple have been as high as $524.74 today.

-

Harris Corp Raises Dividend 18%

Eddy Elfenbein, February 27th, 2012 at 10:22 amGood news from Harris Corp. ($HRS). The company raised its quarterly dividend from 28 cents per share to 33 cents per share. The company also said that it’s raising its payout ratio target from 20% to 25%.

The annual dividend rate is $1.32 per share. Going by Friday’s close, the stock now yields 3.09%. Using the company’s target rate of 25%, $1.32 per share implies total earnings of $5.33. Wall Street currently expects Harris to earn $5.35 per share for the fiscal year ending in June 2013. The stock is currently going for eight times that.

-

S&P 500 Closes at 44-Month High

Eddy Elfenbein, February 27th, 2012 at 10:17 amI wanted to mention this before but Friday’s close made it official: The S&P 500 closed at 1,365.74 which is its highest close since June 5, 2008.

-

Morning News: February 27, 2012

Eddy Elfenbein, February 27th, 2012 at 5:41 amGermany Crisis Role in Focus After G-20 Rebuff

Europe Gets Ready for Round 2 of Bank Loans

Emerging Economies to Challenge U.S. Hold on World Bank

China Money Rate Drops to 2-Week Low as Reserve Cut Takes Effect

Audi-Led Global Carmakers May Be Shut Out of China’s Fleet

Yen Hits 9-month Low Vs. Dollar, Euro Holds Firm

HSBC Says on Path to Meet Profit Goal in 2013

Nokia Offers Cheaper Windows Phone to Battle Android

Apple’s Lead in Smartphones Is Not Guaranteed

Maersk Profits Drop, Sees Weaker 2012

Ahold to Buy Online Retailer Bol.com for 350 Million Euros

Elpida Files for Protection in Biggest Japanese Bankruptcy for Two Years

BP Said to Consider $14 Billion Spill Settlement

Epicurean Dealmaker: Cogito, Ergo Whom?

James Altucher: Ten Lessons I Learned from Shark Tank

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His