Archive for June, 2012

-

Morning News: June 6, 2012

Eddy Elfenbein, June 6th, 2012 at 6:34 amEuro-Area Investment Drop Offsets Export Gains

E.C.B. Meets Amid Gathering Signs of Bank Stress

EU Eyes New Regime To Cope With Stricken Banks

Draghi May Move Toward Rate Cut as Debt Crisis Worsens

Commerzbank Cut as Moody’s Downgrades German, Austrian Banks

Greece Warns of Going Broke as Tax Proceeds Dry Up

Two Fed Officials Cool To More Easing

Buffett Sees No U.S. Recession Unless Europe Causes It

Fannie Mae Names Its Top Lawyer as Chief

Thomas H. Lee Partners Buys Party City for $2.69 Billion

YPF to Invests $1.2 Billion on Argentine Shale Oil

Flagging US Sales Drag Down Ahold Income

Debating Facebook IPO Fallout for Start-Ups

The Social CRM Arms Race Heats Up

Epicurean Dealmaker: Tumbling Dice

Roger Nusbaum: Defensive Action Started

Be sure to follow me on Twitter.

-

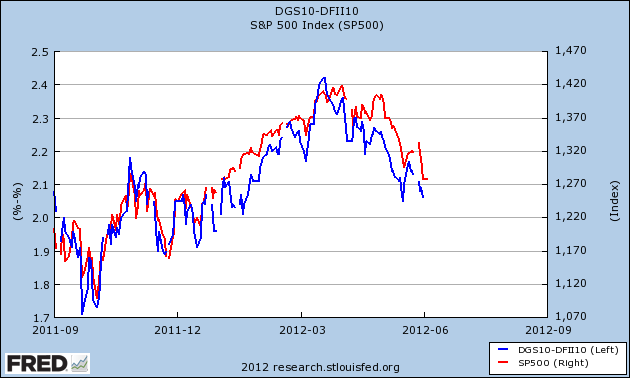

The Market and Inflation Expectations

Eddy Elfenbein, June 5th, 2012 at 3:34 pmThe stock market and inflation expectations have been highly correlated lately. Are inflation expectations driving the stock market? Well, I can’t say for sure. Correlation, of course, doesn’t mean causation. But still, correlation can be very important.

Over the last nine months, every 0.1% move in ten-year inflation expectations has correlated with a 50-point move in the S&P 500.

I suspect that Ben Bernanke and his buddies at the Fed are familiar with the chart above. The issue is that the Fed is nearly out of bullets, but there are still some tricks they haven’t used. One move could be to have the market believe that inflation expectations will rise. The best part is that it won’t cost a dime if (and this is a big if) the market believes what the Fed says.

Matthew O’Brien explains in The Atlantic:

The true nature of central banking isn’t about interest rates. It’s about making and keeping promises. And that brings me to a confession. I lied earlier. Central banks don’t really buy or sell short-term bonds when they lower or raise short-term interest rates. They don’t need to. The market takes care of it. If the Fed announces a target and markets believe the Fed is serious about hitting that target, the Fed doesn’t need to do much else. Markets don’t want to bet against someone who can conjure up an infinite amount of money — so they go along with the Fed.

Don’t underestimate the power of expectations. It might sound a like a hokey religion, but it’s not. Consider Switzerland. Thanks to the euro’s endless flirtation with financial oblivion, investors have piled into the Swiss franc as a safe haven. That sounds good, but a massively overvalued currency is not good. It pushes inflation down to dangerously low levels, and makes exports uncompetitive. So the Swiss National Bank (SNB) has responded by devaluing its currency — setting a ceiling on its value at 1.2 Swiss francs to 1 euro. In other words, the SNB has promised to print money until its money is worth what it wants it to be worth. It’s quantitative easing with a target. And, as Evan Soltas pointed out, the beauty of this target is that the SNB hasn’t even had to print money lately, because markets believe it now. Markets have moved the exchange rate to where the SNB wants it.

-

The Magic Line Everyone’s Watching is 1,277.14

Eddy Elfenbein, June 5th, 2012 at 10:16 amOn April 2nd, the S&P 500 closed at its recent peak of 1,419.04. Traders traditionally mark a correction as a 10% decline, so a 10% fall from 1,419.04 comes to 1,277.14. That’s the number everyone’s been watching.

On Friday, we held above it. The intra-day low was 1,277.25. Yesterday, the S&P 500 got as low as 1,266.74 but thanks to a late-day rally, we closed at 1,278.18.

Today looks more encouraging. We’re currently over 1,284. There’s probably some optimism that the “correction line” held. For now.

-

Morning News: June 5, 2012

Eddy Elfenbein, June 5th, 2012 at 6:34 amEuropean Financial Markets Shaky After PMI Disappointment

Spain Warns on Borrowing as G-7 Prepares to Discuss Crisis

E.C.B. Under Pressure to Ride to the Euro’s Rescue

Drugmakers Afflicted by Greek Pain With or Without Euro

Germany Opens to Banking Coordination in Drive for Fiscal Union

UAE’s Etihad Buys Stake In Virgin Australia

Market’s Echo of Tiananmen Date Sets Off Censors

Solar Panel Payments Set Off a Fairness Debate

Starbucks to Expand Food Offering With La Boulange Bakery Acquisition

Salesforce To Buy Social-Media Marketer Buddy Media

Wynn’s Macau Resort To Cost $4 Billion; Shrugs Off VIP Slowdown Fears

HP Says Oracle Violated Contract, Seeks Billions

Promoting Nutrition, Disney to Restrict Junk-Food Ads

Wall Street CEO Pay Rises 20% With KKR’s Kravis No. 1

Goldman Sachs Said to Cut Jobs as Earnings Outlook Dims

Phi Pearlman: My Fave Vid of the Year from Lazerow…

Joshua Brown: State of the ETP Business

Be sure to follow me on Twitter.

-

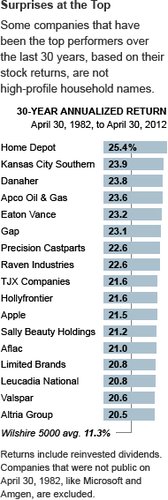

“The Best Investments Are Often the Ones that Few People Have Heard Of”

Eddy Elfenbein, June 4th, 2012 at 12:49 pmRon Lieber at the New York Times writes an article dear to my heart. He notes that the best investments to own are often not very well known. Lieber asked the folks at Wilshire Associates to list the top-performing stocks of the last 30 years.

Here’s what they came up with:

There are a few famous names like Home Depot ($HD), but many are well below Wall Street’s radar. Regular readers of Crossing Wall Street, however, will recognize some of the top stocks like Danaher ($DHR), Raven Industries ($RAVN), Leucadia National ($LUK) and Eaton Vance ($EV).

The top-performing stock on the Wilshire list is Home Depot. Was anyone pointing at that company back in the early 1980s and insisting that it was going to the moon?

“Oh no,” said Arthur Blank, one of Home Depot’s founders, when I asked him this week. “We had no idea that was going to happen. When we went public in 1981, we only had eight stores.”

Indeed, the best investments are often the ones that few people have heard of, and sometimes the companies like it that way.

Take Danaher, which makes a variety of testing and dental equipment, among other things. Its founders are two brothers, Steven and Mitchell Rales, who named the company after a Montana fishing area and rarely talk to the media. Danaher executives did not return several calls for comment, and a former group president, George Koenigsaecker, said its silence had long been strategic. He helped oversee a transition to what became known as the Danaher Business System, a rigorous operating philosophy that survives to this day and wrings excess out of every part of every company it owns.

The company shunned most visitors. “There was little value to sharing this knowledge and your people with companies you might acquire and improve, as opposed to them acquiring your people and improving themselves,” said Mr. Koenigsaecker, who is the author of “Leading the Lean Enterprise Transformation” and is still a shareholder. “I should have bought more.”

As a true believer with intimate knowledge of the company even after his departure in 1992, Mr. Koenigsaecker had the willpower to hold on to the stock. But this is a hard thing to do for most individual investors.

There are thousands of companies that are listed in the stock exchange, and hundreds of them aren’t followed by a single Wall Street analyst. Lieber makes the point that some of these companies like it this way.

If you sit down and read the financial reports, it doesn’t take you long to know as much about a stock as anyone. That’s what happened when I first learned of Nicholas Financial ($NICK). The stock is up more than fivefold in three years and still no one follows it.

-

Factory Orders Fall

Eddy Elfenbein, June 4th, 2012 at 11:06 amThe stock market continues to be sluggish this morning. As I write this, the S&P 500 stands at 1,274. The index has fallen below its 200-day moving average and the number we’re watching now is 1,277.14. That will mark a 10% fall from the market’s peak on April 2nd. This would be the S&P 500’s third 10% correction in the last 12 months.

Wall Street is still reeling from Friday’s awful jobs report. There’s now more talk of QE3. Until now, I’ve strongly doubted that another round of quantitative easing is on the way, and I’m still a doubter until we hear more clues from the Federal Reserve. Incidentally, Ben Bernanke will be speaking before Congress this Thursday.

We’ve had an incredible string of bad economic news lately. Despite last week having only four business days, there were 21 economic reports, and 18 of them came in weaker than expected. Today we learned that factory orders fell by 0.6% in April. The March figure was revised to a drop of 2.1%. This the first time we’ve had back-to-back declines in three years.

-

Soros on the Euro

Eddy Elfenbein, June 4th, 2012 at 9:35 amGeorge Soros’ speech on the euro is getting a lot of attention. I find Soros to be an interesting person but he’s far more wordy than necessary, especially when he gets into “reflexivity.”

Still, I think this is a good talk because he gets behind the mentality that led to the euro crisis. Too often we hear that a crisis happened because one day everyone woke up and decided to be bullish on something. Instead, there are usually many dynamics driving the entire process.

I recommend reading the whole speech, but here’s a key passage:

I contend that the European Union itself is like a bubble. In the boom phase the EU was what the psychoanalyst David Tuckett calls a “fantastic object” – unreal but immensely attractive. The EU was the embodiment of an open society –an association of nations founded on the principles of democracy, human rights, and rule of law in which no nation or nationality would have a dominant position.

The process of integration was spearheaded by a small group of far sighted statesmen who practiced what Karl Popper called piecemeal social engineering. They recognized that perfection is unattainable; so they set limited objectives and firm timelines and then mobilized the political will for a small step forward, knowing full well that when they achieved it, its inadequacy would become apparent and require a further step. The process fed on its own success, very much like a financial bubble. That is how the Coal and Steel Community was gradually transformed into the European Union, step by step.

Germany used to be in the forefront of the effort. When the Soviet empire started to disintegrate, Germany’s leaders realized that reunification was possible only in the context of a more united Europe and they were willing to make considerable sacrifices to achieve it. When it came to bargaining they were willing to contribute a little more and take a little less than the others, thereby facilitating agreement. At that time, German statesmen used to assert that Germany has no independent foreign policy, only a European one.

The process culminated with the Maastricht Treaty and the introduction of the euro. It was followed by a period of stagnation which, after the crash of 2008, turned into a process of disintegration. The first step was taken by Germany when, after the bankruptcy of Lehman Brothers, Angela Merkel declared that the virtual guarantee extended to other financial institutions should come from each country acting separately, not by Europe acting jointly. It took financial markets more than a year to realize the implication of that declaration, showing that they are not perfect.

The Maastricht Treaty was fundamentally flawed, demonstrating the fallibility of the authorities. Its main weakness was well known to its architects: it established a monetary union without a political union. The architects believed however, that when the need arose the political will could be generated to take the necessary steps towards a political union.

But the euro also had some other defects of which the architects were unaware and which are not fully understood even today. In retrospect it is now clear that the main source of trouble is that the member states of the euro have surrendered to the European Central Bank their rights to create fiat money. They did not realize what that entails – and neither did the European authorities. When the euro was introduced the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital; and the central bank accepted all government bonds at its discount window on equal terms. Commercial banks found it advantageous to accumulate the bonds of the weaker euro members in order to earn a few extra basis points. That is what caused interest rates to converge which in turn caused competitiveness to diverge. Germany, struggling with the burdens of reunification, undertook structural reforms and became more competitive. Other countries enjoyed housing and consumption booms on the back of cheap credit, making them less competitive. Then came the crash of 2008 which created conditions that were far removed from those prescribed by the Maastricht Treaty. Many governments had to shift bank liabilities on to their own balance sheets and engage in massive deficit spending. These countries found themselves in the position of a third world country that had become heavily indebted in a currency that it did not control. Due to the divergence in economic performance Europe became divided between creditor and debtor countries. This is having far reaching political implications to which I will revert.

It took some time for the financial markets to discover that government bonds which had been considered riskless are subject to speculative attack and may actually default; but when they did, risk premiums rose dramatically. This rendered commercial banks whose balance sheets were loaded with those bonds potentially insolvent. And that constituted the two main components of the problem confronting us today: a sovereign debt crisis and a banking crisis which are closely interlinked.

-

The Supraview of Return Predictive Signals

Eddy Elfenbein, June 4th, 2012 at 9:00 amHere’s the abstract of a recent academic paper:

This study speaks to investment academics and practitioners by describing the population of return predictive signals (RPS) discovered and publicly identified during the period 1970-2010. Our supraview brings to light a number of new facts about RPS, including that many more RPS exist than is commonly realized (our database contains over 330 signals); the statistical properties of newly discovered RPS have remained stable over time; the returns and Sharpe ratios earned by famous RPS such as accruals and momentum are lower than those of the median RPS; and that RPS with higher mean returns also have higher Sharpe ratios. We propose that the investment performance available to practitioners from exploiting the population of RPS may be very large since empirically we estimate that the average cross-correlation between RPS returns is close to zero. We further show that because the average absolute cross-correlation between RPS returns is also low, the probability that an RPS with a significantly positive raw hedge return will have a reliably positive alpha after being orthogonalized against the market, HML, SMB, MOM and five (15) other randomly chosen RPS is 65% (43%). We interpret these results as being good news for academics and practitioners because they suggest that practitioners can expect to create value for their clients by hunting down new sources of alpha, and academics seeking to document a truly new RPS need not orthogonalize the returns of their new RPS against all pre-existing RPS. However, we note that the low average signed and absolute cross-correlations between RPS returns do present a challenge to academics because they imply that either U.S. stock markets are pervasively inefficient, or there exist a very large number of rationally priced sources of risk in equity returns for theorists to understand and explain.

(Via: CXO Advisory)

-

Morning News: June 4, 2012

Eddy Elfenbein, June 4th, 2012 at 7:20 amEuro-Zone Producer-Price Inflation Eases

Spain Tourism Boost Fizzles Amid Recession

Risk-Exposed Portugal Sticks To Tough Bailout Goals

Cyprus May Be Next Country to Seek Bailout

Iran Backs Iraq’s Thamir Ghadhban to Head OPEC, Shahristani Says

Russian Court to Hear $13 Billion Lawsuit Against BP

S&P 500 Valuation Slips 19% Below ’11 as Shaoul Advises Patience

U.S. Multinationals Lobby to Alter Tax Rules They Sought

Salesforce to Buy Buddy Media for $689 Million in Social Push

WellPoint to Buy 1-800 Contacts

Ford Says Studying Indigenous Brands For China Market

Sony Dips Below 1,000 Yen for First Time Since 1980

Merrill Losses Were Withheld Before Bank of America Deal

Newspapers Cut Days From Publishing Week

Cullen Roche: Those Dreaded Bond Vigilantes Are Coming!

Howard Lindzon: What Does a Market Top Look Like…The Aftermath

Be sure to follow me on Twitter.

-

Dollar Bill On Floor Sends Wall Street Into Frenzy

Eddy Elfenbein, June 2nd, 2012 at 2:10 pmFrom The Onion:

NEW YORK—Wall Street investors experienced a sudden surge in optimism Tuesday when, after six tumultuous weeks that saw record drops in the Dow Jones industrial average, a $1 bill was spotted on the floor of the New York Stock Exchange.

The dollar bill was discovered in the northwest corner of the trading floor at approximately 12:05 p.m., and its condition was reported as “crinkled, but real.” Word of the tangible denomination of U.S. currency spread quickly across the NYSE, sending traders into a frenzied rush of shouting, arm-flailing, hooting, hollering, and, according to eyewitnesses, at least one dog pile.

“With credit frozen and the commercial paper market poised on the brink of collapse, this is the most promising development I’ve seen on Wall Street in months,” said floor trader Tim Formato, one of hundreds who gathered around the $1 bill and excitedly called their clients to inform them that they were looking at actual U.S. tender. “I think I touched it.”

According to witnesses, the trading floor was soon abuzz with energy, as traders pointed at the dollar and repeatedly shouted “Look!” and “Money!” A proposal to divide the $1 note into 1,300 equal pieces and distribute them amongst investors was considered, but ultimately rejected. Early reports estimate the dollar may have passed through as many as 65 hands before disappearing in the late afternoon.

The bill’s absence, however, did not deter the growing enthusiasm from those on the trading floor. By 2:15 p.m., more than 60,000 shares had been purchased in the new publicly traded asset, DLR, after brokers placed a flurry of calls advising their investors to buy into the booming single-dollar market.

By the close of day, economists were estimating the dollar bill’s net worth at just under $270 million.

“We couldn’t be in a better situation right now,” trader Patrick Kady said. “Unless of course it had been a euro.”

However, some financial advisers are warning against the rampant speculation the dollar has caused on Wall Street. Many have cautioned investors not to make rash decisions, such as liquidating all their low-risk government bonds in order to sniff the green paper bill for just a minute.

“I bet it smells like rose petals,” mutual funds specialist Ken Stoute said. “My friend’s friend Tim Formato? He’s on the board at Westminster Securities and he says he touched it. He said it was warm and soft and wonderful. He said he knows where it is now, and I can put in an option on seeing it tomorrow for only $85.”

Since the appearance of the dollar, the Dow has spiked an impressive 993 points—its largest gain ever. Initial numbers are showing the most sizable rises in technology stocks, a trend some are attributing to Microsoft’s CFO Chris Liddell, who toured the trading floor Tuesday morning with the bill stuck to his left shoe.

The overall projection for the market following the incident has been positive, with many analysts claiming that the $1 bill may be an indication of other spare change lying around. This, coupled with reports out of Europe that there is a German college student who has not yet hit her credit card limit this month, could be enough to stabilize the Dow and jump-start the global economy once again.

“This is just another sign that the U.S. economy is as strong and resilient as it has ever been,” said Richard Fuld Jr., former CEO of Lehman Brothers. “I’m just glad we finally have these credit and subprime mortgage loan crises behind us. This $1 bill will carry us through another 10 years of reckless, unregulated borrowing.”

Added Fuld, “Just for God’s sake, don’t invest it in the stock market.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His