Archive for March, 2013

-

The VIX Hits 11.87

Eddy Elfenbein, March 11th, 2013 at 12:28 pmWow! The $VIX got down to 11.87. That’s the lowest reading in six years.

-

BBBY Rises 1.77%

Eddy Elfenbein, March 11th, 2013 at 10:30 amSo far, it’s a good day for our Buy List. Ford ($F), Medtronic ($MDT) and Wells Fargo ($WFC) all hit new 52-week highs. Thanks to the article in Barron’s, Bed Bath & Beyond ($BBBY) is up 1.77% in early trading.

-

Tiger Woods and the Stock Market

Eddy Elfenbein, March 11th, 2013 at 10:12 amIn January, after Tiger Woods won the Farmers Insurance Open, Sam Weinman wrote that historically, a winning Tiger has been correlated with a winning stock market.

We’ve heard how golf’s financial well-being rises and falls with Tiger Woods. But what if it was the entire American economy that hinged on the state of Woods’ game?

You laugh. Yet a closer look at the fluctuations in the Nasdaq Composite Index over the last 17 years show a remarkably similar pattern to Woods’ own ups and downs as a professional.

Consider: When Woods turned pro in August 1996, the Nasdaq bounced around in the 1,100 range. A little more than a year later, with Tigermania in full swing following Woods’ landmark win in the 1997 Masters, the Nasdaq had eclipsed 1,700. The upward progression continued as Woods overhauled his swing under Butch Harmon and then embarked on the most dominant golf stretch of golf in the game’s history. In May 2000, whenWoods was busy winning five of six majors, the Nasdaq famously surpassed 5,000 points.

A coincidence? Probably. But as Gary Kaminsky, the Capital Markets Editor for CNBC, said, “If you want to draw some conclusions, stock market participants who are avid golf fans become more aggressive and optimistic in thinking about their investments when Tiger wins a tournament.”

It’s no secret that a lot of guys on Wall Street are golf nuts. Obviously, I’m more than skeptical of any true relationship between a rising market and a rising Tiger. Of course, the relationship may work the other way, and Woods is being helped by a strong market.

In any event, I’ll point out that Tiger won again this past weekend.

-

Consumers Are Still Spending Away

Eddy Elfenbein, March 11th, 2013 at 9:24 amOne of the concerns many economists had going into this year was that the rise in payroll taxes would cause Americans to rein in their consumer spending. The initial evidence suggests that just ain’t the case. Americans are as shopper-happy as ever. Shopping, it seems, is our national obsession.

I’m hard pressed to call Washington’s policies “austerity;” Uncle Sam is still going to run a sizeable deficit this year, but there clearly will be a fiscal drag on the economy this year. Fortunately, the economy seems to be at the point where it can shoulder that burden. For example, both Ford ($F) and GM expect sales this year to be their best since 2007. We had massive deficits a few years ago, and consumer spending was hard to find.

As I mentioned in a recent CWS Market Review, the key equation that’s under-pinned this market is wherever consumer spending intersects with financing. People buying. People borrowing to do that buying. Banks lending to people to do that buying. Any good company in that constellation has done well.

There are two other important positives to highlight. One is that Corporate America generally has a very strong balance sheet: low debt and lots of cash. Perhaps too much cash. The other is that the economy will probably be helped by businesses restocking their inventory. That should add a little to GDP growth this year. JPMorgan recently said that we’re not too far from a picture-perfect world.

-

Morning News: March 11, 2013

Eddy Elfenbein, March 11th, 2013 at 6:09 amWhy Italy Could Be the Next ‘Bad Boy of Europe’

German Exports Increased More Than Forecast in January

BOJ Nominee Vows Swift Action As Orders Data Disappoints

China’s Retail-Industrial Data Show Weakest Start Since 2009

India Trumps Pakistan’s Iran Rice Trade Boom With Oil Rupees

Dollar Firm On Bets Fed Could Back Off More Stimulus

Payrolls Rise as U.S. Jobless Rate Reaches Four-Year Low

Bernanke Provokes Mystery Over Fed Stimulus Exit

Paulson Said to Explore Puerto Rico as Home With Low Tax

China E-Commerce Giant Alibaba Names Insider To Succeed Billionaire Founder As CEO

AirAsia Buys Zest Air Stake to Boost Philippines Travel Bet

Goldman Leads Decline As Wall Street Commodity Revenues Plummet

Online Bettor Intrade Shuts Down, Cites Irregularities

Chairman of Sony Announces Retirement

Jeff Miller: Weighing the Week Ahead: More Opinions, Less Data

Epicurean Dealmaker: Curriculum Vitae

Be sure to follow me on Twitter.

-

Barron’s: BBBY Could Fetch $85 per Share

Eddy Elfenbein, March 10th, 2013 at 10:05 pmThis weekend, Barron’s highlighted Buy List member Bed Bath & Beyond ($BBBY). I was pleased to see them mention many of things we like about BBBY. The only awkward note was that the article presented the company as an ideal stock for Warren Buffett. That really seemed out of the blue and felt tacked on in order to draw reader interest.

Bed Bath has had no direct competition since Linens ‘n Things was liquidated in 2008 after a bankruptcy. It controls an estimated 25% of the domestic home-furnishings market. Department stores offer limited competition because clothing generally generates higher profits per square foot of selling space than housewares.

Bed Bath’s strategy is unlike any other major retailer’s. It rarely advertises and usually avoids markdowns except on seasonal items, while providing excellent customer service. It targets customers with coupons offering a 20% discount, or $5 off, a single item (with a wide number of excluded products) to help drive traffic. As savvy shoppers know, Bed Bath & Beyond generally accepts expired coupons, and it’s known for a liberal returns policy–customers sometimes needn’t present a receipt. And they often present multiple coupons. The approach works because many customers come for a single item and leave with many, as they walk around the “racetrack” layout of the narrow-aisled stores.

(…)

Bed Bath’s store managers have considerable autonomy in merchandise selection. The company has no central distribution facilities; suppliers typically deliver directly to stores. Feinstein has called this “our uniquely decentralized culture.”

Barron’s said that BBBY “could” fetch $85 per share. Yes, I suppose it could, though I would have to think the odds are low. Still, any reasonable analysis indicates that this is a strong company going for a very fair price. The magazine also said that BBBY “could be the most financially conservative big retailer in the U.S.” (Again with “could”?) Consider that BBBY has zero dent and nearly $4 per share in cash. Thanks to buybacks, share count has dropped by 100 million to 226 million since 2004. I’m not a fan of buybacks, but at least they’re actually reducing the amount of shares.

-

The Bull Market Turns Four

Eddy Elfenbein, March 9th, 2013 at 11:11 amToday is the fourth anniversary of the big March 9, 2009 low. The S&P 500 closed at 676.53 four years ago today. Yesterday, the index closed at 1,551.18. That’s a staggering gain. This is one of the greatest bull markets in history, and it’s also one of the most hated.

Tomorrow is the 13th anniversary of the 2000 Nasdaq high, and Monday is the 10th anniversary of the 2003 pre-war low.

That’s not all for historical milestones. Today is the 80th birthday of the Emergency Banking Act of 1933. This is the act that allows only Federal Reserve-approved banks to operate in the United States of America.

Franklin Roosevelt, who had just become president, declared a national bank holiday. The New York Stock Exchange also closed down. The Emergency Banking Act effectively declared 100% deposit insurance, so the bank runs immediately stopped.

When the stock market re-opened on March 15th, the Dow soared 15.34%. To this day, that still ranks as the Dow’s single-biggest daily gain.

Here’s more on the Emergency Banking Act from Wikipedia:

The Emergency Banking Act was introduced on March 9, 1933, to a joint session of Congress and was passed the same evening amid an atmosphere of chaos and uncertainty as over 100 new Democratic members of Congress swept into power determined to take radical steps to address banking failures and other economic malaise. The EBA was one of Mr. Roosevelt’s first projects in the 100 days. The sense of urgency was such that the act was passed with only a single copy available on the floor and most legislators voted on it without reading it.[1]

According to William L. Silber[2] “The Emergency Banking Act of 1933, passed by Congress on March 9, 1933, four days after FDR declared a nationwide bank holiday, combined with the Federal Reserve’s commitment to supply unlimited amounts of currency to reopened banks, created de facto 100 percent deposit insurance. Much to everyone’s relief, when the institutions reopened for business on March 13, 1933, depositors stood in line to return their stashed cash to neighborhood banks. Within two weeks, Americans had redeposited more than half of the currency that they had squirreled away before the bank suspension. The stock market registered its approval as well. On March 15, 1933, the first day of stock trading after the extended closure of Wall Street, the New York Stock Exchange recorded the largest one-day percentage price increase ever with the Dow Jones Industrial Average gaining 8.26 points to close at 62.10; a gain of 15.34 percent. With the benefit of hindsight, the nationwide Bank Holiday and the Emergency Banking Act of March, 1933, ended the bank runs that had plagued the Great Depression.”

In March 1933 President Roosevelt signed Executive Order 6102 criminalizing the possession of monetary gold by any individual, partnership, association or corporation[3][4] and Congress passed a similar resolution in June of 1933.[5]

This act was a temporary response to a major problem. The 1933 Banking Act passed later that year presented elements of longer-term response, including formation of the Federal Deposit Insurance Corporation (FDIC).

-

Gardner Denver Bought for $3.74 Billion

Eddy Elfenbein, March 8th, 2013 at 1:38 pmOne of my Watch List stocks, Gardner Denver ($GDI), is being bought out for $3.74 billion. KKR is offering $76 per share for the industrial machinery maker, which is only 3% above yesterday’s closing price.

In December, SPX Corp. ($SPW) considered buying GDI for $85 per share but its shareholders shot down the idea. GDI was trading at $54.71 in October when it said it was looking for a buyer. I had even considered adding GDI to this year’s Buy List but the price spike after the October announcement gave me pause. Still, I think KKR is getting a very good deal for GDI.

The stock is up to $74.70 so there must be a little skepticism that the deal will go through.

-

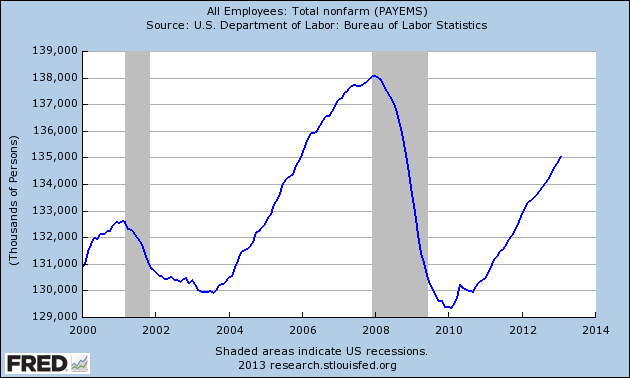

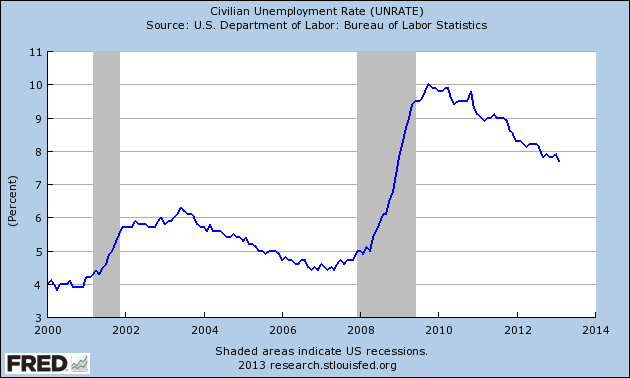

February Jobs Report: +236K

Eddy Elfenbein, March 8th, 2013 at 8:33 amThe Labor Department just reported that the economy created 236,000 new jobs last month. The unemployment rate dropped to 7.7%.

Looking at the details, private sector payrolls rose by 246,000 last month. Wall Street had been expecting a gain of 170,000. Revisions were a mixed bag: December NFP was revised higher by 23,000 but January was knocked back by 38,000.

Overall, this was a very good report. The U.S. economy has now gained back 5.726 million of the 8.736 million jobs lost, or nearly two-thirds.

Here’s the NFP chart:

Here’s the unemployment rate:

-

CWS Market Review – March 8, 2013

Eddy Elfenbein, March 8th, 2013 at 7:06 am“The meek shall inherit the earth, but not its mineral rights.” – J. Paul Getty

Shortly after the opening bell on Tuesday, the Dow finally broke through to a new all-time high. The previous high had been reached on October 9th, 2007, nearly five-and-a-half years before, or 1,974 days to be exact. Let me add that there are certainly a lot of valid criticisms of the Dow. It’s price-weighted and contains only 30 stocks, but make no mistake—the fact that the oldest and best-known index of U.S. stocks just reached an all-time high is a big deal. In less than four years, the Dow has added an astounding 7,780 points.

Since the mega-low reached four years ago tomorrow, the S&P 500 Total Return Index has gained more than 148%. Let’s take a step back and consider some important facts: This is one of the greatest bull market rallies in history, and our Buy List, I’m happy to report, has done much better. For being dead, discredited and worthless, buy-and-hold has had a rather successful four years. The U.S. equity market has added nearly $10 trillion, and as well as the market has done, valuations are still below their peak. Did anyone see this coming four years ago?

Remember how scary things were back then. In 2008, the Dow had its worst year in 77 years. Actually, the market’s rally has been even more impressive when we consider the massive losses centered on some infamous financial stocks. AIG is still trading but it’s 97% below where it was in October 2007.

To show you how much things have changed, in this week’s CWS Market Review, I’ll make the case that right now is the golden age for investing in financial stocks. I’ll also discuss a few upcoming Buy List earnings reports. Several of our Buy List stocks such as Fiserv ($FISV), JPMorgan Chase ($JPM), Oracle ($ORCL), Wells Fargo ($WFC) and Stryker ($SYK) have recently broken out to fresh 52-week highs. (I just raised my Buy Below on Stryker last week, and the stock jumped even higher! SYK is our first 20% winner in the year.) Heck, even WEX Inc. ($WXS) has made back much of what it lost. But first, in response to many questions from readers, I wanted to give you my thoughts on Apple ($AAPL).

Apple Is a Strong Buy Up to $435 per Share

An interesting aspect of this recent market rally is that Wall Street’s super-star stock, Apple ($AAPL), has been left in the dust. Since peaking at $705 in September, shares of the iPod/Pad/Phone maker have fallen as low as $419. That’s a staggering loss of nearly $270 billion in market value.

Many of you have asked me my opinion on Apple so I’ll cover it now and say that the shares are a very good buy (note that AAPL is not on our 2013 Buy List). Let me explain what’s been happening. In the world of investing, money managers are under a great deal of pressure to seek out “non-correlated assets.” In simpler terms, when everybody else zigs, they want stocks that zag.

If the stock market rises, say, 3% in a given month, then we have a pretty good idea of where stocks like DuPont ($DD) or Procter & Gamble ($PG) or Merck ($MRK) will be. But a money manager can’t rely on doing what every else does. If they’re charging top-dollar fees, they need to zero in on the assets that are, in essence, doing their own thing. For a long time, Apple was certainly doing its own thing and doing it very well. Apple wasn’t only weakly correlated with the rest of the market, but there was hardly a major stock out there that behaved like Apple. The closest I could find was Qualcomm ($QCOM) and even that correlation was pretty weak.

At the risk of metaphorical excess, Apple became the golden goose. Money managers just gobbled up shares of AAPL and watched the profits roll in. In Fortune this week, Philip Elmer-DeWitt wrote about the harrowing tale of Andy Zaky who bankrupted a hedge fund and paid newsletter service solely dedicated to investing in Apple. Things were getting crazy, but now we’re seeing the flip side of non-correlation: A rising tide can send a non-correlated boat right to the bottom.

At Business Insider, Joe Weisenthal and Matthew Boesler pointed out that Apple’s recent collapse has been mirrored by the fall in gold miners. This makes sense because all those non-correlated sectors that provided so many good times last year are being abandoned all at once.

I had considered adding Apple to this year’s Buy List but I didn’t think the selling was over just yet. Now, however, the shares are quite inexpensive and most of the momentum guys have been cleared out. The numbers at Apple are simply phenomenal. Apple is sitting on $137 billion in cash, or $145 per share. Going by Thursday’s closing price, Apple is trading for less than 10 times this fiscal year’s earnings, and the dividend yields 2.5%. I’m still not adding Apple to our Buy List (I can’t make any changes until the end of the year), but I rate AAPL a very good buy if you can get it below $435 per share.

The Golden Age of Investing in Financial Stocks

Despite the massive flameout in many financial stocks, the current environment is ideal for investing in financial firms. Eighteen months ago, I said that the Financial Sector ETF ($XLF) was “a speculative buy if it drops below $12 per share.” It did, and today the XLF is over $18. As well as it’s done, the fundamentals of the financials are still remarkably strong.

This is excellent news for stocks on our Buy List like JPMorgan Chase ($JPM), Wells Fargo ($WFC) and Nicholas Financial ($NICK). Let’s run down some of the reasons why the financial sector is so appealing. The biggest is that the Federal Reserve is keeping short-term interest rates near 0% and has promised to keep them there for some time. The Fed’s position clears up a lot of uncertainty, and Wall Street likes it that way. Another big reason in favor of financials is that the economy is slowly improving. At a firm like Nicholas Financial, the overall quality of their loan portfolio has improved dramatically.

We also have to look at the mortgage market. For obvious reasons, many financial stocks are closely tied to the mortgage market, and the U.S. housing sector continues to improve. Thanks to Bernanke and his friends at the Fed, the bond-buying policy has pushed down mortgage rates and they’ll probably stay low. This time, the improvement in the housing market is far sounder and more sustainable than it was last decade. Let’s not forget that lending standards have thankfully improved.

Another key point is that valuations for many financial stocks are still quite modest. JPM just broke though $50 per share and it’s going for less than nine times Wall Street’s estimate for next year’s earnings. Based on Thursday’s close, JPM yields 2.4% and I’m expecting the bank to raise its dividend soon. I think the current 25-cent quarterly dividend will go up to 30 cents per share. That would still be less than 22% of their full-year earnings.

Given the current environment, I doubt many investors will be able to beat XLF this year or do it with less volatility. We’re going to look back at this era as a great time to buy financial stocks.

Three Upcoming Buy List Earnings Reports

Three of our Buy List stocks are due to report earnings later this month. Ross Stores ($ROST) already told us they had strong sales for their fiscal fourth quarter (ending in January). The discount retailer raised its Q4 guidance to a range of $1.05 to $1.06 per share; then a few weeks later Ross raised guidance again, this time to $1.06 to $1.07 per share. Since that’s a pretty tight range, I’m going to go out on a limb and say that’s probably very accurate. Ross Stores also sweetened its dividend by 21%. I love it when good companies raise their dividends.

I’ll be curious to see what kind of guidance Ross offers for Q1. The economic reports suggest that consumers haven’t slowed down at all, although Ross had a tepid sales report for February, and the stock dropped more than 7% on Thursday. For Q1, I’m expecting a range somewhere between $1.00 and $1.10 per share. Don’t let the recent downdraft rattle you: This company has been making all the right moves. Ross Stores is an excellent buy up to $62 per share.

Oracle ($ORCL) is also due to report earnings soon. I don’t know the exact date just yet, but it will probably be sometime in the week after next. I’m looking forward to a good report from Oracle. In December, Larry Ellison’s software empire told us to expect earnings (their fiscal third) to range between 64 and 68 cents per share. I’ve run the numbers, and I think that’s too low. My numbers say that Oracle should be able to deliver 70 cents per share.

I’ll give you a very brief idea of how to think about Oracle. The company is doing very well except for one major weak spot which is hardware. Some of this is due to Oracle’s previous acquisitions. The company has assured us that hardware is about to turn a corner. We haven’t seen this just yet, but it’s been promised. Well, now I want to see some hard evidence.

I also want to see what Oracle has to offer as far as guidance for Q4 (ending in June). The Street currently expects 88 cents per share, but I think the company may offer a conservative estimate. Unlike other companies in the U.S., Oracle has been doing fairly well in Europe. Oracle remains a very good buy up to $37.

Late last year, shares of FactSet Research Systems ($FDS) got dinged when the company gave weaker-than-expected guidance for their second quarter (ending February). The issue isn’t so much problems within FactSet; rather it’s that many banks have been working to cut costs. In fact, we recently saw that as JPMorgan said that it’s looking to cut up to 17,000 jobs by the end of next year (another reason why financials are so strong).

For Q2, FDS said revenues rose to $212 – $215 million, and EPS climbed to $1.11 – $1.13 per share. The Street had been expecting revenue of $216.3 and EPS of $1.13. So this wasn’t exactly a big “miss” but the stock dropped 4.4% which was one of the reasons why I added FDS to this year’s Buy List. FactSet is a very solid company. I’m raising the Buy Below on FDS to $100 per share.

Updated Buy Below Prices

Before I go, I want to say that Harris Corp. ($HRS) is an exceptionally good buy right now up to $53. The stock was punished this week when it was downgraded by Oppenheimer. You can take advantage of their ball call. In addition to FactSet Research, I also want to raise the Buy Below price on Stryker ($SYK) to $66. I’m lifting JPMorgan Chase ($JPM) by two dollars to $52 per share. I’m also going to raise Cognizant Technology Solutions ($CTSH) by one dollar to $82 per share, and WEX Inc. ($WXS) by three dollars to $75 per share.

That’s all for now. Next week, we’ll get important reports on retails sales, industrial production and consumer inflation. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His