Archive for April, 2014

-

Buffett: Market Not “Frothy”

Eddy Elfenbein, April 23rd, 2014 at 4:25 pmHe also has good things to say about IBM.

-

Morning News: April 23, 2014

Eddy Elfenbein, April 23rd, 2014 at 7:54 amGoldman Sachs Stands Firm as Banks Exit Commodity Trading

Demand for Fed Reverse Repos Rises as Treasury Cuts Bill Supply

Sales of Existing U.S. Homes Fall for a Third Month

Citigroup Shareholders Approve Leaders’ Pay

Apple’s Slowing IPhone, IPad Sales Test Investor Resolve

McDonald’s 1Q Profit Slips as US Sales Decline

Procter & Gamble Third-Quarter Profit Rises

Toyota Sells 2.58 Million Vehicles, Outselling General Motors

This Is the Absolute Best Day to Advertise on Facebook

AT&T Inc. Posts Earnings Beat, But Slowing Wireless Segment Pulls Stock Price Down

Gilead’s Hepatitis C Drug Sovaldi Tops Estimates by $1 Billion

Here’s Why This Best-Selling Book Is Freaking Out the Super-Wealthy

Jeff Carter: HFT Isn’t the Elephant In the Room

Jeff Miller: Weighing the Week Ahead: Will Springtime Bring Some Optimism?

Be sure to follow me on Twitter.

-

CR Bard Earns $1.91 Per Share

Eddy Elfenbein, April 22nd, 2014 at 4:31 pmAfter the closing bell, CR Bard ($BCR) reported first-quarter earnings of $1.91 per share. That beat estimates by seven cents per share. Bard had told us to expect earnings between $1.83 and $1.87 per share so this is an impressive beat. Sales rose 8% to 799.3 million. Sales in the U.S. rose 11% and foreign sales were up 3%.

CEO Timothy M. Ring said, “The financial results in the first quarter reflect a positive start to the year, as we exceeded our expectations for both sales and earnings per share. The organization is focused on executing our strategic investment plan with the objective of improving the long-term growth profile of the business.”

The press release describes Bard as “a leading multinational developer, manufacturer and marketer of innovative, life-enhancing medical technologies in the fields of vascular, urology, oncology and surgical specialty products.”

-

The Effect of Smart Beta

Eddy Elfenbein, April 22nd, 2014 at 2:24 pmLately there’s been a lot of talk about Smart Beta. I wanted, gentle reader, to show the exact impact Smart Beta has on your portfolio.

The equation is as follows:

(Smart Beta * 4.78 / ROE ^ 0.78 – Net Operating Cash) * 0

-

The Now-Forgotten Tech Stock Crash on “Earth Day” 1970

Eddy Elfenbein, April 22nd, 2014 at 12:26 pmGary Alexander writes on the now-forgotten tech crash of 44 years ago.

I would hazard a guess that not one in 10 of my readers remembers the stock market crash on Earth Day, 1970. If you Google “Tech stock crash 1970,” you will see precious few entries that directly address that specific crash. The first two Google entries I saw came from our own article on the subject in April 2010, on the 40th anniversary of that crash – “(Back to) Earth Day” – reprinted by Investorplace and NASDAQ.

In writing that 2010 article, I found precious few resources to consult. Due to a lack of online sources, I used a faded old Dun’s Review article from 1971 and a 1973 book, The Go-Go Years: The Drama and Crashing Finale of Wall Street’s Bullish 60s, by New Yorker financial writer John Brooks. The 1997 reprint of that book includes a forward by best-selling author Michael Lewis. Here’s how the book starts:

“On April 22, 1970, Henry Ross Perot of Dallas, Texas, one of the half-dozen richest men in the United States…suffered a paper stock-market loss of about $450 million.” This amounted to “more than the annual welfare budget of any city except New York; and more – not just in figures, but in actual purchasing power – than J. Pierpont Morgan was known to be worth at the time of his death in 1913.”

Furthermore, the collapse of Perot’s EDS stock “was not based on any bad news about the company’s operations. To the contrary, the news was all spectacularly good; per-share earnings for 1969 were more than double those for 1968, and even for the first quarter of 1970 – a time of fast-deepening general business recession – EDS showed a 70% profits increase over the same period for 1969.” The EDS crash, the book shows, was a “bear raid” based upon the narrow float of available shares of EDS at the time.

Perot’s big loss came on the first Earth Day, so I characterized the 1970 stock market collapse as “back to earth” day for tech stocks, which had been the darlings of the late 1960s. Perot was not alone. Many tech stocks fell by 80% or more from 1969 to mid-1970, with the core losses coming in five weeks, April 21 to May 26, 1970. Perot’s EDS fell a total of 85%, from a peak of $162 to $24, while Control Data fell 83%.

In the aftermath of that crash, financial consultant Max Shapiro constructed a list of 30 leading “glamour stocks” and their fate. He picked 10 leading conglomerates (like LTV), 10 computer stocks (led by IBM), and 10 hot technology stocks (Polaroid, Xerox, etc.). In Dun’s Review in January 1971, he showed that the 10 conglomerates fell by an average 86%, the computer stocks fell 80%, and the tech stocks fell 77%.

The overall market did not collapse at anywhere near those levels. The S&P 500 fell 9% in April 1970, another 6% in May, and 5% in June, for a cumulative 19% drop in the second quarter of 1970. The Dow lost just 13% in the second quarter and 35% from peak to trough. But second-tier stocks fared worse. According to Go-Go Years author John Brooks, “a portfolio consisting of one share of every stock listed on the Big Board was worth just about half of what it would have been worth at the start of 1969.”

At the time, the tech stock crash of 1970 was overshadowed by troubling national news. Not only did the Earth Day celebration of April 22 take Ross Perot off the front pages the next day, but there was also the dramatic news of Apollo 13’s near-fatal moon mission (April 11-17), followed by President Nixon’s incursion into Cambodia (April 29), resulting in campus riots and shootings at Kent State (May 4) and Jackson State (May 14), amidst a recession engineered by Nixon as a way to fight inflation by “cooling the economy.” In the week of May 4-8, over 80 college campuses were completely closed down, and a violent conflict between students and “hard hats” took place in the shadow of Wall Street on May 8, 1970.

-

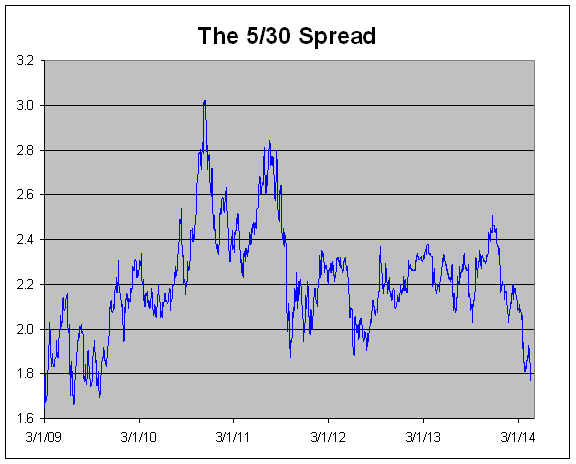

The Long-End of the Yield Curve Flattens

Eddy Elfenbein, April 22nd, 2014 at 11:04 amHere’s a look at the yield spread between the 5- and 30-year Treasuries. The gap between the two recently narrowed to 177 basis points which is a 4.5-year low.

What’s happening is that the back end of the yield curve is starting to flatten. Bear in mind that it’s still quite steep. It’s merely not as steep as it used to be.

What does this flatter back end mean? It’s hard to say but I suspect there are two opposing forces at work. At one end, investors are realizing that the U.S. fiscal situation isn’t as dire as once believed. The CBO recently had the “good” news that this year’s deficit will be under half a trillion dollars (yay?). That’s huge but not as huge as it used to be. Also, yields in the middle part of the yield curve are starting to reflect the belief that interest rates will rise next year, and in 2016.

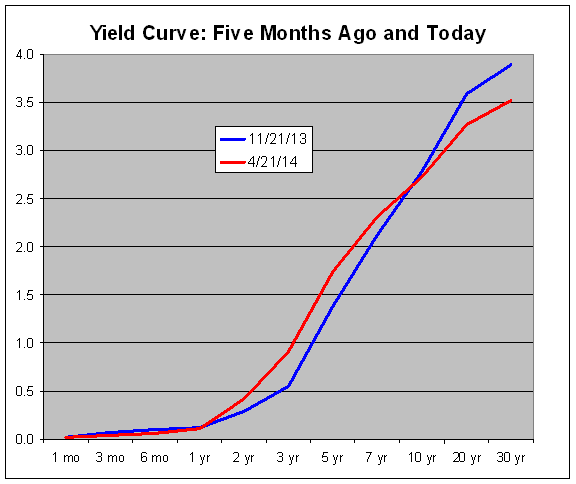

Here’s a look at the yield curve from five months ago and from yesterday. You can see where the red line is both higher and lower than the blue.

Historically, the best indicator for the economy has been the spread between the 2- and 10-year Treasuries. That’s still quite wide.

-

McDonald’s Earns $1.21 per Share

Eddy Elfenbein, April 22nd, 2014 at 8:34 amDisappointing earnings this morning from McDonald’s ($MCD). The fast food joint earned $1.21 per share for Q1 which was three cents below estimates. Interestingly, the stock is unchanged this morning. I suppose that means it was expected for them to miss expectations.

McDonald’s is a cheap stock, and frankly, that valuation isn’t unearned. The restaurant has made several missteps lately and we can see that in today’s numbers. Profits dropped 5.2%. Sales rose 1.4% but not as fast as costs, which rose 2.3% (higher beef costs).

As I see it, the situation at McDonald’s is similar to IBM. They’re both iconic brands who have slipped in recent years. The fundamental business is good but they desperately need to revive themselves. This is what Ford did several years ago, and Microsoft did more recently.

Despite today’s numbers, I think the outlook for McDonald’s is brighter than at IBM because management realizes the task at hand. The issues at MCD can be resolved, and I think it can be done rather cheaply. Their business in Europe isn’t that bad, it’s in the U.S. where the problems are. Their menu is far too complicated.

-

Morning News: April 22, 2014

Eddy Elfenbein, April 22nd, 2014 at 7:07 amU.S. Business Lobby Says Market Access Concerns in China Growing

Battling for a Safer Bangladesh

Ukraine Accord Nears Collapse as Biden Meets Kiev Leaders

Philips More Cautious For 2014 as Euro Crimps Profit

Supreme Court Seems Inclined to Bolster Truth-in-labeling Laws

S&P 500 Rises to Cap Longest Rally in 2014 Amid Earnings

Scorecard Needed for Today’s Drug Industry Dance

Lilly Announces Agreement to Acquire Novartis Animal Health

Ackman, Valeant Team Up to Bid for Allergan

Mulally’s Legacy: Setting Ford on a Stronger Course

Netflix Shares Rise Following Better Than Expected Q1 Profits

The Hot War Between Netflix and Comcast Is Escalating

Tesla CEO: Panasonic Likely Partner in Battery Plant

Joshua Brown: Here’s The Good News…

Roger Nusbaum: Robo Advisors & Behavioral Finance

Be sure to follow me on Twitter.

-

Shiller: “Easy to Beat the Market” Long Term

Eddy Elfenbein, April 21st, 2014 at 5:59 pm -

Bonds Beating Stocks YTD

Eddy Elfenbein, April 21st, 2014 at 12:16 pmHere’s the chart which has confounded a lot of people this year. I think it was broadly assumed that stocks would continue to rally, and bonds would slowly fall. That hasn’t happened. The gold line is the Long-Term Treasury ETF ($TLT) and it’s done quite well this year while the S&P 500 ETF ($SPY) has been mixed.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His