Archive for August, 2013

-

“It’s Getting Crowded in Here”

Eddy Elfenbein, August 7th, 2013 at 11:17 amFord ($F) is hiring even more people:

Ford is expanding again.

This time, the country’s second-largest automaker is adding 800 jobs, primarily in vehicle development.

The move means Ford will add a total of 3,000 white collar jobs this year, with most of them located at the company’s headquarters in Dearborn, Mich.

“It’s getting crowded in here,” one Ford worker said at company headquarters. “I remember when there used to be a lot of empty desks and a lot of long faces.”

Not anymore. As Ford has expanded, it has filled those desks and turned massive losses into record profits.

-

The Legend That Is Starbucks

Eddy Elfenbein, August 7th, 2013 at 10:25 amWhenever I look at it, I always come away thinking that Starbucks ($SBUX) is insanely over-priced, yet the stock keeps proving me wrong. Roben Farzad of Bloomberg has some fascinating facts on SBUX:

More than 19,000 stores and four decades since it started up, Starbucks (SBUX) is still managing to bust out of its balance sheet, defying the law of large numbers.

In the coffee giant’s latest quarter, net income shot up 25 percent from a year ago, on a 13 percent gain in sales, hitting $3.74 billion. Global same-store sales gained 8 percent, well ahead of analysts’ average estimate of 5.8 percent, according to Consensus Metric. Free cash flow—money available to be reinvested in the enterprise, to retire debt, and to pay dividends or repurchase stock—will grow an enormous 50 percent in the year ending September 30, according to a Bloomberg survey of Wall Street analysts.

Consider: Starbucks’s revenue gain of 11.5 percent in the 12 months ended June 30 exceeded that of McDonald’s (MCD) by more than nine times. Consider also: Adjusted for splits, Starbucks was a 73¢ stock in 1992. It’s now worth $73 and sports a $55 billion market cap.

Bloomberg’s Charles Mead reports that Starbucks throws off more free cash relative to its debt than any U.S. restaurant chain. So flush is the Seattle company that it can more than double its debt, to reward shareholders, without hurting its credit. The company plans to add $750 million of debt to the $550 million of bonds it has outstanding—and could take out as as much as $1 billion without materially affecting its credit profile, according to Morningstar (MORN).

Starbucks, which carries an A- credit rating from Standard & Poor’s (MHP), would still have a safer debt-to-equity ratio than about 90 percent of indebted S&P 500 index companies. “They’re happy with that A- rating, but they do recognize that they do have some room to lever up,” Joscelyn Mackay of Morningstar told Mead. “This is a company where their balance sheet has gotten away from them in a positive sense, in that they’ve continued to grow and earnings have continued to grow, and they haven’t kept pace with it.”

“We’ve long recognized that there’s opportunity with an extremely conservative balance sheet to bring a bit of debt on,” Chief Financial Officer Troy Alstead said on a July 25 conference call. Indeed, of the 11 consumer-discretionary companies in the S&P 500 with market values bigger than $50 billion, Starbucks has the least debt. The No. 1 coffee chain is “in the early innings of a global expansion that may last for decades” and is set to benefit from lower coffee costs and higher-margin food sales, Goldman Sachs analysts led by Michael Kelter wrote in a July 26 report.

Props to Howard Schultz for turning around Starbucks since it announced his return to the CEO job in January 2008, after a year in which the share price was cut in half. It has since quadrupled.

The stock is currently going for more than nine times earnings and 27 times next year’s earnings. The dividend yield is just below 1.2%.

It’s a great company, but I think it’s just too pricey.

-

Morning News: August 6, 2013

Eddy Elfenbein, August 7th, 2013 at 6:16 amSteep Learning Curve Ahead for Next RBI Governor Raghuram Rajan

Under Carney, Bank Of England Moves To Forward Guidance

Easy Cash Ebbs for $300 Billion Asean Port-to-Rail Cost

Tapering of Stimulus Could Start as Soon as September, 2 Fed Presidents Hint

Obama Sketches Goals for Retooled Mortgage Market

SEC’s Hunt for Crisis-Era Wrongdoing Loses Steam

BofA Sued by U.S. Over Mortgage Securities

Gold Price Crash Will Not Hurt Our Plans, Says Highland Gold

Chevy Proves It Has Learned A Crucial Rule For Selling Electric Cars

In American Greetings Deal, Echoes of Larger Buyout for Dell

’Washington Post’ Needs Bezos’ Digital Midas Touch

Walt Disney to Lose Millions on Lone Ranger Film

Jeff Carter: Change Management, as it Relates to Startups

Phil Pearlman: how Do You Know When a Stock is Broken?

Be sure to follow me on Twitter.

-

Muppets Most Wanted

Eddy Elfenbein, August 6th, 2013 at 10:53 pm -

Buy List Earnings Calendar

Eddy Elfenbein, August 6th, 2013 at 2:47 pmStock Symbol Date Estimate Result JPMorgan Chase JPM 12-Jul $1.45 $1.60 Wells Fargo WFC 12-Jul $0.93 $0.98 Microsoft MSFT 18-Jul $0.75 $0.66 Stryker SYK 18-Jul $1.03 $1.00 CR Bard BCR 23-Jul $1.38 $1.42 CA Technologies CA 24-Jul $0.74 $0.78 Ford Motor Company F 24-Jul $0.37 $0.45 Moog MOG-A 26-Jul $0.84 $0.90 Fiserv FISV 30-Jul $1.44 $1.50 Harris Corporation HRS 30-Jul $1.15 $1.41 AFLAC AFL 30-Jul $1.51 $1.62 WEX Inc. WEX 31-Jul $1.04 $1.05 DirecTV DTV 1-Aug $1.34 $1.18 Cognizant Technology Solutions CTSH 6-Aug $0.97 $1.07 Nicholas Financial NICK 6-Aug na $0.46 That’s the end of our “June” cycle stocks on the Buy List. We had two companies that ended their quarter in July; Ross Stores ($ROST) and Medtronic ($MDT). Both stocks are due to report in two weeks.

The Credit Card Strategy at Wells Fargo

Eddy Elfenbein, August 6th, 2013 at 12:39 pmHere’s a new look at an old business:

Wells Fargo & Co, the fourth-largest U.S. bank, is trying to grow its relatively small credit-card business with an unusual strategy: appealing to its customers’ distaste for debt.

In 2007, Wells Fargo debuted the Home Rebate Card, which offers a 1 percent rebate that automatically goes toward paying down principal on a Wells Fargo home loan. In the coming months, the bank has plans to roll out cards that provide similar benefits to customers who have taken out student loans, auto loans and other types of consumer debt from the bank.

“The real thing customers wanted was to pay down their mortgage,” Tom Wolfe, Wells Fargo’s executive vice president for consumer credit solutions, said in a recent interview. “That created a thought process where we asked, ‘Why don’t we offer that service for all our products?'”

Wells Fargo believes offering such rewards cards is one of its best bets for boosting the credit card business at a time when consumers remain wary of taking on debt. Outstanding balances on credit cards and other types of revolving debt in the United States have remained flat over the past three years, Fed data show.

Only about one-third of Wells Fargo’s customers carry the bank’s own credit cards – a relatively small number for a bank that controls roughly 10 percent of all U.S. deposits and prides itself on selling customers multiple products. It is ranked eighth among U.S. credit card issuers, with purchase volume of $66 billion in 2012, compared to $566 billion at top-ranked American Express Co and $416 billion at second-place JPMorgan Chase & Co, according to the Nilson Report.

Nicholas Financial Earns 46 Cents Per Share

Eddy Elfenbein, August 6th, 2013 at 11:38 amNicholas Financial ($NICK) reports 46 cents per share for its fiscal Q1:

Nicholas Financial, Inc. announced that for the three months ended June 30, 2013 net earnings increased 5% to $5,700,000 as compared to $5,407,000 for the three months ended June 30, 2012. Per share diluted net earnings increased 5% to $0.46 as compared to $0.44 for the three months ended June 30, 2012. Revenue was $20,476,000 for the three months ended June 30, 2013 as compared to $20,428,000 for the three months ended June 30, 2012.

“Our results for the three months ended June 30, 2013 were positively affected by a non-cash gain related to interest rate swap agreements (mark-to-market) and were adversely effected by an increase in operating expenses,” stated Peter L. Vosotas, Chairman and CEO. During the June quarter we opened our fourth branch office in the South Florida market. “We will continue to develop additional markets and expect to open new branch locations during the remainder of our current fiscal year, which ends March 31, 2014.”

These numbers look pretty good to me. It looks like NICK benefited about four cents per share after-tax thanks to the interest rate swap agreement. I can’t find the details yet because it looks like there’s been an accounting change which adds about $3 million to quarterly revenues. Overall, these results are basically what I was expecting, so that’s good news.

Here’s a spreadsheet detailing detailing NICK’s last few quarters.

Cognizant Beats By 10 Cents Per Share

Eddy Elfenbein, August 6th, 2013 at 11:20 amThe stock market is pulling back this morning. The S&P 500 is currently back below 1,700. Retail stocks are under heat today as American Eagle ($AEO) reported disappointing results. AEO is down about 16% on the day. Wall Street assumes that if one company in a sector is having trouble, then they all must be in trouble. As a result, shares of Ross Stores ($ROST) are also down today. ROST is currently down about 2%. The company will report its second-quarter earnings two weeks from tomorrow.

The big economic news this morning is that the trade deficit dropped to $34.2 billion for June. That’s the lowest since October 2009. Exports rose 2.2% to $191.2 billion which is an all-time record. Imports fell 2.5% to $225.4 billion.

This trade data will probably lead the number crunchers in the government to revise the Q2 GDP figures higher. The initial report said that the economy grew, in real terms, by a measly 1.7% for the June quarter. Today’s report suggests the GDP report could be revised as high as 2.5%. The next GDP report will come out at the end of the month.

Dish Network ($DISH), the big rival of DirecTV ($DTV), reported lousy results for Q2. The company lost 78,000 customers in the quarter. There’s mounting pressure on DISH to sell itself to DTV. I don’t know if that will happen, but it’s definitely being talked about.

The best news for us today is that Cognizant Technology Solutions ($CTSH) had a great earnings report, plus they raised full-year guidance. For Q2, CTSH earned $1.07 per share which was ten cents better than the estimates. Quarterly revenue rose 20.4% to $2.16 billion which was $30 million better than expectations.

Cognizant now sees full-year earnings of at least $4.32 per share on revenue of $8.74 billion. That’s revenue growth of 19%. For Q3, CTSH sees earnings of $1.09 per share. Wall Street had been expecting $1.03 per share. Shares of CTSH are up about 2.86% today.

Morning News: August 6, 2013

Eddy Elfenbein, August 6th, 2013 at 6:23 amECB Has Easing Bias, Not Out of Ammunition: Praet

India’s Rupee Plunges to Record on Fed Concern; Bonds Decline

RBA Shifts Toward Neutral After Cutting Rate to Record

New Zealand Probes Fonterra Over Latest Tainted-Milk Scare

Obama to Urge Congress in Speech to Shutter Fannie Mae and Freddie Mac

Service Industries in U.S. Expand at Fastest Pace in Five Months

MORGAN STANLEY: The Fed’s Decision To Taper In September Is Now Dependent On A Single Data Release

Billionaires’ Latest Trophies Are Newspapers

Sony Rejects Loeb’s Push For Spin Off Of Entertainment Unit

Standard Chartered Net Income Falls 24% on Korea Writedown

Munich Re Quarterly Profit Falls 35% on Disaster Claims

Credit Agricole Rises; Profit Tops Estimate on Greek Exit

Rich Milennials Think About Money Very Differently From The Rest of Us

Joshua Brown: Where Are All the New Households?

Be sure to follow me on Twitter.

The Long-Term CYC/SPX Ratio

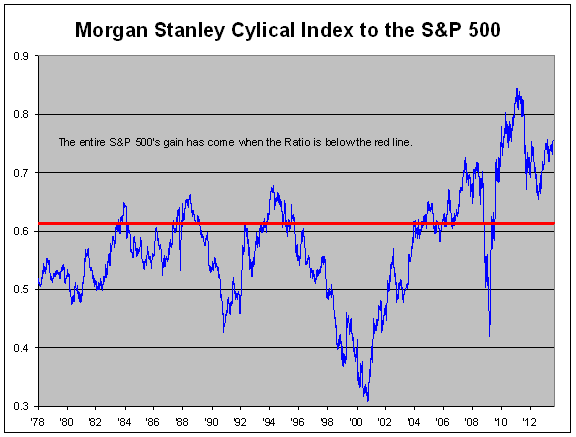

Eddy Elfenbein, August 5th, 2013 at 3:55 pmLast week, I pointed out that the ratio of the Morgan Stanley Cyclical Index to the S&P 500 was nearing a two-year high. On Friday, in fact, the ratio closed barely below its two-year high.

How close? On Friday, the ratio closed at 0.75670; the ratio from this past March 18th was 0.75676. It’s hard to get much closer than that.

What’s interesting is that a high ratio has traditionally meant trouble for the S&P 500. Since 1978, the entire gain of the S&P 500 has come when the Cyclical-to-S&P 500 ratio was below 0.6137 (the red line in the chart below). One-third of the time, the ratio has been above that mark, and the S&P 500 hasn’t, on net, made a dime over that time.

We’re well above 0.6137 right now but I don’t believe this is a signal that the stock market is in trouble. For one, I hardly think the ratio is a good timing device. I think this is more of a sign that the very easy gains are gone. The lesson is that cyclicals get a double-whammy effect — they outperform in strong markets, and underperform in weak ones.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His