Archive for February, 2012

-

Malaysia Islamic Clerics Forbid Forex Trading

Eddy Elfenbein, February 16th, 2012 at 11:36 amVia Eclectic Linkfest I saw this story:

Malaysia Islamic clerics forbid forex trading

Malaysia’s highest Islamic body has issued an edict forbidding foreign exchange trading by Muslim individuals, saying such speculation violates Islamic law.

The National Fatwa Council ruled forex trading by money changers or between banks was allowable but trading by individuals “creates confusion” among the faithful, according to a report issued Wednesday by state news agency Bernama.

Council chairman Abdul Shukor Husin warned “there are many doubts about it (forex trading) and it involves individuals using the Internet, with uncertain outcomes,” Bernama reported.

“A study by the committee found that such trading involved currency speculation, which contradicts Islamic law,” he was quoted saying.

Forex and religion don’t have a great history. The only time Jesus used physical force is when he expelled the money-changers from the temple. Matthew 21:12-13:

And Jesus went into the temple of God, and cast out all of them who sold and bought in the temple, and overthrew the tables of the moneychangers, and the seats of them that sold doves,

And said unto them, It is written, My house shall be called the house of prayer; but ye have made it a den of thieves.

Skipping over any doctrinal issues, trading foreign currency is a terrible idea for individual investors. It’s a zero-sum game and you most likely won’t win.

You’ll notice that it’s always around forex that trading outfits style their sales pitches in order to lure in customers. If you’re saving for your retirement, trust me — stay away from forex.

-

“We Don’t Make Anything Anymore.” Really?

Eddy Elfenbein, February 16th, 2012 at 11:20 amOne of the biggest misconceptions about the U.S. economy is that we “don’t make anything anymore.” Not only is it not true, it’s very not true. The fact is that the United States is a manufacturing superpower. In the last 25 years, industrial production is up by more than 70%.

The difference, of course, is that far fewer people work in that sector. But that’s a big leap to say “we don’t make anything anymore.” We do. We’re just a lot more efficient.

-

More Good Economic News: Jobless Claims Fall to Four-Year Low

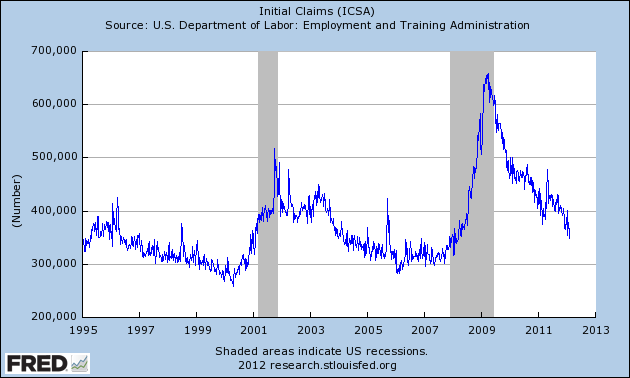

Eddy Elfenbein, February 16th, 2012 at 9:52 amWe had some more positive economic news. Or at least, a lack of terrible economic news. The Labor Department reported that first-time claims for unemployment benefits dropped to a seasonally adjusted 348,000. That’s the lowest number in four years. To give you some perspective, in 2009 jobless claims soared well over 600,000 a few times. Wall Street economists were expecting today’s report to be 365,000, so we’re running a little ahead of expectations. This is more evidence that the jobs market is slowly getting better.

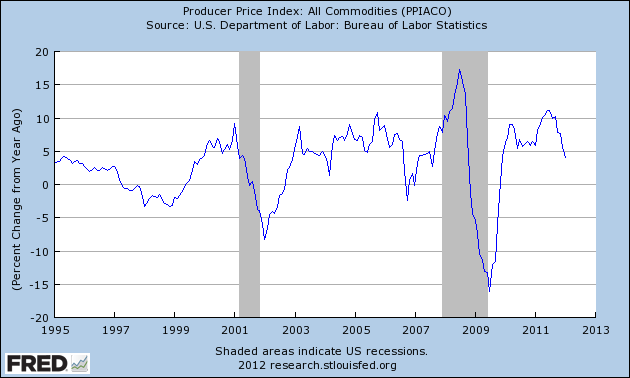

The other good news is that wholesale prices rose by just 0.1% in January. Economists were expecting an increase of 0.4%. Wholesales prices actually fell by 0.1% in December. The takeaway is that inflation still isn’t a major problem for wholesalers. Typically, inflation shows up here first.

Still, we can’t say that there’s no threat of inflation down the road. Today’s report showed that the “core rate,” which excludes food and energy, rose by 0.4%. Economists like to look at the core rate because food and energy prices can be very volatile.

-

Morning News: February 16, 2012

Eddy Elfenbein, February 16th, 2012 at 5:37 amChina to Surpass India as Biggest Gold Market This Year, Council Predicts

Iran Warns 6 Countries in Europe It Will Cut Off Oil

For London Youth, Down and Out Is Way of Life

Oldest Swiss Private Bank is Newest U.S. Target

Summers, Clinton Lead Contenders for World Bank

Citigroup Whistle-Blower Says Bank’s ‘Brute Force’ Hid Bad Loans From U.S.

Morgan Stanley, UBS May Be Cut Up to Three Levels by Moody’s

Kellogg Wins Pringles After Diamond Deal Falls Apart

Nestle Sees 2012 Earnings Gain as Sales Beat

SocGen Fourth-Quarter Net Drops 89% on Investment Bank Loss

Renault Profit Stagnates as Europe Car Market Shrinks

French Distilling Giant Pernod Raises Annual Forecast After First-Half Profit Gains

Olympus Former Chairman and Six Others Arrested Over Fraud

Jeff Carter: The Price of A Gallon of Gas

Jeff Miller: Investors: Read a Lot, Get Squat!

Be sure to follow me on Twitter.

-

The Sports Illustrated Swimsuit Cover Indicator

Eddy Elfenbein, February 15th, 2012 at 4:28 pmCNBC has the stats on one of the more unusual stock market indicators: the Sports Illustrated Swimsuit Cover Indicator.

49 covers from 1964 until now:

* 25 blonde covers — average annual return of Dow 10 percent, S&P 10.9 percent

* Note: The covergirl from 2008, Marissa Miller, is a blonde and the Dow and S&P fell 34 and 39 percent, respectively

* 20 brunette covers — average annual return of Dow 2.2 percent, S&P 2.3 percent

* 3 covers with multiple models of varied hair color

* 1 cover with a redheadAdditionally, the models’ nationality may also yield an interesting result. Since 1978, the S&P 500 posted an average return of 14.3 percent when an American was on the cover of the magazine versus an 10.8 percent increase when a model from another country was selected, according to Bespoke Investment Group.

-

Nope, QE3 Still Ain’t Coming

Eddy Elfenbein, February 15th, 2012 at 2:26 pmI’m amazed how many people claim that the Federal Reserve is about to embark on a third round of bond buying (better known as quantitative easing or QE). This is despite the Fed’s repeated assertions that it’s not coming.

Just the other day, SocGen said that QE3 is coming soon. Even 36% of top economists think QE3 will come sometime this year.

Where do they get this idea?

Last June, I wrote a piece titled “Sorry Folks, QE3 Ain’t Coming.” and I feel like I have to say it again: QE3 ain’t coming.

The Fed released the minutes of its January meeting today. The media has latched on to a very minor mention of QE3:

A few members observed that, in their judgment, current and prospective economic conditions–including elevated unemployment and inflation at or below the Committee’s objective–could warrant the initiation of additional securities purchases before long. Other members indicated that such policy action could become necessary if the economy lost momentum or if inflation seemed likely to remain below its mandate-consistent rate of 2 percent over the medium run.

That’s it? That’s hardly anything. All it says is that “a few” members think QE3 could at some point be needed. That’s a giant leap from, “it’s coming.” Furthermore, the political backlash would be intense, especially during an election year.

The fact is that the employment outlook is (slowly) improving. There was never any real pressure for QE3 and whatever there was, has faded. I’m not saying whether it’s needed or not, but the idea that QE3 is coming is simply a pipedream.

-

The Market Is Doubting the Fed’s Timetable

Eddy Elfenbein, February 15th, 2012 at 10:26 amThe Federal Reserve has said that it doesn’t see itself raising interest rates until late 2014. Well, that’s fine and good. Guys in suits can say whatever they want, but the market often has other ideas. Right now, the market thinks a rate increase may come sooner than the Fed realizes.

As I’ve pointed out before, longer-term interest rates are slowly beginning to creep higher. For over three years, Benrnanke & Co. have kept overnight rates between 0% and 0.25%. Howard Packowitz at the WSJ notes that the futures market is doubting the Fed’s forecast:

Fed-funds futures Tuesday priced in a 90% chance for the FOMC to lift the funds rate to 0.5% at its meeting in late June 2014, from a 94% chance at Monday’s settlement.

An earlier rate hike is possible based on pricing of a shorter-dated contract. It priced in a 40% chance for a 0.5% rate after the late-January 2014 FOMC meeting, up from a 36% chance at Monday’s settlement.

It’s still too early to say exactly what the Fed will do, but I think it’s very possible that the Fed will move before late 2014. This changing market sentiment is also what’s leading investors to take on riskier assets (this is a theme I discussed in last week’s CWS Market Review). In the meantime, watch how cyclical stocks perform relative to the broader market. That will most likely be an early indicator of higher rates.

-

Warren Buffett Loads Up on DirecTV

Eddy Elfenbein, February 15th, 2012 at 7:04 amIn its latest regulatory filing, Berkshire Hathaway ($BRKA) detailed its portfolio changes. Since our strategy here isn’t too different from Buffett’s, we sometimes make similar moves. For example, Berkshire raised its stake in DirecTV ($DTV) by five-fold. On the other hand, they cut their stake in Johnson & Johnson ($JNJ). Interestingly, Buffett is now totally out of ExxonMobil ($XOM).

It also bought about 1.7 million shares in Liberty Media, veteran dealmaker John Malone’s media venture which has stakes in everything from baseball teams and satellite radio to bookstores and cable networks.

Berkshire’s quarter was also notable for a number of large moves. It raised its stake in at least five companies by more than 20 percent, including recent newcomers to the portfolio like Intel and General Dynamics. It also took a new stake in kidney dialysis provider DaVita.

In contrast, it slashed portfolio stalwart Johnson & Johnson by 23 percent. Berkshire had been its fifth-largest shareholder, according to Thomson Reuters data. It also sold its entire position in oil major Exxon Mobil.

DirecTV is due to report its earnings tomorrow. Wall Street expects 92 cents per share for the quarter and $4.38 per share for the year. If the yearly forecast is correct, that means DTV is growing at 29% while going for just over 10 times earnings.

-

Morning News: February 15, 2012

Eddy Elfenbein, February 15th, 2012 at 5:49 amGreece Fights to Win Aid With Pledges to Counter EU Doubts

Portugal’s Debt Efforts May Be Warning for Greece

Austria Bank Capital Needs Decisive for Aaa Rating, Moody’s Says

China Pledges to Invest in Europe Bailout Funds, Hold Euros

China Yuan Down Late On PBOC Guidance; Strong Euro Limits Losses

Italian Economy Slips Into Recession, Contracts 0.7 Percent

Italian Oil Giant Eni Reports 2nd ‘Giant’ Mozambique Gas Find

Fed Clears Capital One’s Deal for ING Direct

Tentative Deal Reached to Preserve Cut in Payroll Tax

French Banking Giant BNP Paribas’ Fourth-Quarter Profit Beats Estimates; Shares Surge

Yahoo-Alibaba Talks Falter as Investor Steps Up Pressure

Berkshire Takes Stakes in Liberty Media, DaVita as Weschler Joins Buffett

Peugeot to Sell Property, Gefco Stake as 2011 Profit Falls

Adidas Rises to Record as Puma Beats Forecast

Edward Harrison: The Political Economy of a Greek Default (and Euro Zone Exit)

Joshua Brown: Where Financial Firms Spend Ad Dollars Online

Be sure to follow me on Twitter.

-

Tadas Viskanta on Why There’s Never Been a Better Time to Be an Individual Investor

Eddy Elfenbein, February 14th, 2012 at 3:39 pmTadas Viskanta of Abnormal Returns has a great post today on how Web 2.0 has unleashed a revolution for individual investors. Here’s a sample:

This is not a novel theme for us. Indeed one thing we mention repeatedly in our forthcoming book is that investing has never been “cheaper or easier” to be an investor. Some of this has to do with the rise exchange traded funds. In other respects it has to do with the blossoming of the options markets. In large part, it has to do with technology. In short, never before have investors had access to data, analysis, opinion and social tools that are commonplace today. Let’s take these points one by one.

- Easier: Investors today can with a brokerage account and a computer is now only a few mouse clicks away from a globally diversified portfolio of ETFs that in terms of expenses rivals what institutions paid a decade ago. For all intents and purposes the expense ratio on the big ETFs is closer to 0.0% that 1.0%. Many brokers now allow online trading of individual bonds and overseas securities.

- Cheaper: Brokerage commissions continue to get driven towards $0 over time. In fact, many brokers today provide commission-free trading of a range of ETFs. Options strategies that would have been cost-prohibitive a few years ago are now viable strategies today. Do you remember when you used to have to pay extra for real-time quotes? Today those are a commodity.

- Richer: The range of asset classes, sectors and strategies available via ETFs is truly dizzying. It is even for interested parties hard to keep up. Will most of these more exotic strategies fail? Probably. But sometimes a strategy, like low volatility investing, that is based in deep academic research, becomes available to investors.

- More social: Blogging and microbloggging (StockTwits & Twitter) has opened up the world of idea generation to the masses. Anyone with a computer these days can put their ideas out there. The blogosphere and Twittersphere is a meritocracy, albeit imperfect, where the smartest and most generous contributors rise to the top. The social model is pushing into things like earnings estimates with Estimize and institutional-grade services like SumZero. Many bloggers these days make fun of the raft of ‘free’ webinars that go on these days. But if you think about it the software and Internet speeds were not there to make mass online seminars possible not all that long ago.

- Smarter: The raw material for investment analysis and trading is of course data. Financial and price data is for the purposes of most individual investors is free these days. Many firms are using data in interesting ways. In the area of fundamental data some firms like Trefis and YCharts are making fundamental analysis easier. A firm like AlphaClone allows you track the moves of (and invest) like the big hedge funds. When it comes to portfolio level data firms like Wikinvest are aggregating account data making analysis easier for investors.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His