CWS Market Review – June 27, 2014

“And ye shall hear of wars and rumors of wars: see that ye be not troubled: for

all these things must come to pass, but the end is not yet.” – Matthew 24:6

Tomorrow is the 100th anniversary of the assassination of Archduke Franz Ferdinand in Sarajevo. The assassination sparked the July Crisis, which eventually led to the First World War. Once the war started, the New York Stock Exchange decided to close down. No one knew the war would last for so long. Soon traders were meeting outside the exchange to do their business (traders never change, do they?). After four months, the NYSE relented and reopened for business.

One hundred years ago today, the Dow Jones Industrial Average was around 80 (it’s not exactly comparable with today’s index, but close enough for our purposes). Since then, the index has doubled, doubled again, doubled again, and doubled four more times—and it’s close to doubling a fifth time. Last Friday, the Dow reached a new all-time high and came within 22 points of cracking 17,000.

It’s been a good century for investors. Of course, 100 years is, shall we say, a rather optimistic time horizon for an individual investor, but my point is to underscore the power of the long term. That’s what stock investing is all about. To quote the Rolling Stones, “time is on my side.” Time is on the side of all disciplined investors, and that was true even when the world was heading towards disaster.

Fortunately for us, we live in a far more peaceful world, but the lessons are the same. In this week’s CWS Market Review, I want discuss the latest mega-deal for one of our Buy List stocks. Oracle ($ORCL) is on the merger warpath again, and this time, they’re buying Micros Systems ($MCRS) for $5.3 billion.

I’ll also discuss the latest plunge in Bed Bath & Beyond ($BBBY). The home furnishing store disappointed Wall Street yet again. The stock dropped more than 7% on Thursday. Here’s the thing: They actually reaffirmed their full-year earnings. I’ll have full details in a bit.

We’ll also look at the horrible GDP revision for Q1. It turns out the economy had its worst quarter in five years. Fortunately, the news looks much better for the rest of this year. I’ll tell you what it all means, but first, what the heck’s going wrong with Bed Bath & Beyond?

Bloodbath & Beyond

After the close on Wednesday, Bed Bath & Beyond ($BBBY) reported Q1 earnings of 93 cents per share. This was one penny below Wall Street’s forecast, although it was within the company’s guidance of 92 to 97 cents per share. Quarterly sales rose 1.7% to $2.657 billion, and the all-important metric for retailers, comparable-store sales, was up 0.4%.

In my opinion, this was a mildly disappointing earnings report, but it’s far from a disaster. The market, however, was very displeased. Shares of BBBY dropped as much as 10% on Wednesday, and this came at the top of a very bad six months for them. The stock eventually closed the day at $56.70, for a loss of 7.2%. That’s its lowest close in 16 months. Yuck!

I realize I’m starting to sound like a broken record, but the problems Bed Bath & Beyond is having aren’t nearly as severe as the market’s behavior suggests. Yes, they’re in a rough spot, but they’re still very profitable. Unfortunately, this is how markets often behave—a stock can either do nothing right or do nothing wrong. Wall Street traders don’t exactly have a dimmer switch. The truth is that BBBY is a sound company that’s working through some issues. The company has been making investments to modernize its systems, and that’s cut into profit margins. They’ve also been hurt by a weak housing market. These are temporary factors.

Let’s look at its guidance. For Q2 (June, July, August), BBBY sees earnings ranging between $1.08 and $1.16 per share. Wall Street has been expecting $1.16 per share. That probably explains much of Wednesday’s sell-off. But here’s the important part. They kept their full-year guidance exactly the same, calling for a “mid-single digit” increase in earnings-per-share. BBBY made $4.79 per share last year. If we take “mid-single digits” to mean 4% to 6%, that works out to a range of $4.98 to $5.08 per share. In other words, the stock is now going for roughly 11 times forward earnings.

Here’s another important fact. Compared with last year’s first quarter, BBBY has 7.2% fewer weighted shares outstanding. In English, they’re gobbling up their own stock at a rapid clip. Unlike so many other companies, BBBY is truly reducing their share count. Plus, the company also has zero long-term debt. I apologize for the volatility, but I think this is one worth sticking with. This week, I’m lowering our Buy Below to $61 per share.

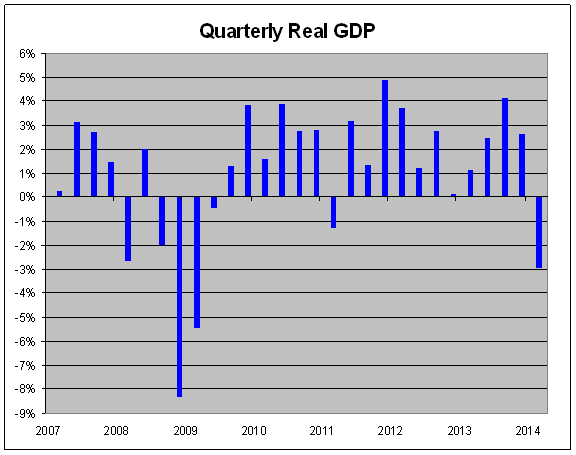

The Economy Dropped by 2.9% in Q1

Wall Street was stunned this week when the government dramatically lowered its report for Q1 GDP growth. The Commerce Department now says that the economy shrank by 2.9% in the first three months of this year (note that GDP figures are annualized and after inflation). That’s the worst quarter for the economy in five years.

Two months ago, the initial report for Q1 GDP showed growth of 0.1%. Last month, that was revised to a drop of 1%. Now it’s down to -2.9%. That’s the biggest downward revision between the second and third reports since records began nearly 40 years ago.

Although these numbers are shocking, I’m pretty skeptical. I’m not saying they’re wrong. I’m just saying…it’s complicated. First, let’s remember that this data is a bit old. It’s for Q1, which was January, February and March, and we’re nearly done with Q2. Also, a huge part of the downward revision had to do with healthcare, since Q1 was the quarter of the Obamacare rollout.

But my major concern is that the GDP numbers don’t line up with more recent data that hint at much stronger growth. Last week, I mentioned that some of the regional Fed surveys are quite optimistic. The trend in jobs is slowly improving. We’ll get the June jobs report next Thursday. Several other metrics like consumer confidence, the ISM reports and industrial production have also looked good. If the economy were truly deteriorating, we would see confirmation in other places. The key weak spot continues to be housing (and by extension, places like BBBY), but that should improve as well.

As investors, our concern isn’t the macro economy but corporate profits. Monday is the end of the second quarter, and soon Corporate America will report earnings results. What’s interesting is that this earnings season will be the first one in several quarters in which we haven’t seen forecasts lowered just before earnings came out. As we all know, Wall Street loves playing the game of guiding analysts lower, then beating those much-reduced expectations.

This time, earnings forecasts have come down some, but not much. The consensus on Wall Street is for the S&P 500 to report earnings of $29.40 for Q2 (that’s an index-adjusted figure). That’s down about 2.5% in the last year, which is very small compared with recent quarters. Typically, analysts overestimate early on, and the forecasts are gradually pared back as earnings season approaches. For now, Wall Street expects full-year earnings of $119.60 for the S&P 500, which means the index is going for about 16.4 times this year’s earnings. That’s slightly on the pricey side, but nowhere near bubble territory.

Next week we’ll get important economic reports that should shed some light on how well Q2 went. Next Tuesday, the June ISM report comes out. The ISM reports have improved for the last four months, and I expect another good number. Due to July 4th´s falling on a Friday, the jobs report for June will come out next Thursday. I think we’ll continue to see improvement of 200,000 to 250,000 jobs. The bottom line is that the Q1 GDP report is an outlier, and it’s old news. The recent data suggest that the economy is poised to grow at 3% annually for the next few quarters.

Oracle Buys Micros for $5.3 Billion

We’ve had a rash of deals on our Buy List. First, DirecTV ($DTV) and AT&T ($T) decided to hook up. Then Medtronic ($MDT) did a big deal with Ireland’s Covidien ($COV). Now Oracle ($ORCL) announces it’s buying Micros Systems ($MCRS) for $5.3 billion.

The deal is for $68 per share, which is a modest premium. However, shares of Micros jumped the Tuesday before last, when initial reports of a deal came out. In the last few years, Oracle has been a merger machine. Over the course of a decade, it has shelled out more than $50 billion to buy about 100 companies. Apparently, Larry Ellison isn’t done. This is Oracle’s biggest deal since they snatched up Sun Microsystems for $7.4 billion four years go. In the last 16 months, Oracle has announced 11 deals.

Micros, by the way, has been an amazing performer. In 1988, the shares were going for just 12.5 cents. The buyout price is 544 times that. Not bad for 26 years. The Micros deal is expected to close by the end of the year. Remember, of course, that any deal has the potential of falling through.

Last week, Oracle missed earnings by three cents per share, and the stock got punished. Fortunately, their guidance was a little better. I think this Micros deal is good for Oracle, and I’m pleased to see them on the offensive. Oracle remains a good buy up to $44 per share.

Buy List Update

This Monday is the final day of trading for the first half of the year. I’ll have a complete review of how the Buy List’s performing. But before then, I can tell you that the Buy List is currently up 1.96% for the year—less than the S&P 500, which has gained 5.89%. Those numbers don’t include dividends. As I’ve mentioned many times, our Buy List has beaten the S&P 500 for the last seven years in a row, and it looks like our streak may be in jeopardy this year. I’m not ready to concede just yet, nor will I depart from our proven strategy, but I want my readers to know exactly where we stand.

Big losers like Bed Bath & Beyond have weighed heavily on our Buy List this year (BBBY is close to a 30% loser YTD). But we’ve also had some bright spots recently. Microsoft ($MSFT), for example, just made another multi-year high on Wednesday. Wells Fargo ($WFC) is also close to a new high. Ford Motor ($F) has shown some strength lately. The automaker just hit an eight-month high on Thursday, and I think it has more room to run. Some of the top bargains on our Buy List include AFLAC ($AFL), Ross Stores ($ROST), eBay ($EBAY) and Cognizant ($CTSH).

That’s all for now. Next week will be an unusual week, since July 4th falls on a Friday. The stock market will be closed on Friday, and it closes at 1 p.m. on Thursday. Expect very light volume, however, since it’s the start of the month. We’ll also be getting the big June jobs report on Thursday morning. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on June 27th, 2014 at 7:07 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His