Archive for April, 2012

-

Morning News: April 27, 2012

Eddy Elfenbein, April 27th, 2012 at 6:26 amSNB Is Ready to Act as Franc Poses Challenges, Jordan Says

Yuan Exceeds Previous Band For First Time Since Widening

Italian Borrowing Costs Jump at $7.9 Billion Auction

Cooling Job Market Takes Toll on U.S. Confidence

Chesapeake’s Outlook Dims as Board Switches Course on CEO Loans

Starbucks Sells Off Big As High Coffee Costs Pressure Profits

BASF’s Oil Unit Offsets Flagging Chemicals Profits

Sharp Posts Record Loss, Expects To Stay In Red

Samsung Ends Nokia’s 14-Year Run as Biggest Handset Maker

Cullen Roche: CSX: The Economy Is Slowly Improving

Joshua Brown: Quick Take on Today’s Jeffrey Gundlach Presentation in NYC

Be sure to follow me on Twitter.

-

Q1 Earnings Summary So Far

Eddy Elfenbein, April 26th, 2012 at 12:19 pmSo far 267 companies in the S&P 500 have reported earnings. Of that, 190 have beaten earnings, 45 have missed, and 32 have been inline. Earnings growth is tracking at 8% and without financials, it’s at 7.2%.

-

Johnson & Johnson Raises Dividend

Eddy Elfenbein, April 26th, 2012 at 11:37 amFor the 50th year in a row, Johnson & Johnson ($JNJ) raised its dividend. The company boosted its quarterly dividend from 57 cents to 61 cents per share. At the current price, the yield works out to 3.77%.

-

Morning News: April 26, 2012

Eddy Elfenbein, April 26th, 2012 at 5:32 amRand Rises to Three-Week High as Bonds Gain on Fed Statement

Deutsche Bank Profit Drops on Debt Crisis

Santander Profit Falls As Loan-Loss Provisions Jump

Anti-Euro Le Pen Gain Spooks Overseas Investors in French Stocks

Fed Cuts U.S. Growth Forecast for 2013 and 2014

White House Announces Intention to Encourage Biological Manufacturing Methods

Chasing Fees, Banks Court Low-Income Customers

Nasdaq-100 Has Biggest Advance in 2012 as Apple Jumps

For Apple, China Is Middle Kingdom

Shell Profit Beats Estimates as Asset Sales Target Raised

Barclays Profit Rises on Rebounding Investment Bank

Caterpillar Revenue Misses Estimates as China Sales Slow

Chrysler Reports Best Quarter Since Fiat Alliance

Alcatel-Lucent Cautions on Europe, U.S.

AstraZeneca’s Brennan to Retire; Forecast Cut

Jeff Miller: Don’t Like the Real Data? Just Pretend!

James Altucher: Note to Facebook Shareholders: What to Do After You Make a Zillion Dollars

Be sure to follow me on Twitter.

-

Guy Rang Closing Bell 90 Seconds Too Early

Eddy Elfenbein, April 25th, 2012 at 9:57 pmOops.

-

AFLAC’s Earnings Call

Eddy Elfenbein, April 25th, 2012 at 6:19 pmFrom Seeking Alpha, here’s a key part of AFLAC’s ($AFL) earnings call. I highlight this because it hasn’t received much attention, but AFLAC actually raised its earnings guidance slightly for next year:

We increased our cash dividend to shareholders in 2011 for the 29th consecutive year. Our objective is to grow the dividend at the rate in line with our earnings per share before the impact of the yen. I believe dividends are an important component of the value we provide the investors. We will again evaluate a dividend increase as the year progresses, but I am confident we will extend our consecutive annual dividend increases to 30 years.

As we have indicated, given our capital structure, our ability to repurchase shares is largely tied to profit repatriation. We mentioned on our fourth quarter call, we estimated 2012 profit repatriation to be about JPY 25 billion, assuming no additional material investment losses through Aflac Japan’s FSA fiscal year end. We still believe that’s a reasonable estimate. We will make a decision about the amount of money we will transfer from Japan to the U.S. around mid-year. And thinking of that decision, we’ll be taking into consideration the needs of our stakeholders in Japan, including our policyholders, but we will continue to be cautious about deploying that capital. If we do purchase any shares this year, it would be late in the fourth quarter. Keep in mind there are many factors involved in this decision and we’ll closely monitor our options. Importantly, we don’t need to repurchase shares to make our 2012 earnings. Furthermore, assuming we incur no material investment losses between now and mid-2013, we would expect to maintain a strong solvency margin ratio and significant capacity for profit repatriation and share repurchase.

You’ll recall, we previously shared that our 2012 operating earnings objective was 2% to 5% growth before currency. We expect the new accounting for DAC to lower earnings per share by approximately $0.05 this year. However, we believe we can cover that impact and still achieve our original target of $6.46 to $6.65 per diluted share before the currency. That means our range for this year increased actually to 3% to 6% over the restated 2011 numbers. We will give you details about 2013 outlook at the analyst meeting next month, as we do each year. But I can say that we still expect the rate of earnings growth in 2013 to improve over 2012. I’m very excited about the opportunities ahead for Aflac.

Because of some accounting changes, AFLAC’s earnings for last year will be restated slightly lower. However, AFLAC says that its earnings-per-share target of $6.46 to $6.65 is still on. Previously, AFLAC had said that it sees earnings growing by 2% to 5% this year. Now that becomes 3% to 6%.

But here’s the key: AFLAC has said that earnings growth in 2013 will be better than 2012, and they reiterated that again today. So let’s say that AFLAC earns $6.60 per share this year. Considering they just beat earnings by a lot, I think it’s reasonable to assume they’ll be at the high end of the range. That translates to 5% growth for this year. If AFLAC accelerated to, say, 6% growth next year, that comes to earnings of $7 per share.

-

Is the Market Up or Down?

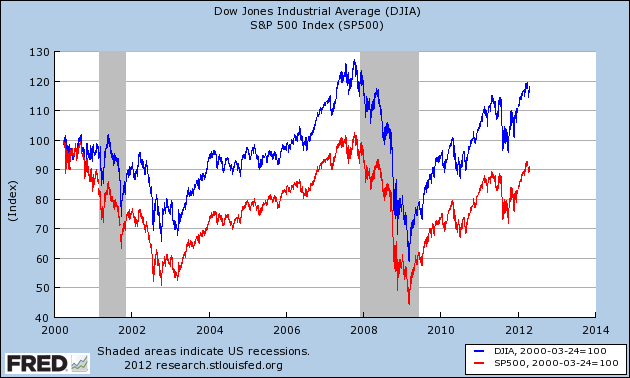

Eddy Elfenbein, April 25th, 2012 at 3:58 pmI’m not a big fan of price-weighted indexes like the Dow Jones Industrial Average. The S&P 500 is far better and that’s what I almost always refer to when I look at the market.

Here’s a good example of how off indexes can be. Since March 24, 2000 — the peak of the market — the Dow is up 17.8% while the S&P 500 is down 8.9%. That’s a huge spread.

-

Today’s Fed Statement

Eddy Elfenbein, April 25th, 2012 at 12:34 pmInformation received since the Federal Open Market Committee met in March suggests that the economy has been expanding moderately. Labor market conditions have improved in recent months; the unemployment rate has declined but remains elevated. Household spending and business fixed investment have continued to advance. Despite some signs of improvement, the housing sector remains depressed. Inflation has picked up somewhat, mainly reflecting higher prices of crude oil and gasoline. However, longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects economic growth to remain moderate over coming quarters and then to pick up gradually. Consequently, the Committee anticipates that the unemployment rate will decline gradually toward levels that it judges to be consistent with its dual mandate. Strains in global financial markets continue to pose significant downside risks to the economic outlook. The increase in oil and gasoline prices earlier this year is expected to affect inflation only temporarily, and the Committee anticipates that subsequently inflation will run at or below the rate that it judges most consistent with its dual mandate.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate to promote a stronger economic recovery in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Sarah Bloom Raskin; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who does not anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate through late 2014.

-

Hudson City Earns 15 Cents Per Share for Q1

Eddy Elfenbein, April 25th, 2012 at 11:28 amHudson City ($HCBK) just reported first-quarter earnings of 15 cents per share which was inline with forecasts.

Hudson City Bancorp Inc posted a first-quarter profit as the lender kept aside less money to cover soured loans.

The holding company for Hudson City Savings Bank reported net income of $73 million, or 15 cents per share, compared with a net loss of $555.7 million, or $1.13 per share, a year ago.

Provision for loan loss for the quarter fell about 38 percent to $25 million as fewer borrowers are defaulting on loans, helping the bank set aside less capital to make up for those losses.

Net interest margin – the difference between what the bank earns on loans and pays out on deposits – increased to 2.15 percent from 1.72 percent, a year ago.

The company expects margins to be pressurized in 2012 as interest rates are expected to remain low.

-

Looking at Apple’s Value

Eddy Elfenbein, April 25th, 2012 at 10:42 amIf you haven’t heard yet, Apple ($AAPL), which I believe is some sort of fruit company, reported outstanding earnings yesterday. For the last nine years, the shares have gained an average of 1% each week. When looking at this company’s numbers, words really do fail me.

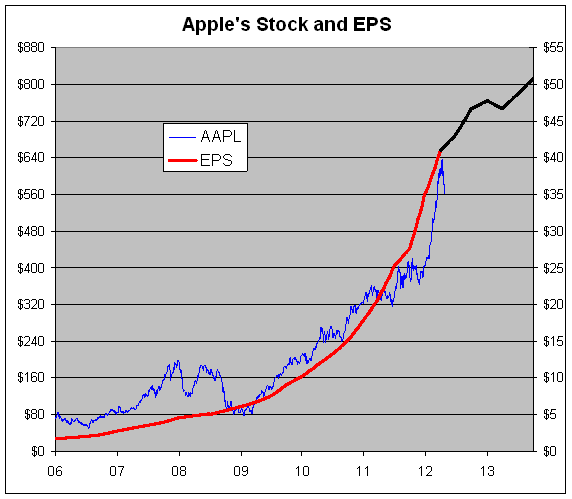

What you can’t do with words you can do with a chart, so below I’ve made a chart of Apple’s stock along with its earnings-per-share. What’s incredible to me is that the stock is still going for a fairly decent price.

The blue line is Apple’s stock and the red line is Apple’s earnings-per-share. The black line is Wall Street’s earnings forecast (I’ll have more on the black line in a moment.) The blue line follows the left scale and the red line follows the right scale.

The two lines are scaled at a ratio of 16 to 1 which means that whenever the lines cross, Apple’s P/E Ratio is exactly 16. I don’t mean to suggest that’s the appropriate multiple for Apple. I used 16 simply because it makes the chart more readable.

About the black line. Apple’s earnings yesterday not only exceeded Wall Street’s forecast but also beat the forecast for the same quarter one year from now. As a result, it appears that Wall Street expects an earnings slowdown. Of course, this isn’t true because analysts will most certainly revise their estimates much, much higher.

For now, I think the best way to view Wall Street’s forecast is to imagine the black line extending from $41 currently to roughly $57 by the end of next fiscal year (September 2013).

With trailing earnings of $41 per share, an earnings multiple of 16 translates to a price of $656. If Apple can earn $57 next fiscal year, then 16 times that comes to $912. I’m not saying Apple will do this, but I believe these are very reasonable assumptions.

Actually, this may understate Apple’s P/E ratio due to the company’s giant pile of cash. The company has an astounding $110 billion in cash. That’s roughly $116 per share. That $116 is probably contributing almost nothing to Apple’s bottom. I mean…have you seen short-term interest rates lately? The only info I have is from the earnings report which lists “other income” of $148 million. Annualized, that’s about 0.5% of Apple’s cash horde.

So to properly look at Apple’s value, we need to apply a multiple to an earnings forecast and then add $116 to that. By the way, Apple will soon start paying a quarterly dividend of $2.65 per share which comes to $10.60 for the year.

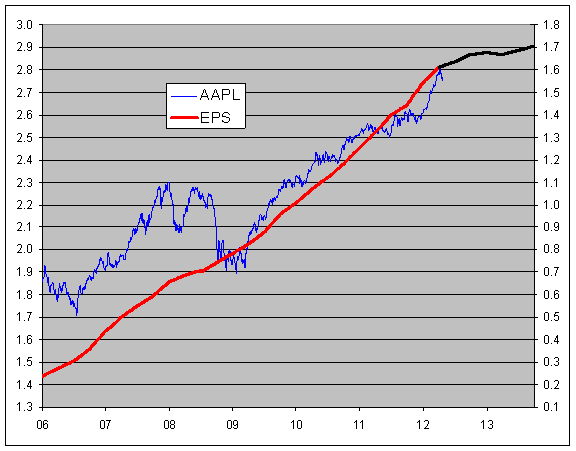

Addendum: Here’s the same chart but with a log scale. I apologize but I don’t know how to make a readable log chart excel chart, so you’ll have to do with seeing the log value on the y-axis. It gets the point across since you can see the earnings line climbing at a consistent rate.

Notice how slightly the recession impacted Apple. You can also see how conservative the earnings estimates are compared with Apple’s earnings trend.

(Instead of a ratio of 16 to 1, this chart has a log spread of 1.2 which comes to a ratio of 15.85 to 1, so it’s nearly the exact same.)

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His