Archive for May, 2013

-

The Golden Age for Financial Stocks

Eddy Elfenbein, May 14th, 2013 at 1:06 pmIn December 2011, I changed my mind on the financial sector and said that it was finally a good buy. At the time, the Financial Sector ETF (XLF) was at $12.82 per share and today it’s been as high as $19.60. That’s a nice 52% run.

Actually, that call wasn’t completely out of the blue. Three months before, I said that the XLF would be a good speculative buy if it fell below $12. I wasn’t ready to say the sector was a flat out buy. The XLF did fall below $12. In fact, it briefly dropped below $11. As usual, market trends can last longer than you thought possible.

In the CWS Market Review from two months ago, I said that we’re in a Golden Age for investing in financial stocks.

Let’s run down some of the reasons why the financial sector is so appealing. The biggest is that the Federal Reserve is keeping short-term interest rates near 0% and has promised to keep them there for some time. The Fed’s position clears up a lot of uncertainty, and Wall Street likes it that way. Another big reason in favor of financials is that the economy is slowly improving. At a firm like Nicholas Financial, the overall quality of their loan portfolio has improved dramatically.

We also have to look at the mortgage market. For obvious reasons, many financial stocks are closely tied to the mortgage market, and the U.S. housing sector continues to improve. Thanks to Bernanke and his friends at the Fed, the bond-buying policy has pushed down mortgage rates and they’ll probably stay low. This time, the improvement in the housing market is far sounder and more sustainable than it was last decade. Let’s not forget that lending standards have thankfully improved.

Another key point is that valuations for many financial stocks are still quite modest. JPM just broke though $50 per share and it’s going for less than nine times Wall Street’s estimate for next year’s earnings. Based on Thursday’s close, JPM yields 2.4% and I’m expecting the bank to raise its dividend soon. I think the current 25-cent quarterly dividend will go up to 30 cents per share. That would still be less than 22% of their full-year earnings.

Given the current environment, I doubt many investors will be able to beat XLF this year or do it with less volatility. We’re going to look back at this era as a great time to buy financial stocks.

I turned out to be right about JPM’s dividend. Less than a week later, the bank raised its dividend to 30 cents per share.

-

FactSet Research Boosts Quarterly Dividend

Eddy Elfenbein, May 14th, 2013 at 10:49 amFactSet Research Systems ($FDS) announced today that it’s increasing its dividend by 12.9%. The quarterly dividend will rise from 31 cents per share to 35 cents per share.

In the big picture, FactSet’s dividend is pretty small. The new dividend translates to a yield of just 1.45% based on yesterday’s close. But what impresses me is the company’s record of continually increasing its dividend. In 2005, their dividend was just five cents per share. FactSet has increased its earnings every year for the last 16 years, and they’re going to do it again.

-

Citizen Pittman

Eddy Elfenbein, May 14th, 2013 at 8:55 amMark Pittman is a guy whose life should be made into a Hollywood movie.

Actually, it already has, sort of. He’s one of the chief commentators to appear in an indie documentary, American Casino, about the subprime-mortgage debacle. His encyclopedic knowledge of the events of 2008 contributed handsomely to what the film’s directors called its “thriller-like exposition.”

Pittman’s own story, however, is even more thrilling than some of the Wall Street scams he spent 15 years of his life exposing. He’s the guy, you see, who dared to sue the Fed. And he won. Vindicated, with all the justice in the world on his side, in the eyes of no less august an institution than the U.S. Federal Courts.

The tragedy is that he didn’t live to enjoy the spoils of his battle with America’s most powerful bank.

It all started with a series of articles Pittman, a veteran financial reporter, wrote for Bloomberg News back when the witches’ brew of Wall Street malfeasance was still coming to a boil. In them, he was among the first to point out the precariousness of the financial markets, with their endless, incomprehensible repackagings and resellings. Later he was the first to detail how Goldman Sachs, Morgan Stanley, and the rest profited from the government’s bailout of AIG. Still later, not one to rest on his laurels, he demonstrated Hank Paulson’s curious double role in the crisis, as one who had both made the mess and later been hired to clean it up.

Award-winning work, all of it, but Pittman was just getting started. In late 2008, as the financial system was hemorrhaging and the government was scrambling to perform triage, Pittman wrote some numbers on a dry-erase board, scratched his head, and asked a simple question: How much money was the government spending, and where was the money going? Doing some simple math, he arrived at a figure of some $12.8 trillion, not all of it clearly accounted for. Later analysts have contested this sum, but correct or no, it’s indisputable that the Federal Reserve in particular refused to disclose who exactly was receiving the $2 trillion it had earmarked for distribution.

Pittman’s next move was to file a Freedom of Information Act request. He reasoned that it was the taxpayers’ money, and that those taxpayers therefore had a right to know just what the Fed was doing with it. The bank stonewalled. Pittman filed another request. Again the Fed refused to play ball.

So Pittman sued. Together with Bloomberg News, he brought the case to federal court, where a judge found that the Fed was indeed obliged to hand over the data requested, and gave the bank five days to comply. Still the Fed didn’t want to do the right thing. It filed appeal after appeal, until finally it was given a stay of implementation until the case could be heard by the Supreme Court. The latter, however, declined to get involved, thus effectively upholding the lower courts’ anti-Fed ruling.

At this point, one would think the Fed would be gracious and concede the victory to its opponents, but still the data were not forthcoming. They began to publish printouts of e-mails, communications logs—anything and everything but the data requested. So that when Pittman died on November 25, 2009, his soul may have gained access to paradise, but his case was still in bureaucratic limbo, endlessly waiting.

But his determination wasn’t for nothing. Some two years later, just before Christmas of 2011, the Fed finally released spreadsheets that detailed the amounts borrowed by some 400 banks. Some have argued that the data actually make the Federal Reserve look good, but all agree the information represents a victory for those in favor of greater government transparency. Scholars and financial analysts can better sort through the wreckage now that one of the black boxes has come to light.

One of Pittman’s friends, Congressman Brad Miller, eulogized the intrepid reporter thus in The Huffington Post:

What made it so entertaining to talk with him was his irreverence for the financial industry, which was a refreshing contrast to the industry’s self-reverence. He didn’t have an angry, confrontational ‘Speak Truth To Power!’ attitude towards the industry; he just saw them as grifters. Mark didn’t see much difference between selling AAA-rated bonds backed by subprime mortgages and sending e-mails claiming to be African royalty in need of help transferring a fortune to a U.S. bank, and he was amused by the financial industry’s pretensions that they were making a great contribution to our economy.

Hollywood would barely have to doctor Pittman’s story to sell it to audiences. Its narrative arc is as perfect as its protagonist’s integrity.

-

Morning News: May 14, 2013

Eddy Elfenbein, May 14th, 2013 at 7:03 amECB Picks Fight With Germany on EU Plans for Failing Banks

Grind of Euro Crisis Wears Down Support for Union, Poll Finds

Janet Yellen, a Top Contender at the Fed, Faces Test Over Easy Money

Retail Sales in U.S. Unexpectedly Increase on Broad-based Gains

Supreme Court Supports Monsanto in Seed-Replication Case

U.S. Hedge Fund Calls For Sony Entertainment Spin-Off

SolarCity Posts Loss as Spending on New Systems Increases

Amazon Introduces Amazon Coins — Virtual Currency for Buying Apps and Games

How A CEO Can Wreck A Brand In One Interview: Lessons From Abercrombie & Fitch Vs. Dove

Lehman Reaches Beyond Grave to Grab Millions From Nonprofits

Verizon Wireless Agrees to Pay Co-Owners $7 Billion Dividend

Bloomberg’s Top Editor Calls Client Data Policy ‘Inexcusable’

Jeff Carter: 500 Startups: Risk vs Reward, Do VCs Execute?

Credit Writedowns: Zero Rates Mean Americans Are Giving Up On Certificates Of Deposits

Be sure to follow me on Twitter.

-

Dylan the Day-Trader

Eddy Elfenbein, May 13th, 2013 at 12:27 pmIn the Washington Post, Steven Pearlstein profiles a 25-year-old day-trader named Dylan Collins. Frankly, it’s a scary existence. I’m happy to say that I have neither the interest or skills to be a day-trader.

Dylan started at AMR in August 2010. He didn’t have a positive trading month until January. He didn’t “make his bank” and get his first paycheck until May. In June, he lost it all.

“There was this Canadian company, Sino-Forest, that we were all buying,” Dylan says. “It looked like the perfect contramove. Then, all of a sudden, trading was halted because of a federal investigation, and it turned out the whole thing was a Ponzi scheme. The whole office lost somewhere between 1 and 2 million dollars. For me it was devastating. . . basically I had to start back at square one.”

Within a few weeks, however, markets were roiled by the first big troubles in the euro zone. Markets became, Dylan recalls, “insanely volatile” — exactly the conditions in which the office at West Palm thrives. By the end of July, Dylan had made back his “bank.” In August, a year into the job, his trading profits were $70,000, two-thirds of which went to him.

It was up and down after that, and more up than down, with swings of as much as $30,000 a month. His $25,000 “bank” grew to $100,000 as he put more and more of his earnings back into the pot. Then, one day last August, Knight Capital, a small investment bank, suffered a glitch in its automated trading that caused trading in dozens of stocks to go haywire. This was just the sort of unexplained, irrational price deviations that are manna from heaven for Dylan and his colleagues. They dove in with all they had. On that day alone, Dylan’s trading profits exceeded $140,000.

A lot of people have moral problems with what Dylan and AMR do. Not me. The market has pricings and they fix them. Assuming you can consistently exploits the market’s mistakes for money–it’s a young man’s game.

“The reason why there aren’t older guys in the office is because of the stress,” Dylan says. “I can see even now that you can get burned out after doing it for five, 10 years. There are nights you can’t sleep because you’re so exposed, or you lie there thinking about the big jobs number that is coming out tomorrow and you know you’re either going to earn $50,000 or lose $50,000, but you don’t know which.”

Under stress, a trader is apt to become too cautious or too comfortable with one trading strategy — and before long he’s caught in one of those self-reinforcing downward spirals of declining income, declining confidence and declining risk tolerance.

Perhaps with that in mind, a couple of the more successful West Palm alumni cashed in their chips, moved back to where they came from and made the transition from day trading to longer-term investors. -

Three-Year High for the S&P 500’s P/E Ratio

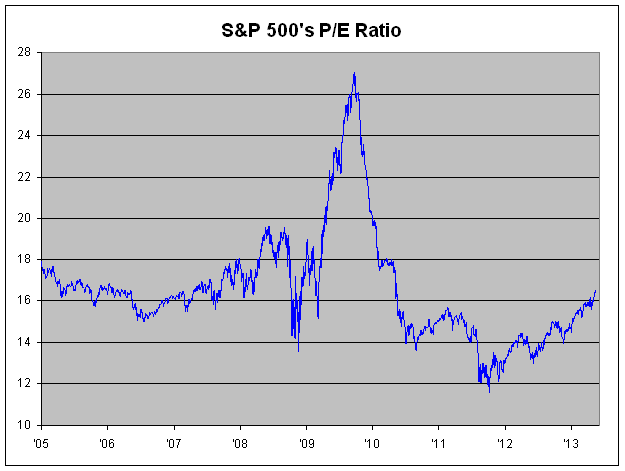

Eddy Elfenbein, May 13th, 2013 at 10:00 amOn Friday, the Price/Earnings Ratio for the S&P 500 closed at a three-year high. By historical comparisons, the P/E Ratio still ain’t that high. It’s currently at 16.49. The ratio has been quite low for the last few years. At its low point in October 2011, the S&P 500’s P/E Ratio touched a 22-year low. All told, the market’s P/E Ratio was expanded by more than 40% which adds a nice breeze to any market rally.

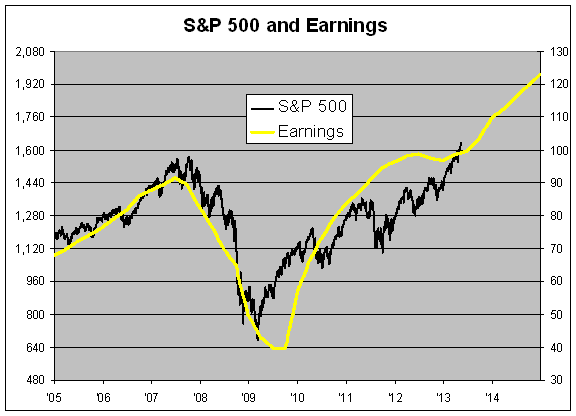

Here’s a look at the S&P 500 (black line, left scale) along with its earnings (yellow line, right scale). I scaled the two lines at a ratio of 16-to-1 so whenever the lines cross, the P/E Ratio is exactly 16. As you can see, we just dipped our heads above the line. For technical note, I’m using the operating earnings as provided by S&P.

Let me point out a few deficiencies of the P/E Ratio. (By the way, just because there are some problems with a metric doesn’t make it useless. You simply need to be aware of its limitations.) The P/E Ratio is made up of two numbers, the price and the earnings. Price is a fixed-point number. You know exactly what it is at any point in time. Earnings, however, are a ratio. It’s the amount of money earnings between two points. The P/E Ratio mixes these two numbers. That usually isn’t an issue, but sometimes it can be.

The biggest problem is that stock prices look ahead while earnings tell you what just happened. Notice how in 2009 the stock market, the black line correctly anticipated the upturn in earnings, the yellow line. Because of the mismatch, the P/E Ratio soared. I remember this caused a lot of consternation among market bears. The P/E Ratio was telling us the market was expensive when it was really its cheapest.

Here’s a look at the market’s P/E Ratio. It’s the exact same graph as above except it’s the black line divided by the yellow line.

But we can also see something interesting about the market crackup in 2007 and 2008. What makes that period noteworthy is that it was largely unexpected as the stock prices quickly reacted to crumbling earnings. On the other hand, you can see how market downdrafts in 2011 and 2012 were incorrect expectations of trouble ahead. Perhaps the market was so burnt in 2008 that it’s become overly cautious today.

The issue for us right now is the stalling out of earnings growth over the last few quarters. The future part of the yellow line is Wall Street’s forecast. If analysts are correct that this is just a small notch in an upward earnings trend, the market is probably underpriced. At ratio of 16 and expected earnings of $123.13, it could be at 1,970 by the end of next year. That’s a 20.6% gain in about 20 months.

Of course, that involves a lot of assumptions that are probably too thin to rely on. Last year, I recall Barry Ritholtz pointing out a chart showing the success rate of analysts’ forecasts. It’s not an enviable record. To oversimplify things, corporate earnings tend to go in two modes — slow, steady rises or sharp dropoffs. Analysts try to split the difference by almost always predicting modest increases. As a result, they’re usually slightly too pessimistic or wildly overly optimistic. The hard part is catching the economy’s turning points. Once you’ve mastered that (LOLz), everything else is easy.

-

Morning News: May 13, 2013

Eddy Elfenbein, May 13th, 2013 at 6:42 amConfusion Reigns: Europe Bickers Over Banking Union

Malta Unlikely To Follow Cyprus Into Crisis

Japan Shares Rise, Bonds Fall on G-7 Tolerance as Gold Declines

China—Slower and More Unbalanced

China’s Investment Slows as Production Trails Estimates

Chinese Creating New Auto Niche Within Detroit

In Taiwan, Lamenting a Lost Lead

What Saudi Arabia Thinks About the U.S. Oil Boom

Gold Bears Pull $20.8 Billion as BlackRock Says Buy

Goldman: The S&P Has Already Hit Our Year-End Price Target, But We Think It Will Go A Lot Higher

Privacy Breach on Bloomberg’s Data Terminals

CEO Sees Profit, IPO for Virgin America

Google+ Struggles To Attract Brands, Some Neglect To Update

Jeff Miller: Weighing The Week Ahead: Are Consumers Ready To Buy? What About Housing?

Epicurean Dealmaker: Go Ahead, Live a Little

Be sure to follow me on Twitter.

-

CWS Market Review – May 10, 2013

Eddy Elfenbein, May 10th, 2013 at 7:06 am“Every once in a while, the market does something

so stupid it takes your breath away.” – Jim CramerYes, Jim, it certainly does. How about traders smacking down Cognizant Technology for ten straight days? Or bringing down Bed Bath & Beyond to $57?

Sheesh, sometimes the market makes no sense at all. Fortunately, we have a long-term strategy that profits from Wall Street’s periodic freak-outs and fire sales. Lately, Wall Street’s been in a happy mood. Until Thursday’s pullback, the S&P 500 rallied for 12 out of 14 days. The Dow has extended its winning streak on Tuesdays to 17. That ties the 1972 Dolphins! Since April 18th, our Buy List is up 6.5%, which is 1% better than the S&P 500.

Here’s what happening: Basically, what we’re seeing is a continuation of the theme that’s played out over the last several months—everyone’s chilling the eff out. Fear is slowly and steadily leaving the markets. For example, junk bonds have taken off recently. The Junk Bond ETF ($HYG) has climbed almost non-stop in the last month. Junk bonds now yield less than what Treasuries did six years ago. Looking at the junk bond market is a good bellwether of what investors are thinking. What the junk rally tells us is that investors are more willing to shoulder a little more risk. For one, the low-risk stuff pays almost nothing, so it’s the smart move.

I should put that into some context. It’s more accurate to say that the market is shifting from almost absurd levels of risk aversion into a period that’s somewhat closer to normal. That’s good for stocks versus bonds, and it’s good for growth stocks as opposed to value stocks. When I say more risk, don’t think of it as being more dangerous. I’ve made sure that our Buy List stocks are financially sound. In this case, I mean riskier in the sense of a longer time horizon. We pretty much know what the two-year Treasury is going to do over the next two years, but it’s harder to say what Oracle ($ORCL) will do. That takes a bit more faith and until now, investors have paid a lot more for a guaranteed return than for one that’s a little more variable.

While defensive stocks had been leading the market this year, that abruptly changed in mid-April as the cyclicals grabbed the lead. Ford Motor ($F), for example, jumped back over $14 recently, and it’s close to a new 52-week high. Can you believe Ford was below $9 last summer? Dear Lord, the stupidity does take your breath away. The cyclical resurgence has been helped by the April jobs report. We had more good economic news as initial jobless claims fell to another five-year low. Of course, the economy is still far from completely healthy, but the key measures are moving in the right direction.

In this week’s CWS Market Review, I want to highlight some great earnings reports from DirecTV and Cognizant Technology Solutions. DirecTV smashed Wall Street’s estimate by 33 cents per share. We also had good news from Ross Stores as the retailer raised earnings guidance for Q1. Later on, I’ll run down a slew of higher Buy Below prices I have for our stocks on the Buy List. The spring bull keeps running past our prices! But first, let’s look at the great results from our favorite satellite TV stock.

Outstanding Earnings from DirecTV and Cognizant Technology

On Tuesday, DirecTV ($DTV) reported truly outstanding earnings. I mean, they really knocked the cover off the ball. For Q1, DTV raked in $1.43 per share, which was 33 cents better than Wall Street’s forecast. Not only did DTV beat estimates, they beat every estimate of all 18 Wall Street analysts who follow the stock. Now that’s an earnings beat!

Once again, Latin America was the key driver of DTV’s success. DTV added 583,000 subscribers in that region, and there are now 16 million subscribers in Latin America. They’re not doing so badly in North America, either. DTV added 21,000 subscribers in the U.S. Revenue for the quarter rose 7.6% to $7.58 billion, which was $50 million better than estimates.

I’ve often highlighted DTV as a company that does share repurchases right. Last quarter, they bought back $1.38 billion worth of their shares. On Wednesday, the stock jumped nearly 7%, and it closed Thursday at an all-time high of $62.98 per share. The stock is now a 25.6% winner on the year for us. The company expects to earn more than $5 per share this year. I’m raising my Buy Below on DirecTV to $67 per share.

Traders were clearly nervous about the earnings from Cognizant Technology Solutions ($CTSH). At one point, the stock had fallen for ten days in a row. Yet this is another good example of why we focus on high-quality stocks. Our Buy List stocks may get knocked around, but they have a very good chance of popping right back up.

Sure enough, on Wednesday CTSH reported earnings of $1.02 per share, which was eight cents better than Wall Street’s consensus. Revenues rose 18.1% to $2.02 billion, which was just ahead of estimates.

Cognizant’s guidance was also quite good. For Q2, they see earnings at $1.06 per share, which was seven cents above Wall Street’s forecast. For all of 2013, CTSH expects earnings of $4.31 per share, which was well above consensus of $4.05 per share. Cognizant is also expanding its stock buyback program. The stock rallied for a 5% gain on Wednesday, and it’s now up 11% in the last two weeks. I’m raising my Buy Below on Cognizant to $73 per share.

CA Technologies Has Strong Earnings but Weak Guidance

CA Technologies ($CA) gave us a mixed bag. The Q1 earnings report was very strong. CA earned 68 cents per share, which was well above the 55 cents per share the Street had been expecting. The problem, however, was CA’s weak guidance. For fiscal 2014, which ends next March, the company expects to earn between $2.35 and $2.43 per share. Wall Street had been expecting $2.53 per share. Late Thursday, CA updated that forecast after the IRS ruled in their favor in a tax dispute. CA now expects FY 2014 earnings of $2.93 to $3.03 per share.

I’m pleased to hear that the company is taking some big steps to restructure itself. CA is taking a $150 million charge next year “that will enable us to rebalance our resources to drive greater innovation and collaboration in product development and greater efficiency and better sales execution.” The share price initially dropped sharply on Wednesday but gained back a lot of lost ground. CA has been a big winner for us this year, and I like the dividend, which now yields over 3.7%. I’m going to hold my Buy Below at $27 per share.

Nicholas Financial Earns 40 Cents per Share

After the closing bell on Thursday, our little used-car financer, Nicholas Financial ($NICK), reported quarterly earnings of 40 cents per share. That’s for their fiscal fourth quarter. As I mentioned in last week’s issue, I’m not so concerned about the precise earnings result from NICK. Since no one follows them (except for us), I just want to see that business continues to go well—and it does.

For the year, NICK earned $1.63 per share. So even after an impressive rally, NICK is still going for less than nine times earnings, and the dividend yields 3.3%. All of the fundamental ratios continue to be very solid. NICK’s net earnings yield is over 22%. The pre-tax yield is over 11%. Costs are a bit on the high side but still within the historical range. Credit losses came in just over 1%. That’s down a bit from last quarter.

I’m most impressed by how much debt NICK has paid off since the big dividend last year. They borrowed all that money they paid out to shareholders. From the fiscal second to third quarter, NICK’s indebtedness rose by $32.1 million. But last quarter, indebtedness dropped by more than $14.3 million. That’s pretty impressive.

The simplest way I can put it is that NICK’s business is almost like an 11% bond, except the credit quality seems to improve every quarter. We still haven’t heard any news on the buyout offer, so I’m assuming the odds of a deal are fairly low. Either way, I like this stock a lot. The company can easily raise their dividend another 20%. Nicholas Financial continues to be a good buy up to $16 per share.

Ross Stores Raises Guidance

While consumers took a hit early in the year with the end of the payroll tax holiday, our deep discounter, Ross Stores ($ROST), has retained a strong hold on its customer base. Ross already told us that they were going to beat their Q1 guidance, which was $1 to $1.04 per share. This week, they got more specific. Ross said to expect Q1 earnings between $1.06 and $1.07 per share. Kind of a narrow range, dontcha think?

Since their Q1 is already over (it ended in April), and that’s a very narrow range, I think we can assume ROST’s forecast is pretty much on the nose. The message is clear: business is going strong. Ross said that sales rose 12% for the four weeks ending May 4th, and comparable-store sales rose 7%. For the 13-week period, sales were up 6%, and comparable sales rose 3%. This company is clearly doing things right. The earnings report is coming out on May 23rd. Ross Stores is a buy up to $70 per share.

Updated Buy-Below Prices

Going into earnings season, I was pretty conservative with our Buy Below prices. I didn’t want to make any big changes until I could study the Q1 reports. Now that we’ve seen mostly very good results, I feel more confident in raising a few of our prices. Plus, our stocks have been doing very well.

Last week, for example, I raised my Buy Below on Harris Corp. ($HRS) to $47, and the stock ran right past that. This week, I’m raising it to $50 per share. Bed, Bath & Beyond ($BBBY) finally broke $70 per share this week. BBBY hasn’t been that high since September. BBBY is second only to DTV as regards its performance for the year. I’m lifting my Buy Below on BBBY to $73 per share.

Medtronic ($MDT) ended their fiscal year in April, and the Q4 earnings report is due out on May 21st. I’m expecting another good report, so I’m raising my Buy Below on MDT by $3 to $51 per share. Also in the healthcare sector, I’m raising Stryker ($SYK) to $71 per share. I still think their full-year guidance is on the low side. CR Bard ($BCR) has been holding up well despite disappointing guidance. I’m raising my Buy Below on BCR to $106 per share.

Lastly, I’m also going to bump FactSet ($FDS) up to $100 per share, and Fiserv ($FISV) up to $95 per share. I’m going to keep Oracle’s ($ORCL) Buy Below at $35 per share, but the stock is a very good value here. I think ORCL could make a run for $40 soon.

That’s all for now. I’m hitting the road, so there won’t be a newsletter next week. Don’t worry, I’ll keep updating the blog with any important news and information. There are no Buy List earnings reports next week, but we will get important reports on retail sales, industrial production and consumer inflation. I’ll be in touch again with the next issue of CWS Market Review the week after next.

– Eddy

-

Morning News: May 10, 2013

Eddy Elfenbein, May 10th, 2013 at 7:00 amYen Falls Beyond 101 per Dollar on Bond Purchases; Franc Slides

German Exports See Knock-On Effect Of Eurozone Crisis

Central Banks Keep Easing After Cuts Fail to Spur Growth

Jobless Applications Fall to Lowest Since 2008

Fannie Mae to send $59.4 billion to Treasury

Global Network of Hackers Steal $45 Million From ATMs

California Sues JPMorgan Chase Over Credit Card Cases

New York May Have To Drop Claims Against BofA Over Merrill

Krugman: There Is No Bubble In Bonds Or Stocks

Icahn and Southeastern Ready Rival Bid for Dell

Amplats Reduces Job-Cut Plans to 6,000 After State Talks

Nvidia Earnings: Profit Rises 29% With Strength in Graphics Chips

Elizabeth Warren: Students Should Get the Same Rate as the Bankers

Cullen Roche: Moody’s High Yield Bonds Are Mispriced

Jeff Miller: Earnings Season and the Dog That Did Not Bark

Be sure to follow me on Twitter.

-

NICK Earns 40 Cents Per Share for Q4

Eddy Elfenbein, May 9th, 2013 at 4:31 pmHere are the latest results:

Nicholas Financial, Inc. announced that for the three months ended March 31, 2013, net earnings decreased 20% to $4,865,000 as compared to $6,045,000 for the three months ended March 31, 2012. Per share diluted net earnings decreased 20% to $0.40 as compared to $0.50 for the three months ended March 31, 2012. Revenue increased 3% to $17,688,000 for the three months ended March 31, 2013 as compared to $17,182,000 for the three months ended March 31, 2012.

For the year ended March 31, 2013, net earnings decreased 10% to $19,966,000 as compared to $22,230,000 for the year ended March 31, 2012. Per share diluted net earnings decreased 12% to $1.63 as compared to $1.85 for the year ended March 31, 2012. Revenue increased 4% to $70,628,000 for the year ended March 31, 2013 as compared to $68,167,000 for the year ended March 31, 2012.

“During the three months ended March 31, 2013, our results were affected by an increase in the net charge-off rate, an increase in operating expenses and an increase in interest expense,” stated Peter L. Vosotas, Chairman and CEO. “Subject to market conditions, we intend to continue expanding our branch network during the coming year.”

On May 7th the Board of Directors declared a cash dividend of $0.12 per share on its common stock, to be paid on June 28, 2013 to shareholders of record as of June 21, 2013. Subject to market conditions and profitability targets, the Company anticipates it will continue to declare quarterly cash dividends in the future, however no assurances can be given.

This was another good report for NICK. They can keep churning out 40 cents per share without much difficulty. For the fiscal year, NICK earned $1.63 per share.

All of the fundamental ratios are still very solid. The net earnings yield is over 22%. Costs are a bit on the high side but still within the historical range. Credit losses came in just over 1%. That’s down from last quarter.

I’m most impressed by how much debt NICK has paid off since the big dividend last year. They borrowed all that money they paid out to shareholders. From the fiscal second to third quarter, NICK’s indebtedness rose by $32.1 million. But last quarter, indebtedness dropped by more than $14.3 million. That’s pretty impressive.

The simplest way I can put it is that NICK’s business is almost like an 11% bond whose quality seems to improve every quarter. The company can easily raise their dividend another 20%.

Here’s a spreadsheet detailing some of NICK’s performance stats.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His