Archive for December, 2013

-

2-10 Spread Hits Two-Year High

Eddy Elfenbein, December 9th, 2013 at 10:58 amOne of the best economic forecasters isn’t a person, it’s a thing. I’m specifically referring to the yield spread between the two-year and ten-year Treasuries.

Over the last 30 years, the 2-10 spread has had a remarkable track record of predicting the economy. Whenever the spread becomes flat or negative — meaning the two-year yields more than the ten — that signals trouble for the economy.

Thanks to the Fed’s low interest rates, the spread has been positive. But due to the recent weakness in the long-end of the bond market, the spread has been growing wider. In fact, the 2-10 spread just hit a two-year high.

Obviously, the Fed’s bond-buying is a factor. We also have to remember that stocks have done well, so higher yields in the Treasury bond market are needed to lure investors. Quietly, the markets expected better economic growth.

-

Morning News: December 9, 2013

Eddy Elfenbein, December 9th, 2013 at 6:51 amYen Weakens Versus Dollar Amid Fed Tapering Bets; Aussie Drops

Abe Gets Toyota-Hitachi Help in Japan Push for Wage Gains

Saffron Wave! Sensex Makes History, 96 Stocks at 52-Week Highs

China Posts Big Trade Surplus as Exports Goes Up

European Stocks Climb After China Trade Data

Bargains Beckon Funds to European Equities

Near a Vote, Volcker Rule Is Weathering New Attacks

Watchdog Warns of Chaos in Competing Derivatives Rules

Bitcoin Has Made a Major Comeback

HSBC Weights $32-Billion Listing for U.K. Banking Business

Alibaba Invests $361 Million in Appliance Maker’s ‘Big Goods’ Logistics

Tech Giants Issue Call for Limits on Government Surveillance of Users

Candy Crush Sage Publisher Delays IPO Over Fears Game Has Become ‘Too Successful’

Credit Writedowns: The Politics of Adjustment

Jeff Miller: Weighing the Week Ahead: An End to the Tapering Obsession?

Be sure to follow me on Twitter.

-

Captain Picard sings “Let it Snow!”

Eddy Elfenbein, December 6th, 2013 at 4:03 pmIt was close but the S&P 500 came just short of closing higher for the ninth week in a row. For the record, the index closed the week at 1805.09 which is only 0.04% below last Friday’s close of 1805.81.

On that note, here’s something that’s sure to cheer you up.

-

Alan Mulally on Colbert

Eddy Elfenbein, December 6th, 2013 at 9:27 amThe Colbert Report

Get More: Colbert Report Full Episodes,Video Archive -

November Jobs Report

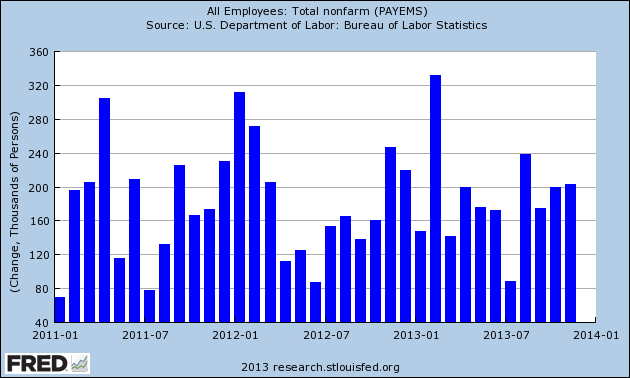

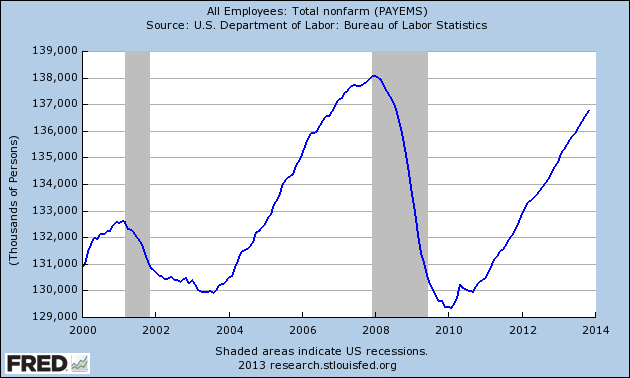

Eddy Elfenbein, December 6th, 2013 at 8:31 amNFP: 203,000 (185,000 est.)

Private Payrolls: 196,000 (Est. 180,000)

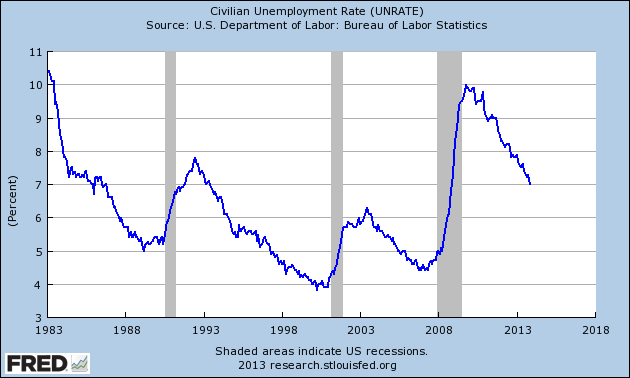

Unemployment Rate: 7.0%

NYT:

Although the holiday shopping season seems to have gotten off to a mixed start, the retail sector added 22,000 jobs last month. Manufacturers, which are closely watched as a bellwether for the broader economy, hired 27,000 workers. And the overall participation rate rose 0.2 percentage point to 63 percent, reversing a decline in recent months.

Even as the overall unemployment rate fell, the situation does remain desperate in some pockets of the labor market.

For example, the unemployment rate among workers aged 16 to 19 remains above 20 percent. And for workers with less than a high school diploma, the jobless rate stood at 10.8 percent.

-

CWS Market Review – December 6, 2013

Eddy Elfenbein, December 6th, 2013 at 7:09 am“Don’t gamble; take all your savings and buy some good stock and hold

it till it goes up, then sell it. If it don’t go up, don’t buy it.” – Will RogersWe’re back! I hope everyone had a wonderful Thanksgiving.

Before I start, I have an announcement. I’m going to unveil the 2014 Buy List in the CWS Market Review for December 20, 2013, two weeks from today. Subscribers to CWS Market Review will be the first to see our new list. As always, I’m only changing five stocks. We keep our turnover low around here. I release the names early to prove to doubters that I don’t “game” the market. I also want to show investors that you don’t have to be a frenetic trader to do well on Wall Street. I’m excited for next year’s Buy List, and I think it will be our eighth year in a row of beating the Street.

Now let’s take a look at the stock market. Actually, stocks are doing something they haven’t done in a while—they’re going down! Thursday was the fifth down day in a row for the S&P 500. Unless there’s a big rally on Friday, this will snap the S&P 500’s eight-week winning streak. That’s the longest weekly winning streak in nearly a decade.

So is it time to panic? Well, no. We shouldn’t blow things out of proportion. Measuring from last Wednesday’s close to yesterday’s close, the S&P 500 has lost of grand total of 1.23%. That’s peanuts, a piddling $200 billion. Bear in mind that the market has made a cool $14 trillion since the low. Yet some observers are acting as if the bursting of the bubble, which they’ve predicted every day for five years, is finally at hand.

But the interesting action isn’t what’s happening in the stock market. No, it’s what’s happening with our easily-provoked friends in the bond pits. The long end of the yield curve is creeping its way higher. The yield on the 30-year Treasury just reached its highest point in more than two years, and the culprit is…(are you ready for this)…promising economic news!

In this week’s CWS Market Review, I’ll talk about what this means for investors and why good news for the economy isn’t such rosy news for our portfolios. I’ll also focus on some of our recent Buy List news. Ross Stores, for example, has been getting beaten up lately. (Spoiler alert: I still like it.) We also got a nice 15% dividend hike from Stryker. I love it when that happens. But first, let’s see if the stock market can withstand this recent assault of good economic news.

Good News Frightens the Markets

Earlier this year, the bond market freaked out when Ben Bernanke hinted that the easy-money party would be coming to an end. The yield on the three-year Treasury spiked from 0.3% in May to nearly 1% after Labor Day. Ben was clearly shocked by the market’s reaction to his comments, and he’s been careful to walk back, or “clarify,” those remarks. Either way, the Fed hasn’t come near tapering since. But now Bernanke is nearly out the door, and Janet Yellen will soon be taking over. The latest conventional wisdom is that tapering will be coming this March. We’ll see about that.

But the bond market has been in a sour mood again. On Thursday, the yield on the 30-year Treasury closed at 3.92% which is its highest yield since August 1, 2011. But here’s the key point: The recent sell-off in the bond market is quite different from what we saw this summer. Back then, it was the middle part of the yield curve that saw the biggest rise in rates. This reflected the belief that short-term interest rates were going to rise sooner than folks had expected.

This time, the rise in rates has largely been at the long end of the curve. In fact, the middle part of the curve hasn’t moved very much at all. The three-year is hovering just over 0.6% which is well below its peak from September.

This is an important change in the market’s attitude, and I think it’s because the current bond market downturn is due to a belief in stronger economic growth rather than an imminent rise in interest rates. Here’s the weird part. Lower bond prices may be specifically due to a belief that the Fed will hold down rates for a while more. In other words, the Fed is working to steepen the yield curve.

So what’s all this good economic news, then? Let’s review. On Monday, the November ISM Manufacturing Index came in at 57.3. That’s the highest level since April 2011. Any reading above 50 indicates that the manufacturing sector is expanding. This was the 50th time in the last 52 months that the ISM has come in above 50. Let me be clear: That isn’t gangbusters, but it’s not bad.

On Wednesday, the Federal Reserve released its “beige book” report, which is a survey of the U.S. economy by region. On balance, the report was encouraging, and business activity seems to be picking up, although there are still pockets of weakness.

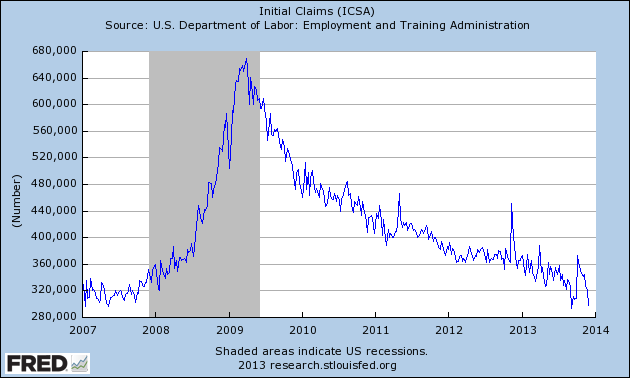

Also on Wednesday, ADP, the private payroll firm, said that 215,000 jobs were created last month. That was 30,000 more than analysts were expecting. Then on Thursday, the number of Americans filing first-time jobless claims fell to 298,000 which is the second-lowest number since early 2007. This report tends to bounce around a lot, so it’s better to look at the trend which has been heading in the right direction. It also appears that any side effects of the government shutdown have passed.

But the really big economic report is Friday’s jobs report for November. I’m writing this to you early on Friday morning before the report comes out, so you may already know the results. But if the non-farm payroll report tops 200,000, it will be more confirmation that the economy is ramping up.

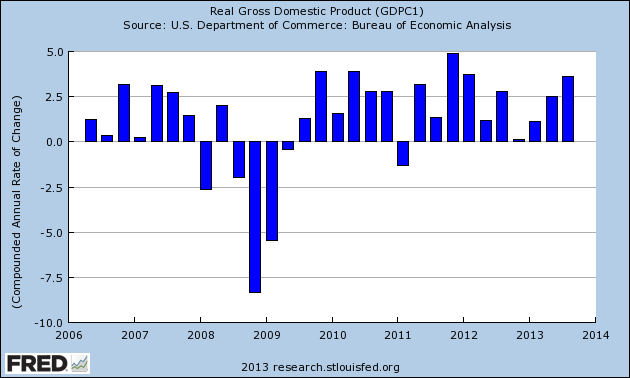

We got more good news on Thursday when the government revised its Q3 GDP report significantly higher. The initial report came in at 2.8%, but now the number crunchers say the economy grew by 3.6% last quarter. Over the last 30 quarters, that’s the economy’s fifth-strongest quarter. But one downside to the GDP revisions is that a good portion of that economic activity was restocking shelves, and not so much people buying stuff off those shelves. However, this was the third quarter in a row that economic growth has accelerated.

These encouraging economic reports aren’t much of a surprise to us. I’ve recently discussed how the rally has been led by cyclical stocks, and that’s usually a precursor of good economic news. By cyclical, I mean industries that are heavily tied to the economic cycle. When things get tight, folks keep buying toothpaste, but new houses? Not so much. Last Wednesday, the relative strength of the Morgan Stanley Cyclical Index reached its highest point since July 2011. For the last 16 months in particular, cyclical stocks, consumer discretionaries especially, have been grabbing the lion’s share of the market’s gains.

I’ve often noted that the current rally is the most-hated rally in Wall Street’s history. OK, perhaps that’s a bit of an overstatement. Still, I suspect that a major reason for this hatred isn’t that the bears haven’t seen drops; it’s that they have. Consider that during the current rally, which began in March 2009, we’ve seen separate drops of 5.6%, 5.8%, 6.4%, 7.1%, 7.7%, 8.1%, 9.9%, 16.0% and 19.4%. Every single one has led to a new high. Every single one.

What’s also interesting is the breadth of this market. The top 10 point contributors in the S&P 500 have accounted for 18% of this year’s gain. In 1999, that number was 65%. The tech bubble was created by a very small number of stocks. That’s not what’s happening now. Nor have we run out of room. Since World War II, the S&P 500 has gained 20% or more 18 times. The following year’s gain has averaged 10%.

Here’s my take: No, I’m not going to predict a crash. That’s a pointless endeavor. I do, however, caution investors not to expect the kinds of easy gains we’ve seen this year to continue. The simple fact is those higher bond yields I talked about are more attractive to investors, and that’s stiffer competition for stocks; that’s what’s driving the “good news is bad news” dynamic. And yes, there’s still the issue of the Fed’s endlessly-discussed taper, but that’s probably a few months off at the earliest. I think that explains the recent downturn in gold. The yellow metal is closing in on a three-year low, and this will be its first yearly loss since 2000.

For now, a lot of healthcare names look very good here, and much of the tech sector has been left out of the rally. I continue to like Oracle ($ORCL) below $36. The company has another earnings report later this month. Ford ($F) is also cheap here. Don’t let the drop below $17 scare you. The automaker had another strong month for sales. Truck sales are at a nine-year high.

Both Cognizant Technology Solutions ($CTSH) and DirecTV ($DTV) are good buys at these levels. Cognizant said this week it plans to hire 10,000 workers in the U.S. over the next three years. Weak companies don’t say things like that. (By the way, here’s a good profile of Cognizant’s CEO Frank D’Souza.)

Stryker Raises Dividend 15.1%

I love how Stryker ($SYK) consistently churns out profits and dividend increases. On Wednesday, the orthopedic company announced that they’re raising their quarterly dividend by 15.1%. The payout rises from 26.5 cents to 30.5 cents per share.

Kevin Lobo, the CEO, said, “Given our strong balance sheet and cash flow generation, we continue to expand our dividend, which has grown 26% on a compound annual basis since 2008.” Stryker’s dividend has doubled in just four years. Based on Thursday’s closing price, SYK now yields 1.67%. The new dividend is payable on January 31 to shareholders of record on December 31. Stryker remains a very sound buy up to $76 per share.

Microsoft Touches 13-Year High

While other stocks were having a tough time this week, Microsoft ($MSFT) continues to edge higher. Shares of the software giant reached a 13-year high on Wednesday. The company also did something interesting. Even though Microsoft is sitting on a ton of cash, they tapped the bond market for $3.25 billion, plus another 3.5 billion in euros.

The reason is that much of MSFT’s cash is sitting outside the U.S., and they’d have to pay taxes on it if they brought it home. Also, the company has been increasing its dividend and has committed to buy back a large number of shares.

For the five-year bond, Microsoft was able to borrow money at just 1.625%, which is less than the stock’s dividend yield of 2.94%. Essentially, the company is making an easy profit by borrowing money. Microsoft is one of the few companies with a AAA credit rating. Microsoft is a 42% winner for us this year. MSFT remains a good buy up to $40 per share.

Ross Stores Is a Buy up to $79 per Share

Two weeks ago, Ross Stores ($ROST) surprised Wall Street (and me) with a dour outlook for their fourth quarter. The discount retailer said they see Q4 earnings ranging between 97 cents and $1.01 per share. The Street had been expecting $1.09 per share. For Q3, Ross beat their own forecast, but traders focused on the forecast and punished the shares.

Prior to the earnings report, ROST had come close to breaking $82 per share. Immediately after the report, it dropped below $74. The stock seemed to recover some, but it took a turn for the worse this week after Ross was downgraded by Credit Suisse. They lowered Ross to Neutral from Outperform, and their price target is $75.

I apologize for the shaky movement, but I want to assure you that I’m still a fan of Ross. Even the best stocks get knocked around from time to time. In fact, Ross was hit even harder earlier this year. After a lousy sales report in March, ROST plunged 7.5%, but it recovered and soared to a new high. The fact is that Ross is having a great year, and it continues to be a good buy up to $79 per share.

That’s all for now. Next week, we’ll get important reports on the Federal budget and retail sales. Also, remember that Fiserv will be splitting its stock 2-for-1 on December 17th, so don’t be shocked by the lower share price. Also, Oracle is due to report earnings after the market close on December 18th. And most importantly, the new Buy List will be coming your way in two weeks! Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: December 6, 2013

Eddy Elfenbein, December 6th, 2013 at 7:02 amGermany’s Central Bank Lifts Growth Forecast

Autobahn Thrills to Cost Foreigners Under German Plan

Australia PM Spurns Qantas Plea For Help As Carrier Cut To Junk Status

Lively Debate on the Influence of Proxy Advisory Firms

Brent Seen Over $100 for Fourth Year as OPEC Bets on Demand

US Talks to Ease Spending Cuts and Avert Shutdown Are In a Critical Stage

Economists React: ‘No Momentum’ in GDP Report

In the Murky World of Bitcoin, Fraud Is Quicker Than the Law

Shell Halts $20 Billion Louisiana Gas-to-Liquids Project

Chevron’s $6.4 Billion China Project Pushed Back Again

Total to Buy Stake in InterOil Assets for Up to $3.6 Billion

Glassdoor, a Jobs Website, Raises $50 Million

Twitter Ups Ad Relevancy with Tailored Audiences

John Hempton: Roddy Boyd and Degree of Difficulty

Jeff Carter: Computer Trading Documentary

Be sure to follow me on Twitter.

-

Cognizant Moving to Texas

Eddy Elfenbein, December 5th, 2013 at 11:59 pm -

Gasp! Good Economic News

Eddy Elfenbein, December 5th, 2013 at 11:10 amThe markets were surprised this morning by some welcomed positive economic news. First, the government revised Q3 GDP growth from 2.8% to 3.6%. That would be the fifth-best quarter for economic growth in the last 30 quarters.

Wall Street had been expecting a higher revision but only to 3.1%. Today’s report was a big surprise. The big change was due to upward revisions in inventory.

The other good economic news was today’s initial claims report. The number of Americans filing first time jobless claims was the second lowest in the last six-and-a-half years.

-

Morning News: December 5, 2013

Eddy Elfenbein, December 5th, 2013 at 6:32 amBOE Seeking Exemption From European Bank Stress Tests in 2014

China Bans Financial Companies From Bitcoin Transactions

Japan Approves $182 Billion Economic Package, Doubts Remain

Moody’s Raises Spain Rating Outlook to Stable

New Forecasts May Put Policy Pressure on ECB

Treasury Chief to Declare Big Gains in Financial Reform

Trade Gap in U.S. Shrank in October on Record Exports

Growth Signs Pick Up Ahead of Key Fed Meeting

3 Banks Failed to Meet Some Relief Tests

Pump Up in Demand Fuels Gasoline

Carl Icahn Softens Stance on Apple’s Cash

BNP Paribas to Buy Stake in Rabobank

J.C. Penney Falls as November Sales Gain Misses Expectations

Cullen Roche: What Can We Learn From 25%+ Years?

Joshua Brown: Alan Greenspan: Bitcoin is a Bubble and Gold is Weak

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His