Archive for August, 2012

-

Bob Dylan Bonds?

Eddy Elfenbein, August 8th, 2012 at 2:00 pmWhen interest rates are near 0%, investors get creative. From the WSJ:

Bob Dylan’s music was the soundtrack for the counterculture of 1960s America.

Now it has become a selling point for an unusual bond offering being marketed to institutional investors and wealthy individuals.

A privately held Nashville, Tenn., company is preparing a $300 million bond backed by the cut it receives as a middleman between music companies and songwriters and the outlets that broadcast their music.

The company, Sesac Inc., has the exclusive rights to the public broadcast or performance of the music of Mr. Dylan, pop singer Neil Diamond, Canadian rock band Rush and jazz singer Cassandra Wilson.

S&P rated the offering triple B minus, one notch above junk, which seems kinda high.

-

Priceline.com Plunges $113

Eddy Elfenbein, August 8th, 2012 at 12:10 pmShares of Priceline.com ($PCLN) are getting severely crushed today. Imagine the USA-Nigeria basketball game, but in stock form. PCLN has been down as much as $113.70, or 16.73%. After the close yesterday, the company reported earnings of $7.85 per share which was very good; it was 49 cents per share more than Wall Street’s consensus.

The problem, however, was guidance for this quarter. The Street had been expecting Q3 earnings of $12.79 per share on revenue of $1.795 billion. Priceline now says earnings will range between $11.10 and $12.10 per share and sales will be between $1.6 billion and $1.67 billion.

Both Priceline and Orbitz are being hurt by the problems in Europe. So is Priceline a good buy at this price? Let’s bring in our World’s Simplest Stock Valuation Measure:

Growth Rate/2 + 8 = PE Ratio

As a reminder, this is just a simple, ballpark tool and we shouldn’t overly rely on it. Wall Street currently projects a five-year earnings growth rate for Priceline of 23.68%. That translates to a P/E Ratio of 19.84. Wall Street’s earnings forecast for 2013 is $38.95, so that works out to a fair value of $772. It appears that Priceline is currently going for $200 below its fair value.

But we should make some adjustments based on the recent lower guidance. The midpoint of today’s guidance is about 9.3% below Wall Street’s forecast. If we apply that as a constant to next year’s earnings, that brings it down to $35.33.

Now as far as growth is concerned, we have to get a little creative. I don’t believe we need to adjust the long-term growth rate by the full 9.3%. Instead, I think it’s better to ratchet it down by half or 4.65%. Decreasing the rate of growth by 4.65% (note, not the overall number but a reduction in the rate) brings the new five-year growth rate to 17.93%. That’s gives us a fair value of $599.

That’s just an estimate but I think it’s a reasonable one. This means that Priceline may be a bit undervalued but not by much. I don’t think something is a strong buy until it’s at least 30% undervalued.

-

Morning News: August 8, 2012

Eddy Elfenbein, August 8th, 2012 at 6:44 amBank Of England Slashes Growth Forecasts To ZERO As Double-Dip Recession Deepens

German June Industrial Production Fell on Construction Output

Greece’s Rating Outlook Lowered by S&P as Economy Weakens

ECB’s Rescue Worsens Spain, Italy Maturity Crunch

Indigestion for ‘les Riches’ in a Plan for Higher Taxes

Bernanke Promotes Financial Literacy, Says Next Generation Will Be Better Off

Regulators Irate At NY Action Against Standard Chartered

Accusations Against Bank on Iran Deals Surprised U.S. Regulators, Too

‘Avengers’ Helps Disney Smash 3Q Profit Forecast

ING Profit Falls 22% on Spain Investment Sales, Loan Losses

Molson Coors 2nd-Quarter Net Slumps 53% on Higher Costs

Pfizer Settles U.S. Charges of Bribing Doctors Abroad

Mobile Payments Go Mainstream With Square’s Nationwide Starbucks Deal

Jeff Carter: Where Is My Buggy Whip?

Cullen Roche: The Anniversary of the S&P Downgrade – Have we Learned Anything?

Be sure to follow me on Twitter.

-

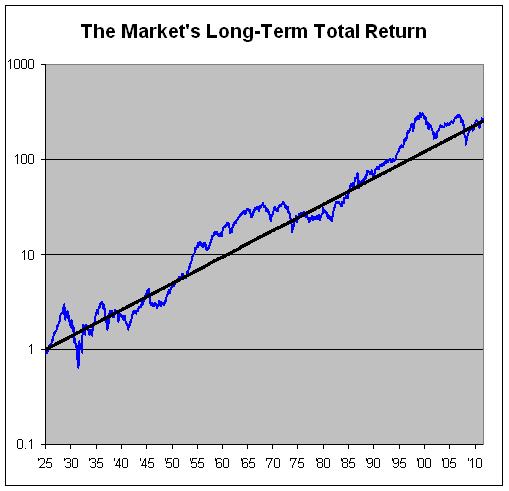

Gross is Right: The Siegel Constant Is History

Eddy Elfenbein, August 7th, 2012 at 12:07 pmRecently, Bill Gross said that the Siegel Constant, the idea that stocks can return 6.6% after dividends and inflation, is no longer useful. I think he’s exactly right on that.

While the data from history has shown that the broader stock market has returned an average of 6.6% a year more than inflation, I think that’s unlikely to continue. The part is most likely not prologue. More importantly, it’s a dangerous assumption for investors to use. At that rate, it means that your investment in the stock market will double, in real terms, every 11 years.

For one, the Siegel Constant is hardly a constant. The data from 1926 through 1999 showed the long-term total return to be over 8%. After more than a decade of sub-par returns, the long-run Siegel Constant is now down to 6.6%.

The other striking fact about the market’s long-term total return is how cyclical it’s been. Here’s the stock market’s long-term total return (in blue) and I’ve added a black trend line that’s grown by 6.6% per year. As you can see, the two lines wind up in the same place, but they’ve hardly tracked each other.

Now here’s the blue line divided by the black line:

What we see isn’t a constant but a cycle. There are long stretches where the market handily outpaces its long-run average (1942 to 1966 and 1982 to 2000), followed by long period of under-performance (1929 to 1942, 1966 to 1982 and 2000 to 2009).

I will defend Siegel against one criticism levied by Gross. Specifically, Gross conflates GDP with stock market return. They’re not the same. Due to dividends, investors should expect the total return of stocks to outpace GDP growth.

-

S&P Sticks By Downgrade

Eddy Elfenbein, August 7th, 2012 at 10:34 amOne year ago, S&P downgraded U.S. debt. The company is sticking by its forecast:

“S&P sticks by its decision,” said Chambers, the 56-year-old chairman of S&P’s sovereign-debt rating committee. “Since the downgrade, our projection for the national debt as a percentage of the economy in five years has actually gotten worse.”

The only person’s judgment who matters is the market’s, and the market’s love for U.S. debt hasn’t subsided. Here’s a look at the long-term Treasury debt ETF ($TLT) over the past year.

-

S&P 500 Breaks 1,400

Eddy Elfenbein, August 7th, 2012 at 10:29 amThe S&P 500 finally broke 1,400 this morning after coming very close several times during the day on Monday. The Nasdaq has burst through 3,000.

Shares of JPMorgan Chase ($JPM) got as high as $37.67 this morning. That’s a post-Whale high. Bear in mind, the stock was at $46 in April. It’s a good lesson in investing that the whole episode cost JPM about one-third of their market value, which is a nice counter argument to the idea of efficient markets.

Earnings season is almost over for us. The last one is Sysco ($SYY) and that’s due on Monday. After that, we turn to the January-April-July-October cycle stocks and we have two, Medtronic ($MDT) and Jos. A. Banks ($JOSB). But those won’t report until the end of the month.

Today’s rally is being led by cyclicals for a change. Energy and Industrials are both doing well today. Energy is probably being aided by the huge fire in California. Defensive sectors like Healthcare and Utilities are mostly unchanged.

-

Morning News: August 7, 2012

Eddy Elfenbein, August 7th, 2012 at 6:41 amDraghi Channeling Merkel Has Traders Raise Bets Against Euro

Italian Economy Contracts for Fourth Straight Quarter

Monti Warns of Euro Breakup as Tussle Over Spain Aid Hardens

South Africa Fines Telkom $55 Million For “Bullying”

Goldman Sachs’s MIST Topping BRICs as Smaller Markets Outperform

Standard Chartered Falls Most in 24 Years on U.S. Iran Probe

Standard Chartered Faces N.Y. Suspension Over Iran Deals

Fed Official Calls for Bond Buying

SEC To Tighten Rules Following Knight Bailout

Best Buy Founder Richard Schulze Offers To Buy Struggling Retailer

Hospital Chain Inquiry Cited Unnecessary Cardiac Work

Lawsuit Accuses G.M. of Blocking Plan to Rescue Saab

Gold Trove Found at Israel Castle Reveals Crusaders’ Forex Moves

Joshua Brown: Chicken or the Egg: The Actively Managed ETF Problem

Roger Nusbaum: Jeremy (Grantham) Spoke

Be sure to follow me on Twitter.

-

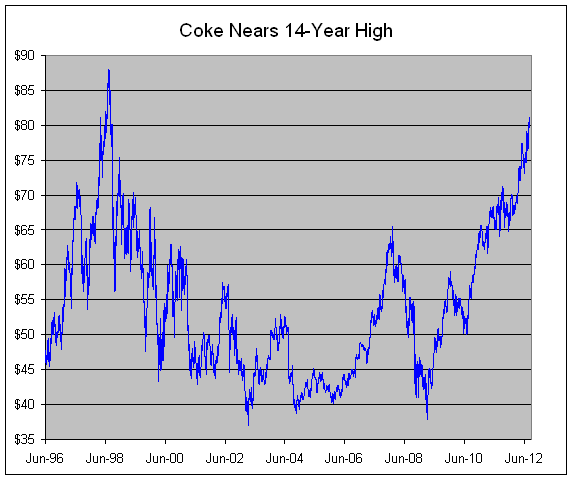

Coca-Cola Nears 14-Year High

Eddy Elfenbein, August 6th, 2012 at 10:25 amShares of Coca-Cola ($KO) are due to split 2-for-1 in a few days. This will be Coke’s first stock split in 16 years.

Coke was enormously overpriced in mid-1998 and the stock is closing in on breaking its all-time high close of $87.94 set on July 14, 1998. If today’s market holds up, KO will close at its highest price in 14 years.

Despite KO’s rally, I still think the stock is massively overpriced.

-

The S&P 500 Nears 1,400

Eddy Elfenbein, August 6th, 2012 at 10:06 amThe market is up this morning and the S&P 500 is very close to breaking 1,400. This is a continuation of Friday’s big rally. The big market news today is that Best Buy’s founder, Richard Schulze, has offered to buy out Best Buy ($BBY) for $24 to $26 per share. BBY closed Friday at $17.64 per share. The stock is up strongly this morning, but only to $21 or so. I think this means that the market is skeptical that Schulze’s deal will come to pass.

A few weeks ago, I noted that Cognizant Technologies Solutions ($CTSH) “is starting to look pretty good at this price.” The stock is up 11.8% on strong earnings and higher guidance.

-

Morning News: August 6, 2012

Eddy Elfenbein, August 6th, 2012 at 6:40 amDraghi Echoing Merkel Has Trader Raise Bets Against Euro

Monti Calls for More Crisis-Fighting Urgency in ECB Standoff

As Libor Fault-Finding Grows, It Is Now Every Bank for Itself

U.K. House Prices Fall as Halifax Sees Stagnant Market

Swiss Banks Face Slow Death as Taxman Chases Assets

Fearing an Impasse in Congress, Industry Cuts Spending

Soft-Spoken Yellen Wields Outsize Influence As Fed’s No. 2

GM, Honda Report Strong Growth in China Sales

Taiwan’s HTC July Sales Fall 45 Percent On Year

Knight Investors Eye Prize in Market-Making for Individuals

Hon Hai Climbs on Renegotiation Over Sharp Stake Price

F&N Seen Breaking Up in Singapore After Heineken Brewer Sale

Apple And Samsung Take Australian Legal Battle To The “Hot Tub”

Jeff Miller: Weighing the Week Ahead: Time to Assess the Evidence?

Howard Lindzon: The REAL Four Horsemen of the Global Economy…Make it Three… and The Stocktwits 50

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His