Archive for July, 2012

-

The S&P 500 and Earnings

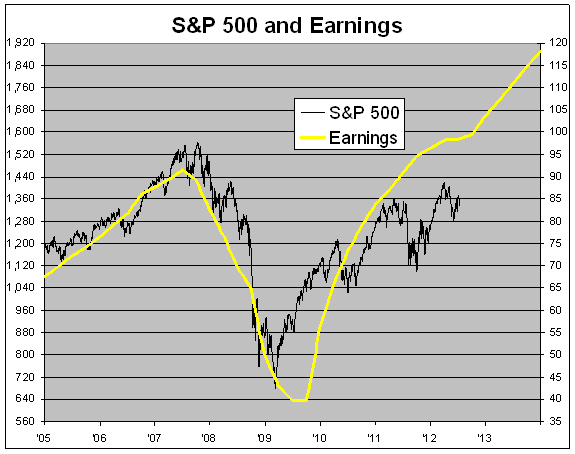

Eddy Elfenbein, July 16th, 2012 at 10:44 amHere’s a look at the S&P 500 (black line, left scale) along with its earnings (yellow line, right scale). The two lines are scaled at a ratio of 16-to-1 which means that whenever the lines cross, the market’s P/E Ratio is exactly 16.

We’re at a crossroads right now in the market. Earnings are going to be flat this earnings season but they’re expected to be flat. Wall Street currently expects earnings and the economy to reaccelerate later this year (note the upturn in the yellow line). The market, however, is a doubter. Actually, right about now is the trough in earnings growth.

If analysts are right and earnings start growing again, the market right now is very cheap. Under a reacceleration scenario, I think the S&P 500 could easily hit 1,500.

But if traders are picking up something not yet seen in the data, and the economy drops sharply, stocks could drop even further.

-

Morning News: July 16, 2012

Eddy Elfenbein, July 16th, 2012 at 6:59 amMerkel Gives No Ground on Demands for Oversight in Crisis

Euro-Area Inflation Held Steady in June, Imports Fell in May

Focus Shifts to Regulators in British Inquiry on Rate-Fixing

London Self-Regulatory System Proves Illusory in Libor Scandal

China’s Cabinet Meets as Wen Warns on Economy

India Inflation Eases; Monsoon Holds Key To Rate Cut

Crude Oil Futures Drop From One-Week High

Consumer Bureau Poised to Unleash Rules

JPMorgan Blaming Marks on Traders Baffles Ex-Employees

Surveys Give Big Investors an Early View From Analysts

Buffett Empowers Deputies by Raising Funds to $8 Billion

Microsoft and NBC Complete Web Divorce

BASF To Take On Asia’s Battery Chemicals Makers

Howard Lindzon: Instagram (Facebook) Trumps Twitter

Jeff Miller: Weighing the Week Ahead: A Summertime Three-Ring Circus

Be sure to follow me on Twitter.

-

JPMorgan Chase Earns $1.21 Per Share

Eddy Elfenbein, July 13th, 2012 at 7:05 amJPMorgan just released their earnings report. For the second quarter, the bank earned $1.21 per share. They said that the botched trade in London lost $5.8 billion including $4.4 billion during the second quarter. They said that the trader was misleading them so they’ll have to restate Q1 earnings. Their income for Q1 will be $459 million less than originally reported.

Here’s the earnings report:

JPMorgan Chase & Co. (NYSE: JPM) today reported second-quarter 2012 net income of $5.0 billion, compared with net income of $5.4 billion in the second quarter of 2011. Earnings per share were $1.21, compared with $1.27 in the second quarter of 2011. The Firm’s return on tangible common equity for the second quarter of 2012 was 15%, compared with 17% in the prior year.

Jamie Dimon, Chairman and Chief Executive Officer, commented on financial results: “Importantly, all of our client-driven businesses had solid performance. However, there were several significant items that affected the quarter’s results – some positively; some negatively. These included $4.4 billion of losses on CIO’s synthetic credit portfolio, $1.0 billion of securities gains in CIO and a $545 million gain on a Bear Stearns-related first-loss note, for which the Firm now expects full recovery. The Firm’s results also included $755 million of DVA gains, reflecting adjustments for the widening of the Firm’s credit spreads which, as we have consistently said, do not reflect the underlying operations of the Firm. The Firm also reduced loan loss reserves by $2.1 billion, mostly for the mortgage and credit card portfolios. These reductions in reserves are based on the same methodologies we have used in the past – the good news is that these reductions reflected meaningful improvements in delinquencies and estimated losses in these portfolios. We continue to maintain strong reserves.”

Dimon continued: “Since the end of the first quarter, we have significantly reduced the total synthetic credit risk in CIO – whether measured by notional amounts, stress testing or other statistical methods. The reduction in risk has brought the portfolio to a scale that allowed us to transfer substantially all remaining synthetic credit positions to the Investment Bank . The Investment Bank has the expertise, capacity, trading platforms and market franchise to effectively manage these positions and maximize economic value going forward. As a result of the transfer, the Investment Bank’s Value-at-Risk and Risk Weighted Assets will increase, but we believe they will come down over time. Importantly, we have put most of this problem behind us and we can now focus our full energy on what we do best – serving our clients and communities around the world.”

Commenting further on CIO, Dimon said: “CIO will no longer trade a synthetic credit portfolio and will focus on its core mandate of conservatively investing excess deposits to earn a fair return. CIO’s $323 billion available-for-sale portfolio had $7.9 billion of net unrealized gains at the end of the quarter. This portfolio has an average rating of AA+, has a current yield of approximately 2.6%, and is positioned to help to protect the Firm against rapidly rising interest rates. In addition to CIO, we have $175 billion in cash and deposits, primarily invested at central banks.”

“The Firm has been conducting an extensive review of what happened in CIO and we will be sharing our observations today. We have already completely overhauled CIO management and enhanced the governance standards within CIO. We believe these events to be isolated to CIO, but have taken the opportunity to apply lessons learned across the Firm. The Board of Directors is independently overseeing and guiding the Company’s review, including any additional corrective actions. While our review continues, it is important to note that no client was impacted.”

Commenting on the balance sheet, Dimon said: “Our fortress balance sheet remained strong, ending the second quarter with a strong Basel I Tier 1 common ratio of 10.3%. We estimate that our Basel III Tier 1 common ratio was approximately 7.9% at the end of the second quarter, after the effect of the final Basel 2.5 rules and the Federal Reserve’s recent Notice of Proposed Rulemaking.”

Dimon concluded: “Through the depth of the financial crisis and through recent events, we have never stopped fulfilling our mission: to serve clients – consumers and companies – and communities around the globe. During the first half of 2012, we provided $130 billion of credit to consumers. Over the same period we provided nearly $10 billion of credit to small businesses, the engine of growth for our economy, up 35% compared with the same period last year. For America’s largest companies, we raised or lent over $720 billion of capital in the first six months to help them build and expand around the world. Even in this difficult economy, we have added thousands of new employees across the country – over 62,000 since January 2008. In 2011, we founded the “100,000 Jobs Mission” – a partnership with 54 other companies to hire 100,000 U.S. veterans by the year 2020. We have hired more than 4,000 veterans since the beginning of 2011, in addition to the thousands of veterans who already worked at our Firm. I am proud of JPMorgan Chase and what all of our employees do every day to serve our clients and communities in a first-class way.”

Excluding all adjustments, the bank earned 67 cents per share last quarter.

-

CWS Market Review – July 13, 2012

Eddy Elfenbein, July 13th, 2012 at 6:17 amThe second-quarter earnings season is about to enter full bloom. We only have a few reports in so far, but the early numbers indicate this is going to be a lousy season. Bespoke Investment Group found that only one of the 16 companies that have reported has beaten expectations.

This is especially disappointing because Wall Street has been slashing its earnings forecasts for the last several weeks. In other words, we’re having trouble meeting reduced expectations. On top of that, many companies have offered lower guidance for the rest of the year. On Thursday, the S&P 500 closed lower for the sixth day in a row.

So who’s to blame for the poor earnings? We can point to the usual suspects like tight margins and weak growth in Europe. But we also need to pin some blame on a new suspect: the strong U.S. dollar. Thanks to the euro’s tanking, the dollar has rallied to a two-year high and this has made many U.S.-based companies less competitive in foreign markets. Unfortunately, this will put the squeeze on stocks like Ford ($F).

In this issue of CWS Market Review, we’ll take a closer look at some of the upcoming reports for our Buy List stocks. I’ll also highlight which stocks look especially good right now. There are lots of good bargains out there. (Anyone notice the nice rally in Johnson & Johnson ($JNJ) in the past month?). I’ll also look at the prospects for the U.S. economy. Other regions around the world are clearly slowing down. Will the U.S. follow?

It’s Time for JPM to Face Wall Street

I’m writing this letter very early on Friday morning and some time later today, JPMorgan Chase ($JPM) will be our first Buy List stock to report earnings. This report will obviously be of great interest to Wall Street not only due to JPM’s huge influence on the Street but also because we’ll get to see the first details of how serious the trading losses were in their London office. Officially, CEO Jamie Dimon has said that the trading loss was $2 billion and that it might grow to $3 billion, but New York Times said that it might be as high as $9 billion. Unfortunately, there’s been far more speculation than news.

Before the losses were reported, Wall Street had been expecting JPM to earn $1.24 per share for Q2. The consensus is now down to 76 cents per share. Since the bank has 3.81 billion shares outstanding, a $2 billion loss works out to 52.5 cents per share. So the decrease in guidance closely matches the expected trading loss.

Here’s my take: The trading loss is simply inexcusable and I’d like to see Mr. Dimon leave the CEO’s suite. The share price has suffered from what we euphemistically call “headline risk.” But JPM is still a very profitable outfit. If earnings, excluding the big loss, are still strong, which I expect will be the case, JPM is an outstanding buy. The key for us is to see how strong the fundamentals of the bank are. After a brief recovery during June, the stock has drifted lower again recently. I still rate JPMorgan a strong buy anytime the stock is below $38 per share. The problem for us is that even if the bank’s earnings are good, it may take some time before investors are willing to go back into the stock. This is an investment for the long haul.

Stryker and Johnson & Johnson Will Report Next Week

Stryker ($SYK), the medical equipment firm, is due to report earnings on Tuesday. Three months ago, the company reported earnings of 99 cents per share which matched estimates. Revenues were above expectations and gross margins improved. For Q2, Wall Street is again expecting earnings of 99 cents per share. I’ve run the numbers and that sounds about right.

In April, I was pleased to see Stryker reiterate its forecast of “double digit” earnings growth for this year. I think there’s a good chance that this forecast is too low, but I wouldn’t expect any increase in guidance until later in the year. Double-digit earnings growth translates to earnings of at least $4.09 per share. That means the stock is going for less than 13 times earnings. That’s a good deal for a high-quality stock like Stryker. I also think we’ll see another generous dividend increase later this year.

Over the past few months, shares of Stryker have closely followed the S&P 500 (see the chart below). Stryker is a much better bargain than the overall market so I expect to see some outperformance soon. I rate Stryker a very good buy up to $60 per share.

Johnson & Johnson ($JNJ) hasn’t officially said when it will report earnings, but I’m assuming it will be sometime next week. JNJ is oddly in a position somewhat similar to JPM in that their seemingly endless recalls soured many investors on the stock. The good news is that the company has a new CEO, and it appears that JNJ has put these issues behind them. After doing not much of anything for several months, the stock suddenly perked up last month. From June 12th to July 3rd, Johnson & Johnson gained nearly 10%. On Thursday, the shares got very close to a new 52-week high.

JNJ’s stock got knocked around earlier this year when the guidance they gave for 2012 ($5.05 to $5.15 per share) was below Wall Street’s consensus of $5.21. Yet as things now stand, I think JNJ has a decent shot of getting to $5.21. The Q1 earnings report was pretty good. Wall Street’s consensus for Q2 is $1.29 per share. That’s very doable. JNJ currently yields 3.6% which is more than twice a 10-year Treasury. I rate Johnson & Johnson a strong buy up to $70 per share.

Some Buy List Bargains

Like the rest of the market, our Buy List has gotten tossed around for the past few days, but several stocks look especially good right now. Fiserv ($FISV), for example, has performed exceptionally well. The stock got to a 52-week high last week. I’m looking forward to another good report soon.

CR Bard ($BCR) is one of our quiet stocks, but it’s continued to thrive in this market. The stock broke above $108 recently and it’s now our #2 best performer this year with a gain of 23.52%. CA Technologies ($CA) is in first place with a gain of 26.11%.

I was rooting for Oracle ($ORCL) to finally break $30 per share. The stock came within two cents on July 3rd, but it couldn’t do it. I still like Oracle a lot. The last earnings report gave me a lot of confidence in ORCL. The stock is a great buy below $30.

Don’t Believe the Recession Talk—For Now

There’s a growing chorus of folks who are convinced that the U.S. economy is either in a recession right now or about to go into one. I want to choose my words carefully here. While there’s plenty of evidence that economic growth is very sluggish, there’s zero clear-cut evidence that the economy is currently in a recession. That may soon change, but until then, I don’t see an imminent recession nor do I see the Federal Reserve launching another round of quantitative easing.

The stock market is still trying to recover from the lousy jobs report from last Friday. The jobs market, however, may have turned a corner. On Thursday, we got the best jobless claims report in more than four years. Some folks are dismissing the report as an anomaly due to the July 4th holiday. We’ll need more data to say for sure, but this could indicate some strength in employment. Even the dismal gain of 80,000 jobs in June is still a gain. During the depths of the recession we saw massive jobs losses each month.

Ben Bernanke and his buddies at the Fed seem to prefer a wait-and-see approach. On Wednesday, the Fed released the minutes from its June 19-20 meeting. This gave us some hints as to what the Fed is thinking. The central bankers agreed that unemployment will be a problem for another five to six years, but they don’t believe that’s serious enough to provide for more stimulus.

The minutes indicate that members of the Fed have been disappointed by economic growth being slower than expected (I share that view), and they’re concerned that inflation is trending below its 2% target. Apparently, there’s opposition to further stimulus, but we don’t know how broad that opposition is.

As market watchers, we’ve already seen economically cyclical stocks lag the market. This was a tipoff that the economy wasn’t as rosy as many people expected. This week, several Wall Street firms got the hint and slashed their forecasts for Q2 GDP growth. They estimate growth coming in between 1% and 1.5% which is very weak, but it’s still not receding.

The weaker growth has caused the bond market to continue its rally. This week, the U.S. Treasury sold 30-year bonds at a record low yield of 2.58%, and 10-year bonds at a record low of 1.46%. While the economy is in a rough patch right now, the evidence still does not point to a recession. In fact, many market watchers now anticipate economic growth (and profit growth) to accelerate into 2014.

That’s all for now. Next week will be a big week for earnings. We’ll also get key reports on industrial production and retail sales. This will tell us more about how the economy is behaving. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Here are some more videos (here, here, here, here and here) of the interview I did with Brian Richards of The Motley Fool.

-

Morning News: July 13, 2012

Eddy Elfenbein, July 13th, 2012 at 5:31 amItaly Bond Rating Cut by Moody’s on Contagion Risks

Italy Exits Before Greece in BofA Game Theory

France Has No Problem With Sovereignty in Euro Crisis Response

China’s Growth Rate Slowed in the 2nd Quarter, Down Sharply From a Year Ago

China Economic Data Questioned as Electricity Use Slows

Bank Analysts at Odds Over Libor Litigation Bill

Geithner Tried to Curb Rate Rigging in 2008

Treasury Yield Is 3 Basis Points From Low on Slowdown

New Claims for Unemployment Benefits Fall by 26,000

Airbus Confronts Delivery Challenge as Boeing Prevails With MAX

Acer Cuts PC Shipment Forecast on Global Economy, Windows 8

Acron Says Will Buy Even Minority Stake In Tarnow

The Curious Case Of Iowa Broker’s Romanian Property Empire

Credit Writedowns: The Euro Disaster Is About More Than Just Current Account Imbalances

Joshua Brown: Two Reasons the LIBOR Scandal Matters (And One Reason It Doesn’t)

Be sure to follow me on Twitter.

-

Two Investing Tips

Eddy Elfenbein, July 12th, 2012 at 11:10 am -

Morning News: July 12, 2012

Eddy Elfenbein, July 12th, 2012 at 7:37 amEU’s New Crisis Model Gives Spain More Time for Cuts

ECB Zero Rate Slashes Banks’ Overnight Deposits

Europe’s Downturn Creates Unlikely Smugglers

BOJ Refrains From Adding Stimulus, Spurring Stock Decline

Housing Rebound Signaled as Banks Resume Foreclosures

S&P 500 Erases Loss as Investors Look for Stimulus Signs

Oil Drops on Demand Concern Amid Signs Economy Slowing

Fed Is Torn on Tipping Point for Action

HSBC to Apologize at Senate Hearing

Many Regulators Put Their Attention on How JPMorgan Marketed Its Funds

Groupon Shares Hit New Low in Latest Plunge

Cummins Cuts Full-Year Revenue Estimate, Raises Dividend 25%

Jeff Carter: More Federal Stimulus Expected Soon

Roger Nusbaum: 401k Daytrading For Dummies!

Be sure to follow me on Twitter.

-

Cummins Plunges on Lower Forecasst

Eddy Elfenbein, July 11th, 2012 at 2:16 pmA few weeks ago, I said that Cummins ($CMI) was going for a deep discount. I spoke too soon. The stock plunged yesterday after the company slashed its sales forecast for this year from 10% to 0%.

The culprit is, as you might guess, weakness from overseas markets. The key fact is that Cummins generates two-thirds of its revenue from outside the United States. The company said that revenue for Q2 will come in at $4.45 billion while Wall Street had been expecting $5.07 billion.

The good news for investors is that Cummins is raising its quarterly dividend from 40 cents to 50 cents per share. I still think Cummins is underpriced but it’s nowhere near the bargain I had believed.

-

How Many Stocks Should You Own?

Eddy Elfenbein, July 11th, 2012 at 9:53 am -

Dimon Faces Analysts

Eddy Elfenbein, July 11th, 2012 at 9:50 amFrom Bloomberg:

Jamie Dimon will seek to restore investor confidence this week after a trading loss wiped out $39 billion of JPMorgan Chase & Co. (JPM)’s market value and marred his reputation as one of the industry’s best risk managers.

In a departure from his customary earnings-day conference call, Dimon will meet analysts for two hours on July 13 at the bank’s New York headquarters to field questions about the loss and what he’s doing to contain the damage. The firm also is being probed over the possible gaming of U.S. energy markets and was subpoenaed in global investigations of interest-rate fixing.

There has been a “sudden change of perception in the company,” said Nancy Bush, an analyst and contributing editor at SNL Financial LC, a research firm based in Charlottesville, Virginia. “I’ve been watching banks for 30 years now and when they lose the luster, it is extremely hard for them to get it back, particularly when you have someone who was built up and lionized like Dimon.”

Bush said the 56-year-old chief executive officer did an “admirable job of saying nothing” when he appeared before Congress twice last month to testify about the trading loss, which stemmed from bets on credit derivatives at the firm’s chief investment office in London. “But I don’t know if that can go on,” Bush said.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His