Archive for May, 2014

-

Taking Short-Term Risk for Long-Term Reward

Eddy Elfenbein, May 11th, 2014 at 8:08 pmHere’s an interesting passage from David Aldous’ review of The Black Swan. Aldous is a stats professor at Berkeley.

I am always puzzled that writers on financial mathematics (Taleb included) tend to ignore what strikes me as the most important insight that mathematics provides. Common sense and standard advice correctly emphasize a trade-off between short term risk and long term reward, but implicitly suggest this spectrum goes on forever. But it doesn’t. At least, if one could predict probabilities accurately, there is a “Kelly strategy” which optimizes long-term return while carrying a very specific (high but not infinite) level of short term risk, given by the remarkable formula

with chance 50% [or 25% or 10%] your portfolio value will sometime drop below 50% [or 25% or 10%] of its initial value.

Now actual stock markets are less volatile, and consequently the best (fixed, simple) investment strategy for a U.S. investor over the last 50 years has been to invest about 140% of their net financial assets in stocks (by borrowing money). It is easy to say [p. 61] The sources of Black Swans today have multiplied beyond measurability and imply this is a source of increased market volatility, but it is equally plausible or implausible to conjecture that mathematically-based speculative activity is pushing the stock market toward the “Kelly” level of volatility.

Here’s what he means by a “Kelly strategy.”

-

CWS Market Review – May 9, 2014

Eddy Elfenbein, May 9th, 2014 at 7:09 am“It never was my thinking that made the big money for me. It always was my sitting.” – Jesse Livermore

Welcome to the Revenge of the Boring Stocks. The stock market’s rotation continues, as former high-flyers have been getting punished, while boring old dividend-payers are suddenly popular. What’s happening is that there’s been a resurgence of rationalism, sobriety and prudent investing. No one saw this coming.

Last week, I said that Friday’s jobs report could be a big one, and I was right. The economy created 288,000 jobs in April. That’s the biggest gain in more than two years. But here’s the odd part: the bond market has rallied ever since. The yield on the 10-year Treasury finally broke below 2.6% this week and touched its lowest point since October. Despite many predictions of its imminent demise, the boring T-bond market is well ahead of the stock market this year.

The big news for our Buy List is that DirecTV officially said they’re looking at a possible merger with AT&T. On Wednesday, shares of DTV gapped up 8% to hit a new all-time high. I think they’re in a position of strength in any merger negotiation. We’re now sitting on a 23.2% gain YTD. I’ll have all the details on DTV in a bit.

In addition to a good earnings report from DirecTV, we also saw good earnings from Cognizant Technology, although traders took the shares down. Not to worry. I’ll explain why CTSH is as strong as ever. I’ll also preview next week’s earnings report from CA Technologies (which now yields 3.4%). But first, let’s look at the market’s rotation and why the cool stocks are finally getting their comeuppance.

The Revenge of Boring Stocks

On the surface, the stock market seems to be pretty tame, and there’s not a lot of volatility. But just below the surface, there’s been a major correction unfolding that’s manifested itself in several different ways.

The best way I can describe this phenomenon is that boring stocks have suddenly become popular, while formerly popular stocks are now hated. I described last year’s market as a massive chilling out. It was a reaction against the earlier flight to ultra-conservative investments. In 2013, investors cautiously moved into riskier assets. That was good for us, but what we’re seeing this year is a reaction against the excesses of last year’s rotation.

As a result, we’re seeing a market that’s frustrated a lot of folks. The guys at Bespoke Investment Group point out that in the last two months, the stocks that analysts like the most are down the most, while the stocks they hate the most are up the most. Goldman Sachs notes that “nearly 90% of large-cap growth mutual funds and 90% of value funds were underperforming their benchmarks year-to-date.”

Let’s look at some examples. On Thursday, shares of Tesla, the electronic-car stock, dropped 11.3% after the company said it beat earnings estimates by 20%. Analysts are worried about rising costs, but my point is that in this market, an earnings beat isn’t enough to help a stock that’s zoomed in the past year. Look at Twitter which lost 18% after its “lock-up” period expired. The company recently reported Q1 earnings of $183,000. That’s about one-thirtieth of a penny per share. That’s not enough to buy even one share of Berkshire Hathaway. Or look at Amazon which is now 30% off its high. It’s all the way down to 489 times last year’s earnings. And it’s not just tech stocks; it’s any hi-flier that’s richly valued. Whole Foods Market is now 40% off its high. The P/E Ratio of the Nasdaq is twice that of the rest of the market.

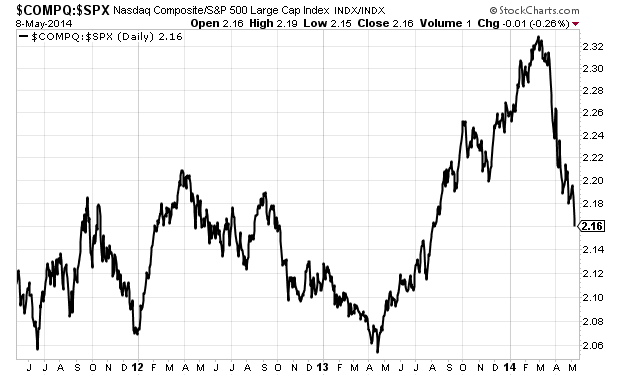

Check out this chart which shows the Nasdaq Composite divided by the S&P 500. You can see how the Nasdaq creamed the S&P 500 last year but has been flattened by it lately.

This anti-pricey-stock sell-off has distorted market perceptions because it’s affected the stocks that individual investors love so much. The boring stocks have been doing just fine, especially if they pay a dividend.

James Saft at Reuters notes that “according to Societe Generale data, the single most important characteristic driving equity returns in the past month has been dividend yields.” That makes sense. Utilities, for example, have been doing very well this year. The Utility ETF ($XLU) is up 13% YTD, and the Vanguard REIT ETF ($VNQ) is up 15% this year. Bespoke gives us another great factoid: The 300 stocks in the Russell 1000 that don’t pay a dividend are down 7.21% since March 5, while the 300 highest-yielding stocks are up 2.11%. The dividend is the difference.What’s also interesting is that the market’s breadth has badly deteriorated. At recent market peaks, the number of stocks making new 52-week highs has gradually fallen. In other words, a smaller and smaller group of stocks is doing the heavy lifting. If you glance at a list of stocks reaching new 52-week highs, it’s likely to be almost entirely oil stocks, with DirecTV and Apple thrown in. The average stock in the Russell 1000 is now down 11.4% from its 52-week high, even though the entire index is down 1.5% from its high.

Another area where we can see the rotation is in small-caps, which have badly underperformed. On Tuesday, traders were rattled when the Russell 2000 closed below its 200-day moving average. That hasn’t happened in more than 17 months. Half of the stocks in the Russell 2000 are more than 20% off their highs. In contrast, the mega-caps in the Dow 30 have barely budged.

This rotation isn’t done yet. Investors should make sure they have high-quality dividend stocks in their portfolios. Some of our Buy List stocks with rich yields include Microsoft (2.8%), CA Technologies (3.4%), McDonald’s (3.2%) and Ford (3.2%). Now let’s look at our star stock of the week.

DirecTV Soars on Possible Merger News

In last week’s CWS Market Review, I mentioned how shares of DirecTV ($DTV) jumped on news that AT&T had been talking with DTV about a possible merger. This week, it got much more serious. Shortly before the closing bell on Wednesday, news broke that DirecTV is working with Goldman Sachs to look at such a deal. If Goldie’s involved, you can be sure it’s serious.

Ever since the Comcast/Time Warner Cable deal was announced, a response deal between AT&T and DirecTV has made a lot of sense. I suspect that until now, DTV hasn’t been terribly interested in a merger. In business, of course, everyone has a price. I won’t predict whether something will come about, but I’ll add that a deal would certainly help out AT&T at a crucial time for them. The good news for us is that DirecTV is in the position of strength. The only worry is that they don’t get too greedy as regards price because DISH is waiting in the wings.

On Tuesday, DirecTV reported another solid quarter. The satellite-TV operator earned $1.63 per share for Q1. That beat estimates by 15 cents per share. The company added 361,000 subscribers in Latin America, which was far more than analysts’ estimates of 227,000. DirecTV now has 20.3 million subscribers in the U.S. (You can see why AT&T wants that.)

DirecTV has been our top-performing stock this year, up 23.2% YTD. This week, I’m raising our Buy Below on DirecTV to $89 per share. What a great stock.

Cognizant Technology Raises Full-Year Guidance

On Wednesday, Cognizant Technology Solutions ($CTSH) reported Q1 earnings of 62 cents per share. That’s pretty good. Three months ago, the IT-services company told us to expect earnings of 59 cents per share. Quarterly revenue rose 19.9% to $2.42 billion.

For Q2, Cognizant sees revenues coming in between $2.50 billion and $2.53 billion, and EPS of 62 cents. The Street had been expecting 63 cents per share. For all of 2014, Cognizant projects revenue of at least $10.3 billion and earnings of at least $2.54 per share. Three months ago, CTSH had disappointed investors when they projected 2014 earnings of at least $2.51 per share, while the Street had expected $2.54 per share. In other words, the estimate is back where we started.

Gordon Coburn, Cognizant’s president, said, “We remain confident in the overall demand environment and in our ability to deliver our previously stated revenue guidance of at least $10.3 billion for 2014, up at least 16.5% over 2013.”

Even though these numbers were pretty good, the stock dropped 4.4% after the earnings report. That’s partly a reflection of the turn against growth companies (CTSH doesn’t pay a dividend). Fortunately, on Thursday, CTSH made back about half of Wednesday’s loss. Granted, it’s a pricey stock. The current price is about 19 times earnings, but their business is growing rapidly. Cognizant remains a very good buy up to $52 per share.

CA Technologies Is a Buy up to $34 per Share

CA Technologies ($CA) reported blow-out earnings in January. The company earned 84 cents per share for their fiscal Q3, which was 14 cents better than estimates. CA said they see full-year earnings ranging between $3.05 and $3.12 per share. Since they’ve already made $2.48 for the first three quarters, that forecast implies 57 to 64 cents per share for Q4. Wall Street expects 58 cents per share.

As I highlighted earlier, CA pays a generous quarterly dividend of 25 cents per share. In fact, I think they could afford to bump that up to 30 cents per share. The stock has been meandering lower recently. On Wednesday, CA touched its lowest point since mid-October. Thanks to the lower share price, CA’s yield is up to 3.4%, going by Thursday’s close. Earnings are due to come out on Thursday morning, May 15. This is an excellent stock for income-oriented investors. CA Technologies remains a good buy up to $34 per share.

Buy List Updates

Before I go, I want to update you on some of our Buy List stocks. I’m ready to pound the tables for Bed Bath & Beyond ($BBBY). The stock has sunk down to a very attractive price. The last earnings report and guidance for fiscal Q2 have convinced me that they can bounce back. The store has a solid balance sheet, and earnings of $5 per share are very doable. I’m lowering my Buy Below to $66 per share, but if you’re able to get BBBY below $61, then you got a very good deal.

Another retailer I like here is Ross Stores ($ROST), which will be reporting fiscal Q1 earnings on May 22. Wall Street’s consensus is for $1.15 per share. The discount retailer also said that Barbara Rentler will become their new CEO on June 1. She’ll become the 25th female CEO in the Fortune 500. I’m keeping my Buy Below on ROST at $76 per share.

In January, shares of Moog ($MOG-A) got hit hard after they lowered their full-year guidance. At the time, I wrote, “While this news is disappointing, it doesn’t change my fundamental opinion of the company.”

This is why we like high-quality stocks. They bend but rarely break. I’m happy to say that Moog has bounced back. Yesterday, the stock got as high as $69.57 per share, which is a 22% gain from its February low. Last week, I raised our Buy Below to $69, and this week, I’m upping it to $72 per share. Moog is a solid, boring stock. Last year, that was an insult. This year, it’s a compliment.

At this week’s Ford ($F) shareholder meeting, CEO Alan Mulally got a standing ovation. Not many corporate executives get that nowadays, but Mulally has delivered the goods. In the last five years, Ford has made $42.3 billion.

The automaker just announced a $1.8 billion share-buyback program. The goal is to reduce share count by 3%. Ford also reported that sales in China were up 29% in April and are up 41% YTD. Ford is a still a very good buy up to $18 per share.

That’s all for now. Next week, we get important economic reports on retail sales and industrial production. The government will also report on consumer and wholesale inflation. So far, inflation has been tame, but I’ll be curious to see if there’s any indication of higher prices. Also, stay tuned for earnings from CA Technologies, which will come out Thursday morning, May 15. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: May 9, 2014

Eddy Elfenbein, May 9th, 2014 at 6:35 amDraghi, ECB Play the Waiting Game

Warren and Allies Said to Reject Fannie Mae Overhaul Bill

Jobless Claims Fall More Than Expected

Later Easter Drives Retail Sales in April

I Haven’t Updated My iTunes Software Since 2011. That’s Why Apple Needs Beats

Lévy Blames Takeover Risk For Publicis-Omnicom Merger Failure

Alcatel-Lucent First-Quarter Loss Narrows on Cost Reductions

ArcelorMittal Reports 12% Increase in Profit

CBS Sales Fall Short as Ads Decline From Super Bowl Year

‘Candy Crush’ Maker King Serves Up Bittersweet Results, Shares Fall

Alibaba’s Rise: Success and Setbacks

Inside Tesla’s Two-State Bake Off For The Gigafactory

Kellogg to Stop ‘All Natural’ Kashi Claim

Jeff Carter: Demand Driven Innovation

John Hempton: Further Explanation Re: Gulfports Quarterly Guidance

Be sure to follow me on Twitter.

-

NICK Deal Isn’t Expect to Close Soon

Eddy Elfenbein, May 8th, 2014 at 12:50 pmI took Nicholas Financial ($NICK) off this year’s Buy List after the announced deal with Prospect Capital ($PSEC). It’s no secret that I didn’t like the deal and I thought NICK sold out for a low price.

I don’t know the details but the deal should have closed by now, and it’s been dragging on. There’s always a chance a deal can fall through, and that’s a real possibility here.

Prospect said in its most-recent 10-Q that the NICK deal won’t close by June 12. The problem is compounded by the fact that NICK didn’t have a shareholder meeting last year. If you go for too long without one, the Nasdaq will kick you off the exchange. Until now, that wasn’t a big deal since NICK was expecting to be bought out by now.

After trading just below $16 per share for a few months, the stock dropped 4% yesterday. Nicholas is in trouble. Someone needs to stand up and do something fast.

-

Ford to Buy Back 116 Million Shares

Eddy Elfenbein, May 8th, 2014 at 9:58 amThe stock market is mildly positive this morning. The initial claims report dropped to 319,000, which is still fairly low. Last week’s number was revised up to 344,000.

Ford Motor ($F) reported that its sales in China were up 29% last month, and their sales are up 41% in the last year. The automaker also said it will buy back 116 million shares worth $1.8 billion. Ford said this will offset dilution caused by stock-based compensation. Ford is up more than 2% this morning.

DirecTV ($DTV) is down about 1.7% this morning, and this comes after yesterday’s big rally.

Fiserv ($FISV) is up to a new 52-week high this morning. Moog ($MOG-A) has been as high as $69.24, and it’s not far from its all-time high from late last year. Three months ago, the shares were down to $57.

-

Morning News: May 8, 2014

Eddy Elfenbein, May 8th, 2014 at 7:01 amNew Draghi Era Seen on Hold at ECB as Euro Area Recovers

China Trade Surplus Rises to $18.45 Billion in April

China, Vietnam, Philippines Collide Amid Escalating South China Sea Tensions

Barclays to Shrink Investment Bank and Create an Internal ‘Bad Bank’

Toyota Chalks up Record Profit, Vehicle Sales

’Fast Money’ Recap: Valuation Matters for Tesla

StanChart Says Weak First-Quarter Continued in April and May

21st Century Fox Profit Tops Projections Thanks to Super Bowl Ad Sales

Bayer’s $14.2 Billion Merck Buy Shows OTC Strategy Split

Alibaba Bets on a Growing Chinese Economy and New Consumers

Disney Is Winning Over The Youngest Viewers To Build Lifelong Fans

Apple Gives ex-Burberry CEO Potential $67 Million Signing Bonus as She Takes Reins as Retail Boss

Glencore Names ex-BP Boss Tony Hayward as Chairman

Cullen Roche: Yes, Inflation Really is Low

Roger Nusbaum: Hire Someone Or Go It Alone? Yes!

Be sure to follow me on Twitter.

-

DirecTV Is In Play

Eddy Elfenbein, May 7th, 2014 at 5:02 pmFasten your seat belts, DirecTV ($DTV) is in play.

DirecTV working with advisers on possible AT&T merger

DirecTV is working with advisers including Goldman Sachs to weigh a possible merger with AT&T , according to Dow Jones, which cited sources.

The two companies have been in talks since AT&T approached the satellite TV company about a deal, the sources said.

If you squint real hard, you can just barely make up when the story broke.

If you can’t see it, the news broke about 10 minutes before the close.

Update: The WSJ has more.

A deal for DirecTV would bolster AT&T’s ability to distribute movies and television shows at a time when it increasingly sees video as central to its future. The telecom company is pursuing a dual approach, expanding its U-verse pay TV service while also building so-called over-the-top services to deliver video content over broadband and wireless connections.

The combined company would have annual revenue of about $160 billion and may be better positioned to negotiate for the needed rights to TV shows and movies.

In addition, a deal for DirecTV could deliver significant financial benefits for AT&T at a time when Wall Street is concerned about the amount of cash needed to fund AT&T’s dividend. UBS analyst John Hodulik said in a recent research note that the deal would provide AT&T the free cash flow needed to pay its dividend for the next decade.

-

Moog Fights Back

Eddy Elfenbein, May 7th, 2014 at 2:25 pmAfter getting creamed earlier this year, shares of Moog ($MOG-A) have slowly fought back. The stock has been as high as $67.78 today which is the highest in more than three months. The all-time high is $69.97 from December.

-

Is Twitter Cheap? I Have No Idea

Eddy Elfenbein, May 7th, 2014 at 12:24 pmShares of Twitter ($TWTR) have been getting clocked lately. This is part of the broader smash-up in momentum stocks that we’ve seen. The lock-up period for Twitter has just expired so insiders are now allowed to sell their shares. Even though a number of insiders said they wouldn’t jump ship, the market ain’t waiting around. The stock dropped 18% yesterday, and it’s down another 4% today.

So is Twitter cheap? Honestly, I have no idea. Twitter is one of those stocks that’s outside the realm of fundamental analysis. By any reasonable measure, the shares are vastly overpriced, but so are many stocks in embryonic sectors. If I can’t make it add up, then I stay away.

The Street expects to make four cents per share this year. That ain’t much for a $30 stock. It’s actually an increase from zero just a few weeks ago. For Q1, Twitter made a grand total of $183,000. That’s not per-share but the whole thing. That’s around what a successful restaurant makes. On a per-share basis, that works out to one-thirtieth of a penny.

The question now before the market is: “Will a momentum crack-up turn into a broader sell-off?” It’s too early to say for sure, but I’m inclined to think it won’t. The yield curve is still wide, and outside the momentum names, valuations are hardly excessive. Remember that a stock like McDonald’s, which is far more representative of the U.S. economy than many tech stocks, still yields close to 3.2%. That’s not far from the 30-year Treasury.

-

Cognizant Down 6% Despite Earnings Beat

Eddy Elfenbein, May 7th, 2014 at 10:49 amShares of Cognizant Technology Solutions ($CTSH) are down about 6% this morning after the IT provider’s earnings report. For Q1, CTSH earned 62 cents per share which was seven cents better than estimates. That’s up from 51 cents per share a year ago. Quarterly revenue rose 19.9% to $2.42 billion.

For Q2, the company sees revenues between $2.50 billion and $2.53 billion, and EPS of 62 cents. The Street had been expecting 63 cents per share. For all of 2014, they project revenues of at least $10.3 billion and earnings of $2.54 per share. Three months ago, CTSH had disappointed investors when they projected 2014 earnings of at last $2.51 per share (that’s post-split), while the Street had expected $2.54 per share.

“Cognizant continues to be well positioned to help clients as they face the secular shifts impacting their businesses,” said Francisco D’Souza, Chief Executive Officer. “Our broad set of capabilities and our compelling value proposition enable Cognizant to help clients simultaneously ‘run better’ and ‘run different,’ by not only driving efficiency in their current operations, but also helping them to re-imagine and re-design their business models.”

“We remain confident in the overall demand environment and in our ability to deliver our previously stated revenue guidance of at least $10.3 billion for 2014, up at least 16.5% over 2013,” said Gordon Coburn, President. “Our strategy of re-investing in our business to build strength across all of our growth horizons is clearly paying off. As the impact of digital technologies increasingly becomes a CEO level agenda item, Cognizant is well positioned to capitalize on this trend.”

These numbers look pretty good, and there’s not much surprising here. I don’t see what can justify today’s sell-off, but I’ve never understood short-term moves.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His