CWS Market Review – September 19, 2014

“The market is fond of making mountains out of molehills and exaggerating

ordinary vicissitudes into major setbacks.” – Benjamin Graham

Is it ever! We all know how the market likes to be a major drama queen, and frankly, that’s what makes investing so much fun. This week, for example, was an exciting week for Wall Street. On Wednesday, Janet Yellen and her buddies on the Federal Open Market Committee decided to taper the Fed’s bond purchases by another $10 billion. Starting in October, the central bank will buy $10 billion in Treasuries and $5 billion in mortgage-backed securities. What this means is that the Fed will almost certainly wrap up Quantitative Easing once and for all at their next meeting in late October.

In addition to their regular policy statement, the Fed threw another statement our way:

A Declaration of Normalization Principles, which describes how the Fed will depart from (as they prefer to phrase it) “monetary accommodation.” I’ll explain what it all means in bit, but skipping all the econo-jargon, it means that we can expect low interest rates to stick around a while longer.

That’s good news for investors, and the stock market approved of the Fed’s move. On Thursday, the S&P 500 galloped to 2,011.36, which is the index’s 34th record close of the year. There’s also some relief that the “no” side appears to have won in Scotland’s independence referendum.

Later on in this issue, we’ll look at the recent earnings report from Oracle ($ORCL). The enterprise-software king missed earnings yet again, but the really big news is that Larry Ellison is stepping down as CEO! I’ll tell you what it all means. We also got an 11% dividend increase from Microsoft ($MSFT), which is exactly what I predicted in last week’s CWS Market Review. I’ll also preview the upcoming earnings report from Bed Bath & Beyond ($BBBY). But first, let’s look at why the Fed isn’t going to raise rates anytime soon.

Expect Rates to Stay Low for a Long Time

On Wednesday, the investing world came to a halt to hear what the Federal Open Market Committee had decided. Since there has been some noticeable improvement in the economy, some investors were speculating that the Fed might ditch its key phrase “considerable time” as it pertains to the period between the end of Quantitative Easing and I-Day, the date of the first interest-rate increase. Previously, Janet Yellen described that period as lasting “around six months,” which was a big-time rookie mistake.

As it turns out, the Fed decided to keep its “considerable time” proviso. They also kept the affirmation that “there remains significant underutilization of labor resources,” which is a fancy way of saying there’s still a lot of folks out of work. And that’s certainly true.

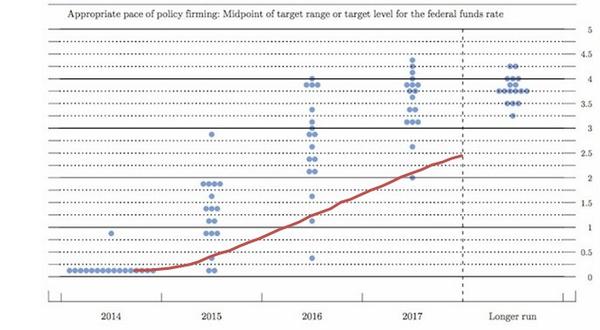

As I mentioned before, the Fed decided to taper its bond purchases, and the next meeting should bring the final taper. So that leads us to wonder: How much longer do we have to wait for rates to rise? We got a hint of that as the Fed also released its projections for the economy and interest rates. The Fed includes a scatter plot of blue dots for each of the 17 FOMC members (not all of whom vote). The most important chart shows where the 17 members of the FOMC see interest rates at year’s end for the next few years, as well as the forecast for the long run.

What I found truly surprising is how hawkish the projections are. Most Committee members see interest rates hitting 1% before the end of next year, and 2.5% before the end of 2016. That’s well ahead of the futures market. I’m surprised to see such a divergence between the Fed and the markets. In fact, it’s a divergence between the Fed and what the Fed has previously said. What’s going on? I noticed that there were two dissenters on the Committee this time, so we may see a growing divide at the Fed. The projections could be an indication that the inflation hawks are growing.

The chart below (courtesy of Jake of EconomPic) shows the FOMC’s projection for interest rates (the blue dots) along with what the futures market currently projects (the red line). Note how much more hawkish the FOMC is.

My view is that there’s no need to raise rates anytime soon. I think mid-2015 would be the earliest possible date. As the policy statement made clear, there’s still a lot of slack in the labor market, and inflation is dead as a doornail. This week, we got more evidence of how tame inflation has been. We actually had deflation last month. The government said that consumer prices fell 0.2% in August. Wall Street had been expecting no change.

Don’t think the low inflation was solely due to lower energy prices, however. The “core rate,” which excludes food and energy prices, was flat last month. Economists had been expecting an increase of 0.2%. This was the lowest core inflation report in more than four years. Remember that with 0% interest rates and deflation, real rates are positive!

There are also plenty of signs that the economy isn’t completely well. Last Friday, the government reported that Industrial Production fell 0.1% last month. This was the first decrease since January. This data series can be a bit bumpy, so it’s too early to say that this could be a sign of trouble. Interestingly, in the Fed’s economic projections this week, the central bank lowered its growth forecasts for next year.

I should also point out an important fact that’s often overlooked. The debate on Wall Street concerns when the Fed will start raising rates. But even when it does, real rates will still be negative, and they’ll probably stay that way for two more years, give or take. Consider that the yield on the five-year TIPs only recently crossed into positive territory.

On Thursday, we got some good news for the labor market. First-time jobless claims dropped to 280,000. That’s one of the lowest reports in the last 40 years. This report, however, can be very noisy, so economists prefer to focus on the four-week moving average. The last jobs report wasn’t very good, so this may be an omen of more strength down the road. As always, it’s important to look at the trend, not just one or two data points. (Naturally we don’t want to exaggerate any ordinary vicissitudes.)

What Does This Mean for Investors?

The market has had an interesting reaction to the Fed this week. In short, what’s been happening has continued to happen, only more so. But I think the market read too much into the Fed’s hawkish projections and assumes higher rates are on the way. Much of the action this week has been the strong-dollar trade (lower gold, lower bonds, higher stocks, large-caps beating small-caps).

The overall stock market responded to the Fed by rallying, but it’s an uneven rally, as we would expect. The spread between large- and small-caps has grown even larger, which is a natural reaction to a stronger dollar. The big boys are leading this rally by a good margin, and the Russell 2000 is actually down for the year. Here’s a remarkable stat: Nearly half of the stocks on the Nasdaq are down by 20% or more. In other words, there’s a stealth bear market going on, even as the broader rally continues.

As I mentioned last week, the U.S. dollar is strong, and it’s getting stronger. The dollar rallied to a six-year high against the Japanese yen. That helped push shares of AFLAC ($AFL) to a new 52-week low on Wednesday. The euro fell to a 14-month low against the dollar.

The same forces are at work in the gold pits. On Thursday, gold fell below $1,220 an ounce for the first time since January. Gold looks ugly, and I think it will get uglier. The Fed’s most important audience, the bond market, responded by selling off. On Thursday, the two-, three- and five-year Treasuries all closed at the highest yield in over three years. But any maturity less than that barely moved. While long-term yields fell for much of this year, they’ve started to rise over the past three weeks. One of the best economic indicators is the spread between the two- and ten-year Treasuries, and that’s increased a bit recently.

What to do now: Investors should continue to focus on high-quality stocks like those on our Buy List. I would pay particular attention to stocks with above-average dividend yields like Ford ($F), Wells Fargo ($WFC) and Microsoft ($MSFT). Now let’s look at one of my favorite tech stocks.

Larry Ellison Steps Down as Oracle’s CEO

After the closing bell on Thursday, Larry Ellison shocked Wall Street by announcing that he’s stepping down as CEO of Oracle ($ORCL). In his place, Mark Hurd and Safra Catz will both become CEO. Interestingly, Oracle’s statement has never referred to them as co-CEOs, which is a concept with a troubled history. Ellison will become Executive Chairman and Chief Technology Officer.

Honestly, I’m not a fan of the dual-CEO concept, and it rarely works. On top of that, no one is truly CEO as long as Larry Ellison is Chairman of the Board. I don’t mean that disrespectfully; I’m a big Larry fan. I like anybody who owns their own MIG-29 or Hawaiian island, but let’s remember that he owns 25% of the shares. I doubt this two-CEO configuration will last more than two years, but I’ll give it a fair shake.

Now on to earnings. For fiscal Q1, Oracle earned 62 cents per share, which was two cents below Wall Street’s estimate. In June, Oracle had given us an earnings range for Q1 of 62 to 66 cents per share. This is the third quarter in a row where Oracle has missed consensus. Quarterly revenues rose 3% to $8.6 billion, which was below the Street’s consensus of $8.78 billion. Oracle had been expecting growth of 4% to 6%.

Hardware continues to be a trouble spot for Oracle. For Q1, hardware sales dropped 8% to $1.2 billion. But there are some bright spots as well. Oracle’s cloud revenue rose more than 30% to $475 million. The company’s cash flow rose 7% to $6.7 billion, which is an all-time record. Oracle also said that it will repurchase $13 billion in shares.

On to guidance. For Q2, which ends in November, Oracle expects earnings to range between 66 and 70 cents per share. Wall Street had been expecting 74 cents per share. Oracle expects top-line growth between 0% and 4%. Frankly, this is a so-so earnings report. It’s not terrible, but it tells me Oracle is still having trouble in key markets. However, I’m not about to abandon them. Oracle remains a buy up to $44 per share.

Bed Bath & Beyond’s Earnings Preview

Bed Bath & Beyond ($BBBY) is due to report fiscal Q2 earnings on Tuesday, September 23. This certainly has a lot of shareholders nervous because the shares have been slammed by the market for the last three earnings reports. It’s clear that the market went overboard last time (down to $55?), and shares of BBBY have slowly inched their way back.

In June, the home-furnishings store told us to expect Q2 earnings to range between $1.08 and $1.16 per share. My numbers say that earnings will come in on the high-end of that range. For all the trouble BBBY has gotten from the market, the company has been consistent with its full-year earnings estimate. It expects earnings growth in the “mid single digits.” If we take that to mean 4% to 6% and apply it to last year’s earnings of $4.79 per share, it gives us a range of $4.98 to $5.08 per share for this year. That means the stock is going for less than 13 times earnings, which is quite reasonable. The company also floated its first bond deal in 20 years to fund $1.1 billion in share buybacks. I can’t say I’m a big fan of that move, but I understand the company’s impatience with the market. Bed Bath & Beyond remains a buy up to $70 per share.

Microsoft Raises Its Dividend By 11%

In last week’s CWS Market Review, I wrote:

Be on the lookout for a dividend increase soon from Microsoft ($MSFT). The software giant isn’t normally thought of as a dividend stock, but they’ve been working to change that. In the last four years, Microsoft has increased its dividend by 115%. The quarterly payout is currently 28 cents per share. I think MSFT will raise it to 31 cents per share.

I was right! After the closing bell on Tuesday, Microsoft ($MSFT) raised its quarterly dividend to 31 cents per share. That’s an increase of 11%. Over the last five years, MSFT has raised its dividend by 138%. The new dividend works out to $1.24 for the year. Going by Thursday’s close and the new dividend, Microsoft now yields 2.66%. Fiscal Q1 earnings are due out in another month. Last Friday, the shares broke above $47 for the first time since Bill Clinton was president. Microsoft remains a very good buy up to $48 per share.

That’s all for now. Next week is the last full week of trading before the end of the third quarter. We’ll get key reports and new and existing home sales. On Thursday, we’ll get the latest report on Durable Goods. Last month’s report was very strong thanks to a surge in aircraft orders. On Friday, the government will update the numbers for Q2 GDP growth. Goldman Sachs said it will be 4.7%, which would make Q2 the best quarter in more than eight years. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 19th, 2014 at 7:04 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His