Archive for May, 2013

-

Johnny Cash – I’ll Fly Away

Eddy Elfenbein, May 31st, 2013 at 8:09 pm -

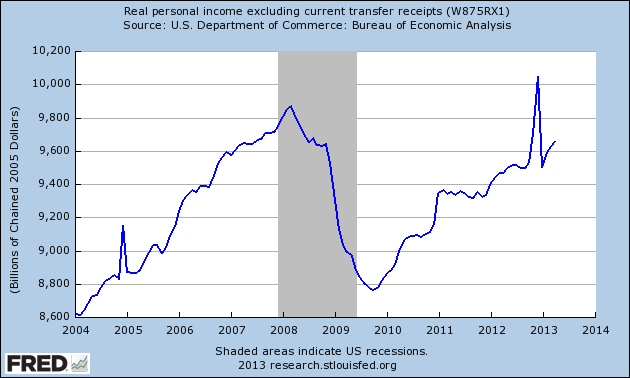

Personal Income Unchanged for April

Eddy Elfenbein, May 31st, 2013 at 10:08 amThe government reported this morning that personal income was unchanged in April. Economists were expecting an increase of 0.1%. So far, the market doesn’t seem terribly interested.

The stat in the personal income report that I find most interesting is real personal income after transfer payments. That’s a mouthful but it’s one of the better gauges for how the economy is performing. It rose by 0.3% in April.

Here’s a look at the data series:

The big jump at the end of last year was due to the dividend payouts. What I find interesting is that, looking past the December spike, the rising trend is continuing.

-

CWS Market Review – May 31, 2013

Eddy Elfenbein, May 31st, 2013 at 7:05 am“As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes.”

– John Maynard KeynesLast Wednesday, May 22nd, the stock market experienced a very rare event. The indexes jumped up early in the day, hit a new intra-day high, then turned around and closed lower by more than 1% (see the chart below). That may not sound like much, but it totally freaked traders out, and they’re an irritable crew to begin with.

Why did this put everyone on edge? Because the last two times this happened were just before the market crashes of 2000 and 2007. Despite the big intra-day swing, the stock market is still holding up well, and I’m surprised at the number of folks who are convinced that we’re headed for an imminent downturn. Let’s look at the evidence.

Is a Market Crash Imminent?

As usual, I’m not going to bother with trying to predict what the herd will do. As investors, we need to accept reality on reality’s terms. The fact is that the bears have not been treated well by this market. As long as the S&P 500 stays above its 50-day moving average (right now about 1,598), I think we’re mostly safe. As always, I urge all investors to take a conservative approach and focus on high-quality stocks like the ones you see on our Buy List.

Speaking of our Buy List, it’s been red hot lately. I probably shouldn’t mention it, as it might jinx us, but our Buy List has finally caught up to the overall market. Since April 18th, our Buy List is up 10.43%, which is ahead of the S&P 500’s 7.32%. Ten of our Buy List stocks are up more than 20% for the year, and Microsoft ($MSFT) is up 31% this year.

Ford Motor ($F), in particular, has been a rock star for us. Did anyone else notice that Ford finally broke $16 per share on Thursday? Good, me too. As impressive as Ford’s run has been, the stock is far from expensive. Ford currently trades at less than 10 times next year’s earnings estimate. I’m looking forward to another good earnings report in late July. This week, I’m raising my Buy Below on Ford to $18 per share.

Several of our financial stocks have also been performing very well. On Thursday, both of our large banks, JPMorgan Chase ($JPM) and Wells Fargo ($WFC), hit new 52-week highs. I’ve been cautious on raising my Buy Below prices, but this week, I’m going to raise my Buy Below on WFC to $46 per share. Last week, I mentioned that Nicholas Financial ($NICK) looked especially attractive below $13.70. The sale didn’t last long. On Thursday, NICK jumped up to $14.82. I’ve also been very impressed with AFLAC ($AFL) recently. The stock came close to breaking $57 on Thursday. I still think AFL is a bargain.

What Do Higher Long-Term Rates Mean for Us?

At the end of September 2012, analysts on Wall Street were expecting 2013 earnings for the S&P 500 of $114.96. Today, the consensus is down to $109.53, yet the S&P 500 has gained more than 14% over that time. What’s changed is that the earnings multiple has slowly expanded. One dollar in earnings, or expected earnings, is worth more than that same dollar a few months ago. Every day, it seems like investors become less and less nervous. Interestingly, this week we learned that consumer confidence rose to a five-year high. (Just once, I’d love to see a rise in consumer confidence reported as a drop in consumer humility.)

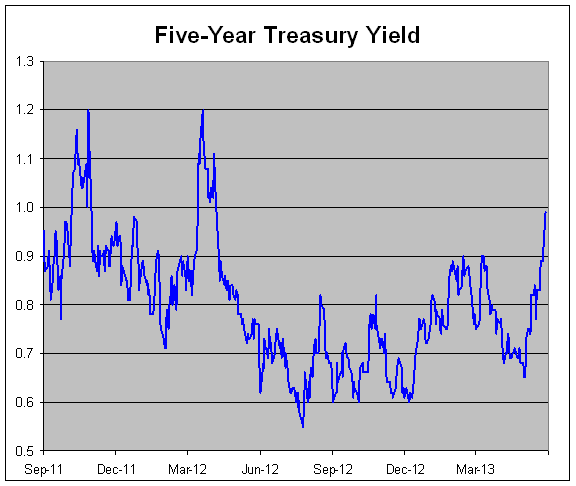

The odd aspect of this rally is how gradual it’s been. It’s also as if we go up by a small amount each day. The S&P 500 has only had one 2% down day all year. But the interesting action lately hasn’t been in the stock market—it’s been in the bond market. After hearing warnings of this for months, long-term interest rates have finally started to rise. On Tuesday, the yields for the middle part and long end of the yield curve had their highest rates in more than a year. Bear in mind, of course, that interest rates are still very low. Uncle Sam can borrow for five years at a measly 1%. At the beginning of May, the five-year fetched 0.65%.

The move in the bond market is being mirrored by a similar move in the stock market. The difference is that stocks aren’t going down; they’re going up, but the more defensive names are trailing. Remember last week, when I talked about the Garbage Stock Rally? This is how it’s playing out.

We can really see evidence of this by looking at the weakness of utility stocks. Investors like to buy boring utilities, so they’re protected from sudden downdrafts. Yet we’ve had a bull market, and utes have gotten clobbered anyway. From April 29th to May 30th, the Utilities Sector ETF ($XLU) dropped nearly 9%. What’s happening is that investors are choosing growth over dividends. Interestingly, Warren Buffett just made a big purchase in the utility sector. Berkshire Hathaway’s MidAmerican Energy said it’s buying NV Energy for $5.6 billion.

Whenever bonds start to fall, there’s often a fear that we’re entering a debt crisis. This time around, these fears are simply nonsense. For one, stocks are rallying from the down turn in bonds. While this rally has seen cyclicals do well (like Ford), the real strength has come from financials (as I mentioned earlier). Twenty months ago, the Financial Sector ETF ($XLF) dropped below $11. On Thursday, it closed at $20.17. Last December, I tweeted, “I still think buying XLF, sitting back and cracking a beer will be a tough strategy to beat in 2013.” Indeed it has. The XLF is up 23% on the year.

This leads me to think that higher long-term rates signal growing optimism for the economy. The U.S. dollar has also been doing well. Remember that financial markets tend to lead the economy by a few months, so the strength for the economy hasn’t shown up just yet.

For now, I encourage investors not to be rattled by any short-term moves. We’ve had a long stretch of low volatility, and those don’t last forever. Get used to seeing higher interest rates. Mortgage rates have been climbing as well. I don’t believe the Fed is close to shutting off the stimulus. This is a very good time for stocks. Investors should focus on quality and be careful not to chase any stocks. Wait for good stocks to come to you. One stock that looks especially good right now is Oracle ($ORCL). The company is due to report earnings in about three weeks. I’m raising my Buy Below on Oracle to $38 per share.

Before I go, I want to make two more adjustments to our Buy Below prices. I’m raising CA Technologies’ ($CA) Buy Below to $29, and I’m dropping Cognizant‘s ($CTSH) down to $70 per share.

That’s all for now. There are a few important economic reports next week. On Monday, we’ll get the ISM report for May. The ISM has come in at 49.9 or better for the last 46 months in a row. Let’s see if the streak stays alive. For the latter half of the week, the focus will be on jobs. On Wednesday, ADP will release its monthly jobs report. The initial claims report comes out on Thursday. Then the all-important May jobs report comes out on Friday morning. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: May 31, 2013

Eddy Elfenbein, May 31st, 2013 at 6:02 amEuro-Area Inflation Accelerates as Food Costs Offset Energy Drop

Frankfurt “Blockupy” Protesters to Target ECB, Banks and Airport

What They Said: India’s Growth Slumps to a Decade Low

Unions Press to End Special Trade Status for Bangladesh

ANALYST: The Dominoes Are Falling, As the Fed’s Turning Point Is Crushing Emerging Market Currencies

GDP: U.S. Economic Growth Revised To 2.4% For Q1

Treasury Extends HAMP Mortgage-Modification Program Through 2015

Americans Have Rebuilt Less Than Half Of Wealth Lost To The Recession, Study Says

Smithfield Traders Wager Shuanghui’s Deal Wins

Not So Anonymous: Bitcoin Exchange Mt. Gox Tightens Identity Requirement

Sell U.S. Treasuries Before They ’Crash,’ Bank of America Says

General Petraeus, the General Partner

John Hempton: Practical Lessons in Assessing Exotic Risks

Phil Pearlman: The Difficulties of Measuring Sentiment

Be sure to follow me on Twitter.

-

Shady Stock Buybacks

Eddy Elfenbein, May 30th, 2013 at 10:57 amJames Saft at Reuters highlights an issue that I’ve often discussed. Namely, companies using stock buybacks to mask their executive compensation.

You know those “shareholder-friendly” stock buybacks the market is so excited about? Most of that money is going to offset options granted to executives.

Perhaps even better, much of the funding for this transfer of assets (or just reward for managerial excellence in a competitive marketplace, if you prefer) is being funded by debt.

And what is making this latest debt binge possible? Quantitative easing.

That is pretty much all you need to know as an investor, both about the state of American corporate governance and monetary policy.

Here are the facts about S&P 1500 companies, excluding financials, courtesy of Societe Generale quantitative analyst Andrew Lapthorne:

“In the first quarter of 2013, buybacks done to offset the dilution from executive stock options reached a post-crisis high. Meanwhile, the amount of buybacks done to reduce the overall share count (i.e. for the benefit of shareholders) reached a 32-month low,” he writes in a note to clients.

In other words, companies buying up shares with one hand and handing them out to employees with the other. And, at least in the first quarter, they were handing out so many that more than half of the billions being spent on buybacks was simply going to keep pace with new share issues, much of which is compensation.

-

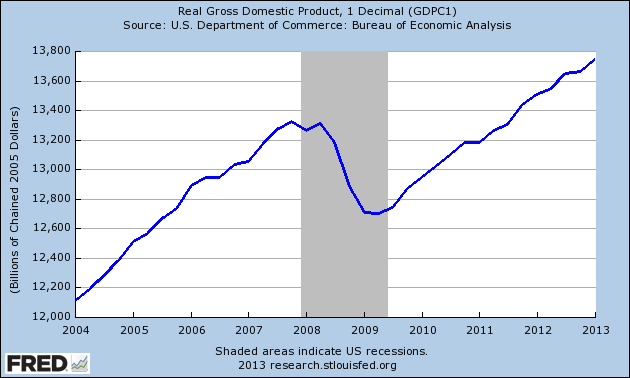

Q1 GDP Growth Revised to 2.4%

Eddy Elfenbein, May 30th, 2013 at 10:16 amThe government revised the first-quarter GDP report down to 2.4% growth from the initial estimate of 2.5%. Obviously, that’s not a very big adjustment. We’re also starting to get some distance from Q1. We’re already two-thirds of the way through Q2.

This is a frustratingly low number, though some the details below the surface are encouraging. I’m also glad to see that there’s some momentum to the economy. Growth this year should surpass last year’s growth rate. We haven’t had back-to-back quarters of GDP growth topping 2.4% since 2007.

-

Morning News: May 30, 2013

Eddy Elfenbein, May 30th, 2013 at 6:52 amEuro-Area Economic Confidence Climbs Amid Recession

Japan’s Stocks Correction Raises Stakes for Abe’s Growth Plan

Philippine Growth Underpinned By Revitalised Manufacturing Sector

Brazil Steps Up Pace of Rate Increases as Inflation Hurts Growth

Berkshire’s Abel Builds Buffett Energy Unit With Purchase

Shuanghui’s Smithfield Deal Pushes Morgan Stanley to Top of Asia M&A Tables

Nasdaq to Pay SEC $10 Million Over Facebook IPO

For Virtual-Currency Cops, Liberty Reserve Was the Easy Part

Roku Gets $60 Million in New Funding to Expand Streaming

Tesla: We’ll Hurry Up (On Superchargers), But You’ll Wait A Bit For A Cheaper Car

Volcker Warns on Limits of U.S. Fed’s Easy Money

Jeff Carter: Which Vertical Should You Invest In+Why The Stock Market Still Has Legs

Be sure to follow me on Twitter.

-

The Five-Year Breaks 1%

Eddy Elfenbein, May 29th, 2013 at 2:37 pmFor the first time in more than a year, the five-year broke above 1%. The yield hasn’t yet closed above 1%. Last summer, the yield got down to 0.54%.

The longer end of the yield curve is moving up but it’s interesting to see the middle part of the curve also being effected.

-

Sallie Mae To Splits in Two

Eddy Elfenbein, May 29th, 2013 at 10:49 amOne way of finding good stocks to buy is to wait for an historically strong company to spin off assets of split itself up. For example, in 1996, Dun & Bradstreet spun off Cognizant Technology Solutions. D&B also spun off Moody’s and Nielsen. Corporate Executive Board was spun off from the Advisory Board in the 1990s. Tyco recently spun off ADT and Pentair.

What you’ll often find is that one unit has been effectively subsidizing poorer performing units. This can create internal problems. Or a poor merger will mask how well a smaller unit has performed. Once freed from the mother ship, the small company can prosper as its own stock.

Today, Sallie Mae (or more formally, SLM Corp.) said it’s going to break itself in two. One company will be an education loan management business and the other will be a consumer banking business.

The principal assets of the business are likely to include approximately $118.1 billion in federally guaranteed loans, $31.6 billion in private education loans, $7.9 billion of other interest-earning assets; and a leading education loan servicing platform that services loans for about 10 million federal education loan customers. This includes 4.8 million customer accounts serviced under Sallie Mae’s contract with the U.S. Department of Education.

Sallie Mae’s private education loan origination and servicing businesses, including Sallie Mae Bank and the private education loans it currently holds, will operate separately under the Sallie Mae brand. Joseph DePaulo, executive vice president of banking and finance will serve as the consumer education lending franchise’s CEO.

The consumer banking business’ assets are likely to include about $9.9 billion of assets made up mostly of private education loans and related origination and servicing platforms; cash and other investments and the Sallie Mae Upromise Rewards program.

The two separate companies will initially be owned by Sallie Mae stockholders, but the separation of the businesses does not require a shareholder vote.

Earlier this year, Abbott Labs splits itself up. The medical products company is still called Abbott Labs ($ABT). The research company has the ugly name AbbVie ($ABV). Interestingly, it spinoffs, it’s often the less-interesting company that prospers. Both look too expensive here.

-

Morning News: May 29, 2013

Eddy Elfenbein, May 29th, 2013 at 6:07 amEuro Bulls Rule in Germany Amid Merkel-Draghi Aplomb

OECD Sees Weaker Recovery, Burden on Central Banks

IMF Forecasts Lower China Growth, Warns on Debt

Home Prices Rise, Putting Country in Buying Mood

Eurozone Fears for Slovenia as Bad Debt Brings Economy to a Standstill

Fannie, Freddie Regulator Reaches Settlement With Citigroup

Apple CEO Sees More ‘Gamechangers’; Hints At Wearable Devices

Wal-Mart Pleads Guilty to Dumping Hazardous Waste

Suntory Unit Gets $4.7 Billion IPO Approval

SoftBank and Sprint Said to Win National Security Clearance for Deal

Teco Energy Agrees to Buy New Mexico Gas for $750 Million

KKR, Carlyle Said To Eye Bids For Singtel’s $1.9 Billion Australia Unit

Eminem Meets Marchionne in Chrysler Redesign of 200 Sedan

Credit Writedowns: On QE, Inflation and Deflation

Jeff Carter: Gary Gensler of the CFTC: Thinks He Should Be King

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His