Archive for May, 2013

-

Our 2013 Buy List So Far

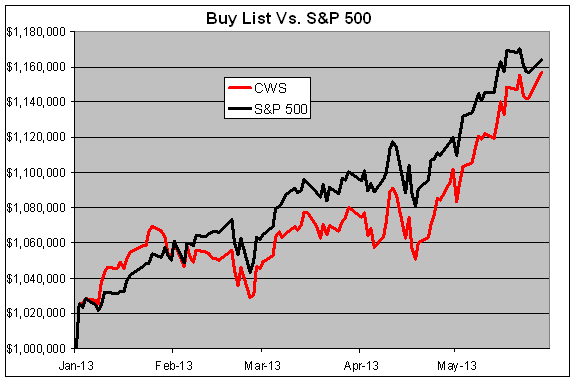

Eddy Elfenbein, May 28th, 2013 at 6:46 pmHere’s a look at how our Buy List and the S&P 500 have done year-to-date:

We’re trying to beat the S&P 500 for the sixth year in a row. Unfortunately, we’re currently trailing the index. Through Tuesday, our Buy List is up 15.66% for the year while the S&P 500 is up 16.40% (not including dividends). I’m very competitive and I’m confident we’ll end on top once again.

The good news for us is that we’ve closed the gap considerably. At the start of the year, we charged out of the gate and ran more than 1.8% ahead of the index by January 24th. After that, the S&P 500 soared and the Buy List lagged. By April 23rd, we were more than 3.6% behind the S&P 500. The recent rally, however, has been very good for our Buy List.

I should take a step back and point out that our Buy List follows the S&P 500 pretty closely. When I talk about trailing the index by 3%, or 0.74% as we are now, that’s small potatoes compared with other portfolios, whether they be hedge funds or mutual funds. The daily changes between the Buy List and the S&P 500 have a correlation in excess of 92%. Goldman Sachs recently said that the average mutual fund is trailing the market by 10% this year.

-

The Gradual Rally

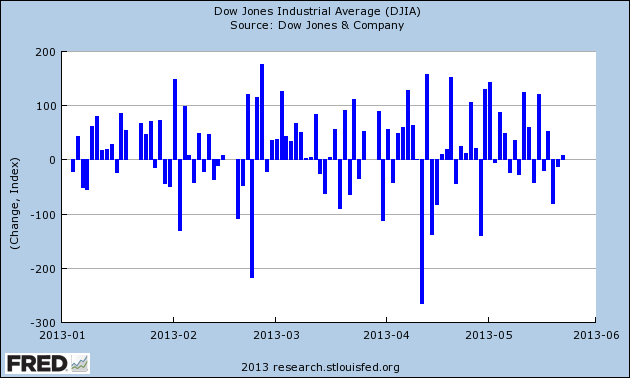

Eddy Elfenbein, May 28th, 2013 at 2:19 pmThis has been one of the most gradual rallies I’ve ever seen. It’s as if the market goes up by a small amount nearly every day. I find this statistic remarkable — the Dow hasn’t had a three-day slump all year.

The S&P 500 has now gone more than 100 days without having a 5% pullback. That’s the longest streak like that since early 2007. Bespoke notes that the largest pullback this year, measuring from the high, has been 3.49%. That’s the smallest since 1995.

-

“If You Only Know 5 Things About Investing”

Eddy Elfenbein, May 28th, 2013 at 11:08 amThe Motley Fool’s Morgan Housel is quickly becoming one of my favorite writers on things financial. Morgan recently wrote a great post titled, “If You Only Know 5 Things About Investing, Make It These.”

Here’s a sample:

2. The single largest variable that affects returns is valuations — and you have no idea what they’ll do

Future market returns will equal the dividend yield + earnings growth +/- change in the earnings multiple (valuations). That’s really all there is to it.

The dividend yield we know: It’s currently 2%. A reasonable guess of future earnings growth is 5% per year.

What about the change in earnings multiples? That’s totally unknowable.

Earnings multiples reflect people’s feelings about the future. And there’s just no way to know what people are going to think about the future in the future. How could you?

If someone said, “I think most people will be in a 10% better mood in the year 2023,” we’d call them delusional. When someone does the same thing by projecting 10-year market returns, we call them analysts.

-

Stocks Surge on Best Consumer Confidence Report in Five Years

Eddy Elfenbein, May 28th, 2013 at 10:52 amThe S&P 500 is having one of its best days of the year, which has already been a strong year for stocks. Between last Wednesday’s high and last Thursday’s low, the index dropped just over 3%. We’ve already made back most of that. The Dow is currently up over 200 points today and it looks headed for its 20th-straight Tuesday gain.

The cyclical sectors are doing very well today. The only down sector is utilities. Mirroring that move, long-term bonds are down and the 10-year yield is up to 2.10%. Today’s consumer confidence report was the best in five years. Economists were expecting the Conference Board’s index to rise to 71.2. Instead, it rose to 76.2. Also this morning, the Case-Shiller Index showed that home prices are up more than 10% in the past year. That’s the fastest pace since 2006.

Our Buy List is also doing well. All 20 stocks are up. Ford ($F) and CA Technologies ($CA) just touched new 52-week highs.

-

Morning News: May 28, 2013

Eddy Elfenbein, May 28th, 2013 at 6:12 amRajoy Sees Reprieve as Spanish Recession Evidence Mounts

BOJ’s Miyao Says JGB Stability Vital, Offers No New Steps

The Unemployment Chart That Could Still Destroy Europe

Bundesbank VP: US Foreign Bank Capital Proposals Violate G-20 Agreements

Amazon’s Workers in Germany Stage Second Strike

Credit Suisse Warns Of U.S. Tax Spat Escalation If Talks Fail

Nigerian Smartphone Boom Challenges Nokia Africa Dominance

Obamacare Unveiled as California With New York Lead U.S.

Sony’s Bread and Butter? It’s Not Electronics

Valeant Agrees to Buy Bausch & Lomb in $8.7 Billion Deal

AstraZeneca Buys Heart Firm Omthera For Up To $443 Million

Club Med Management Plans Buy-Out With Largest Investors

A Divergence is Opening Up Between Inflation and the Stock Market

Joshua Brown: The Power of Reddit

Cullen Roche: Inflation at Odds with Equities

Be sure to follow me on Twitter.

-

In Memoriam

Eddy Elfenbein, May 27th, 2013 at 10:02 am -

Morning News: May 27, 2013

Eddy Elfenbein, May 27th, 2013 at 5:29 amChina Industrial-Profit Growth Accelerates as Sales Increase

Asian Stocks Drop for Fifth Day as Yen Strengthens, Oil Decline

BoJ Board Rift Over Ambitious Price Goal Will Test Governor Kuroda

What Can Go Wrong Next? Global Arrows Pointing At The Apple Over Ireland’s Head

Sweden Riots Put Faces to Statistics as Stockholm Burns

China Builds EU Beachhead With $5 Billion City in Belarus

Abu Dhabi Wealth Fund Cuts Reliance on External Managers

Renault to End Better Place Partnership After Bankruptcy

Qatar Telecom Raises $12 Billion to Buy Maroc Telecom, CEO Says

Europeans Press China Over Trade in Telecom

Freeport to Restart Indonesia Open-Pit Mining Soon

Our Mixed Message to Veterans on Memorial Day

Concert Industry Struggles With ‘Bots’ That Siphon Off Tickets

Jeff Miller: Weighing the Week Ahead: Time for More Volatility?

Be sure to follow me on Twitter.

-

Strong Durable Goods Report for April

Eddy Elfenbein, May 24th, 2013 at 9:23 amThe durable goods report for March was a bust, but April’s came back pretty strong. This morning, the Commerce Department said durable goods were up 3.3% in April which beat the 1.5% economists were expecting.

Quickening activity in the housing and auto industries may ripple throughout manufacturing, rendering the economy better able to recover from a slowdown this quarter. At the same time, government cutbacks, higher taxes on consumers and cooling exports are crimping demand, which means any acceleration will be slow to develop.

“This report is consistent with the economy continuing to recover, but just at a moderate pace,” said Scott Brown, chief economist at Raymond James & Associates Inc. in St. Petersburg, Florida, and the second-best forecaster of capital goods orders over the past two years, according to data compiled by Bloomberg. “We’re not getting much demand from the rest of the world, but we are getting growth domestically.”

-

CWS Market Review – May 24, 2013

Eddy Elfenbein, May 24th, 2013 at 7:03 am“Risk comes from not knowing what you’re doing.” – Warren Buffett

We’re back after a short hiatus last week. I was impressed that the stock market had the audacity to rally even without an update from me. Early Wednesday, the S&P 500 got as high as 1,687! Jeez, I thought I was being bold last year when I said the stock market would break 1,500 sometime early in 2013. Well, we ran right past that and starting knocking on the door of 1,700. Goldman Sachs recently said they see the S&P 500 getting to 2,100 by 2015!

Here’s an amazing stat: The Dow hasn’t had a three-day losing streak all year. Bespoke Investment Group notes that the S&P 500 has already run past the year-end target that every single Wall Street had at the start of the year. This rally is remarkably broad-based. It seems like everyone’s going up. Normally, 55% of stocks trade above their 200-day moving average. Today that number is 81%.

I’m not much for picking market tops, but I think more caution from investors is warranted. My feeling is that as long as the S&P 500 stays above its 50-day moving average (currently about 1,590), I think the bears will be held at bay.

Until then, our Buy List continues to be an oasis for conservative investors. In the last month, our Buy List has gained 6.60% to the S&P 500’s 4.54% (that doesn’t include dividends). We’re still a bit behind the market for the year (15.73% to 14.16%), but I’m confident we’re on our way towards beating the market for the seventh year in a row.

In this week’s CWS Market Review, we’ll take a closer look at what’s been driving the rally and see whether it will continue. We’ve had lots of good news from the Buy List recently including a dividend increase from JPMorgan Chase ($JPM). In March, I reassured you there was nothing wrong with FactSet Research Systems ($FDS) after it plunged, and the stock has now rallied to a new year-to-date high. The best news, however, was a very good earnings report from Medtronic ($MDT). At one point on Tuesday, MDT gapped up 8% to a five-year high. Before I get to that, let’s talk about the great Garbage Rally of 2013.

Welcome to the Garbage Rally

On Wednesday, the stock market briefly got a case of jitters after the Federal Reserve released the minutes from its last meeting. The media and traders jumped on this rather unwieldy sentence: “A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting, if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome.”

I’ll be blunt—this ain’t gonna happen. Not next month and probably not this year. Listen to me: The Fed is going to keep on buying bonds to support the economy. Traders are obsessed with the idea that the Fed is about to announce a policy change. Indeed, it will be a big deal when it comes, but we’re not there yet. Remember that the last two inflation reports showed that consumer prices are falling, which means that real interests are rising. Ben Bernanke made it clear in his testimony on Wednesday that policy accommodation will continue “in the medium term and beyond.”

All investors need to understand that an important outcome of the Fed’s policy is that it’s shifting investors (shoving them, really) into riskier assets. We’re starting to see that play out quite dramatically. For example, stocks are doing better than bonds. At the start of the year, the dividend yield for the S&P 500 was 48 basis points higher than the 10-year Treasury. Today, they’re about the same. Even within stocks, the riskier ones are leading. The small-cap Russell 2000 broke above 1,000 this week for the first time ever. The index is up more than 27% since mid-November.

A recent study found that companies with the worst balance sheets—what I unfairly like to call “Garbage Stocks”—have done the best this year. Bloomberg recently noted that companies in the S&P 500 with speculative grades rose by an average of 24% this year, while stocks with investment grades rose by 18%. Please don’t think I’m advocating that we depart from our tried-and-true strategy of investing in top-quality stocks. No, I simply want to show you what’s been happening underneath the surface of this rally.

Plus, it’s not so much that garbage stocks are popular. Instead, they’ve been left behind for so long that it’s time they played catch up. Importantly, the Fed’s low-rate policy makes carrying lots of debt less burdensome. Since November 15th, financially weak stocks are up an average of 38%, while the broader market is up 23%. When you alter the playing field, the game changes. Junk bond offerings, for example, are on pace for another record year this year, while the massive yield spread for junk has narrowed.

In the mean time, investors who are focused on the long term should continue to hold the stocks on our Buy List. Now let’s get to the recent news on our stocks.

Buy Medtronic up to $57

On Tuesday, we got an outstanding earnings report from Medtronic ($MDT). The medical device company reported fiscal Q4 earnings of $1.10 per share which was seven cents more than what Wall Street had been expecting. The stock gapped up nearly 8% on Tuesday before giving back some of its gains.

Frankly, the strong earnings report was a shock to me as well. I knew business at Medtronic was going well, but this report was better than even I was expecting. Digging into the numbers, the big surprise was that sales of pacemakers and defibrillators rose. Pretty much everyone was expecting more declines. Sales of defibrillators rose by 1.5%, and pacemakers were up by 2.6%. Company-wide, revenues rose by 3.8% last quarter. Medtronic’s CEO, Omar Ishrak, said that for the first time in four-and-a-half years, sales of defibrillators and spinal products rose in the U.S. in the same quarter.

Now let’s recall some history. Last May, Medtronic forecast earnings for this year to range between $3.62 and $3.70 per share. In January, they raised the low end of their estimate by four cents per share. As it turned out, Medtronic made $3.75 per share for the year. That’s up from $3.46 per share in 2012.

For fiscal 2014, Medtronic projects earnings between $3.80 and $3.85 per share. Wall Street had been expecting $3.84 per share. Earlier this week, MDT got to a five-year high. Sometime next month, I expect Medtronic to raise their dividend by one penny to 27 cents per share. This would be the 36th consecutive annual dividend increase. I’m raising my Buy Below on Medtronic to $57 per share.

Ross Stores Earns $1.08 per Share

We also had a good earnings report from Ross Stores ($ROST). Note that both Ross and Medtronic are on a January-April-July-October reporting cycle. For their first quarter, Ross earned $1.07 per share which is up 15% from a year ago. This wasn’t much of a surprise since the deep discounter had already told us that earnings would come in between $1.07 and $1.08 per share. Q1 Sales rose 8% to $2.54 billion, and comparable-store sales were up by 3%.

The CEO said, “We are pleased with the slightly better-than-expected sales and earnings we delivered in the first quarter, especially considering this growth was achieved on top of strong prior-year gains. These results continued to be driven by our ongoing ability to offer terrific bargains to today’s value-oriented consumers.”

For Q2, Ross sees earnings between 89 and 93 cents per share. Wall Street had been expecting 91 cents per share. Ross earned 81 cents per share for last year’s Q2. For the whole year, Ross projects earnings between $3.70 and $3.81 per share. Wall Street was a little higher, at $3.88 per share.

Ross is now a 20.3% winner on the year for us. I’m very happy with how this company is performing, and I’m keeping my Buy Below price on Ross Stores at $70 per share.

JPMorgan and FactSet Raise Their Dividends

Jamie Dimon, the head honcho at JPMorgan Chase ($JPM), won a big victory this week when shareholders shot down a motion to split up the jobs of CEO and chairman. Dimon holds both. I wish the vote had gone the other way. As much as I admire JPM, Jamie Dimon is a walking headline risk for shareholders.

The good news is that the bank said it’s raising its quarterly dividend from 30 cents to 38 cents per share. That’s a pretty hefty increase. Going by the new dividend and Thursday’s closing price, JPM yields 2.85%. I’m raising my Buy Below on JPMorgan Chase to $56 per share.

In March, FactSet Research Systems ($FDS) reported impressive fiscal Q2 earnings, and for their Q3 (ending in May), they projected earnings between $1.14 and $1.16 per share. That’s a pretty optimistic forecast, but what’s strange is that the stock plunged 10% after the earnings report.

Fortunately, I’ve long given up on the idea of making sense of short-term market tics. In the CWS Market Review from March 22nd, I said that I wasn’t at all worried about FactSet and that it “remains a very good buy.” I’m glad we stuck to our guns. The stock made back everything it lost.

Last week, FactSet said that it’s raising its quarterly dividend by 13% to 35 cents per share. The stock recently broke out to a new high for the year. FDS is now up more than 13% from its post-earnings report low. This week, I’m raising my Buy Below price on FactSet to $108 per share. This is a solid stock.

Updates on Microsoft, Ford and NICK

Before I go, I have a few more updates. Microsoft ($MSFT) has performed incredibly well for us this year. It’s actually the best performer of the year for us. Who saw that coming? The software giant just unveiled its new Xbox One. I’m keeping my Buy Below at $35 per share.

Last Friday, Ford Motor ($F) finally pierced my $15 Buy Below price. On Wednesday, Ford got as high as $15.32. The company recently announced that it’s expanding its North American production to meet the summer demand. I’m raising my Buy Below on Ford to $16 per share.

Shares of Nicholas Financial ($NICK) have dropped back a bit after the last earnings report. Now that enough time has passed, it’s safe to say that nothing ever came of the buyout offer. That’s OK. I’d rather see management hold out for the best possible deal. I’m keeping my Buy Below at $16, but if you’re able to add shares of NICK below $13.70, you’re getting a very good deal. That’s a yield of 3.5%, and I think there’s a good chance that NICK will raise its dividend this summer.

That’s all for now. The stock market will be closed on Monday for Memorial Day. Next week we’ll get the important Case-Shiller report on home prices, plus a revision to the Q1 GDP report. The government’s initial estimate said that the economy grew by 2.5% for the first three months of the year, which was less than what economists were expecting. It will be interesting to see if that number will be revised higher. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: May 24, 2013

Eddy Elfenbein, May 24th, 2013 at 6:32 amECB’s Draghi: ‘Imperative’ to Set Up New Bank Body

Apple’s Tax Magic Leaves Irish Bondholders Unmoved

In Tax Overhaul Debate, It’s Small Vs. Large Companies

Housing and Jobs Data Suggest Steady Growth

Procter & Gamble Brings Back Former CEO To Fix Company

Target, Macy’s and Others Sue Visa and MasterCard Over Fees

Sears Reports Bigger-Than-Expected 1Q Loss

Key Measure Of German Business Confidence Rebounds In Unexpectedly Strong Showing

Gap Earnings: Turnaround Picks Up Speed

Boeing CEO Sees 5-Year Edge On Airbus in Twin-Aisle Jets

Is Tumblr Going to Be Yahoo’s YouTube?

Pandora Media First-Quarter Loss Widens

Howard Lindzon: What Type of Financial Investor Are You?

Jeff Carter: Build a Relationship to Invest in a Company

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His