Archive for August, 2013

-

Morning News: August 12, 2013

Eddy Elfenbein, August 12th, 2013 at 4:50 amJapan’s Q2 GDP Misses by a Huge Margin

Japan’s Below-Forecast Growth Fuels Sales-Tax Debate

Shanghai Rallies Over 2% To 7-Week High On Economic Optimism

Korea on High Alert for Looming Energy Shortage

Carney Call to End Men-Only Club Puts Pressure on Osborne

Recovery Hopes Leave European Shares Hovering at Two and a Half Month Highs

Germany Thumbs Nose at the NSA

WTI Fluctuates After Week’s Biggest Gain as Hedge Funds Cut Bets

Lowballing of Losses Key to Whale Probe

Rockwell Collins to Buy Carlyle’s Arinc for $1.39 Billion

Taiwan’s HTC Looks To Iron Man For Rescue

Musk Gets $4.3 Million of Stock Options for Model X Work

Cullen Roche: Yes, Government Deficits Equal Private Surpluses (Basically)

Jeff Miller: Weighing the Week Ahead: Is It Time to Book Profits?

Be sure to follow me on Twitter.

-

August Is the Sunday of Months

Eddy Elfenbein, August 10th, 2013 at 4:59 pm -

“Don’t You Dare Miss It”

Eddy Elfenbein, August 9th, 2013 at 7:07 pmThe week is over! Time to stop watching stock tickers on a glowing screen and enjoy yourself. The weekend is here — don’t your dare miss it.

-

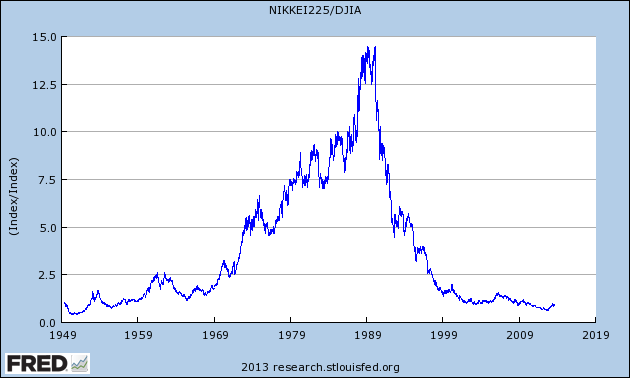

The Nikkei Relative to the Dow

Eddy Elfenbein, August 9th, 2013 at 9:33 amIn 1950, the nominal value of the Nikkei was 0.4 of the Dow. Forty years later, it was 14.6 times the Dow. That rate of outperformance is amazing. But by last October, the ratio had fallen all the way back to 0.64 of the Dow.

Thanks to the Nikkei’s furious rally, the ratio broke 1.0 in May, but has since drifted back to 0.9.

-

CWS Market Review – August 9, 2013

Eddy Elfenbein, August 9th, 2013 at 7:28 am“I made my money by selling too soon.” – Bernard Baruch

As I expected, this was a quiet week on Wall Street. Consider this: Tuesday was the S&P 500’s worst day since June 24th, but the more arresting fact is that that terrible, awful plunge was a loss of a mere -0.57%. Yes, that was our worst loss in a span of 30 trading days! Sheesh, going by recent history, -0.57% doesn’t even scratch the paint. In 2008, the S&P 500 lost more than -0.57% in a single day 38% of the time. How times have changed.

Much of the calmness is certainly due to the wrapping up of Q2 earnings season. I’m happy to say that this earnings season was a good one. So far, 443 stocks in the S&P 500 have reported earnings; 72% have beaten earnings expectations, and 55% have beaten their sales expectations. We had two very good earnings reports this past week. Cognizant Technology Solutions ($CTSH) smashed analysts’ estimates by 10 cents per share, and they guided higher for the year. Also, Nicholas Financial ($NICK) churned out another stellar quarter. I’ll have more on these two in a bit, plus higher Buy Below prices.

I was pleased to see a strong trade report this week. Exports are at a record high, and the U.S. trade deficit is the narrowest it’s been since 2009. The trade report will probably cause the number crunchers to revise the Q2 GDP report higher by 0.5% to 1.0%. That’s also more in line with the earnings reports we’ve seen from the private sector. Also, the ISM Non-Manufacturing Index from earlier this week was particularly strong.

In this week’s CWS Market Review, I want to bring you up to speed on several of our Buy List stocks. It turns out that Ford ($F) is having trouble keeping up with demand. The automaker literally can’t build its cars fast enough! But first, let’s look at the outstanding earnings report from Cognizant Technology.

Cognizant Technology Is a Buy up to $78 Per Share

In April, shares of Cognizant Technology Solutions ($CTSH) got treated to a first-class beat-down. The stock, which had cracked $81 in March, was wallowing below $62 by late April. Of course, one of the benefits of our set-and-forget Buy List is that we don’t get scared out of plunging stocks. We stand firm and watch the storm clouds pass us by.

What freaked out the market was poor earnings by Cognizant’s competitors. There were also concerns that Congress’s pending immigration legislation would be bad for the outsourcing business. The good news came in May, when Cognizant beat earnings by eight cents per share and delivered positive guidance for Q2.

Despite the impressive outlook, the stock didn’t do much. I knew it was time to strike. In the June 28th issue of CWS Market Review, I highlighted Cognizant as being “particularly attractive at the moment.” Sure enough, the stock started to rally in July, and it soon broke $74 per share.

This past Tuesday, we got another solid earnings report from Cognizant, plus strong guidance. For Q2, CTSH earned $1.07 per share, which was ten cents better than estimates. Quarterly revenue rose 20.4% to $2.16 billion, which was $30 million better than expectations.

Cognizant now sees full-year earnings of at least $4.32 per share on revenue of $8.74 billion. That’s revenue growth of 19%. For Q3, CTSH sees earnings of $1.09 per share. Wall Street had been expecting $1.03 per share. The stock gapped up over $76 on Tuesday, although it later gave back much of those gains. Don’t think you’re too late to party. I’m raising Cognizant’s Buy Below to $78. CTSH remains a very good buy.

I’m Raising NICK’s Buy Below to $17 Per Share

Also on Tuesday, Nicholas Financial ($NICK) reported fiscal first-quarter earnings of 46 cents per share. That’s basically in line with what I was expecting. As things stand now, the used-car lender can keep churning out profits of 40 to 45 cents per share for a long time. The economy continues to improve, and this means their loan portfolio is getting stronger. We also have the Fed’s commitment to keep short-term rates low for an extended time. That’s good for NICK.

Looking at the numbers, it appears that NICK benefited from about four cents per share after taxes, thanks to the interest-rate-swap agreement. I can’t find the details yet, because it looks like there’s been an accounting change which adds about $3 million to quarterly revenues. NICK’s stock didn’t react strongly to the earnings news, which is fine by me. With smaller-cap stocks, there’s often a delayed reaction of a few days after a good earnings report.

One thing I’d like to see NICK do is raise its quarterly dividend. The current dividend is 12 cents per share, or 48 cents for the year. At Thursday’s closing price, that works out to 3.1%. I think NICK can raise its dividend as high as 15 cents per share. The company has previously announced its dividend after the conclusion of the shareholder meeting, which is usually in August. This year, the meeting will be held in December. I’m going to raise my Buy Below on NICK to $17 per share. Nicholas Financial is an excellent buy.

Updates on Our Buy List Stocks

I want to add a few updates on some Buy List stocks.

After its great earnings report, Fiserv ($FISV) keeps on rallying. The shares got as high as $101.85 on Thursday. The company just announced a new share-repurchase authorization for 10 million shares, which is about 8% of their outstanding shares. This is a very strong company.

Our healthcare stocks like Stryker ($SYK), Medtronic ($MDT) and CR Bard ($BCR) have been doing quite well lately. MDT nearly got to $56 this week. A judge just ordered Zimmer Holdings to pay Stryker $228 million to settle a patent suit. That’s nice to hear. CR Bard seems to go up every day. The stock just hit another 52-week high. BCR is up nearly 20% since April 24th.

Ted Reed at TheStreet.com had an interesting article on Ford ($F). It turns out that Ford is actually having trouble making its cars fast enough to meet demand. Ford’s inventory is running dangerously low. Reed says, “Ford’s Fusion supply is down to 30 days, about half the industry average, while the Escape supply is around 40 days.” The good news is that Ford is expanding to meet demand.

JPMorgan ($JPM) revealed this week that the bank faces civil and criminal charges over sales of its mortgage-backed securities between 2005 and 2007. The stock slumped a bit on the news. For now, I don’t want to comment on the potential impact of this, since it’s too early to say. I don’t have any reason to believe it will impact the long-term profitability of JPM. But now is a good time to reiterate my belief that Jamie Dimon should step aside.

We’re now done with earnings reports for Buy List stocks that have a June reporting period. We have two Buy List stocks, Ross Stores ($ROST) and Medtronic ($MDT), that ended their quarters in July. Those two should be reporting their earnings in two weeks.

Through Thursday, our Buy List is up 24.13% for the year, compared with 19.02% for the S&P 500 (not including dividends). That’s our biggest lead of the year. If all goes well, this will be our seventh straight year of beating the S&P 500.

That’s all for now. Next week, we’ll get some important economic reports. On Tuesday, the Census Bureau reports on retail sales. This will give us a look at how strong the consumer is. Then on Thursday, we’ll get the inflation report for July. Also on Thursday, the Federal Reserve reports on Industrial Production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: August 9, 2013

Eddy Elfenbein, August 9th, 2013 at 6:17 amJapan’s Debt Exceeds 1 Quadrillion Yen as Abe Mulls Tax Rise

China’s Output Data Adds To Case For Economy Steadying

German Regulators Said to Review Off-Balance-Sheet Loans

The US Is Well On Its Way To Replace Saudi Arabia As The World’s Largest Oil Producer

Fed’s Evans Sees Labor Improvement With September Taper Possible

U.S. Warns Against Eminent-Domain Mortgage Seizures

Home Prices Rise Steeply in West, Sunbelt

Elon Musk’s Fortune Soars $570 Million as Tesla Beats Estimates

Wells Fargo and American Express Join Forces on Credit Cards

Investor William Ackman Targets J.C. Penney’s CEO

Tumblr Founder to Get $81 Million to Remain at Yahoo

Smashburger CEO Attributes Success To Unorthodox Marketing Strategy

SEC Seeks Admission of Wrongdoing From JPMorgan in ‘London Whale’ Case

Roger Nusbaum: The End of Wall Street as We Know It?

Joshua Brown: Confessions of an Institutional Investor

Be sure to follow me on Twitter.

-

Day Trading Is a Sucker’s Game

Eddy Elfenbein, August 8th, 2013 at 2:20 pmI’ve got bad news for all you day traders out there. Just like assembly-line workers, switchboard operators, copy clerks, and hand weavers before you, you’ve now been automated out of existence.

Why, you ask in dismay? The latest issue of Wired explains everything.

It would appear that yet another exotic breed has been spotted in the thickets of the Wall Street jungle—or more accurately, in suburban New Jersey, which is where all the high-speed servers and fiber-optic cables that are their lifeblood are located. This new breed, the high-frequency trader, or HFT, is a scientifically engineered, ultra-streamlined version of the financial sharks of yesteryear.

Or rather they’re not, since they’re not really like investment bankers, stock analysts, junk-bond dealers, corporate raiders, sellers of complex derivatives, or any other species we’ve seen before. In fact, they’re not really interested in the stock business at all, if by “business” one means the furnishing of capital to companies so that the latter may profitably market their goods and services and go on to share the resultant bounty with investors.

What they are interested in is numbers. Streams and streams of numbers. Their approach is to develop algorithms that detect minute changes in stock prices and then to have computers place buy or sell orders on the basis of the patterns in the fluctuations. If an algorithm notices, for example, that a particular stock’s price has gone up for several minutes consecutively, it might decide to hop on the gravy train, buying up lots of shares, only to dump them a second later. Each individual sale might only net the user a fraction of a cent, but multiply that by several hundred shares a day, and by tens of thousands of iterations between 9:30 a.m. and 4 p.m., and you have, in theory at least, the possibility of some serious positive cashflow.

These HFTs (also known as “Quants”) draw their ranks not from MBAs but from former physicists, engineers, IT geeks, and even pro poker players, and they seem to share a curiously abstract view of the stock market, regarding it as a kind of abstract mathematical puzzle akin to Sudoku—you can imagine them getting together on Saturday nights to discuss Fibonacci sequences or proofs for Fermat’s Last Theorem. They don’t bother to concern themselves with p/e ratios, quarterly dividends, or earnings per share, let alone with the companies they trade in or the products made by those companies. Instead, they focus on evermore complex methods of data mining, as well as the hope of ever-faster modes of information transmission, since their profits derive from their ability to stay ahead of the curve, however infinitesimally. Their One Great Hope is the Perfect Transmission Network, one that would enable their remote transactions to be executed on Wall Street at the speed of light—in other words, without the lag time, sometimes several excruciating microseconds in length, currently imposed by technological limitations.

If all this sounds slightly insane, it’s because it is. Especially when one learns just how small the profits involved are. One HFT at a recent conference in London hypothesized that under ideal conditions—famous last words—his latest algorithm would be able to execute 64,000 trades per day, at an average profit of $0.0001 per trade, for a grand total of $600. Not shabby, by any means, but at that rate, he might as well get an honest job. Another researcher speculated that by buying up all the Tweets issued during a given time period—say, six months—and then aggregating them and analyzing them for words with emotional content (“calm,” “happy,” “relaxed,” and the like), it would be possible to divine America’s financial mood and thus predict the course the Dow will take a few days down the line.

Interesting? Sure. Sound investing strategy? Highly debatable.

What all this means for you is that now more than ever, day trading is a fool’s errand. If you were ever tempted to enter the fray, recognize once and for all that those banks of computers chugging away at their algorithms have you hopelessly outclassed. There’s simply no way an individual human being can compete against a fleet of CPUs that rivals NASA’s. Do not, I repeat, do not try it. You will lose.

The good news is that this means that our formula for investing is now at an even greater premium. The ingredients of that formula are the same as ever: (1) Find good-quality companies; (2) Buy said companies’ stock at good prices; (3) Be patient. You don’t need to be the fastest trader, or have the most gizmos working for you. You don’t have to make the perfect trade every time. What you do have to do is research the companies thoroughly, and focus on the long term.

The cult of the financial analyst was laid in its tomb ten years ago. Now the much-vaunted figure of the day trader is headed for the same scrap heap. But the intelligent investor is left standing, even if a robot beats him out of a fraction of a penny. And we’ll still be here even when all those transmissions actually take place at the speed of light, thus depriving the HFTs of their modus vivendi.

In the meantime, it’s best to remember those haunting words by T.S. Eliot, himself a Lloyd’s Bank employee:

Between the order

And the confirmation

Between the bid

And the ask

Falls the shadow. -

Personal Finance 101

Eddy Elfenbein, August 8th, 2013 at 2:17 pmIt’s easy to laugh at the comic books put out by the Fed.

No, you didn’t read that wrong. The New York Fed really does have a series of comics, and they’re available both in free print versions and on its website. Included are such titles as “The Story of Banks,” “The Story of the Federal Reserve System,” “The Story of Foreign Trade,” “The Story of Monetary Policy”—you get the idea.

Not all the materials are technical, of course. “A Kid’s Guide to Money” attempts to teach budgeting to whatever generation is now replacing the Millennials in the long parade of evermore-entitled American self-seekers, while “Wishes and Rainbows” is more philosophical: A little girl finds the secret to raising colorful flowers in a black-and-white world. How to distribute them? Allow the market to dictate the price of scarce resources? Sell off the community’s wealth to more-developed neighbors with superior technology? From each according to his abilities, to each according to his means?

Granted, the Fed is making the satirist’s job pretty easy here. You don’t need to be super-hip to take campy delight in the books’ stodgy, unconsciously-patronizing-to-the-kids tone and cheesy graphics, which are pretty much what you’d expect from educational materials mandated by bureaucratic fiat. (Reading through them, you can almost hear the fluorescent lights humming in some grim federal building in the most forlorn corner of L’Enfant Plaza.) One activity book opens, “An old rock group called the Rolling Stones once sang….” Another features characters whose similarity to the stars of Hanna-Barbera’s Scooby-Doo franchise is just this side of legally actionable. Still another features two not-fun videogames (here and here).

But quickly the laughs give way to chagrin. And a dawning sense of alarm.

Why alarm? Because what quickly becomes apparent is that for all their lameness, these materials are trying to address a real need. Specifically, the need for financial literacy, which, on the evidence of certain events in the housing and credit markets of not too long ago, would appear to be sorely lacking in today’s America.

The Fed isn’t alone in throwing its hat into this educational ring. In 2011, Virginia’s public schools made a combined economics/financial-literacy class mandatory for graduation. Other states have similar requirements on the books. Meanwhile, many colleges now mandate that their charges take Personal Finance 101 immediately upon enrolling.

These curriculum changes may, of course, be motivated by whatever fad is now sweeping the graduate schools of Education and so filtering down to the state bureaucracies. But I prefer to reject such cynicism, however justified. I really want to believe that America’s public officials are indeed finally waking up to reality, that they recognize that in an increasingly post-pension world, a world where people are living longer and where Social Security cannot be relied upon to maintain one’s standard of living after retirement, the good citizens of the republic must, sad to say, learn to make intelligent decisions with their money. Nowadays this has become even more imperative, given that the country’s financial-services sector has become ever more aggressive—and ever more devious—in its strategies to separate folks from their hard-earned dollars.

Whatever the case, the teachers would appear to have their work cut out for them. A 2010 study by the University of Arizona found that college students all too frequently indulge in “risky coping strategies.” Among these “strategies”: postponing necessary health care and using one credit card to pay off another. Meanwhile, a financial-literacy workshop hosted by a community-outreach association in the Bronx tries to render its participants “work-ready.” Its activities include teaching 22-year-olds how to read their paychecks and explaining that check-cashing counters are frequently not the best option for those in need of funds. One attendee confessed she’d bought two pairs of headphones the day before the workshop, for reasons unclear even to herself. Several students were surprised to learn that credit cards are not a form of free money.

Astonishing, I know. But lest you come to the conclusion that such cluelessness could only flourish between East Tremont Avenue and the Bruckner Expressway, there is abundant evidence of its pervasiveness in all sectors of American society. Annamaria Lusardi, a Dartmouth economist who heads up the Financial Literacy center, has found that a majority of Americans do not understand the idea of compound interest. And Broke, U.S.A., journalist Gary Rivlin’s ground-level view of the Great Housing Scam of the 2000s, describes scores of people—rich, poor, and everything in between—who refinanced out of low-interest mortgages, or who thought they had signed fixed-rate agreements when they had really signed adjustable-rate ones.

When you combine this total lack of comprehension with Americans’ ever-growing sense of entitlement—our sense that not being able to pay for the things we want should be no impediment to our buying them—you have a disturbing sense that our culture that is in deep trouble.

Maybe the Fed is onto something, after all.

“A Kid’s Guide to Money,” page 4:

“We all have a limited amount of money that we can use to buy things. Sure, it would be nice to have whatever we want whenever we want it, but because money is scarce, we have to make choices. When you make a choice, you give up one thing in exchange for another thing. This is how adult life works.”

A sobering lesson. Would that we had learned it back in 2004.

-

Morning News: August 7, 2013

Eddy Elfenbein, August 8th, 2013 at 6:18 amEvery Country in Europe Should Be Glad It’s Not Greece

China Trade Rebounds in Further Sign Economy Stabilizing

Forget ‘Taper’ Risk: China is a Bigger Threat

BOJ Beat: 5 Takeaways From Kuroda News Conference

Every Country in Europe Should Be Glad It’s Not Greece

Tesla Motors Stock Soars After Operating Profit Beats Expectations

Facebook and Groupon Win Back Investors, Spur Rally

Silicon Valley Optimistic About Jeff Bezos Buying Washington Post

Turner, HBO and Warner Bros. Drive Time Warner to Strong Quarter

JPMorgan Reveals It Faces Civil and Criminal Inquiries

AOL to Buy Adap.tv, a Video Ad Platform, for $405 Million

Commerzbank Sees Signs of Growth

Deutsche Telekom Tops Sales Estimates, Boosts U.S. Spending

Cullen Roche: Japanese Sales Growth is Surging

Credit Writedowns: The Changing Debate Over China’s Economy

Be sure to follow me on Twitter.

-

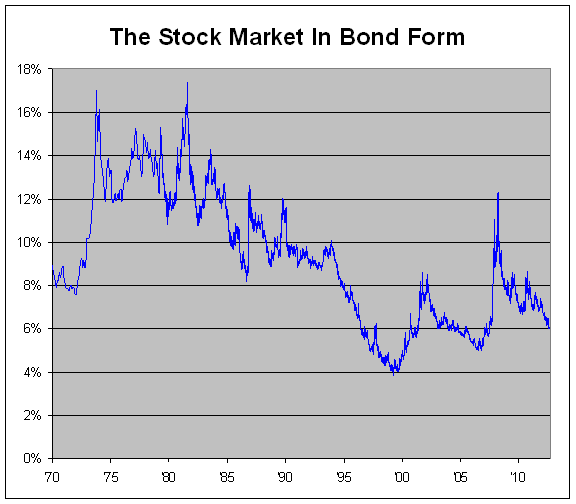

What if the Stock Market Were a Bond?

Eddy Elfenbein, August 7th, 2013 at 2:52 pmHere’s an update to one of my more off-the-wall ideas. I was curious to see what the historical performance of the stock market looks like, but in the form of a bond.

Crazy? Let me explain.

I took all of the historical market performance of the Wilshire 5000 (including dividends) and invented a hypothetical long-term bond that matched the market’s daily gains step-for-step.

I assumed that it’s a bond of infinite maturity and pays a fixed coupon.

There’s one hitch, though. I have to choose a starting yield-to-maturity for the beginning of the data series in December 1970. So this isn’t a completely kosher experiment because the starting point is based on my guess.

If I choose a number that’s too high, the historical performance won’t be able to keep up, and the yield-to-maturity would grow higher and higher and soon leave orbit. Conversely, if my starting YTM is too low, the yield would gradually get pushed down to microscopic levels.

Fortunately, the data makes my job easy. After four decades, the window I have to work with is pretty narrow. Starting with 10% is too high, and 8% is too low. After playing with the numbers, I finally settled on 8.93%.

Even though this “bond” is completely make-believe, it reflects what the actual stock market really did for the past 42-1/2 years. Through yesterday, the “bond’s” yield stood at 6.01%.

Here’s what the actual stock market looks like, expressed in the form of a bond:

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His