Archive for October, 2012

-

WMT and JNJ Break Out from Long Ranges

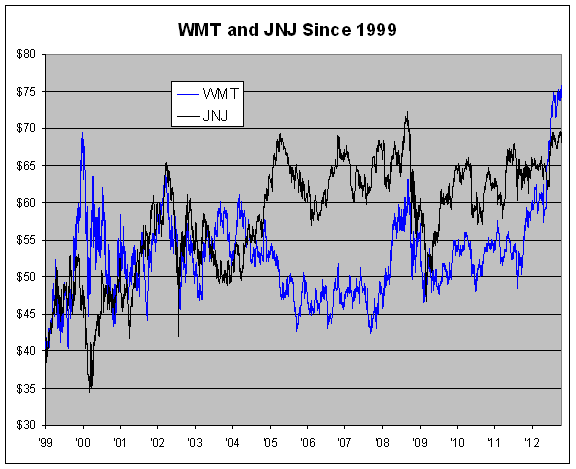

Eddy Elfenbein, October 15th, 2012 at 1:26 pmIn June, shares of Walmart ($WMT) finally took out the stock’s all-time high from 12.5 years before. For much of that time, the stock was locked in what I called the “Mother of All Trading Ranges.” Consider this: For 3,107 straight trading days (or 148 months), Walmart never closed above $65 or below $42. Not once.

Now we’re seeing a similar story with Johnson & Johnson ($JNJ). Last week, the stock came close to breaking through $70 per share which is something it hasn’t done in more than four years. While JNJ’s trading range hasn’t been as narrow or as long as Walmart’s, the stock has spent almost the entire past eight years bouncing between $57 and $72 per share.

This could signal that after a very long rough patch, large-cap blue chips are ready to make new highs.

-

Lazard Lowers Harris to Sell

Eddy Elfenbein, October 15th, 2012 at 12:20 pmShares of Harris Corp. ($HRS) are down today after Lazard Capital lowered their rating on the stock to “Sell.” The stock has been down as much as 4.7% today. This comes after a drop of 4% on Friday.

Let me caution investors not to get too rattled by this sell-off. I think Lazard is way off base here but let’s remember that Harris has had a very strong run since the summer. I had purposely kept my buy-below price at $50 even though the stock had cleared that hurdle. It even broke $52 per share recently. We want to stay disciplined and wait for good stocks to come to us.

Good stocks can bounce around like that. In fact, Harris lost 15.6% between April 30 and May 18 of this year. Despite that, it’s still up over 30% on the year for us. That’s just how the stock market works.

Harris is going for less than 10 times earnings, and the lower share price gives the dividend a yield of 3.15%. Only a few weeks ago, Harris raised their dividend by 12%. I expect another good earnings report in a few weeks. Harris remains a very solid buy.

-

Profits from HFT Down 35% from Last Year

Eddy Elfenbein, October 15th, 2012 at 11:11 amThe New York Times reports that profits from high-frequency trading are down big this year:

Profits from high-speed trading in American stocks are on track to be, at most, $1.25 billion this year, down 35 percent from last year and 74 percent lower than the peak of about $4.9 billion in 2009, according to estimates from the brokerage firm Rosenblatt Securities. By comparison, Wells Fargo and JPMorgan Chase each earned more in the last quarter than the high-speed trading industry will earn this year.

While no official data is kept on employment at the high-speed firms, interviews with more than a dozen industry participants suggest that firms large and small have been cutting staff, and in some cases have shut down. The firms also are accounting for a declining percentage of a shrinking pool of stock trading, from 61 percent three years ago to 51 percent now, according to the Tabb Group, a data firm.

It is a swift reversal for trading firms that have often looked to other investors like profit machines, thanks to high-powered software and superfast data connections that can take advantage of small changes in the price of a stock.

Part of the reason HFT is getting squeezed is a general decline in trading volume. There’s also been a decline in volatility. Rising markets tend to be much calmer than falling markets.

-

Four Years Ago Today: The Dow Loss of 7.87%

Eddy Elfenbein, October 15th, 2012 at 10:56 amToday is the fourth anniversary of the Dow plunging 733.08. That was a loss of 7.87% which was the third-worst percentage loss of the past 80 years. The two that came ahead of that were both in 1987. This Friday will mark the 25th anniversary of the 1987 crash.

Interestingly, the point loss of October 15, 2008 was less than the 777.68 point loss from September 29, 2008, just 16 days before. Since the market had dropped so much between those two points, the latter, smaller drop was a larger percentage loss. Measuring from the close of October 15 to the close from this past Friday, the Dow is up by 55.4%.

The stock market is mostly flat today. I’m glad to see shares of JPMorgan Chase ($JPM) up a little today. Even though the bank reported good earnings and beat estimates as I expected, the market didn’t give the shares much of a boost on Friday.

Here’s a stunning fact: Bespoke reports that the S&P 500 has closed lower on the first day of trading each week for 12 of the past 14 weeks. That’s always been a Monday except for the Tuesday after Labor Day. I guess news over the weekend has usually been bad.

On the banking front, shares of Citigroup ($C) are up 3.2% today on a good earnings report. Profits actually fell to $1.06 per share but that was 10 cents ahead of expectations. I’m still pretty cautious on Citi. The previous two earnings reports were good but the Q4 report from last year was a disaster. Citigroup’s earnings were hurt by a $4.7 billion loss related to a joint venture brokerage business with Morgan Stanley ($MS).

The Commerce Department reported that retail sales rose by 1.1% last month. The number for August was revised upward to 1.2%. When we knock out sales for cars, gasoline and building materials, retail sales rose by 0.9% for September which beat expectations for 0.3% growth.

This is an important report because consumers drive the economy, and sluggish consumers have been responsible for sluggish economic growth this year. The trend of higher home prices seems to be translating into greater consumer spending.

Finally, Alvin Roth and Lloyd Shapley won this year’s Nobel Prize for Economics.

-

Morning News: October 15, 2012

Eddy Elfenbein, October 15th, 2012 at 5:38 amMarkets Look For More Action, Less Talk On The Eurozone

Global Economy Distress 3.0 Looms as Emerging Markets Falter

China Shares End Lower Following Profit Warnings

Tame China Inflation Takes Pressure Off Policymakers

India Inflation Rises To 7.8 Percent In September

Bernanke Defends Fed Stimulus As China, Brazil Raise Concerns

Forecasts For Faster GDP Growth Entail Avoiding Fiscal Cliff

Crude Oil Drops as Iran Offers Nuclear Talks

Softbank to Buy 70% of Sprint as Son Seeks Growth in U.S.

CNH Rejects Fiat Industrial Merger Terms

Amazon.com Says E-Book Refunds May Be Coming

Microsoft Makes New Push Into Music

Joshua Brown: Beating the Show-Offs

Cullen Roche: Cracks in the Profit Facade….

Be sure to follow me on Twitter.

-

The 50-DMA Holds!

Eddy Elfenbein, October 12th, 2012 at 6:12 pmIt was close. Very, very close. But the S&P 500 closed just barely above its 50-DMA. The index closed Friday at 1,428.59. The 50-DMA is now 1,328.38.

-

S&P 500 Threatens to Close Below 50-DMA

Eddy Elfenbein, October 12th, 2012 at 1:59 pmFor the first time since June 28th, the S&P 500 may close below its 50-day moving average. The index came close a few times in July but never did. The key number to watch today is 1,428.37.

-

JPMorgan Easily Beats Estimates

Eddy Elfenbein, October 12th, 2012 at 1:04 pmJPMorgan Chase ($JPM) reported its Q3 earnings this morning and as I expected, they easily surpassed Wall Street’s consensus. For July, August and September, the bank raked in $5.7 billion or $1.40 per share which was 18 cents above the Street’s forecast. Profits were up 34% and revenues rose 6% to $25.9 billion. The Street had been expecting $24.5 billion for the top line.

More good news is that the losses from the London Whale debacle are basically ending. JPM execs said that the trade is still unwinding and the red ink has been reduced to a “modest” loss for Q3. All told, the trade cost them $6.2 billion. JPM said that core loans rose by 10% and mortgages were up by 29%. Overall, this was a very good quarter for JPM.

“I would hope for America’s sake we start to fix the things that make the mortgage underwriting too tight,” Mr. Dimon said on a conference call with reporters.

Throughout its core lending businesses, JPMorgan showed signs of strength. The commercial banking group reported record revenue. The volume of credit card sales jumped 11 percent over the previous year, bolstering the broader unit. The card services and auto business posted profits of $954 million, up 12 percent.

With the improving credit environment, JPMorgan set aside less money to cover potential losses. In the mortgage banking business, the bank cut the amount of reserves by $900 million. Across the bank, JPMorgan set aside $1.79 billion of such funds, compared with $2.41 billion a year earlier.

The stock gapped up earlier today but has since pulled back to the mid-$41 area which is where it was during the first part of this week.

-

CWS Market Review – October 12, 2012

Eddy Elfenbein, October 12th, 2012 at 8:05 am“Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it.” – Peter Lynch

Earnings season is finally here. This is when we find out who on Wall Street has been naughty and who’s been nice. This earnings season could be the first one in eleven quarters that corporate profits come in below where they were the year before. The analyst community currently expects a 1.7% drop in earnings. That’s not much, and I should add that that’s well within the margin of error, so we may end up seeing a small earnings increase. Unlike last quarter, analysts have largely stopped slashing their earnings forecasts, so that may be a positive sign.

We continue to get evidence that the economy may have turned around. I’m not saying things are good, but the sluggish GDP numbers we’ve seen in 2012 may not last into next year. The biggest news came last week when the Labor Department reported a big drop in the unemployment rate. The jobless rate fell from 8.1% in August to 7.8% for September. We had more good news on Thursday with the lowest jobless claims report in four-and-a-half years.

Until the election passes, I continue to urge caution with the stock market. Investors must think defensively. Focus on high-quality names, solid dividends and companies with decent guidance. In this week’s CWS Market Review, I’ll highlight some names I like on our Buy List. I’ll also discuss some of the upcoming earnings reports. But first, let’s look at what’s happening with the broader market.

The S&P 500 Just Put in a Double Top

After hitting a multi-year high on September 14, the S&P 500 pulled back, then put on another rally that petered out last week just shy of the highs from mid-September. Market technicians call that a “double top,” and it’s usually a bad sign. A triple top may follow. I’m careful not to place too much emphasis on these chart patterns, but I think it’s telling us that the bulls didn’t have enough confidence to keep the rally going. In fact, they were much more confident when the news was much worse.

Another reason I think the economy may be doing better than a lot of folks suspect is that the cyclicals continue to lead the market. Since cyclical stocks tend to be choppy, their outperformance has been rather haphazard. Still, economically sensitive stocks have led the rest of the market since August 2. During that time, there were two counter moves, one in late August and another in late September, when investors rushed towards safer names.

The larger trend is that investors are now willing to take on more risk than they had been. It’s hard to reason with a market where a 10-year Treasury goes for 1.7% (and that’s actually 31 basis points above its summer low) while a stock like Johnson & Johnson ($JNJ) yields a hefty 3.59%.

We have two earnings reports due next week, plus JPMorgan Chase’s ($JPM) is due out later today. (I incorrectly said in last week’s newsletter that JPM was scheduled to report on Thursday.) I’m writing this on Friday morning, so you may already know JPM’s earnings. I’ve been expecting a major earnings beat. Also, Wall Street carefully watches their earnings report because the company is the first of the major banks to report.

The stock had done well lately and on Thursday, JPM reached its highest close in five months. I currently rate JPM a buy up to $43 per share, and it’s very close to that. But I don’t want to make any changes to my Buy-Below price until I’ve had a chance to digest the earnings report. JPM is a very profitable bank. Yes, Jamie Dimon is a loudmouth, but that fact shouldn’t affect the stock as much as it does. (By the way, Bethany McLean at Reuters dissects the case against JPMorgan and finds many problems with the government’s case.) Stick by JPM.

Stay Tuned for Earnings from Stryker and J&J

On Monday, Johnson & Johnson ($JNJ), the mega healthcare conglomerate, is due to report their third-quarter earnings. This company is in the beginning stages of what could be an impressive turnaround. The new CEO, Alex Gorsky, has only been on the job for only a few months, but investors have been impressed so far. Before Gorsky, it seemed like JNJ made two things—lots of money and lots of bad press.

For Q3, Wall Street expects $1.21 per share. In July, JNJ lowered their full-year guidance to a range of $5 to $5.07 per share. I think that’s a very reasonable target. One of the problems with JNJ is that it’s been squeezed this year by the strong dollar. However, the currency market took back a lot of the dollar’s gain this year. That could be good for JNJ’s bottom line.

My take: Blue chips don’t get much bluer than JNJ. I really like the dividend which gives JNJ a rich yield of 3.59%. Johnson & Johnson is a high-quality buy up to $70 per share.

Stryker ($SYK), the medical devices stock, will report earnings on Tuesday, October 16th. I like this company a lot. Three months ago, Stryker missed the Street’s consensus by a penny per share, but that was largely due to weakness in Europe. For Q3, Wall Street expects 98 cents per share, which again could be slightly too high, but I’m not very worried about a stock like Stryker missing by a hair.

The important news is that in July, Stryker reiterated its forecast for double-digit earnings growth for this year. Not many companies are doing that in this environment, and that guidance translates to full-year earnings of $4.09 per share. Stryker should be able to hit that. The stock has been fairly disappointing this year; it’s been locked in a trading range between $52 and $56. Prudent investors should take notice whenever a sluggish stock has superior earnings. Stryker is a top-notch company. Buy up to $57.

Top Values on Our Buy List

Each week, I like to highlight a few stocks on the Buy List that are exceptionally good values right now. I continue to think Moog ($MOG-A) is a very inexpensive stock. Don’t overlook boring stocks. Moog is a solid buy any time you see the shares below $45.

I’ve noticed that CA Technologies ($CA) has slid down in recent weeks. Going by Thursday’s closing price, the stock yields 4%. That’s a good deal. CA Technologies is a good buy up to $30 per share.

Another stock that’s been drifting lower has been Oracle ($ORCL). The last earnings report didn’t impress Wall Street much. I think this is a good opportunity to pick up shares of Oracle below $31, which is just over 10 times next year’s earnings estimate. (Here’s a good interview with CEO Mark Hurd.) Oracle is a very good buy up to $35.

Hudson City ($HCBK) continues to march higher. On Thursday, the stock got as high as $8.24, which is a new 52-week high. The stock is up over 30% on the year for us. I’m raising my Buy-Below price to $9.

Before I go, many of you have asked me about a stock not on our Buy List, Apple ($AAPL). The stock has pulled back over the last three weeks. I can’t predict if all the selling is done, but on a pure valuation basis, Apple is very reasonably priced. The stock is going for less than 12 times next year’s earnings. On top of that, Apple’s cash-and-investments position currently stands at $117 billion. That’s a staggering figure. In my opinion, the stock is easily worth $800 per share.

That’s all for now. Next week will be dominated by more earnings news. Several major companies are due to report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: October 12, 2012

Eddy Elfenbein, October 12th, 2012 at 2:04 amIMF, World Bank Meetings In Tokyo

Spain Says Downgrade Won’t Affect Plans

Yuan Gains Steam in Global Trade

Indian Industrial Output Up 2.7% In August; Too Early To Celebrate, Say Analysts

U.S. Trade Gap Widens As Exports Fall Again

USDA Sees Tightening Corn, Soy Supplies

Biden, Ryan Clash as Both Pledge Unemployment Below 6%

U.S. Struggles to Rescue Green Program Hit by Fraud

Moment Of Truth Approaching For U.S. Manufacturers

Sprint Nextel In Talks For Possible Takeover By Japan’s Softbank

Infosys Profit Disappoints, Shares Fall

Can AMD Mount a Turnaround in the Server Space?

In Fight for a Mexican Company, a Peek Into a Tycoon’s World

Joshua Brown: In The Thick of It

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His