Archive for September, 2015

-

Morning News: September 25, 2015

Eddy Elfenbein, September 25th, 2015 at 7:03 amJanet Yellen Says Fed Is Likely to Raise Interest Rates This Year

Oil Prices Pare Gains on Stronger Dollar, Weak Japan Data

Asian Development Bank to Double Funding to Combat Climate Change

The Environmental Legacy of the Volkswagen Scandal

Takeaways For Investors From Durable Goods Orders

Investors Are Mining For Water, the Next Hot Commodity

Google Said to Be Under U.S. Antitrust Scrutiny Over Android

Energy Transfer Equity Is Closing In On A Deal For Williams

Sharp Pressed to Find Investors in Smartphone Display Business

Schlumberger Won’t Extend Deadline to Buy Eurasia Drilling Stake

Is PEP More ‘Diverse’ Than KO?

Are Millennials Delusional? Half Say They’ll Cover The Cost Of College For Their Kids

Jeff Carter: Poker, Options and Startup Investing

Roger Nusbaum: Bear Market Coming? Bear Market Here?

Be sure to follow me on Twitter.

-

Bed Bath & Beyond Earns $1.21 per Share

Eddy Elfenbein, September 24th, 2015 at 4:43 pmFor fiscal Q2, Bed Bath & Beyond (BBBY) just reported earnings of $1.21 per share. Sales rose 1.7% to $2.995 billion. In constant currency sales were up 2.2%. Same store sales rose 0.7%, and 1.1% in constant currency.

The company sees Q3 earnings of $1.14 to $1.21 per share. They’re keeping their full-year guidance of flat to mid-single digits.

Net earnings per diluted share continue to be modeled to be between a relatively flat and a mid-single digit percentage increase for the fiscal full year. For the third quarter of fiscal 2015, the Company is modeling net earnings per diluted share to be approximately $1.14 to $1.21, compared to $1.23 in the prior year period. This modeled range would result in year-over-year net earnings per share growth of approximately 5% to 11%, after taking into account the impact of certain non-comparable items. Based on the modeled diluted weighted average shares outstanding for the fiscal third quarter of 2015, these non-comparable items, totaling about $0.15, are: the non-recurring favorable credit card fee litigation settlement that occurred in the third quarter of fiscal 2014; the significantly lower net after tax benefits that are planned in the third quarter of fiscal 2015 as compared to fiscal 2014 due to distinct tax events; and a modeled unfavorable foreign currency rate impact in the third quarter of fiscal 2015. Comparable sales are modeled to increase between 1.0% and 3.0% for the third and fourth quarters of fiscal 2015.

Here are some quarterly financial stats going back a few years.

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Nov-11 $2,343,561 $958,693 $357,020 $228,544 $0.95 Feb-12 $2,732,314 $1,163,669 $550,765 $351,043 $1.48 May-12 $2,218,292 $887,199 $313,398 $206,836 $0.89 Aug-12 $2,593,015 $1,032,669 $365,137 $224,330 $0.98 Nov-12 $2,701,801 $1,074,010 $361,649 $232,750 $1.03 Feb-13 $3,401,477 $1,394,877 $598,034 $373,872 $1.68 May-13 $2,612,140 $1,032,971 $323,101 $202,490 $0.93 Aug-13 $2,823,672 $1,113,484 $389,766 $249,304 $1.16 Nov-13 $2,864,837 $1,121,690 $374,647 $227,197 $1.12 Feb-14 $3,203,314 $1,297,437 $527,073 $333,299 $1.60 May-14 $2,656,698 $1,030,885 $300,701 $187,052 $0.93 Aug-14 $2,944,905 $1,134,045 $368,741 $223,953 $1.17 Nov-14 $2,942,980 $1,128,974 $352,683 $225,408 $1.23 Feb-15 $3,336,593 $1,325,875 $532,168 $321,061 $1.80 May-15 $2,738,495 $1,044,133 $273,269 $158,451 $0.93 Aug-15 $2,995,469 $1,140,950 $350,194 $201,678 $1.21 Morning News: September 24, 2015

Eddy Elfenbein, September 24th, 2015 at 7:13 amGerman Consumers Increasingly Concerned About Economy

Norway Cuts Rates to Record Low to Save Economy From Oil Slump

Xi Jinping Hears Tough Complaints of American Business

We Still Aren’t Sure What Will Cause Janet Yellen to Pull the Trigger

Gross Tells Fed to `Get Off Zero Now!’ as Economies Run on Empty

Oil Rebounds Near $48 on Bargain-Hunting After Sharp Fall

Jack Dreyfus, Wall Street Lion On Main Street’s Side

After Volkswagen Revelation, Auto Emissions Tests Come Under Global Scrutiny

Sharp Poised to Miss First-Half Forecast, Cut 2016 Target

AI Supercomputer Watson Goes West As IBM Courts Tech Hotshots

Anheuser-Busch InBev Acquires L.A. Craft Beer Maker Golden Road Brewing

Nomura Loses $493 Million in Monte Paschi Derivatives Settlement

Wal-Mart Presses Suppliers to Share Benefits of Cheaper Yuan

Instagram’s Mobile Ad Revenue Will Exceed Google’s

Cullen Roche: Three Things I Think I Think – Angry Old Guys and Low Risk Young People Edition

Howard Lindzon: Repeat After Me…You are an Active Investor…The Stock Market is a Game.

Be sure to follow me on Twitter.

Morning News: September 23, 2015

Eddy Elfenbein, September 23rd, 2015 at 7:10 amEuro Area Seen on Track for Steady Growth as Orders Accelerate

European Court Adviser Calls Trans-Atlantic Data-Sharing Pact Insufficient

China Factory Slump Casts Pall But Europe Pierces Gloom

The Fed Is a Lot Closer to Its Target Using This Inflation Measure

NY Regulator Issues First License For Bitcoin Company

‘European Detroit’ Fear Grips VW Company Town as Scandal Widens

Boeing to Sell 300 Jets to China Firms, Set Up China Plant

Netflix’s Emmy Performance: A Premonition Of Tough Times Ahead?

Uber to Launch Carpooling Service for Commuters in China

ConAgra Foods Swings to Loss on Charges Related to Private-Label Business

Total Cuts Oil Output Target as Prices Expected to Stay Low

Starbucks Falls Short After Pledging Better Labor Practices

Jeff Carter: The Bubble is Somewhere Else

Joshua Brown: Fundamentals Are Only Half The Story

Be sure to follow me on Twitter.

Moynihan Wins Vote

Eddy Elfenbein, September 22nd, 2015 at 11:04 amThe New York Times report

Brian T. Moynihan gets to keep his job as both chief executive and chairman of Bank of America after shareholders on Tuesday backed the board’s decision to grant him both titles.

Roughly 63 percent of the shareholders’ votes cast approved a proposal allowing the board to decide whether its top executive should hold a dual leadership role at the bank.

Critics said their opposition to the measure was less a judgment on Mr. Moynihan’s stewardship of the bank and more a rejection of the way he and the bank’s board went about combining the chief executive and chairman titles last October. The board unilaterally overturned a shareholder vote in 2009 that required the two roles be separated.

Tuesday’s vote had become a rallying cry for shareholder activists, who said too many companies like Bank of America had run roughshod over the wishes of their investors. Some of the nation’s largest pensions funds in California, New York and Illinois came out against keeping the jobs together, saying two separate positions would provide more oversight at the bank.

There should be far more shareholder challenges against management. Consider this fact. Twenty years ago today, shares of Bank of America (BAC) closed at $17. Today, the stock is going for about $15.50. Isn’t that worth shaking up?

Happy Gann Day!

Eddy Elfenbein, September 22nd, 2015 at 9:41 amToday is September 22, or Gann Day. What’s Gann Day you ask? Six years ago, Randall Forsyth wrote in Barron’s:

It doesn’t appear on any calendar, but Sept. 22 is known among aficionados of various and arcane market indicators as the day pinpointed by the late technical analyst, W. D. Gann, when markets are more likely to reverse than any other day of the year.

For some reason, stocks, commodities and currencies have a curious tendency to make major tops or bottoms on this day, as Paul Macrae Montgomery points out in a special study edition of Universal Economics newsletter entitled, “A Date Which Will Live in Infamy.”

While it is a bit of hyperbole to equate Sept. 22 with FDR’s characterization of the Dec. 7, 1941 attack on Pearl Harbor, the number of huge reversals that took place on or about that date is stunning.

Montgomery recalls living through the October “massacres” of 1978 and 1979, the crash of 1987, the mini-crash of 1989, the 1997 Asian collapse and the Long-Term Capital Markets plunges, which started to cascade downward in late September. And while gold bullion topped in January 1980, gold stocks made their highs on Sept. 22 of that year, he adds. That date also saw the peak in many oil stocks.

Looking back farther, on Sept. 22, 1929, the Dow Jones Utility Index became the final major average to make its high before the Great Crash. And in 1873, a panic forced the New York Stock Exchange to shut down, Montgomery further details.

And who can forget 2008, when markets went into freefall in the days following the collapse of Lehman Brothers? What’s remembered less well now is the market chaos in the subsequent days after the House of Representatives initially rejected legislation that created the Troubled Asset Relief Program.

Currencies have seen historic changes around this date as well, he adds. The British pound was taken off the gold standard and was devalued a huge 28% on Sept. 21, 1931. Exactly 54 years later, the Group of Five produced the Plaza Accord, which brought a sharp decline in the dollar and expansion of global liquidity. Black Wednesday, when Britain was forced to withdraw from the European Exchange Rate Mechanism, came a few days early on Sept. 16, 1992.

I also recollect that Treasury note and bond yields made their historic highs in late September, 1981, with shorter maturities hitting 17% and long bonds reaching 15%. That marked the end of a 35-year bear bond market from the end of World War II.

Why the apparent coincidence of these market upheavals beginning around Sept. 22? Montgomery posits a possible link to the Autumnal Equinox, which takes place Tuesday afternoon in the Northern Hemisphere. And he also observes an increasing incidence of market reversals around the time of Vernal Equinox in the Spring.

I think it’s all nonsense, but these “facts” are fun. Since that was written, the stock market touched an important low on October 3-4, 2011. Last year, the S&P 500 reached an all-time intra-day high on September 19 and fell sharply until mid-October.

(Via Gary Alexander at Navellier Market Mail.)

Morning News: September 22, 2015

Eddy Elfenbein, September 22nd, 2015 at 7:04 amUK Finance Minister Voices Support For China’s Commitment to Reforms

Hacking Allegations Threaten to Overshadow Xi-Obama Summit

Goldman Has Come Up With (Yet) Another New Name for ‘Smart Beta’

How US Biotech Valuations Got Stretched

Streaming Music Service Deezer Plans IPO to Challenge Spotify, Apple

Oyster to Exit E-Book Subscription Business

Pressure Builds on Volkswagen CEO

Asian Development Bank’s Regional Gloom Deepens

Big Price Increase for Tuberculosis Drug is Rescinded

Apple Presses Ahead With Efforts to Create Car, Though Big Issues Remain

How UBS Spread the Pain of Puerto Rico’s Debt Crisis to Clients

Win or Lose, Bank of America Vote Shows New Shareholder Muscle

What If the Richest Person in Every Country Gave All Their Money to the Poor?

Cullen Roche: The Misguided Interest Rate Obsession

Roger Nusbaum: Fed Day Resolves Nothing

Be sure to follow me on Twitter.

Hillary Crushes Biotechs

Eddy Elfenbein, September 21st, 2015 at 8:41 pmA fairly average day in the market disrupted when Hillary Clinton tweeted this:

Price gouging like this in the specialty drug market is outrageous. Tomorrow I'll lay out a plan to take it on. -H https://t.co/9Z0Aw7aI6h

— Hillary Clinton (@HillaryClinton) September 21, 2015

The market reacted swiftly. Check out the Biotech ETF (IBB):

Don’t feel too bad for biotechs. That ETF is currently at $340. Four years ago, it was going for $94. Biotechs have done incredibly well.

There are a few points to highlight. The first is that anything can impact your stock. The entire biotech sector was hit just from this one tweet.

This is also why I’m leery of stop-losses. Stops can be a useful tool, but bear in mind that you can get knocked out of good positions for silly reasons.

We can also see how one sector can depart from the rest of the market. The overall stock market did fairly well today. Here’s how the ten S&P sectors performed today. See how big the gap is between Health Care and everybody else.

Financials 1.07%

Technology 1.00%

Staples 0.85%

Discretionary 0.75%

Energy 0.57%

Industrials 0.45%

Utilities 0.43%

Materials 0.29%

Telecom 0.26%

Health Care -1.38%11 Straight Alternating Weeks

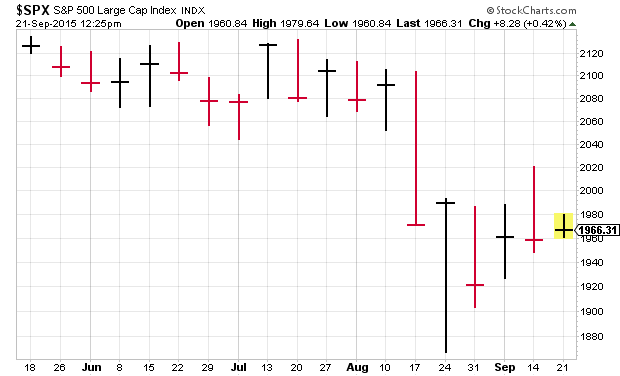

Eddy Elfenbein, September 21st, 2015 at 12:28 pmIt was a close call, but the S&P 500 closed slightly lower for the week last week. That makes 11 straight “alternating” weeks for the S&P 500.

Morning News: September 21, 2015

Eddy Elfenbein, September 21st, 2015 at 7:08 amChina Beige Book Says Pessimism `Thoroughly Divorced From Facts’

Trading Meat for Tires as Bartering Economy Grows in Greece

Putin Faces Growing Exodus as Russia’s Banking, Tech Pros Flee

Crude Oil Moves Lower After The Fed Does Nothing

Oil Speculators Most Bullish in Two Months as OPEC Calls for $80

Insurance Deals Are Starting to Make Less Sense

Why You Can’t Trust the Advice You Get from Social Security

Volkswagen Drops 23% After Admitting Diesel Emissions Cheat

Bank of America, Funds Lobby Hard to Sway Vote on Moynihan

Lennar Profit and Revenue Beat Expectations as Home Sales, Prices Rise

Dialog Shares Slump After $4.6 Billion Deal to Acquire Atmel

How Warner Bros. Battled Its Way to No. 1 in Video Games

Howard Lindzon: The Fantasy Sports Boom…It’s For Real

Jeff Miller: Has the Fed Assumed a Third Mandate?

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His