Archive for October, 2013

-

What Happened to Exxon Mobil?

Eddy Elfenbein, October 29th, 2013 at 10:16 amWhat happened to Exxon Mobil ($XOM)? The oil giant used to dominate the market, but the stock has been a major laggard during this bull market. It’s not just the sector; XOM has lagged the XLE as well (see below).

Exxon is still a big kid. They have a market cap of $390 billion which is second only to Apple ($AAPL) in the S&P 500. But it’s not that far ahead of Google ($GOOG) which comes in at $340 billion. If XOM had merely kept pace with the S&P 500, their market cap would be over $700 billion today.

Is XOM a good buy here? That’s hard to say. The stock is probably lower than where it ought to be, but it’s not clear how much long-term potential there is. XOM is going for 11 times next year’s earnings, but those earnings are projected to be less than last year’s profit.

You can often find good buys by looking at what strong stocks have lagged the market for a few years. XOM certainly fits that. But I’m not convinced the stock is a bargain just yet.

-

Harris Earns $1.18 per Share

Eddy Elfenbein, October 29th, 2013 at 9:51 amNice earnings beat for Harris ($HRS) this morning. For its fiscal Q1, the company earned $1.18 per share which was five cents more than expectations. Quarterly revenues dropped 5.5% to $1.19 billion which was $30 million below consensus.

Harris also reaffirmed their guidance for this year (their fiscal year ends in June). They see full-year earnings ranging between $4.65 and $4.85 per share. Wall Street expects $4.74 per share.

The company generated free cash flow (net cash provided by operating activities less capital expenditures) of $139 million in the first quarter compared with $77 million in the prior year. Free cash flow was 109 percent of income from continuing operations.

“First quarter operating performance provided a positive start to our fiscal year,” said William M. Brown, president and chief executive officer. “Previous restructuring actions together with our continuing progress on operational excellence allowed us to post solid results in the quarter, despite the tough government spending environment.”

HRS has been as high as $61.94 this morning which is up 4.3% from yesterday’s close. The stock is currently off its high.

AFLAC ($AFL) and Fiserv ($FISV) are due to report after the closing bell.

-

Morning News: October 29, 2013

Eddy Elfenbein, October 29th, 2013 at 6:29 amRajan Raises Key Rate to Fight Inflation as Cash Curbs Eased

EU Delays Bank Capital Rule Following Nordic Protest

Hopes of Market Reforms in China Tempered by Political Realities

The White House May End US Spying On Friendly Foreign Leaders

Medicare Chief Is About to Get Grilled on Obamacare

UBS Profitability Goal Delayed by Capital Demands

Ron Paul: Son Will Hold Up Yellen to Get Fed Bill Vote

Deutsche Bank Profit Slumps 94% on 1.2 Billion-Euro Charge

Lloyds Looks to Reinstate Dividend

Infosys Said to Reach Settlement With U.S. on Visa Probe

Apple’s Profit Falls Despite Higher Sales of iPhones

BP Ups Asset Sales, Dividend as Big Oil Q3 Kicks Off

Goldman Pushes Junior Investment Bankers to Take Weekends Off

Roger Nusbaum: Are We A Country of Moochers?

Cullen Roche: The Debt Bad Guys

Be sure to follow me on Twitter.

-

Updates on CR and CMI

Eddy Elfenbein, October 28th, 2013 at 1:09 pmEarlier this month, I noted that Global Payments ($GPN) rose sharply. I had highlighted GPN thirteen months ago, and the stock has done very well since then.

In that same post from September 2012, I wrote: “Cummins ($CMI) seems to be a very attractive stock. I’m surprised the stock is so low. The same could be said for Crane ($CR).”

Not exactly sophisticated analysis, but I was right again. Here’s how those stocks have performed compared with the S&P 500:

As of today, both stocks are about fairly priced. I no longer see a big bargain here.

-

Stocks Are Flat Ahead of Apple’s Earnings

Eddy Elfenbein, October 28th, 2013 at 11:19 amThe stock market is about flat today. I think the Industrial Production report helped some but most traders are still focused on earnings. Apple’s earnings are due after the bell, and that will get a ton of attention. We’re almost exactly halfway through earnings season; 248 of the S&P 500 companies have reported so far, and 76% have beaten earnings estimates. That’s not bad.

The S&P 500 has been as high as 1,762.77 today which is another all-time intra-day high. The market closed Friday at 1,759.77 which was an all-time high close. Our Buy List briefly passed the 30% YTD gain market, but has since fallen back.

Steven Russolillo notes the strong breadth of today’s market. A total of 451 stocks in the S&P 500 are higher this year. That’s the second-most breadth since 1980. In 2003, 458 stocks were up for the year. This isn’t always the case. In 1998 and 1999, most of the heavy lifting of that bull rally was done by a small number of stocks.

Stocks like AFLAC, Stryker, Medtronic and Ross Stores are at new highs. There are no Buy List earnings reports today, but tomorrow AFLAC, Fiserv and Harris are due to report.

Of course, the Fed meets again tomorrow and Wednesday but I don’t expect to hear any tapering news. To taper now would be like getting picked off with two outs in the bottom of the ninth in the World Series. That’s unheard of.

-

September Industrial Production Rises 0.6%

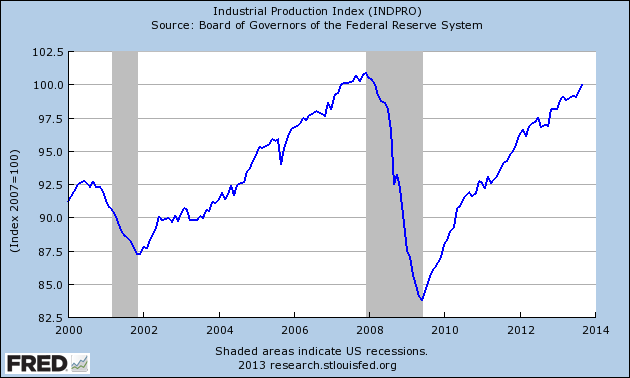

Eddy Elfenbein, October 28th, 2013 at 10:59 amThe Federal Reserve reported this morning that Industrial Production rose 0.6% last month. The details showed that manufacturing was rather tepid but the utility was very strong.

Unlike the stock market, the Industrial Production data series is one that hasn’t been able to surpass its pre-recession peak. The September report was the first to crack 100 since March 2008. The series is based on 100 being the average for 2007. IP still has to grow another 0.8% to top the peak from December 2007.

IP is an interesting data series to follow since it correlates strongly with expansions and recessions. We can’t say what the future will hold, but the economy has been slowly rising this year.

-

Morning News: October 28, 2013

Eddy Elfenbein, October 28th, 2013 at 6:18 amChina May Revamp Rural-Land Rights as Part of Reforms

Euro Jobless Fault Line Festers as Italy Scars Recovery

The Dubai Economy Is Going Nuts, And There’s A Surprising New Factor Fueling The Boom

Japan Regulator, Tepco Chief Meet Over Fukushima

Panel Says No Cover-up in Japan’s Mizuho Mob Loans Scandal

Yellen Poised to Rival Obama With Financial Power

F.D.A. Shift on Painkillers Was Years in the Making

Fee Wars: Why Do iShares Sector ETFs Cost So Much?

Bank of America Verdict Spotlights U.S. Focus on Civil Cases

Apple’s iPhone Sales, Holiday Quarter Up for Scrutiny

Twitter Go-It-Alone App Strategy Boosts Costs Before IPO

Toyota Outsells GM in Quarter as Abe Gives Edge to Japan

Amazon Sales Growing Ahead of Holiday Shopping Season

Jeff Miller: What Happened to the Part-Time Employment Story?

Credit Writedowns: US Stock Market Capitalization Higher Than Any Time Except NASDAQ Bubble

Be sure to follow me on Twitter.

-

Between the Folds

Eddy Elfenbein, October 26th, 2013 at 4:41 pmI can’t embed this video, but here’s a link to Between the Folds — an amazing documentary on origami.

-

Strong Opens for Microsoft and CA

Eddy Elfenbein, October 25th, 2013 at 12:14 pmBoth Microsoft ($MSFT) and CA Technologies ($CA) opened strongly this morning. Both are paring their gains but are still up on the day.

-

CWS Market Review – October 25, 2013

Eddy Elfenbein, October 25th, 2013 at 7:08 am“The stock market is designed to transfer money

from the active to the patient.” – Warren BuffettWe’re now at the peak of third-quarter earnings season. So far, the results have been quite good. According to numbers from Bloomberg, 77% of companies in the S&P 500 have exceeded their earnings expectations, while 53% have topped their sales forecasts. For Q3, the S&P 500 is on track to see 2.5% earnings growth and 2.2% sales growth.

I’m happy to say that our Buy List stocks are continuing to report very strong earnings. The star from this past week was CR Bard, which beat Wall Street’s estimate by 10 cents per share. The stock gapped up 7% on Wednesday to reach a new all-time high (check out the amazing 12-month chart below). Then on Thursday, Ford Motor beat estimates by seven cents per share, and the stock cracked $18 for the first time in nearly three years. After the close on Thursday, we also got very good reports from CA Technologies and Microsoft.

On Tuesday, the Labor Department finally released the September jobs report, which had been delayed due to the government shutdown. The report showed that the economy created a disappointing 148,000 jobs last month. We’re in an odd situation where bad economic news results is good market news. The reason is that traders think, correctly in my view, that this bad economic news will cause the Federal Reserve to hold off on any tapering plans. As a result, the S&P 500 jumped to a new all-time high on Tuesday.

In this week’s CWS Market Review, I’ll run through our latest Buy List earnings reports. We also have a big batch of earnings coming our way next week, including AFLAC, Fiserv and Harris. Plus, we have another Fed meeting next Tuesday and Wednesday, but I strongly doubt we will hear anything new. The tapering plans have apparently been tapered. But first, let’s look at the great earnings report from CR Bard.

CR Bard Is a Buy up to $140 per Share

In last week’s CWS Market Review, I raised our Buy Below on CR Bard ($BCR) from $119 to $126 per share. Thanks to a very strong earnings report, the stock tore right through that mark and raced to a new all-time high.

Let’s run through the numbers. In July, Bard told us to expect Q3 earnings to range between $1.37 and $1.41 per share. Apparently, business is going much better than expected. On Tuesday, the medical-equipment company reported earnings of $1.50 per share, which was a full ten cents higher than Wall Street’s forecast.

Third-quarter sales were up 3%, and sales outside the U.S. rose by 8%. Once we adjust for currency, non-U.S. sales were up 6%. Looking at Bard’s numbers is a little tricky because we have to adjust for some acquisitions costs. But the best news from Bard was that they’re raising their earnings guidance for this year. Before, Bard expected full-year earnings of $5.55 to $5.60 per share. Now they see 2013 earnings coming in between $5.70 and $5.75 per share. That translates to Q4 earnings ranging between $1.34 and $1.39 per share.

Bard’s CEO said, “We are pleased with the results this quarter, exceeding expectations on both the top and bottom line. Consistent with our plan, we continue to focus on shifting the mix of the portfolio to faster revenue growth through targeted investments and acquisitions. Our business development activities, together with the results this quarter and other recent events, represent important steps in helping us improve the growth profile of the business going forward.”

Another thing I love about Bard is that they’ve raised their dividend every year since 1972, including a 5% increase in June. This week, I’m raising my Buy Below to $140 per share. Bard is an excellent stock.

Ford Motor Does It Again

On Thursday, Ford Motor ($F) reported third-quarter earnings of 45 cents per share, which was seven cents more than Wall Street’s consensus. This was Ford’s 17th profitable quarter in a row. The automaker also raised its earnings forecast for this year.

Before, Ford had said they expect pre-tax earnings for this year to match the results from 2012. Now they expect earnings to exceed last year’s results. I was also impressed to see that Ford’s losses in Europe were less than expected. Europe has been an anchor dragging on Ford’s business, but the company has been working to change that.

CEO Alan Mulally and his team have tried to apply to Europe the same turnaround strategy that’s worked so well in North America. Ford lost $228 million in Europe last quarter, which is a whole lot better than the $468 million they lost in last year’s Q3. It looks like Ford will be profitable in Europe by 2015.

Ford’s quarterly revenues rose 12% to $36 billion. In North America, Ford made a cool $2.3 billion. Interestingly, Mulally said that he’d “be pleased” to stay at Ford through the end of 2014, which should end speculation that he’s about to take the top job at Microsoft. Shares of Ford opened Thursday’s trading at $18.02. That was the first time since January 2011 that Ford has topped $18 per share.

The turnaround at Ford has been stunning. The company had junk-rated debt for eight years. Now all the major ratings agencies give Ford investment-grade status. My view: Ford continues to be a very good buy up to $18 per share.

Very Strong Earnings from Microsoft and CA Technologies

After the close on Thursday, we got very good earnings reports from two of our tech stocks, CA Technologies and Microsoft.

For their fiscal Q2, CA Technologies ($CA) earned 86 cents per share, which was 13 cents more than Wall Street had been expecting. The company also raised their full-year guidance for revenues and earnings. Previously, they saw non-GAAP diluted earnings rising by 16% to 20%. Now that range is 17% to 20%. Small, but we’ll take it. The new forecast works out to an earnings-per-share range of $2.96 to $3.03. Wall Street had been expecting $2.97 per share.

Two years ago, CA raised their quarterly dividend fivefold, to 25 cents per share. It’s been there ever since, but this latest report suggests to me that another increase may be on the way. The stock currently yields 3.2%. This was a great quarter. I’m raising my Buy Below on CA Technologies to $33 per share.

Microsoft ($MSFT) reported earnings of 62 cents per share, which was eight cents better than the Street’s consensus. Sales rose 16% to $18.5 billion, which was $700 million more than estimates. The software giant earned 53 cents per share one year ago.

While it’s true that Microsoft has been clobbered in the mobile-phone market, the company still does huge business with the corporate world. Microsoft’s commercial revenue rose 10% to $11.2 billion. I think people lose sight of how profitable they are. In July, Microsoft announced a major reorganization. Then last month, the company reached a deal to buy Nokia’s handset business for $7.2 billion (a very bad move, in my opinion).

I was particularly impressed when Microsoft recently raised their quarterly dividend by 21.7% to 28 cents per share. That shows a lot of confidence. Going by Thursday’s close, MSFT yields 3.3%. Microsoft remains a very good buy up to $37 per share.

Upcoming Buy List Earnings Reports

Next week is going to be a busy week for our Buy List. We have several earnings reports coming. Let me preview them now.

On Tuesday, October 29, AFLAC, Fiserv and Harris are due to report third-quarter earnings. Shares of AFLAC ($AFL) have been doing well lately, and the stock hit a five-year high this week. I’ve been impressed by their performance this year. In July, AFLAC reported very good results for Q2.

However, the duck stock’s big problem this year has been the dollar/yen exchange rate, which has eaten into their bottom line. Forex knocked 22 cents off their earnings in Q2. That smarts. Fortunately, the exchange rate has stabilized over the past few months. For Q3, AFLAC sees earnings coming in between $1.41 and $1.51 per share. For all of 2013, they see earnings ranging between $5.83 and $6.37 per share. AFLAC remains a solid buy up to $70 per share.

Fiserv ($FISV) has been one of our steady winners this year. On Tuesday, the stock got as high as $106.39, which is an all-time high. In July, the company said they expect full-year earnings between $5.84 and $6.03 per share. For the first half of the year, Fiserv has already made $2.83 per share, which is a 16% increase over last year’s first half. Wall Street expects $1.51 for Q3 and $1.65 for Q4. That’s very doable. Fiserv remains a good buy up to $108 per share.

Harris ($HRS) stole the show last earnings season when they creamed estimates by 26 cents per share and soared 8% the following day. The communications-equipment company continued to rally and broke $61 per share this week. Harris is due to report earnings again next Tuesday, October 29. Will Harris repeat their performance from July? I’m not expecting such a big earnings beat, but I think it’s very likely Harris can top the Street’s view of $1.13 per share. Technically this will be for Harris’s fiscal first quarter. Harris has said they expect full-year earnings (ending next June) to range between $4.65 and $4.85 per share. I rate Harris a good buy up to $62 per share.

WEX Inc. ($WEX) will release its earnings on Wednesday, October 30. Three months ago, WEX said that earnings for Q3 will be between $1.16 and $1.23 per share. That’s up from $1.08 per share for last year’s Q3. For all of 2013, WEX sees earnings ranging between $4.27 and $4.37. WEX Inc. is a buy up to $89 per share.

Moog ($MOG-A) is due to report earnings next Friday, November 1. The maker of flight-control systems is our biggest winner on the year, with a 47.2% gain. The stock hit another 52-week high on Thursday. This earnings report will be for Moog’s fiscal fourth quarter. Moog said that earnings for the entire year should be $3.25 per share, and earnings for the current fiscal year will range between $3.90 and $4.10 per share. The shares are still quite reasonable here. Moog remains a buy up to $61 per share.

Nicholas Financial ($NICK) hasn’t said when they’re going to report earnings, but there’s a very good chance it will be next week. The stock has done very well for us lately. The current environment is just about perfect for NICK. Interest rates are low, so it’s easy for them to borrow. The economy is slowly improving, and that helps keep payments coming in on time. I think Nicholas can keep churning out quarterly earnings of 45 cents per share, give or take, for the indefinite future. I also think there’s a good chance we’ll see another dividend increase in December after the shareholder meeting. NICK remains a very good buy up to $18 per share.

That’s all for now. We’re going to have many more earnings reports next week. Also, the Federal Reserve meets again on Tuesday and Wednesday. I think the market is pretty much convinced that there will be no tapering news in the post-meeting policy statement. On Monday, we’ll finally get the Industrial Production report, which was supposed to come out on October 17. The Industrial Production index is getting very close to its peak from six years ago. I’ll be very curious to see if we can set a new high. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His