Archive for November, 2013

-

October NFP +204K, Unemployment 7.3%

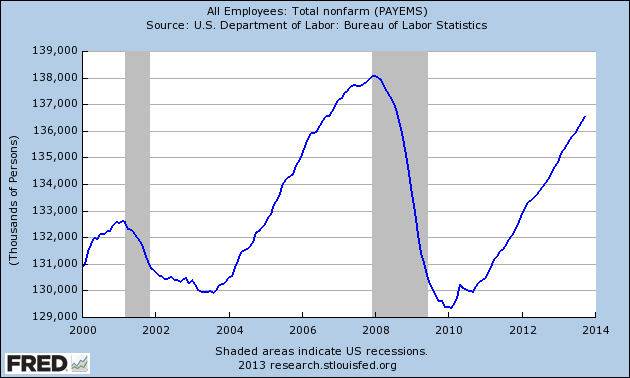

Eddy Elfenbein, November 8th, 2013 at 8:58 amThe October jobs report is out. The economy created 204,000 new jobs last month. Plus, the report for September was revised higher by 60,000 and the report for August was revised higher by 45,000.

The unemployment rate ticked up to 7.3%, but if we work out the decimals, the increase was only 0.045%. We now have the lowest jobs-to-population ratio in 27 months.

From peak to trough, NFP fell by 8.736 million in 25 months. In 44 months since the low, we’ve gained back 7.234 million. In seven years, NFP has increased by 1,000.

In October, the number of Americans either unemployed or out of the workforce entirely came to 102.813 million. That’s an all-time high and it’s up 22.3% in 10 years.

-

CWS Market Review – November 8, 2013

Eddy Elfenbein, November 8th, 2013 at 7:11 am“Wisely and slow; they stumble that run fast.” – Romeo and Juliet, Act II, Scene 3

Third-quarter earnings season is just about over, and it’s been a fairly good one for Wall Street. The latest numbers show that 442 of the S&P 500 companies have reported so far. Of those, 74% have beaten earnings estimates. It looks like the final numbers will show that earnings grew by 4.1% for Q3. Analysts currently expect to see 6.8% growth for Q4. This continues the earnings-acceleration trend we’ve seen this year.

For our Buy List, this has been an exceptionally strong earnings season. This past week, we saw excellent earnings reports from Cognizant Technology Solutions ($CTSH) and DirecTV ($DTV). CTSH not only beat earnings: they raised guidance, and the shares broke out to a new all-time high on Thursday (see chart below). DirecTV smashed earnings by 26 cents per share. Through Thursday, our Buy List is up 29.25% for the year, which is 6.75% more than the S&P 500. That’s our largest lead of the year. If our lead holds up for eight more weeks, it will be the seventh year in a row that we’ve beaten the market.

In this week’s CWS Market Review, I’ll cover our recent earnings reports. I also want to highlight Ford Motor ($F), which is going for a very attractive price. Later on, I’ll focus on some earnings reports due later this month. But first, let’s look at the great earnings report from Cognizant Technology.

Cognizant Technology Beats and Guides Higher

In last week’s CWS Market Review, I said that I expected Cognizant Technology ($CTSH) to beat Wall Street’s earnings estimate—and that’s exactly what happened. On Tuesday, the IT consulting firm reported Q3 earnings of $1.13 per share, which was four cents higher than Wall Street’s consensus. Quarterly revenues rose 21.9% to $2.31 billion, $50 million more than consensus.

This was a very good quarter. Cognizant’s president said, “Our performance during the quarter was stronger than anticipated due to a faster ramp up in demand for outsourcing services and strong discretionary spending on consulting and technology services.” Interestingly, Cognizant benefited from the rollout of the Affordable Care Act, often known as Obamacare. What happened is that a lot of companies and state governments spent money to improve their networks, and that’s very good news for CTSH. Their healthcare business grew by 11% last quarter, which was more than double the rate of their financial-services segment.

But the best news for us is that Cognizant raised their full-year guidance from $4.32 to $4.37 per share. Oh, how I love a beat-and-raise announcement! Full-year revenue is expected to be at least $8.84 billion, which is an increase of 20.3% over last year.

In the CWS Market Review from June 28, I wrote, “One stock on our Buy List that looks particularly attractive at the moment is Cognizant Technology Solutions.” We got that one right. CTSH is up more than 41% since then, and it hit a new all-time high on Thursday. This is still a good buy, although not a super buy like it was in June. This week, I’m raising my Buy Below on Cognizant to $94 per share.

DirecTV Smashes Estimates

Our other big winner this week was DirecTV ($DTV). DTV reported Q3 earnings of $1.28 per share, which was 26 cents more than consensus. Now that’s an earnings beat! In the U.S., DirecTV added 139,000 subscribers, which doubled expectations. Bear in mind that this is happening at the same time that Time Warner and Comcast are hemorrhaging subscribers.

To use the business jargon, DTV is benefiting from a low “churn rate,” which is a fancy way of saying that they’re not giving folks a good reason to cancel. I think a lot of that is due to their NFL Sunday Ticket package. They’ve also benefited from the mini-war between CBS and Time Warner. DTV’s churn rate is especially impressive considering that they’ve been able to raise their prices.

DirecTV’s quarterly revenue rose 6.3% percent to $7.88 billion, which barely topped expectations. I should add that their bottom line included some special items and a fee settlement, but even taking those into consideration, DirecTV handily beat expectations.

Latin America continues to be a strong growth area for DirecTV. They added 260,000 subscribers in that region, which is less than I was expecting. After the earnings report, the stock jumped, then plunged, but soon stabilized. Don’t let the short-term volatility scare you. This is a good stock. I’m raising my Buy Below on DirecTV to $67 per share.

Ford Is an Exceptionally Good Buy Here

Every so often I like to highlight stocks that are exceptionally good buys, as I did with Cognizant this summer. Right now, Ford Motor ($F) is one of the best bargains on our Buy List.

The stock has pulled back recently, and on Thursday Ford closed at $16.55 per share. That’s less than 10 times this year’s earnings estimate. I usually recommend a dose of skepticism when dealing with Wall Street estimates, but in this case, that estimate includes three quarters of results, so it’s not exactly a wild guess.

What’s interesting is that Ford has fallen back at the same time Microsoft ($MSFT) has rallied. In fact, Microsoft just touched a 12-year high. The two events are connected. For several weeks there’s been speculation that Ford’s CEO Alan Mulally would leave Ford to become the new CEO at Microsoft. A lot of traders have been riding the Mulally play (long MSFT, short F). I’ve downplayed these rumors, and I’m still a doubter, but an influential analyst said this week that it’s very likely. Nomura’s Rick Sherlund said that Mulally will be named MSFT’s CEO by December.

While losing Mulally would be a setback for Ford, I think it’s a mistake to think Ford would be cast adrift. Ford’s turnaround is already well established, and they’re spreading that strategy to Europe. Just two weeks ago, the automaker announced another strong earnings report, and they raised guidance. Also, Ford’s losses in Europe were much better than expected.

Ford has now delivered 17 straight profitable quarters in a row. I also expect the company will raise their quarterly dividend in January. The current dividend is 10 cents per share, and I think it can rise to 12 or 13 cents per share. At 13 cents, or 52 for the year, that gives Ford a yield of 3.1% based on Thursday’s close. My take: Ford is worth $22 per share. I currently rate Ford a buy up to $18 per share, but if you can get it below $16.60, that’s a very good deal.

Earnings Preview for Medtronic and Ross Stores

We’ve had all of our Buy List earnings reports for stocks that end their quarter in September. Now we have two coming soon for stocks with October quarters. Medtronic is scheduled to report earnings on Tuesday, November 19. Then on Thursday, November 21, Ross Stores is due to report.

Medtronic ($MDT) has quietly turned into one of our biggest winners this year. The shares are up nearly 40% for the year. The consensus on Wall Street is for earnings of 90 cents per share, which is very doable. The company has said it expects full-year earnings (ending in April) between $3.80 and $3.85 per share. In June, Medtronic raised its dividend for the 36th year in a row. Business is still going well here, and I think they can easily hit their full-year guidance. The CEO said Medtronic is looking to generate $25 billion in free cash flow over the next five years. Medtronic continues to be a good buy up to $57 per share. Be careful not to chase this one.

In August, Ross Stores ($ROST) said that it expects earnings to range between 75 and 78 cents per share, which I think is a conservative forecast. The Street expects 80 cents per share. Ross has been a very strong performer for us. Last week, I raised the Buy Below to $81 per share. Ross Stores remains a solid buy.

That’s all for now. Next week should be a fairly quiet week on Wall Street. Earnings season is just about over, and there are only a few economic reports scheduled. On Thursday, the Census Bureau will release the trade report. Then on Friday, the Fed will report on Industrial Production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: November 8, 2013

Eddy Elfenbein, November 8th, 2013 at 6:16 amEuro Bulls Crack as Odds of Return to 2013 Lows Jump

Draghi Shows Pledges Backed by Rate Surprise

Standard & Poor’s Cuts France’s Credit Rating to AA

China Exports Rise More Than Estimated After September Drop

U.S. Jobs Market Seen Taking a Hit From Government Shutdown

IRS Refunded $4 Billion to Identity Thieves

Twitter Resists Investor Frenzy to Avert Facebook Flop

UBS Pays $3.76 Billion to Swiss Central Bank In Buy-back of Toxic Assets

Disney 4Q Profit Rises but Pay TV Unit Underwhelms

Nvidia’s Quarterly Forecast Raises Competition Concerns

Penney Monthly Same-store Sales Rise For First Time Since 2011

Richemont Says Luxury-Goods Maker Rules Out Selling Brands

Economist Tyler Cowen Explains Why The Future Will Be Awesome — For About 15% Of Us

Joshua Brown: Twitter IPO Post-Mortem

Jeff Miller: Same Story, Two Headlines

Be sure to follow me on Twitter.

-

How Much Would You Pay? (UPDATE)

Eddy Elfenbein, November 7th, 2013 at 6:02 pmWhat if I told you I had a company that last year generated $4 in sales? The problem is that I had $5 in expenses so we actually lost $1.

The good news is that things got better this year. For the first nine months, we generated sales of $5.30. But again, we spent heavily. We had expenses of $7 so we lost $1.70. We have $5 in debt.

How much would you pay for this company?

If you said $179, congratulations. That’s Twitter.

Update: Going by Twitter’s first-day close, make that $305 per share.

-

The Deficit and Unemployment

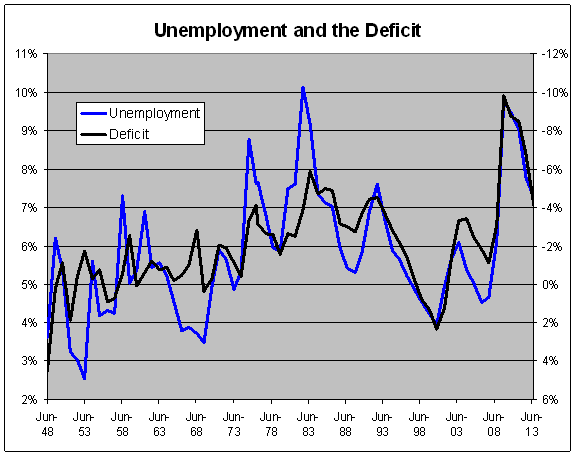

Eddy Elfenbein, November 7th, 2013 at 3:37 pmEarlier this year, I unveiled my Simple Rule for Government Finances. The equation is simple: Take the unemployment rate and multiply it by -2, then add 10 and that should be the government’s deficit as a percent of GDP.

With today’s new data point on the government’s deficit as percent of GDP we can see that my equation holds up well with one out-of-sample data point. Hooray!

Here’s a chart of the Unemployment Rate (blue line, left scale) along with the Deficit as a Percent of GDP (black, right). I’ve scaled the two axes to follow my rule.

Simply put, my equation says that the budget should be balanced when the economy is at 5% unemployment. For every 1% it moves above that, the deficit increases by 2% of GDP. For every 1% below that, the surplus increases by 2% of GDP.

The relationship has held up fairly well for the last 30 years. It’s interesting to see how government financing is a function of the economy—and of course, the economy is impacted by government finances. Perhaps my equation reflects some sort of equilibrium.

If this relationship is accurate, it suggests that the deficit was too high during the GWB years, but too low during the early Reagan years. Perhaps real rates explain the difference.

-

The Great Salad Oil Swindle

Eddy Elfenbein, November 7th, 2013 at 3:02 pmFifty years ago this month, one of the most ingenious Wall Street frauds unraveled. It was the Great Salad Oil Swindle.

Before Bre-X, there was Allied Crude Vegetable Oil Refining Corporation. In 1962, Anthony “Tino” De Angelis set about to corner the soybean oil market through a combination of futures and fraud. De Angelis’s company was heavily involved in the shipping of foodstuffs between the U.S. and Europe following WWII. During the following decades, Allied focused on the soybean oil used to make salad dressings. Along with a checkered past in the meat business, De Angelis gained notoriety for shipping substandard or uninspected vegetable oil to government contractors and then overcharging them.

As a result of his shipping operations, De Angelis learned that consumer credit giant American Express was entering the field warehousing business. This appealed to De Angelis because American Express, following inspections, would vouch for the goods of clients that stored inventory shipments in its warehouses. Clients then could use American Express’s warehouse receipts to take out loans, putting up the authenticated value of their inventories as collateral. De Angelis became one of American Express’s first big clients.

Moving from dubious business practices to outright product fraud, De Angelis began filling his oil tanks with water and then adding thin layers of oil to the tops of each tank in an attempt to deceive inspectors. Liter upon liter of watered down inventory piled up in warehouses while De Angelis took out millions in loans from banks. He used much of the money to buy up soybean oil futures so that he could completely corner the market. Problems started to crop up, however, when the soybean oil being stored at American Express warehouses vastly exceeded soybean producers’ output. Somebody blew the whistle and American Express inspectors swooped in to discover the tanks of oil-sprinkled water that De Angelis had been storing. In total, the tanks in De Angelis’s inventory represented more than $175 million worth of faked soybean oil.

On November 19, 1963, Allied Crude Vegetable Oil Refining Corporation filed for bankruptcy. De Angelis filed for personal bankruptcy as well, leaving American Express to foot the bill on the bad loans. In addition to American Express, the scandal weakened other Wall Street firms, which contributed to the financial chaos that followed the Kennedy assassination a few days later. With massive losses, American Express shares dropped sharply and Warren Buffett, value investor extraordinaire, scooped up a 5% interest in the ensuing fire sale. De Angelis was sentenced to seven years in prison. However, the ultimate losses from the salad oil scandal were difficult to separate from the general bloodletting on Wall Street in 1963.

Norman Miller won a Pulitzer Prize for his reporting on the scandal and later wrote the book, The Great Salad Oil Swindle.

-

The Fiscal Year Numbers Are In

Eddy Elfenbein, November 7th, 2013 at 12:49 pmToday’s third-quarter GDP report also gave us our first look at the GDP for the entire 2013 fiscal year. Nominal GDP totaled $16.62 trillion for the FY 2013 which was an increase of 3.26% over FY 2012. (This is, of course, our first look; there numbers will be updated many more times.)

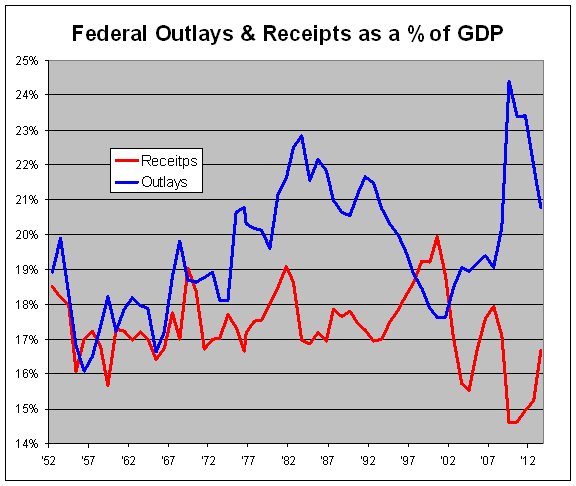

With the recent budget data, we now have the latest data point on the government’s taxing and spending as a percent of GDP. You often see this chart in policy debates so you may be familiar with it, but I have to explain that three months ago, the BEA updated the entire GDP data series. As a result, many of the versions of this chart you see on the web are incorrect.

Below is the updated version. This may be the only place you’ll find it:

Also, I’m a big fan of the St. Louis Fed’s FRED database, so it pains me to say that their numbers are out-of-date as well. Their Fiscal Year GDP (FYGDP) series is based off the old GDP data. Also, their Receipts, Outlays and Deficit as a percent of GDP series (FYFRGDA188S, FYONGDA188S, FYFSDFYGDP) are based on calendar year GDP, not fiscal year. I’ve also included the 1976 “transitional quarter.”

Now let’s look at the numbers:

Uncle Sam spent $3.45 trillion last year which works out to 20.79% of the economy. That’s the second year in a row that spending as a percent of GDP has fallen and it’s well below the recent peak of 24.41% set in 2009.

The Feds took in $2.77 trillion in revenue which works out to 16.69% of GDP. That’s the fourth increase in a row, though it’s working off a very low bottom. The oft-heard talking point about “the lowest taxes in 60 years” is no longer operative.

The deficit came out to $680 billion which is 4.09% of GDP. I thought we had a shot of dropping below 4% but we couldn’t do it. Still, it’s an enormous decrease from the prior four years.

-

Q3 GDP Growth = 2.8%

Eddy Elfenbein, November 7th, 2013 at 10:42 amThe government reported that the economy grew by 2.8% in the third quarter. That was better than expectations of 2%. Unfortunately, much of the increase was driven by inventory restocking.

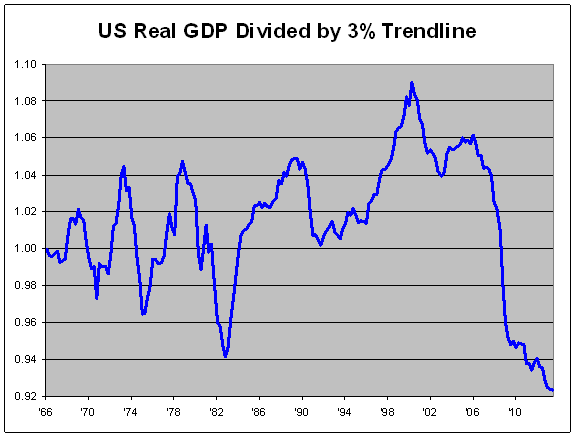

While this was the third quarter in a row of rising growth, it was also the 20th time in the last 25 quarters that GDP growth failed to crack 3%. What makes this interesting is that 3% growth was about the average growth rate for 40 years for the U.S. economy.

Below is a chart I made and I think it shows you just how poorly the economy has performed. I took real GDP and divided it by a 3% trendline. I used $4.2 trillion in Q1 of 1966 as my base.

Whenever the blue line rises, that means the economy is growing faster than 3%. A falling line indicates slower than 3%. We tracked 3% pretty well for a long time. But lately, the economy has nose-dived. We’re currently at 92.3% of the trend.

I don’t see us reverting to the mean. This may be the new normal.

-

Morning News: November 7, 2013

Eddy Elfenbein, November 7th, 2013 at 6:07 amDraghi Weighs Whether Rate Cuts Too Valuable as ECB Meets

S&P Affirms India’s Rating at BBB-/A-3; Outlook Remains Negative

Société Générale and Crédit Agricole Aim for Swap on Derivatives Venture

Cautious Consumers Seen Curbing U.S. Economic Growth

Revenue Growth Hopes Feather Twitter’s Nest

Twitter IPO Price Indicates Asian Players Are Undervalued

Square Exploring 2014 IPO With Banks

ArcelorMittal Core Profit Better Than Expected at $1.71 Billion

Lenovo Profit Up 36% As Smartphone Sales Grow

Investors Slam The Brakes On Tesla, Time To Stay On The Shoulder?

Tesla’s Valuation Drives Me Crazy

Deutsche Telekom Sales Exceed Estimates on T-Mobile US

Nestle Sheds Bulk of Jenny Craig in Effort to Slim Down

An Offer From Amazon to Its Most Bitter Rivals

Cullen Roche: Shiller: Is Economics a Science?

Be sure to follow me on Twitter.

-

Twitter Priced at $26 per Share

Eddy Elfenbein, November 6th, 2013 at 9:56 pmTwitter ($TWTR) will start trading tomorrow. The company will debut on the NYSE under the symbol TWTR. The underwriters have announced a price of $26 per share. That values the company at $14.2 billion.

Everyone on Wall Street has their fingers crossed on this one since the Facebook ($FB) IPO was a bit of a flop. Trading was delayed and the stock didn’t do well for several weeks. I suspect that FB wasn’t well advised by their bankers. Also, I think they got greedy. Twitter seems to be avoiding these mistakes.

Twitter is selling 70 million shares to the public so it will raise $1.82 billion for the company. I strongly suspect that the price will pop once the shares hit the market.

So is Twitter a good buy? The heck if I know.

With investing, I rely on the fundamentals of a business. One of the limits of fundamental analysis is that it assumes the general stability of the business environment. With a company like Twitter, that environment is far from stable. I can make a pretty good guess as to what Harris will look like in three years. But with Twitter, I have no earthly idea.

Twitter is currently losing money, and it will continue to do so. If things go well, they may turn a profit by 2015. Again, that’s if things go well. At $26 per share, twitter is being valued at 12.4 times next year’s estimated sales. Facebook currently trades at 11.6 times 2014 sales, and LinkedIn is at 12.2 times. That’s a rich valuation.

Until I can see a consistent positive cash flow stream from Twitter, I’m staying far away from this stock. That’s not a moral judgement against the stock. I wish them well. But for my kind of investing, I never take risks I don’t have to.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His