Archive for January, 2014

-

Morning News: January 29, 2014

Eddy Elfenbein, January 29th, 2014 at 6:40 amImpact of Turkey Rate Decision Fades Fast

EU Unveils Plan to Ban Banks’ Proprietary Trading

‘Fragile Five’ Is the Latest Club of Emerging Nations in Turmoil

Obama Seeks Trade Deals Sought by Biggest U.S. Companies

New York State Regulator Promises Tough Bitcoin Rules

LG Beats Its Rivals in Q4 Smartphone Sales

Pressure Builds for Apple to Overhaul or Expand Product Portfolio

Sony Credit Cut To Junk Status As Smartphones ‘Cannibalize’ Its TV And PC Businesses

American Airlines, US Airways Report Combined $1.95 Billion earnings for 2013

Fiat Scraps Dividend After Chrysler Buy

McDonald’s Seeks to Out-Latte Starbucks Amid Coffee Wars

Ford Posts Higher Profit But Faces Pressure in U.S.

Another Score for Crowdfunding: Indiegogo Raises $40 Million

Russia Bucks the Trend – Talks the Ruble Lower

Credit Writedowns: Turkey Moves, Focus Shifts to Fed

Be sure to follow me on Twitter.

-

MyRA

Eddy Elfenbein, January 28th, 2014 at 10:16 pmFrom President Obama’s State of the Union address:

Let’s do more to help Americans save for retirement. Today, most workers don’t have a pension. A Social Security check often isn’t enough on its own. And while the stock market has doubled over the last five years, that doesn’t help folks who don’t have 401ks. That’s why, tomorrow, I will direct the Treasury to create a new way for working Americans to start their own retirement savings: MyRA. It’s a new savings bond that encourages folks to build a nest egg. MyRA guarantees a decent return with no risk of losing what you put in. And if this Congress wants to help, work with me to fix an upside-down tax code that gives big tax breaks to help the wealthy save, but does little to nothing for middle-class Americans. Offer every American access to an automatic IRA on the job, so they can save at work just like everyone in this chamber can. And since the most important investment many families make is their home, send me legislation that protects taxpayers from footing the bill for a housing crisis ever again, and keeps the dream of homeownership alive for future generations of Americans.

I don’t know the details yet, but I’m having a hard time imagining what the benefits could be.

-

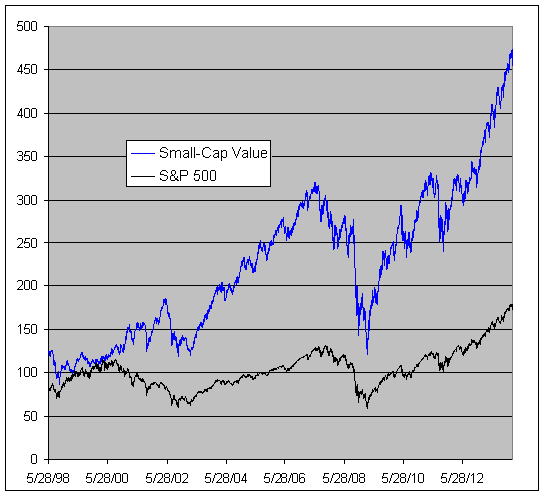

The Small-Cap Value Rally

Eddy Elfenbein, January 28th, 2014 at 4:05 pmIn reference to yesterday’s post on the small-cap premium, I want to look at the performance of small-cap value stocks compared with the rest of the market.

The difference is quite startling. This chart below has the Vanguard 500 Index Fund (VFINX) in black along with the Vanguard Small-Cap Value Index Fund ($VISVX) in blue. Both include dividends. I also set both funds to 100 on April 8, 1999, which was the start of small-cap outperformance.

-

Ford Beat by Three Cents per Share

Eddy Elfenbein, January 28th, 2014 at 10:52 amWe had more good earnings news today. Ford ($F) reported fourth-quarter earnings of 31 cents per share which was three cents better than estimates. In terms of net income, that’s a cool $3.04 billion. As usual, the company is doing well in North America. The F-Series trucks are very popular. For the 32nd year in a row, they were the top-selling vehicle in the U.S.

The weak spot continues to be Europe. True, the economy there is a bit of a wreck, but Ford needs to be stronger in that market. For the year, Ford lost $1.61 billion in Europe. They expect more losses this year, but a profit by 2015. Things are improving. Ford lost $571 million in Europe last quarter which is bad, but it’s better than the $732 million they lost in Q4 2012. Also, Ford had a small loss from Latin America and a small profit from Asia, but those are still pretty minor parts of their overall business.

Ford reiterated that profits will fall a bit this year ($8 billion to $7 billion pre-tax), but that’s because the company has very ambitious plans to roll out new models. Ford is introducing 23 new vehicles of which 16 are in North America. Overall, these were good results from Ford.

-

Morning News: January 28, 2014

Eddy Elfenbein, January 28th, 2014 at 6:47 amAsian Stocks Fall a Fourth Day Amid China, Fed Stimulus Concerns

Worried by EM Sell Off, Investors Seek Foothold in South Korea and Mexico

Calm Returns to Emerging Markets

RBI’s Dovish Outlook Soothes Bond Investors

U.K. 4Q GDP Grows 0.7%, Ending Best Year Since 2007

Bank of Montreal Parent Acquires British Asset Manager for $1.2 Billion

Why Nothing Apple Does Is Ever Good Enough

Ford Sets Profit Records in Key Markets Before Busy Year

DuPont 4th-Quarter Profit Doubles

Philips Q4 EBITA Beats Forecasts, Sees Tough 2014

Comcast Profit Rises 26% on Broad Sales Growth

Siemens Profit Rises as CEO Presses On With Cost Cuts

Bitcoin Executive Charlie Shrem is Accuse of Money Laundering

Markets, Herding and Avalanche Dynamics

John Hempton: When the Hedge Doesn’t Work

Be sure to follow me on Twitter.

-

Is There a Small-Cap Premium?

Eddy Elfenbein, January 27th, 2014 at 3:25 pmJosh Brown highlighted an interesting post by Alex Bryan at Morningstar, “Does the Small-Cap Premium Exist?”

Bryan touches on a few important points which I’ve long suspected. The long-term data suggests that small-cap stocks outperform their larger-cap bretheren.

This is a good example of the fact being true, but it needs more context. The outperformance of small-caps has historically been very erratic. We’ve gone for many years, decades in fact, with small-cap stocks underperforming.

The data also shows that most of the outperformance comes during the month of January. This is suspicious and it tells me that something else is going on. Perhaps beaten down small-caps are subjected to tax-loss selling.

Bryan notes that there hasn’t been a small-cap premium over the last 30 years, nor does it appear in other countries. He thinks that liquidity may have played a role in shaping the historical data, and that may not play such a large factor in the future.

I suspect that there is a small-cap premium but it’s very small and not very stable. I also think it’s more visible among small-cap value stocks than small-cap growth issues. There are lots of values to be found among small-caps but I would never buy a stock because it’s small.

We often talk about the stock market as if it’s one entity, but that’s very misleading. The bull market of the late-1990s was heavily skewed to large-cap stocks. Morgan Housel writes, “In 1999, one of the best years for the market ever, more than half of stocks in the S&P 500 declined. Two companies, Microsoft and Cisco, accounted for one-fifth of the index’s return.” People speak of the terrible stock market from 2000 to 2009, but small-cap value stocks didn’t do so poorly, because they had been so badly left behind.

-

Scary Looking Chart

Eddy Elfenbein, January 27th, 2014 at 3:09 pmThis is hardly sophisticated analysis, but I’m struck by how scary this long-term chart of the Consumer Discretionaries ETF ($XLY) looks. I’ve compared it to the SPY.

The largest holding in the XLY is Amazon which is always dangerous to bet against. But it also has solid Buy List stocks such as Ford ($F) and McDonald’s ($MCD).

-

The Emerging-Markets Meltdown

Eddy Elfenbein, January 27th, 2014 at 7:55 amI wanted to talk a little about what’s been happening in the market recently. The Dow fell 176 points on Thursday and another 318 points on Friday. The real pain, however, has been in the emerging markets, and especially in their currency and bond divisions.

A lot of folks are blaming the Federal Reserve, and the winding down of QE (more on that in a bit). While our central bank is a convenient villain—and very often, the proper one—in this case, I don’t think they deserve the blame.

Let’s take a step back. When the financial crisis hit, the Fed and other central banks lowered interest rates to the floor. Econ 101: Money goes to where it’s treated best, so people started investing heavily in emerging markets where the yields (and risks) were higher. Investors particularly liked the so-called BRICs (Brazil, Russia, India and China). I’d throw South Africa into the mix as well.

The problem is that a lot of the emerging economies have some serious structural problems. The inflow of cash bought them time, but they haven’t done much to change their ways. Now that the Fed is talking about winding down its extraordinary measure, investors realize that near-0% interest won’t last much longer. Naturally, that will dry up the capital flow to the emerging markets. This problem is compounded by the fact that the governments in the emerging markets loaded up on dollar-dominated U.S. Treasury debt. As a perverse result, they’re doubly sensitive to moves in U.S. interest rates.

People knew this day would eventually come; they just didn’t know when. “When” is apparently now. The governments in the emerging markets are somewhat like a person who builds a balsa-wood house in a tornado zone. When the house goes to smash, they blame the poor foresight on the builder’s part, not the tornado.

The situation in Argentina is especially screwed up—although when I use the phrase “screwed up” in conjunction with our friends on the Rio Plata, it’s like saying there’s “trouble” in the Middle East. The president of Argentina didn’t make any public appearances for six weeks. Can you imagine if President Obama had done the same?

President Kirchner promised not to devalue the currency, but reality intervened. Of course this was after the government spent a pile of cash trying to defend the indefensible peso. In the last three years, Argentina’s currency reserves have been cut in half. No one really knows what the inflation rate or dollar-peso exchange rate truly is.

There are a lot of people in Argentina, in and out of government, whose job it is to see how well the economy is doing. They track all sorts of complicated econ data, but I have a simple rule I use: How loudly are the politicians yapping about the Falklands? If they’re loud, you can be sure that means the economy is a wreck.

I don’t want to pick on Argentina. Turkey is in bad shape as well. Brazil doesn’t look so hot, either. The one saving grace for a lot of EMs was their monster customer in China. But when we got sluggish economic reports from China, that really spooked EM investors. And oh yeah, there also appears to be a revolution going on in Ukraine. That, too, affects things.

It’s gotten so desperate that even the poor battered yen has done well. I’ll give you another easy rule: If your country exports a lot of commodities (especially to China), then your currency probably got whacked. Places like Turkey, Argentina and Venezuela are running very low on their forex reserves. Broadly speaking, I think currency devaluations can be the best of several bad options, but they don’t work all by themselves. You need reform, too, and that can be politically unpopular.

Quick tangent: One stock that I like to follow is Ingredion (INGR). They make high-fructose corn syrup. A lot of their operations are in Argentina, and last year, INGR cut its full-year forecast due to the government’s policies. The shares got hit hard on Thursday and Friday. By most superficial measures, the stock is cheap, but I’m not going near it. There are just too many unknowns.

Several years ago, Bill Gross of PIMCO made a daring investment when he loaded up on Brazilian bonds. That was a shrewd move, and it turned out to be a big winner. So it was a bit jarring when Gross recently said that Brazil is no longer attractive.

I don’t know where all these recent EM developments are headed, but we’re going to soon find out who’s been responsible and who hasn’t. Mexico, for example, will probably pull through just fine. Poland as well. But I’m not so sure about others. Until then, we can expect a little more volatility in our markets and a lot more in the emerging markets.

-

Morning News: January 27, 2014

Eddy Elfenbein, January 27th, 2014 at 5:54 amGerman Business Confidence Rises as Growth Pickup Seen

Euro Jobless Record Not Whole Story as Italians Give Up

Record Japan Trade Deficit Highlights Cheap Yen Woes

Yen and Swiss Franc in Vogue on Emerging Market Stress

India Lifts Ban on Airbus A380s, Foreign Carriers Interested

Justice Department Inquiry Takes Aim at Banks’ Business With Payday Lenders

Apple Manufacturing Partner Looks to Build Factory in the US

Liberty Global Increases Buyback Program by $1 Billion

LG Electronics’s Mobile Unit Suffers Hit

AT&T Gives Up Right to Offer to Buy Vodafone Within 6 Months

Google to Buy Artificial Intelligence Company DeepMind

Chipotle Blurs Lines With a Satirical Series About Industrial Farming

Tata Motors Chief Karl Slym Dies

Epicurean Dealmaker: Mirror, Mirror, on the Wall… and Mirror, Mirror Redux

Jeff Miller: Weighing the Week Ahead: What Is The Market Message?

Be sure to follow me on Twitter.

-

S&P 500 Falls 2.09%

Eddy Elfenbein, January 24th, 2014 at 5:49 pmToday was the worst day for the stock market is more than four months. The S&P 500 dropped 2.09% to 1,790.29. We lost two important marks — 16,000 on the Dow and 1,800 on the S&P. The S&P 500 closed below its 50-day moving average for the first time since October 9. The index is 5.2% above its 200-DMA, which we haven’t closed below in 14 months.

Nineteen of our 20 Buy List stocks closed down today. Microsoft ($MSFT), thanks to the good earnings report, was our only winner.

The big loser was Moog ($MOG-A) which lost 8.85% after their earnings report. Despite that big loss, our Buy List held up reasonably well compared with the rest of the market. For the day, we lost 2.20% which was 0.11% worse than the S&P 500. Moog, by itself, made up 0.45% of today’s loss.

For the quarter, Moog made 88 cents per share which was one penny below expectations. Their outlook, however, was rather weak:

Moog also warned that its profits for the entire fiscal year would fall about 10 percent short of what both the company and analysts were forecasting. Moog now said it expects its profits to rise to $169 million, or $3.65 per share. That’s less than the $3.95 to $4.10 per share that the company forecast last fall and below the $4.06 per share that analysts were forecasting, but still an improvement from the $3.50 it earned last year.

Moog said it now plans to spend an additional 15 cents per share on research and development expenses for its aircraft business, while its business system conversion also is forecast to cost about 10 cents per share more than expected. The company also trimmed its sales forecast for the year by nearly 2 percent, or $45 million, to $2.63 billion from the previous prediction of $2.67 billion. That’s still up from $2.61 billion last year. The expectation of lower sales growth led to a reduction of about 10 cents per share in the company’s earnings forecast.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His