Archive for June, 2012

-

Spain Secures Massive Bailout

Eddy Elfenbein, June 11th, 2012 at 9:09 amThere’s good news for Spain today. Rafael Nadal won his seventh French Open and the European agreement to rescue Spain’s banks for $125 billion. This bailout looks pretty bad for Spain’s prime minister who two weeks ago said they didn’t need any money. The markets have a different opinion since Spanish stocks are up strongly today.

The politicians in Spain are contorting themselves in an effort to say this isn’t what it is – a bailout. The desired results are already apparent. At one point, Spanish bonds were trading at 548 basis points over German bonds. That spread is now down to 466 basis points. This latest bailout is a big chunk of money and it’s why everyone is so focused on Greece’s elections next weekend. If Greece again decides to ditch austerity, that could knock them out of the eurozone. I don’t think it will come to that but it’s a real possibility.

The futures in the U.S. markets hint at a decent open.

-

Morning News: June 11, 2012

Eddy Elfenbein, June 11th, 2012 at 6:39 amGreece Threatens Wall Street Jobs in Third Trading Plunge

Risk Assets Rally On Spain Plan, But Gains Fragile

Ireland Pursues Debt Gain From Spain’s Banking Pain

Italy Moves Into Debt-Crisis Crosshairs After Spain

Selling Abroad, China Eases Slump at Home

China Shares End up After Stronger-Than-Expected Economic Data

Oil Climbs Above $100 On Spanish Banks Rescue, Iran

Telefonica to Sell $1.4 Billion of China Unicom Stake

World’s Biggest Airline to Form in $11 Billion Merger

BMW Posts May Sales Record, Volumes Up 6.4%

Tesco UK Arm Notches Up One Year of Falling Sales

UnitedHealth to Keep Reform Provisions, Regardless of Court Ruling

Banks Look to Burnish Their Images by Backing Green Technology Firms

Radio Royalty Deal Offers Hope for Industrywide Pact

Epicurean Dealmaker: 50 Ways to Leave Your Lover

Jeff Miller: Weighing the Week Ahead: A Search for Leadership

Be sure to follow me on Twitter.

-

Venice in 3D

Eddy Elfenbein, June 8th, 2012 at 4:03 pm -

CWS Market Review – June 8, 2012

Eddy Elfenbein, June 8th, 2012 at 6:58 amI don’t look to jump over 7-foot bars: I look around for 1-foot bars that I can step over. – Warren Buffett

In the CWS Market Review from February 17th, I explained why the monthly jobs report has become so important to the stock market. The first Friday of each month has become a Super Bowl-like event for Wall Street.

The reason has to do with simple economics. Corporate profit margins have gone about as far as they can go. Companies have done a commendable job increasing their bottom lines, but it’s mostly been done by cutting costs. For many businesses, the main cost is labor. The problem with cutting costs and raising your profit margin is that it’s a finite solution. You can’t do it forever and at some point, you gotta grow the top line. It’s as simple as that and in a low-inflation environment, raising prices is out of the question. That leaves us with getting more customers in the door, and that means more jobs.

The poor jobs market has taken its toll on stocks, but in this week’s issue of CWS Market Review, I’ll show you what’s been driving the market recently. I’ll also explain why the stock market wants inflation to go up, or more specifically, why it wants inflation expectations to go up. All investors need to understand this fact.

I’ll also highlight some of our Buy List stocks that have turned sharply recently. Even in a tough environment like this one, high-quality stocks can prosper. Fiserv ($FISV), for example, is back above $68 and it’s within striking distance of a new 52-week high; and quiet, unassuming Sysco ($SYY) is up to its highest close in over a month. But first, let’s talk about the market’s sudden about-face this week.

After a Tough Battle, the Bulls Hold the Line

Last Friday’s dismal, awful, no-good jobs report rattled Wall Street. Sixty-nine thousand jobs was less than half of what economists were expecting, and the numbers were revised downward for the previous months. The slump in the market brought the S&P 500 as low as 1,266 on Monday. The index also dropped below its 200-day moving average for the first time in five months. Bloomberg said the market was going for 12.9 times earnings which was its lowest valuation since November.

But here’s the key: the index never closed below the magic line of 1,277.14. Not once. Why’s that number so important? Because it marks an exact 10% correction from the April 2nd high of 1,419.04. I know it sounds bizarre, but trust me, technicians watch these battles closely and there was a war this week for the market’s soul. Last Friday, the S&P 500 closed at 1,278.04, and on Monday it closed at 1,278.18. In other words, the bulls had held the line.

Once the bulls finally made a stand, the game quickly changed. Technicians call what happened a “doji pattern,” meaning the opening and closing were at nearly the same price. Dojis can often mark important turning points. The market rose modestly on Tuesday and then surged 2.3% on Wednesday for its best one-day rally of the year. Even Facebook ($FB) went up. The S&P 500 broke above its 200-DMA, and the Dow finally closed out back-to-back gains which it hadn’t done since late April. Remarkably, that was one of the longest droughts without consecutive ups in the last 100 years.

The market was also buoyed by some positive economic news which was a welcome relief from a stunning run of dismal economic reports. On Tuesday, the ISM Services Index came in at 53.7 which was 1.7 above expectations. Then on Wednesday, a Federal Reserve report was surprisingly positive on the economy. On Thursday, the Labor Department reported that initial unemployment claims fell to 377,000.

The market was also relieved that China cut interest rates for the first time since 2008. Perhaps the best news came when Spain held a bond auction that went fairly well. The country’s budget minister had publicly warned Europe that a bailout was inevitable since the bond market had effectively shut them out. That’s why this recent bond auction was good news. Bear in mind that half of U.S. GDP growth was due to exports.

What Does Wall Street Want? Inflation!

Last Friday, the yield on the 10-year Treasury bond closed at a ridiculously low yield of 1.47%. The yield has come up some since then as the stock market has turned, but the fate of the bond and stock markets are closely tied.

The low-yield for bonds tells us how scared investors are and that they’re willing to pay nearly any price for safety. Ultimately, however, the low yields are good for stocks since they lower borrowing costs and make cash flows from equities more attractive.

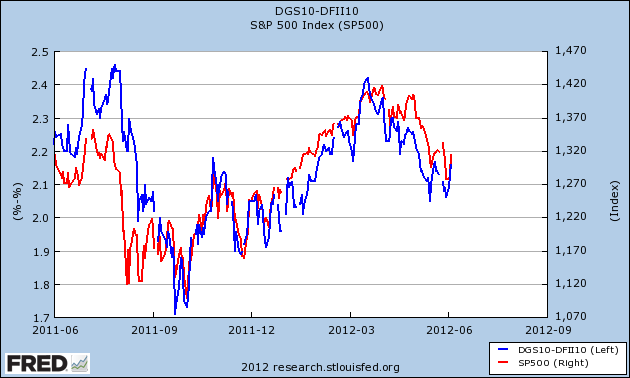

What’s fascinating is that the stock market has been strongly correlated with the 10-year inflation premium found in the bond market. That’s the difference between the yield on the 10-year Treasury and the yield on the 10-year TIPs. Check out this chart below which shows the S&P 500 (red line) and the difference between the 10-year inflation premium (blue line). For the last several months, these lines have been acting like waltzing partners.

Roughly speaking, every 0.1% increase in inflation expectations adds about 50 points to the S&P 500. (Note: This is a short-term correlation, not a long-term rule.) This relationship makes sense for several reasons. One is that higher inflation would shake money out of the bond market, and that will undoubtedly find its way towards stocks. Remember also that we’re not talking about inflation specifically but about expectations of inflation. Only part of the bond rally is due to lower inflation expectations.

Also, a stronger economy would boost stock prices and the ensuing greater demand would put upward pressure on prices. Banks are currently sitting on tons of cash and if they think inflation will tick up, that will spur them to ramp up lending. With that, businesses will see greater incentives to borrow and expand—and hopefully hire employees. This would create a positive reinforcing cycle.

In his Congressional testimony this week, Ben Bernanke specifically referred to the inflation expectations metric we’re using, except he used the five-year rate. Bernanke said that he expects inflation to stay around 2%. Obviously, the Fed is constrained by its dual mandate to provide maximum employment and low inflation. But right now, rising prices are not a problem. In fact, consumers are benefitting from falling (but still elevated) prices at the pump. Oil is in the midst of its longest losing streak in 13 years.

I think if inflation expectations were allowed to drift higher, it would be accompanied by a decent stock rally. Inflation expectations probably wouldn’t need to rise very high—perhaps to 2.7% (which is where they were in mid-2006) would do the trick. I don’t expect this tight stock-inflation relationship to last. But for the next several months, the future of the market and the course of inflation expectations are joined at the hip. Any market rally is dependent on higher inflation expectations.

Ford Continues to Be One of the Best Buys Around

Now let’s turn to some of the stocks on our Buy List. Ford Motor ($F) had some more good news this week. I continue to believe this is one the cheapest stocks around. The company took advantage of its increased debt rating by raising $1.5 billion from the bond market. This was Ford’s first investment-grade offering in seven years. The offering of five-year bonds was popular enough to get a coupon of 3%.

Ford also said that it’s working to iintroduce indigenous, or China-only, brands to China. The company is also working on building up its own brands in that country. I think this is an exciting move. Ford’s stock dipped below $10 per share earlier this week which I think is an unbelievable value. The automaker will most likely earn about $1.50 per share this year. The shares were at $19 early last year and the company’s outlook has improved by any objective measure. Ford Motor continues to be an excellent buy.

A few weeks ago, I highlighted Sysco ($SYY) as a good stock to own during turbulent markets. SYY just broke above its 200-day moving average and closed at its highest level since May 2nd. I was particularly impressed to see that Sysco was able to auction off $300 million in three-year bonds with a coupon of 0.55%. The company also sold $400 million worth of 10-year bonds with a coupon of 2.6%. That’s the seventh-lowest coupon for a bond of that maturity.

What’s interesting to note is that Sysco’s stock currently yields 3.77% which is more than the company’s cost of debt. Theoretically, Sysco could borrow money to buy its own stock for a quick arbitrage profit. (BTW, I hope they don’t!) This shows you the big disconnect between the stock and bond markets.

Reuters summed it well: “Although Sysco’s business is not the most glamorous, delivering food is viewed by investors as an essential business that generates guaranteed cash flow in good and bad economic times.” Sysco remains a good buy up to $30.

That’s all for now. Next week, Wall Street is nervously eyeing the Greek election scheduled for Sunday, June 17th. The last election produced a stalemate as no one could get a governing coalition together. Not next week but the week after, we’ll get earnings reports from Bed Bath & Beyond ($BBBY) and Oracle ($ORCL). I’m also expecting another dividend increase from Medtronic ($MDT). Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 8, 2012

Eddy Elfenbein, June 8th, 2012 at 6:16 amFlight To Safety Sends Bond Yields Up; Stocks, Euro Down

Spain Set To Request Aid For Banks This Weekend

Spain Downgraded to BBB as Fitch Predicts Slump Through 2013

Bundesbank Raises 2012 Growth Forecast as Low Rates Help Economy

Japan’s Current-Account Surplus Shrinks as Trade Slumps

As Grain Piles Up, India’s Poor Still Go Hungry

Capital Rules, Bank Leverage Ratio, Mexico TV

Bonds Rise As Bernanke Keeps Door Open on Stimulus

Sberbank Said to Buy Dexia Unit Denizbank for $3.6 Billion

Business Software IPOs Hope To Trump Market Woes

Best Buy Chairman Leaving Early

There Go Those Bank Fees Again!

Making Sense of Morgan Stanley’s Derivatives Moves

Joshua Brown: Yes, Dividends. Almost Always.

Cullen Roche: Bull Versus Super Bull

Be sure to follow me on Twitter.

-

Warren Buffett on “Owner’s Earnings”

Eddy Elfenbein, June 7th, 2012 at 11:35 amI think this is one of the most important investing concepts Warren Buffett has ever made. He outlines what he calls “Owner’s Earnings,” which is reported earnings plus depreciation, depletion, amortization, and certain other non-cash charges minus the average annual amount of capitalized expenditures for plant and equipment. Buffett says that Owner’s Earnings is a much better indicator of corporate health than Cash Flow.

This is from his 1986 Chairman’s Letter:

If we think through these questions, we can gain some insights about what may be called “owner earnings.” These represent (a) reported earnings plus (b) depreciation, depletion, amortization, and certain other non-cash charges such as Company N’s items (1) and (4) less (c) the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. (If the business requires additional working capital to maintain its competitive position and unit volume, the increment also should be included in (c). However, businesses following the LIFO inventory method usually do not require additional working capital if unit volume does not change.)

Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since(c) must be a guess – and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes – both for investors in buying stocks and for managers in buying entire businesses. We agree with Keynes’s observation: “I would rather be vaguely right than precisely wrong.”

The approach we have outlined produces “owner earnings” for Company O and Company N that are identical, which means valuations are also identical, just as common sense would tell you should be the case. This result is reached because the sum of (a) and (b) is the same in both columns O and N, and because (c) is necessarily the same in both cases.

And what do Charlie and I, as owners and managers, believe is the correct figure for the owner earnings of Scott Fetzer? Under current circumstances, we believe (c) is very close to the “old” company’s (b) number of $8.3 million and much below the “new” company’s (b) number of $19.9 million. Therefore, we believe that owner earnings are far better depicted by the reported earnings in the O column than by those in the N column. In other words, we feel owner earnings of Scott Fetzer are considerably larger than the GAAP figures that we report.

That is obviously a happy state of affairs. But calculations of this sort usually do not provide such pleasant news. Most managers probably will acknowledge that they need to spend something more than (b) on their businesses over the longer term just to hold their ground in terms of both unit volume and competitive position. When this imperative exists – that is, when (c) exceeds (b) – GAAP earnings overstate owner earnings. Frequently this overstatement is substantial. The oil industry has in recent years provided a conspicuous example of this phenomenon. Had most major oil companies spent only (b) each year, they would have guaranteed their shrinkage in real terms.

All of this points up the absurdity of the “cash flow” numbers that are often set forth in Wall Street reports. These numbers routinely include (a) plus (b) – but do not subtract (c). Most sales brochures of investment bankers also feature deceptive presentations of this kind. These imply that the business being offered is the commercial counterpart of the Pyramids – forever state-of-the-art, never needing to be replaced, improved or refurbished. Indeed, if all U.S. corporations were to be offered simultaneously for sale through our leading investment bankers – and if the sales brochures describing them were to be believed – governmental projections of national plant and equipment spending would have to be slashed by 90%.

“Cash Flow”, true, may serve as a shorthand of some utility in descriptions of certain real estate businesses or other enterprises that make huge initial outlays and only tiny outlays thereafter. A company whose only holding is a bridge or an extremely long-lived gas field would be an example. But “cash flow” is meaningless in such businesses as manufacturing, retailing, extractive companies, and utilities because, for them, (c) is always significant. To be sure, businesses of this kind may in a given year be able to defer capital spending. But over a five- or ten-year period, they must make the investment – or the business decays.

Why, then, are “cash flow” numbers so popular today? In answer, we confess our cynicism: we believe these numbers are frequently used by marketers of businesses and securities in attempts to justify the unjustifiable (and thereby to sell what should be the unsalable). When (a) – that is, GAAP earnings – looks by itself inadequate to service debt of a junk bond or justify a foolish stock price, how convenient it becomes for salesmen to focus on (a) + (b). But you shouldn’t add (b) without subtracting (c): though dentists correctly claim that if you ignore your teeth they’ll go away, the same is not true for (c) . The company or investor believing that the debt-servicing ability or the equity valuation of an enterprise can be measured by totaling (a) and (b) while ignoring (c) is headed for certain trouble.

To sum up: in the case of both Scott Fetzer and our other businesses, we feel that (b) on an historical-cost basis – i.e., with both amortization of intangibles and other purchase-price adjustments excluded – is quite close in amount to (c) . (The two items are not identical, of course. For example, at See’s we annually make capitalized expenditures that exceed depreciation by $500,000 to $1 million, simply to hold our ground competitively.) Our conviction about this point is the reason we show our amortization and other purchase-price adjustment items separately in the table on page 8 and is also our reason for viewing the earnings of the individual businesses as reported there as much more closely approximating owner earnings than the GAAP figures.

Questioning GAAP figures may seem impious to some. After all, what are we paying the accountants for if it is not to deliver us the “truth” about our business. But the accountants’ job is to record, not to evaluate. The evaluation job falls to investors and managers.

Accounting numbers, of course, are the language of business and as such are of enormous help to anyone evaluating the worth of a business and tracking its progress. Charlie and I would be lost without these numbers: they invariably are the starting point for us in evaluating our own businesses and those of others. Managers and owners need to remember, however, that accounting is but an aid to business thinking, never a substitute for it.

-

Bernanke’s Testimony

Eddy Elfenbein, June 7th, 2012 at 10:06 amHere are Ben Barnanke’s remarks that he’ll deliver before the Joint Economic Committee. As I’ve said before, the Fed has not given us any hints that more quantitative easing is coming or is needed. By reading this testimony, it’s clear that Bernanke’s doesn’t think more QE is needed:

Chairman Casey, Vice Chairman Brady, and other members of the Committee, I appreciate this opportunity to discuss the economic outlook and economic policy.

Economic growth has continued at a moderate rate so far this year. Real gross domestic product (GDP) rose at an annual rate of about 2 percent in the first quarter after increasing at a 3 percent pace in the fourth quarter of 2011. Growth last quarter was supported by further gains in private domestic demand, which more than offset a drag from a decline in government spending.

Labor market conditions improved in the latter part of 2011 and earlier this year. The unemployment rate has fallen about 1 percentage point since last August; and payroll employment increased 225,000 per month, on average, during the first three months of this year, up from about 150,000 jobs added per month in 2011. In April and May, however, the reported pace of job gains slowed to an average of 75,000 per month, and the unemployment rate ticked up to 8.2 percent. This apparent slowing in the labor market may have been exaggerated by issues related to seasonal adjustment and the unusually warm weather this past winter. But it may also be the case that the larger gains seen late last year and early this year were associated with some catch-up in hiring on the part of employers who had pared their workforces aggressively during and just after the recession.2 If so, the deceleration in employment in recent months may indicate that this catch-up has largely been completed, and, consequently, that more-rapid gains in economic activity will be required to achieve significant further improvement in labor market conditions.

Economic growth appears poised to continue at a moderate pace over coming quarters, supported in part by accommodative monetary policy. In particular, increases in household spending have been relatively well sustained. Income growth has remained quite modest, but the recent declines in energy prices should provide some offsetting lift to real purchasing power. While the most recent readings have been mixed, consumer sentiment is nonetheless up noticeably from its levels late last year. And, despite economic difficulties in Europe, the demand for U.S. exports has held up well. The U.S. business sector is profitable and has become more competitive in international markets.

However, some of the factors that have restrained the recovery persist. Notably, households and businesses still appear quite cautious about the economy. For example, according to surveys, households continue to rate their income prospects as relatively poor and do not expect economic conditions to improve significantly. Similarly, concerns about developments in Europe, U.S. fiscal policy, and the strength and sustainability of the recovery have left some firms hesitant to expand capacity.

The depressed housing market has also been an important drag on the recovery. Despite historically low mortgage rates and high levels of affordability, many prospective homebuyers cannot obtain mortgages, as lending standards have tightened and the creditworthiness of many potential borrowers has been impaired. At the same time, a large stock of vacant houses continues to limit incentives for the construction of new homes, and a substantial backlog of foreclosures will likely add further to the supply of vacant homes. However, a few encouraging signs in housing have appeared recently, including some pickup in sales and construction, improvements in homebuilder sentiment, and the apparent stabilization of home prices in some areas.

Banking and financial conditions in the United States have improved significantly since the depths of the crisis. Notably, recent stress tests conducted by the Federal Reserve of the balance sheets of the 19 largest U.S. bank holding companies showed that those firms have added about $300 billion to their capital since 2009; the tests also showed that, even in an extremely adverse hypothetical economic scenario, most of those firms would remain able to provide credit to U.S. households and businesses. Lending terms and standards have generally become less restrictive in recent quarters, although some borrowers, such as small businesses and (as already noted) potential homebuyers with less-than-perfect credit, still report difficulties in obtaining loans.

Concerns about sovereign debt and the health of banks in a number of euro-area countries continue to create strains in global financial markets. The crisis in Europe has affected the U.S. economy by acting as a drag on our exports, weighing on business and consumer confidence, and pressuring U.S. financial markets and institutions. European policymakers have taken a number of actions to address the crisis, but more will likely be needed to stabilize euro-area banks, calm market fears about sovereign finances, achieve a workable fiscal framework for the euro area, and lay the foundations for long-term economic growth. U.S. banks have greatly improved their financial strength in recent years, as I noted earlier. Nevertheless, the situation in Europe poses significant risks to the U.S. financial system and economy and must be monitored closely. As always, the Federal Reserve remains prepared to take action as needed to protect the U.S. financial system and economy in the event that financial stresses escalate.

Another factor likely to weigh on the U.S. recovery is the drag being exerted by fiscal policy. Reflecting ongoing budgetary pressures, real spending by state and local governments has continued to decline. Real federal government spending has also declined, on net, since the third quarter of last year, and the future course of federal fiscal policies remains quite uncertain, as I will discuss shortly.

With regard to inflation, large increases in energy prices earlier this year caused the price index for personal consumption expenditures to rise at an annual rate of about 3 percent over the first three months of this year. However, oil prices and retail gasoline prices have since retraced those earlier increases. In any case, increases in the prices of oil or other commodities are unlikely to result in persistent increases in overall inflation so long as household and business expectations of future price changes remain stable. Longer-term inflation expectations have, indeed, been quite well anchored, according to surveys of households and economic forecasters and as derived from financial market information. For example, the five-year-forward measure of inflation compensation derived from yields on nominal and inflation-protected Treasury securities suggests that inflation expectations among investors have changed little, on net, since last fall and are lower than a year ago. Meanwhile, the substantial resource slack in U.S. labor and product markets should continue to restrain inflationary pressures. Given these conditions, inflation is expected to remain at or slightly below the 2 percent rate that the Federal Open Market Committee (FOMC) judges consistent with our statutory mandate to foster maximum employment and stable prices.

With unemployment still quite high and the outlook for inflation subdued, and in the presence of significant downside risks to the outlook posed by strains in global financial markets, the FOMC has continued to maintain a highly accommodative stance of monetary policy. The target range for the federal funds rate remains at 0 to 1/4 percent, and the Committee has indicated in its recent statements that it anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate at least through late 2014. In addition, the Federal Reserve has been conducting a program, announced last September, to lengthen the average maturity of its securities holdings by purchasing $400 billion of longer-term Treasury securities and selling an equal amount of shorter-term Treasury securities. The Committee also continues to reinvest principal received from its holdings of agency debt and agency mortgage-backed securities (MBS) in agency MBS and to roll over its maturing Treasury holdings at auction. These policies have supported the economic recovery by putting downward pressure on longer-term interest rates, including mortgage rates, and by making broader financial conditions more accommodative. The Committee reviews the size and composition of its securities holdings regularly and is prepared to adjust those holdings as appropriate to promote a stronger economic recovery in a context of price stability.

The economy’s performance over the medium and longer term also will depend importantly on the course of fiscal policy. Fiscal policymakers confront daunting challenges. As they do so, they should keep three objectives in mind. First, to promote economic growth and stability, the federal budget must be put on a sustainable long-run path. The federal budget deficit, which averaged about 9 percent of GDP during the past three fiscal years, is likely to narrow in coming years as the economic recovery leads to higher tax revenues and lower income support payments. Nevertheless, the Congressional Budget Office (CBO) projects that, if current policies continue, the budget deficit would be close to 5 percent of GDP in 2017 when the economy is expected to be near full employment.3 Moreover, under current policies and reasonable economic assumptions, the CBO projects that the structural budget gap and the ratio of federal debt to GDP will trend upward thereafter, in large part reflecting rapidly escalating health expenditures and the aging of the population. This dynamic is clearly unsustainable. At best, rapidly rising levels of debt will lead to reduced rates of capital formation, slower economic growth, and increased foreign indebtedness. At worst, they will provoke a fiscal crisis that could have severe consequences for the economy. To avoid such outcomes, fiscal policy must be placed on a sustainable path that eventually results in a stable or declining ratio of federal debt to GDP.

Even as fiscal policymakers address the urgent issue of fiscal sustainability, a second objective should be to avoid unnecessarily impeding the current economic recovery. Indeed, a severe tightening of fiscal policy at the beginning of next year that is built into current law–the so-called fiscal cliff–would, if allowed to occur, pose a significant threat to the recovery. Moreover, uncertainty about the resolution of these fiscal issues could itself undermine business and household confidence. Fortunately, avoiding the fiscal cliff and achieving long-term fiscal sustainability are fully compatible and mutually reinforcing objectives. Preventing a sudden and severe contraction in fiscal policy will support the transition back to full employment, which should aid long-term fiscal sustainability. At the same time, a credible fiscal plan to put the federal budget on a longer-run sustainable path could help keep longer-term interest rates low and improve household and business confidence, thereby supporting improved economic performance today.

A third objective for fiscal policy is to promote a stronger economy in the medium and long term through the careful design of tax policies and spending programs. To the fullest extent possible, federal tax and spending policies should increase incentives to work and save, encourage investments in workforce skills, stimulate private capital formation, promote research and development, and provide necessary public infrastructure. Although we cannot expect our economy to grow its way out of federal budget imbalances without significant adjustment in fiscal policies, a more productive economy will ease the tradeoffs faced by fiscal policymakers.

Thank you. I would be glad to take your questions.

-

The Stock Market Builds on Yesterday’s Rally

Eddy Elfenbein, June 7th, 2012 at 9:56 amThe stock market is building on its impressive jump from yesterday. The S&P 500 rose 2.3% yesterday, and so far, we’re up another 1% today. After the stock market rose 110% in a little over three years, one of the greatest rallies in history, a two-month fall of 7% was taken somehow by bears as vindication for their views.

One of the major concerns in Europe is in Spain. The bond market had effectively shut them out of raising more money. Fortunately, they had a successful bond auction this week. That’s probably one of the reasons why AFLAC ($AFL) has responded so well. Shares of AFL rose from a low of $38.18 on Monday to as high as $41.55 today.

Sysco ($SYY) went to the bond market and borrowed money for three years with a coupon of 0.55%. The other part of their borrowing was at ten years, and that carried a coupon of 2.6%. Bear in mind that Sysco’s stock currently yields 3.8%.

This quest for high-quality bonds has gained pace in the last couple of weeks as supply has receded amid rising eurozone contagion worries.

Although Sysco’s business is not the most glamorous, delivering food is viewed by investors as an essential business that generates guaranteed cash flow in good and bad economic times.

Sysco is regarded as a quality, powerful franchise with a diverse selection of food products that gives it significant pricing power.

Sysco’s deal is expected to encourage other issuers who have been sitting on the sidelines waiting for overall market nervousness to subside.

The other positive news today is that China cut its interest rates for the first time since 2008. Also, unemployment claims fell to 377,000.

-

Morning News: June 7, 2012

Eddy Elfenbein, June 7th, 2012 at 6:46 amMerkel Backs Two-Speed Europe With Core Euro in Poke at Cameron

Spain Holds a Trump Card in Bank Bailout Negotiations

IIF Criticizes ECB For Claiming Seniority In Greek Debt Swap

China Spends US $21.4 Billion On Foreign Assets In First Quarter

China Vows To Speed Up Tax Reform in 2012

King Confronts Stimulus Revival Case as U.K. Slump Persists

Global Food Prices Fell Most in 2 Years in May on Grains

U.S. Productivity Fell 0.9% in First Quarter as Growth Cooled

Bill Pushes for Increase in Wages

Halliburton Q2 Hit By Costly Indian Bean Shortage

Nasdaq Sets Aside $40 Million to Settle Facebook Trading Claims

IPO “Whisper” Estimates May Be Heard After Facebook

Linkedin, Eharmony Suffer Data Breaches

Can Occupy Wall Street Survive?

Credit Writedowns: First Mover Advantage

Jeff Carter: Sub Penny Trading

Be sure to follow me on Twitter.

-

Warren Buffett Discusses the Economy

Eddy Elfenbein, June 6th, 2012 at 6:49 amI can’t embed this video but at this link you can hear Warren Buffett talk about the economy.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His