Archive for November, 2013

-

The Effect of Inflation on Real Stock Returns

Eddy Elfenbein, November 12th, 2013 at 11:54 amI’ve been doing more splicing of the Ibbotson data. Today, let’s look at the effect inflation has had on real stock returns. This may seem counter-intuitive but the more consumer prices rise, the worse stock prices have done. This makes sense since stocks are in competition with bonds, not consumer prices, and bonds do worse as inflation rises. At the other end, real stock markets have done very poorly under deflation. Historically, what the market appears to like best is low, stable inflation.

Now let’s look at some numbers. I took all of the monthly returns from 1925 to 2012 and broke them into three groups; there were 75 months of severe deflation (greater than -5% annualized deflation), 335 months of severe inflation (greater than 5% annualized), and 634 months of stable prices (between -5% and +5%).

The 75 months of deflation produced a combined real return of -46.77%, or -9.60% annualized. The 335 months of high inflation produced a total return of –70.84%, or -4.32% annualized. The 634 months of stable prices produced a stunning return of more than 177,000%. Annualized, that works out to 15.21%, which is more than double the long-term average.

Here’s an interesting stat: The entire stock market’s real return has come during months when annualized inflation has been between 0% and 5.1%. The rest of the time, the stock market has been a net loser.

-

One Full Year Above the 200-DMA

Eddy Elfenbein, November 12th, 2013 at 10:50 amThis Saturday will mark the one-year anniversary of the S&P 500’s last close below its 200-day moving average. This run represents both the market’s climb and its low volatility. The end result is a steady march upward.

-

Morning News: November 12, 2013

Eddy Elfenbein, November 12th, 2013 at 6:32 amU.K. Inflation Slows More Than Forecast to Least in a Year

Compared to CFTC, Heading TARP May Have Been Easy Job

U.S. Nears Energy Independence by 2035 on Shale Boom, IEA Says

Gold Extends Drop to Three-Week Low on Outlook for U.S. Stimulus

Alibaba Breaks Sales Record Amid China Singles-Day Rebate

Here Are Six Reasons Twitter’s Stock Will Be Volatile

Shire of Ireland to Pay $4.2 Billion for U.S. Drug Maker

Vodafone Adds to Network Spending as Sales Miss Estimates

News Corp Misses Revenue Target As Australian Income Slumps

Transocean Yields to Icahn, Pursuing a Trendy Strategy

World Trade Center Tower Debuts in Manhattan Leasing Test

More Anxious Retailers Will Open Earlier on Thanksgiving

Cullen Roche: Hatzius: Baseline for Taper is March 2014

Credit Writedowns: Low Inflation is Creating a QE Trap

Be sure to follow me on Twitter.

-

Transocean Soars

Eddy Elfenbein, November 11th, 2013 at 5:22 pmI had been looking at Transocean ($RIG) as a possible candidate for next year’s Buy List. Unfortunately, a lot of RIG’s big discount evaporated over the past few days.

The company said Monday that it has agreed to support a dividend of $3 per share and reduce the size of its board. It is also looking to boost margins by $800 million through cost-cutting efforts and other measures. Transocean’s stock jumped 3.8% to $55.47 in early Monday trading.

Icahn, a minority shareholder in Transocean, had previously pushed for a $4 per share dividend but Transocean’s shareholders rejected it. Icahn, known for shaking up companies in which he invests, had also wanted several board changes.

Transocean isn’t out of the running for the Buy List, but its candidacy obviously isn’t as strong.

-

Are We in a Bubble?

Eddy Elfenbein, November 11th, 2013 at 10:44 amThe latest rage on Wall Street is to pronounce that stocks are in a bubble. This is rather unusual in that true bubbles are very rare. This is, of course, different from stocks dropping in a routine lousy market. That happens every few years.

Do I think that stocks are in a bubble? Honestly, I don’t know. And more importantly, I don’t much care. Let me explain.

For one, it’s odd to make a judgment about the aggregation of 6,000 publicly traded stocks. Our Buy List is pretty well diversified and that’s just 20 stocks. Where the entire S&P 500 is headed isn’t that important for a disciplined stock picker.

Also, even if the market is about to plunge, it’s very difficult to get the timing just right. Lots of people saw the housing bubble but they were very early. The bubble kept on going. Recently I noted that if an investor bought an S&P 500 index fund just prior to the Financial Crisis, say in March 2008, and held on to today, they would have made a decent return by historical standards. Time may not heal investing wounds, but it sure can help a lot.

When looking at valuation metrics, I urge investors to look at as many as they can, but never be a slave to just one. I’m particularly leery of metrics like the Cyclically Adjusted P/E ratio, also known as CAPE. The CAPE looks at the stock market’s current value weighted against the last ten years of earnings. The idea is to smooth out the economic cycles. I think this is a bad idea because stocks and earnings are themselves cyclical.

Also, the inclusion of so much prior data is, in my opinion, an unfair anchor to carry. The historic plunge in corporate earnings in 2008-09 will still be a part of CAPE for another five years. If we look at operating earnings or dividends, we can see what an outlier that profit data is. Interestingly, the market’s dividend yield has remained fairly consistent for the last decade, except for the worse parts of the Financial Crisis.

After two of the biggest bear markets in history is precisely when so many people are scared of another bubble. I’m reminded of people saying that shortly after 9/11 was actually the safest time to fly. Bubbles are now, apparently, everywhere.

I think the best way to look at the issue is to divide bear markets into two categories. One is where price shoots far above value. That’s your classic bubble ala 1987 or 2000. The second is when value crumbles beneath price. That happened in 1990 and 2008.

You might be surprised to hear me say that 2008 wasn’t a bubble. That’s right; stock valuations really weren’t that excessive. It was the fundamentals that turned out to be terrible. Believe it or not, stock valuations were above average in 1929, but not out of sight. The frothiest part of the bull market occurred in the last six months. The 1920s was not a decade of stock euphoria.

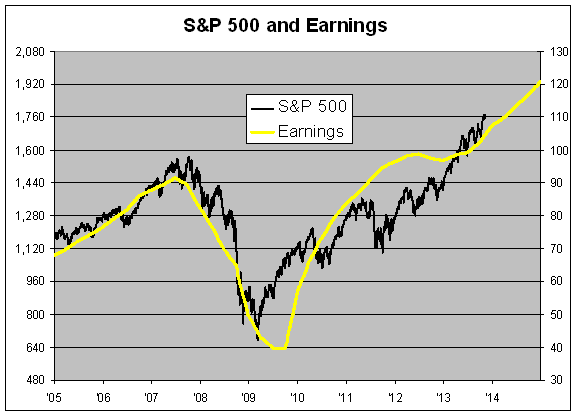

I think there’s a natural tendency to reverse engineer a narrative that the world was enthralled to greed and everyone bought stocks without thought. That describes the feeling about Tech stocks in 1999, but it’s not an accurate description of today’s environment. The S&P 500 is going for about 17 times this year’s earnings. That’s about normal. The P/E Ratio has risen over the last two years, but it’s really gone from low to average, not from normal to nose-bleed territory.

Analysts currently estimate that the S&P 500 will earn $120 per share next year. Now’s the time for skepticism. For one, analysts don’t have a great forecasting track record. The critical question is, could fundamentals soon fall apart? Are there hidden factors that might make the S&P 500 earnings, say, $90 or even less next year? This is the question to worry about.

It’s also hard to predict things that are unexpected because, well, they’re not expected. If they were expected, they probably would be much less interesting. Also, it’s the unexpectedness of an event that makes it important.

The things that worry me are the things we aren’t thinking about. For one, corporate profit margins are very high. I think it’s reasonable to expect that earnings growth will be below economic growth over the next several years. Though the high profit margins probably aren’t a reflection of corporate greed, rather they’re a natural byproduct of slow growth and low interest rates.

Earnings recessions generally don’t announce themselves beforehand, but there are some useful warning signs. One good indicator is the yield curve. When short-term rates rise above long-term rates, the economy often runs into trouble soon after. For now, the yield curve is far from inverted.

Another late cycle indicator is rising inflation. According to the latest numbers, that’s not a problem either. I also like to follow the monthly ISM reports. A reading below 45 is often a sign of trouble. Once again, we’re in the safe zone.

(You can sign up for my free newsletter here.)

-

Scattered Thoughts on Twitter

Eddy Elfenbein, November 11th, 2013 at 10:21 amJust about everything that could be said about Twitter’s IPO has been said. Still, I wanted to add a few scattered thoughts.

Twitter is another good example of a stock where fundamental analysis is basically useless. By any reasonable valuation metric, Twitter is vastly overpriced. That’s not a novel insight. However, that doesn’t mean Twitter’s stock won’t do well.

The reason is that fundamental analysis assumes a level of environmental consistency that doesn’t exist in Twitter’s business. Who knows what their business will look like in a few years? Yet I have a pretty good idea what Harris’s business will look like. This is why I’m staying away from Twitter. I simply can’t offer a reasonable estimate as to what their profit will be. But I do wish them well.

After a big IPO like Twitter, you often hear that the company “left money on the table.” Perhaps. But I think that misses a few key points.

Remember that Twitter floated a relatively small amount of shares. Look at it from their point of view. One issue is that the company has a lot of people working for them who were paper millionaires, and their wealth was very illiquid. The company doesn’t want to alienate long-time employees. Now that Twitter is public, those people are much wealthier, and even factoring in a lock-up period, their wealth is far more liquid than it was before.

We also have to consider the major benefit of an inflated stock price. Twitter can now print money for free which they can use for acquisitions. In other words, their shares are a currency. Every central bank in the world longs for this. Expect to see Twitter roll up a lot of small tech firms, and they’ll use their stock to close the deal.

When looking at stocks, we often talk about price versus value. But this is a good example of the two concepts blurring. An elevated stock price is itself a boost to value because it can aid your financial strategy. I wouldn’t say that a rich valuation can turn a bad company into a good one, but it has helped many good companies become better.

There isn’t much better defense than owning stocks of firms that know what they’re doing.

-

Morning News: November 11, 2013

Eddy Elfenbein, November 11th, 2013 at 6:14 amEuro Zone’s Fizzling Growth Seen to Back Draghi Cut Case

German Bonds Climb Before Growth Report as Yield Curve Steepens

Online Shopping Marathon Zooms Off the Blocks in China

Brent Rises After Iran Talks Fall Short of Agreement

Yellen to Get Quizzed as Taper-Timing Debate Rages

Supreme Court to Take Up Challenges to Union Practices

Postal Service to Make Sunday Deliveries for Amazon

Shire Buys U.S. Drug Firm ViroPharma for $4.2 BIllion

Grifols to Acquire a Novartis Diagnostics Business Unit for U.S. $1,675 Million

Transocean Reaches $1.1 Billion Dividend Accord With Icahn

Panasonic Says Ready to Spend $1 Billion on New Deals

If You Believe in Bitcoin, You Should Never Buy Anything in Bitcoin

Jeff Miller: Weighing the Week Ahead: Do Sidelined Investors Face Upside Risk?

Roger Nusbaum: The Dude Who Came Up With 4% Rule Tells Barron’s It Might Not Work and Allowing For The Possibility of Risk

Be sure to follow me on Twitter.

-

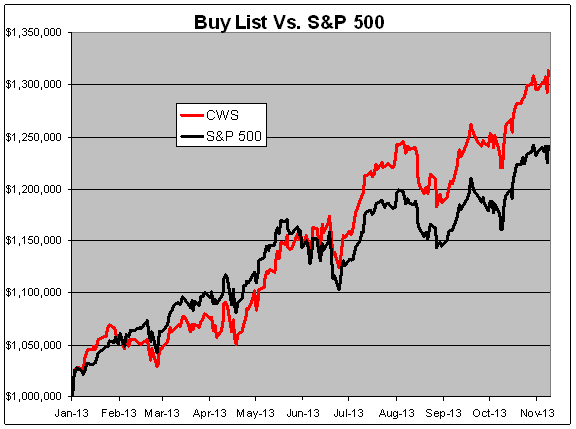

Buy List YTD

Eddy Elfenbein, November 9th, 2013 at 4:01 pmThe end of the year is in sight. Through Friday, our Buy List is up 31.34% for the year compared with 24.15% for the S&P 500 (not including dividends). That lead of 7.19% is our largest of the year. At one point in April, we were trailing the S&P 500 by 3.61%.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His