Archive for November, 2013

-

Morning News: November 4, 2013

Eddy Elfenbein, November 4th, 2013 at 6:50 amECB’s Asmussen Says ESM Should Be Last Port of Call For Banks

EU Moots Funding Backstop For Non-Euro Zone Banks

What British Business Wants From a Reformed Europe

Gas Prices Are Declining, And It’s Turning Into Real Wealth Gains For Americans

Here’s How Every Sector Has Performed Compared to the Overall Stock Market

Twitter Debut Seen Setting the Tone for Social-Media Valuations

HSBC Profit Rises 30% on Cost Cuts as Currency Trades Probed

BlackBerry Bidder Faces Deadline to Seal Deal

Samsung Ready to Slowly Lift Veil to Investors

Alcatel Seeks $2.7 Billion After Stock Doubles Under Combes

Riding the Hashtag in Social Media Marketing

Jeff Miller: Weighing the Week Ahead: Time for a Year-End Rally?

Be sure to follow me on Twitter.

-

Frankenstein: Summary & Analysis by Thug Notes

Eddy Elfenbein, November 3rd, 2013 at 4:03 pm -

War of the Worlds 1938

Eddy Elfenbein, November 1st, 2013 at 4:14 pmSeventy-five years ago this week, 23-year-old Orson Welles produced “The War of the Worlds.” Here’s the original broadcast.

-

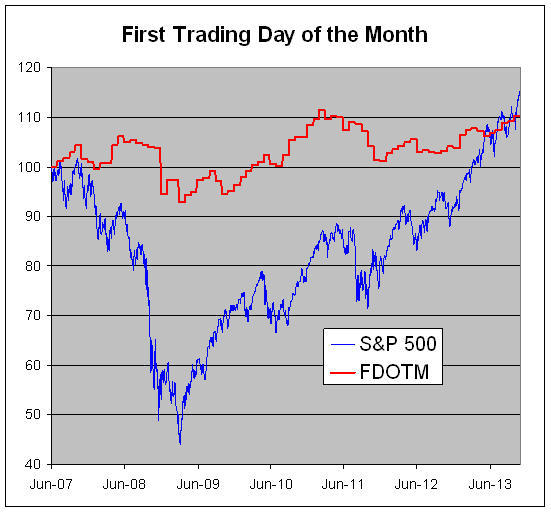

Another Winning First Day of the Month

Eddy Elfenbein, November 1st, 2013 at 11:06 amOn the first trading day of the month, the S&P 500 has rallied 16 times in the last 22 months — and we’re up again today.

This would also be the sixth month in a row where the market rallied on the first day of the month after falling on the last day of the month.

Going back to June 4, 2007 through yesterday, the S&P 500 has gained 14.12% (not dividends, just the index). The combined return on just investing on the first trading day of the month was 10.06%. The rest of the time was just 3.69%. As recently as three weeks ago, that last number would have been negative. That means the entire capital gain of the S&P 500 came on just the first trading day of each month.

-

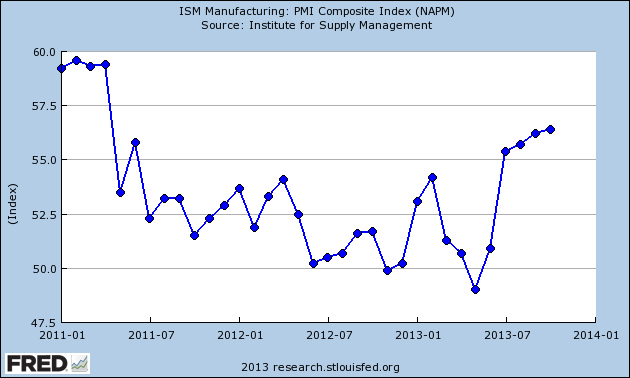

October ISM = 56.4

Eddy Elfenbein, November 1st, 2013 at 10:05 amThis morning’s ISM report came in at 56.4. That’s the strongest report since April 2011.

-

Ford Has Its Best October Since 2004

Eddy Elfenbein, November 1st, 2013 at 10:00 amFrom MarketWatch:

Ford Motor reported a 14% rise in U.S. vehicle sales for October to 191,982 units, from 168,456 vehicles a year ago. Retail sales climbed 15% to 142,487, making that the best October since 2004, the car maker said Friday. Sales of passenger cars jumped 19%, while those of utility vehicles rose 9% and truck sales gained 14%. Ford Fusion and Fiesta posted their best-ever October sales, and F-Series topped 60,000 sales for the sixth straight month. The last time Ford sold more than 60,000 trucks for six consecutive months was 2006, it said. Still, vehicle sales fell shy of analysts’ expectations of a 15.5% jump to 193,988 units, Overall U.S. car sales are forecast to climb to 15.4 million in October from 15.2 million in September, according to a MarketWatch poll. Ford shares were up 0.4% in early trading.

A bit below expectations but still good.

-

Moog Earns 96 Cents Per Share

Eddy Elfenbein, November 1st, 2013 at 8:16 amThis morning, Moog ($MOG-A) reported earnings of 96 cents per share which matched estimates. This was for their fiscal fourth quarter. For the entire year, Moog earned $3.50 per share which is up 5% from last year. Their backlog is up to $1.3 billion.

Moog reiterated its forecast for the new fiscal year of earnings ranging between $3.90 and $4.10 per share. The midpoint is a 14% increase over last year. John Scannell, Moog’s CEO said, “Fiscal ’13 will be remembered as the year of restructuring and write-offs. Looking past these adjustments, our fiscal ’13 operational performance was actually up on fiscal ’12 and we look forward to further improvements in fiscal ’14.“

Here are some details of the quarter.

Aircraft Controls sales for the year crossed the billion dollar mark for the first time. Sales of $1.1 billion were up 10%. Commercial aircraft sales were very strong, up 20%. Total military sales were $596 million, up 4%, on K-46 tanker development, F-35 production and aftermarket sales. Military aftermarket sales were $231 million, 8% higher.

In the fourth quarter, Aircraft Controls sales of $276 million increased 9% from the same quarter last year. Commercial revenues increased 23% as production rates for aircraft continue to ramp up. Military aircraft sales were down slightly, at $146 million, on slower OEM deliveries. Military aftermarket sales were marginally higher at $62 million.

Space and Defense sales of $396 million for the year were 10% higher. Sales of controls for spacecraft, payloads and space exploration programs increased 28%, driven by acquisitions and NASA program sales. Defense sales were 5% lower as program deliveries slowed. Security product sales were $48 million. For the fourth quarter, Space and Defense sales mirrored the trend for the year.

Industrial Systems had revenues for the year of $592 million, a 7% decrease from last year. Wind energy sales were down 38% from a year ago as demand in China and Europe declined. Industrial automation sales were down 3%, with most of the underlying markets experiencing softness. Sales for simulation and test equipment were stronger, up 6%. Non-renewable energy product sales were 3% higher. Industrial Systems sales in the fourth quarter were up 2% at $153 million.

Components segment sales were $415 million for the year, up 11%. The growth was in energy, industrial and medical markets with aerospace and defense sales unchanged. Sales for the quarter were a record $105 million. Both the year and fourth quarter sales reflected higher energy and industrial sales because of the Tritech and Aspen Motion Technologies acquisitions.

Medical Devices generated sales of $147 million for the year, up 5% from the year previous on higher pump and administration set sales. For the quarter, sales in Medical Devices of $39 million were up 9% from a year ago.

-

CWS Market Review – November 1, 2013

Eddy Elfenbein, November 1st, 2013 at 7:07 am“Time is on your side when you own shares of superior companies.” – Peter Lynch

After rising on 13 out of 15 days, the stock market has taken a small breather the last two days. This has been quite an impressive run for the market, so a little relief is understandable. This year is shaping up to be the best for the S&P 500 in a decade. The index has been positive for the entire year, with an amazing 33 record highs so far.

We’re heading into the back end of earnings season. So far, the results for Q3 have been decent. Companies are topping estimates, but those estimates have been steadily pared back for the last 18 months.

The latest numbers show that 364 of the 500 members of the S&P 500 have reported earnings so far. Of those, 75% have beaten earnings estimates, while 53% have beaten sales estimates. When the final numbers are in, analysts see the index posting 3.7% earnings growth for Q3. Remember that overall earnings fell in Q1 and Q2 of this year, so this is a nice turnaround. In fact, analysts forecast that earnings growth will continue to accelerate. For Q4 (which is now one-third over) analysts see earnings growth rising to 7.5% and climbing another 8.3% for Q1 of 2014.

In this week’s CWS Market Review, I want to cover some of the great Buy List earnings reports from this week. Fiserv beat earnings and raised guidance. Harris jumped nearly 6% on a nice earnings beat. WEX Inc. also beat and raised guidance. The stock spiked nearly 7% in two days.

Not all the earnings news was good. Frankly, the earnings reports from Nicholas Financial and AFLAC were a bit disappointing, but nothing too severe. The best news was that AFLAC raised its dividend for the 31st year in a row. Not many stocks can say that.

I’ll also take a look at our remaining earnings reports. In particular, I’m expecting good news from Cognizant Technology. But first, let’s look at the great earnings report from Harris.

Harris Is a Buy up to $65 per Share

In last week’s CWS Market Review, I said “it’s very likely” Harris ($HRS) would beat earnings. I was right. On Tuesday, the communications-equipment company reported earnings for their fiscal Q1 of $1.18 per share, which was five cents better than Wall Street’s consensus. The shares jumped nearly 6% on Tuesday to reach a new five-year high. The rally in this little stock has been amazing. Harris is now up over 50% in a little over six months.

I was pleased to see Harris reaffirm its full-year guidance of $4.65 to $4.85 per share. This is for the fiscal year that ends in June. The Street had been expecting $4.74 per share. The details of this report were very impressive. I’m raising my Buy Below on Harris to $65 per share.

Fiserv Beat Earnings and Raised Guidance

After the closing bell on Tuesday, Fiserv ($FISV) reported Q3 earnings of $1.56 per share, which was also five cents better than the Street’s view. Earnings were up 24% for the quarter and 18% for the first three quarters. Fiserv’s CEO said, “We remain on track to achieve our 2013 financial objectives and have meaningful momentum as we head into 2014.”

That’s certainly true. Fiserv now sees 2013 earnings ranging between $5.94 and $6.02 per share. That’s an increase of 10 cents per share on the low end. It also implies a growth rate of 17% to 19%, which is very good for this environment. Fiserv remains an excellent buy up to $108 per share.

WEX Is a Buy up to $99 per Share

On Wednesday, WEX Inc. ($WEX) reported earnings of $1.29 per share, which was a full ten cents per share above expectations. Business is obviously going better than the company anticipated. Three months ago, WEX said that earnings for Q3 would be between $1.16 and $1.23 per share.

WEX put up some impressive numbers. Quarterly revenue jumped 19% to $191.5 million. The CEO said, “For the quarter, revenue increased 19% year over year and was towards the high end of our guidance, while adjusted net income, increasing 20%, exceeded our expectations.”

WEX also raised its full-year guidance range to $4.37 – $4.44 per share. The earlier range was $4.27 – $4.37 per share. That’s a nice increase. For Q4, WEX sees earnings coming in between $1.04 and $1.12 per share. Wall Street had been expecting $1.11 per share.

Thanks to the earnings report, the stock rallied 4.3% on Wednesday and another 2.3% on Thursday. The shares crossed $94 and hit a new all-time high. I’m raising my Buy Below on WEX to $99 per share.

Disappointing Earnings from AFLAC and NICK

Not all the earnings news was positive this week. On Tuesday, AFLAC ($AFL) reported Q3 earnings of $1.47 per share, which was a penny below expectations. I want to emphasize that this was only slightly disappointing, and my overall view on AFLAC hasn’t changed at all. The company is still matching its own numbers. In July, they gave us a range for Q3 of $1.41 to $1.51 per share.

The enemy of AFLAC’s bottom line is quite obvious. The yen/dollar exchange rate gobbled up 21 cents per share last quarter. I tend to look past currency exchange because it’s a transient issue. Sometimes it helps you; sometimes it doesn’t. Over the last few months, it’s hurt AFLAC. We shouldn’t complain too much since the weaker yen probably helps the Japanese economy, which is where AFLAC does most of its business.

AFLAC’s based its forward guidance on a yen/dollar rate of 95 to 100. For Q4, they see earnings ranging between $1.38 and $1.43 per share. That works out to full-year earnings of $6.16 to $6.21 per share. The previous range was $5.83 to $6.37 per share.

For 2014, AFLAC sees earnings coming in between $6.28 and $6.52 per share. AFLAC has said that its goal for this year is to grow its currency-neutral operating earnings by 4% to 7%. Next year, due to a number of business headwinds, that growth rate will drop to 2% to 5%. The company said that those headwinds should pass by the end of next year.

I have to stress that this is all in earnings per share because AFLAC plans to buy back a whole lot of shares. The company plans to buy $800 million worth of shares this year and another $800 million to $1 billion next year.

AFLAC also raised its dividend by 5.7%. The quarterly payout rises from 35 to 37 cents per share. This is the 31st year in a row that AFLAC has raised its dividend. The stock dropped 3% after the earnings report, but I’m not at all worried. This is a fine company that’s navigating a difficult environment. As Peter Lynch said, “Time is on your side when you own shares of superior companies.” AFLAC remains a very good buy up to $70 per share.

The other disappointing report came from Nicholas Financial ($NICK), which reported quarterly earnings of 35 cents per share. I had been expecting earnings closer to 45 cents per share.

I still need to dig into the numbers, but it appears that NICK had a large increase in operating costs. There was also a 22% increase in their provision for credit losses. I’m not sure what drove these increases, but they account for the entire earnings shortfall. NICK tends to be pretty conservative with its business, so these results were rather unexpected.

Again, I’m still a fan of the company. I’m just a little curious as to what exactly happened last quarter. On Thursday, the stock dropped 5%, which places it back where it was a few weeks ago. I hope to see a dividend increase from the board before the end of the year. NICK continues to be a good buy up to $18 per share.

Earnings Next Week from DirecTV and Cognizant Technology

Next Tuesday we get our final two earnings reports for this season as DirecTV ($DTV) and Cognizant Technology ($CTSH) report. DTV is a hard stock to predict. For Q1, the company had a massive earnings beat. Then for Q2 they missed badly. The difficulty is that a major growth area for DTV is Latin America, but the economy has been rough in that region lately. Wall Street currently expects Q3 earnings of $1.02 per share. DirecTV is a buy up to $64 per share.

In the CWS Market Review from August 30, I said that Cognizant “may be the best bargain right now on our Buy List.” The stock’s up more than 17% since then, and I think it’s still a good value. Three months ago, they beat earnings and guided higher. For Q3, CTSH said to expect earnings of $1.09 per share. I think they can beat that. Cognizant is a very good buy up to $90 per share.

Two items before I go. Ross Stores ($ROST) has been very strong lately. The retailer reports in three weeks, but I want to raise my Buy Below to $81 before it gets away from us. This is a very good stock.

Also, Moog ($MOG-A), our #1 performer this year, is due to report on Friday. The earnings report may be out by the time you’re reading this. Wall Street expects earnings of 96 cents per share. Moog is a solid buy up to $61 per share.

That’s all for now. We have still more earnings reports to come next week. Cognizant and DirecTV both report on Tuesday. We’re also going to get some important economic reports. On Thursday, we’ll get our first look at third-quarter GDP growth. Then on Friday, the Labor Department will release the October jobs report. If we see any pickup in hiring, that could lead to the Fed finally getting its tapering act together. I’m beginning to think we won’t see any taper until next year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: November 1, 2013

Eddy Elfenbein, November 1st, 2013 at 6:23 amDraghi’s Deflation Risk Complicates Recovery

Economists React: China Manufacturing Up in October

R.B.S. to Split Off Troubled Loans of About $61 Billion Into “Bad Bank”

South Korean Exports Hit Record High on Smartphone and Car Demand

The Fed Left One Big Question Unanswered

Fannie Mae Sues Banks for $800 Million Over Libor-Rigging Claims

IRS Eases Rules on Healthcare Flexible Spending Accounts

Walmart Kicks Off Online Holiday Deals Early in Intense Season

Sony Shares Drop 11% on Poor Earnings

Angry Over U.S. Surveillance, Tech Giants Bolster Defenses

Three Reasons Buffett’s Not Buying

Here’s What Happened When Cisco Lost A $1 Billion Deal With Amazon

Oracle Shareholders Oppose Compensation for Ellison

Cullen Roche: Margin Debt: What Does It Really Tell Us?

Roger Nusbaum: Does It Make Sense to Implement the Taleb Portfolio?

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His