Archive for March, 2016

-

Morning News: March 31, 2016

Eddy Elfenbein, March 31st, 2016 at 7:05 amEurozone Inflation Data Highlights ECB’s Struggle

China Rating Outlook Cut at S&P on Risk of Slower Rebalancing

MSCI Says China’s Trading Halts May Keep It Out of Stock Indexes

What Actually Drives The Price Of Oil

Sanctions ‘Overreach’ Risks Driving Business From U.S.: Treasury’s Lew

Inside the Little-Known Japan Firm Helping the FBI Crack IPhones

GE Files to End Fed Oversight After Shrinking GE Capital

Drone Startup Airware Raises $30 Million, Adds Cisco’s John Chambers To Board

Yahoo – Case Study in Why Activist Investors Exist, and Succeed

Here’s How GlaxoSmithKline’s CEO Thinks Pharma Should Modernize

Carnival Tops Estimates in Period Marked by Terror, Zika Worries

Did Johnson & Johnson Hide the Dangers of Baby Powder for Decades?

MetLife Wins Battle to Remove ‘Too Big to Fail’ Label

Jeff Miller: No More Junk In My Food

Be sure to follow me on Twitter.

-

Two-Year Yield Falls

Eddy Elfenbein, March 30th, 2016 at 4:33 pmJanet Yellen’s comments yesterday basically acted as a stealth rate cut. It’s interesting to note that the two-year yield has fallen from over 1% two weeks ago to 0.76% today.

That’s helped the stock market recover. The S&P 500 rose for the third straight day. The index closed today at 2,063.95 which is its highest close all year.

At one point in February, the S&P 500 was down 11% for the year. Now it’s up just under 1% YTD.

-

Morning News: March 30, 2016

Eddy Elfenbein, March 30th, 2016 at 7:05 amLatest Plan to Rescue Puerto Rico Is Met With Disdain on Island

Yellen Spurs Global Stock Rally as Oil Rebounds, Dollar Tumbles

Lew Defends Sanctions, but Cautions on Overuse

When It Comes to Saving Money, Millennials Are Killing It

Harvesting Sunshine More Lucrative Than Crops at Some U.S. Farms

Apple’s New Challenge: Learning How the U.S. Cracked Its Phone

Foxconn Offers to Buy Sharp for $3.5 Billion

Google’s Moonshot Projects Are Turning into a Massive Pain

In Starwood Deal, Conventional Wisdom Upended

Norfolk Southern Steps Up Fight Against Canadian Pacific Merger

McCormick Raises Offer for Premier Foods

Budweiser Is Having a Ball in Russia

Can Kellogg Save Cereal by Selling It as a Snack Food?

Cullen Roche: My Wisdom on Smart Beta & Factor Investing

Be sure to follow me on Twitter.

-

The Bull Market in Chicken

Eddy Elfenbein, March 29th, 2016 at 3:38 pmWhich is probably better than a chicken market in bull. Check out the recent surge in Tyson’s (TSN) and Hormel (HRL).

-

Janet Saves the Market

Eddy Elfenbein, March 29th, 2016 at 2:19 pmA rather quiet day of trading got a big boost shortly after noon, thanks to dovish comments from Janet Yellen. Speaking at Economic Club of New York, the Fed Chairwoman said that there’s no rush to raise interest rates.

“Given the risks to the outlook, I consider it appropriate for the committee to proceed cautiously in adjusting policy, ” Ms. Yellen said. She didn’t give details about the timing of the next rate increase.

This really isn’t news. She’s reiterated what she said after the last Fed meeting.

“Although the baseline outlook has changed little on balance since December, global developments pose ongoing risks,” she said. “These risks appear to have contributed to the financial market volatility witnessed both last summer and in recent months. ”

(…)

The hits to the economy “have been at least partially offset by downward revisions to market expectations for the federal funds rate that in turn have put downward pressure on longer-term interest rates, including mortgage rates, thereby helping to support spending, ” she said. “For these reasons, I anticipate that the overall fallout for the U.S. economy from global market developments since the start of the year will most likely be limited, although this assessment is subject to considerable uncertainty. ”

Before the remarks, the S&P 500 was trading around 2,035. The index quickly jumped to 2,045 and then took another step to 2,050. Last Monday, the S&P 500 closed at 2,051.60, which was its highest close this year.

The dollar dropped and many dividend-friendly stocks were rewarded.

-

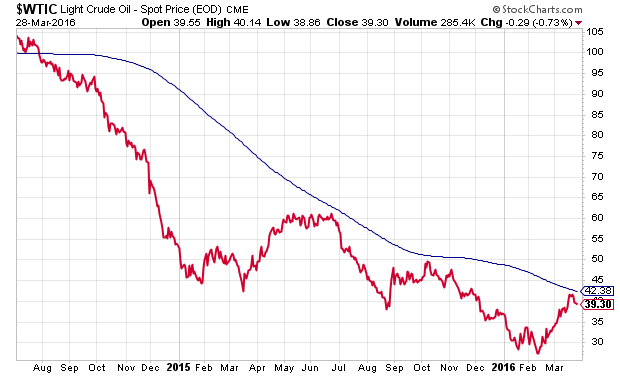

Crude Oil and the 200-DMA

Eddy Elfenbein, March 29th, 2016 at 11:28 amCrude oil has traded below its 200-day moving average for more than 18 months. That’s a pretty amazing streak. It’s come close to breaking the line, but has failed each time. It happened again last week.

OPEC meets again in April to discuss production cuts. So far, the cartel has announced plans for further meetings to plan more discussions for further possible plans to maybe discuss production cuts. I expect more of the same.

-

Ross Just Opened 28 New Stores

Eddy Elfenbein, March 29th, 2016 at 11:07 amRoss Stores (ROST) continues to grow impressively. The discounter opened 28 new stores in February and March.

Ross Stores recently opened a total of 22 Ross Dress for Less® (“Ross”) and six dd’s DISCOUNTS® stores across 15 different states in February and March. These new locations are part of the Company’s 2016 expansion plans to add approximately 70 Ross and 20 dd’s DISCOUNTS locations throughout the year.

“These recent openings reflect our ongoing plans to continue building our presence in both existing and newer markets, including the Midwest for Ross, and expansion of dd’s DISCOUNTS,” said Jim Fassio, President and Chief Development Officer. “Ross Dress for Less remains the largest off-price apparel and home fashion chain in the U.S with 1,295 locations in 34 states, the District of Columbia and Guam. We continue to identify plenty of domestic growth opportunities ahead for both Ross and dd’s DISCOUNTS, and believe that over the long term, Ross can grow to 2,000 total locations and dd’s DISCOUNTS can become a chain of 500 stores.”

-

When the Storm Passes

Eddy Elfenbein, March 29th, 2016 at 10:43 amMost people realize it when a rainstorm starts but they generally don’t notice it when the rainstorm ends. That’s a reflection of how the mind works, and also how rainstorms work. The rain just slowly tapers off and then it’s gone.

The same can be said for market drama. Investors are well aware of it when it’s going on, but when it fades away, they don’t see that as an event. Over the last two weeks, the stock market’s volatility has dropped dramatically.

In the chart above, notice how much the spread between the daily high-low range has narrowed. Yesterday was the 10th day in a row where the S&P 500 closed up or down by less than 1%. In fact, four of the last five days, the index changed by less than 0.1%. Now compare that with the start of the year where 1% days were coming more than 50% of the time. We were on track for one of the most volatile years since the 1930s. The Volatility Index peaked over 30 last month. Recently, it dipped below 14 though it’s back over 15 now.

This is an important generality. The stock market tends to move in two gears—quick and down, and slow and up. This year we went from quick down to quick up. I suspect we’re in for several weeks of quietness.

-

Morning News: March 29, 2016

Eddy Elfenbein, March 29th, 2016 at 7:10 amNatural Gas Prices Rise With Demand Expectations

Existing Home Sales Collapsed In February – Why You Can Rest Easy

Saudi Land Purchases Fuel Debate Over US Water Rights

Consumer Spending in U.S. Rose 0.1% in February for Third Month

Yahoo Sets April 11 Deadline to Submit Preliminary Bids

As Valeant Struggles, Its Tally Sheet of Scandals Grows

Samsung Pay Launches in China and Singapore

Foxconn’s Price Tag for Sharp Likely to Fall by More Than $2 Billion

TSMC’s $3B Plant Latest Sign Of Growing China Clout In Sensitive Chip Industry

Banker Accused of $25 Million Fraud Arose From a Gilded Legacy

Cullen Roche: My “Wisdom” on Robo Advisors

Roger Nusbaum: Markets Confront Terror & Tragedy

Be sure to follow me on Twitter.

-

Barron’s on Cerner

Eddy Elfenbein, March 28th, 2016 at 9:40 amIn this weekend’s Barron’s, Vito J. Racanelli looks at Cerner (CERN) and sees a bargain.

The market’s love affair with health-care stocks has grown frosty. Since mid-July the sector is the market’s worst performer, down 13%. Shares of Cerner (ticker: CERN), a provider of health-care information technology have fallen even more, losing about a third of their value in the past 12 months to $51.46. The stock isn’t much above where it traded three years ago, and it looks invitingly cheap.

Cerner hasn’t helped its case by missing revenue expectations in the past few quarters. On Feb. 16, when reporting fourth- quarter results, it tweaked its 2016 sales projection, guiding for a range of $4.9 billion to $5.1 billion, versus a prior forecast of $5 billion. Revenue of $4.4 billion in 2015 was below an earlier projection of $4.8 billion to $5 billion.

Bookings continue to grow nicely, up 16% in the fourth quarter to $1.35 billion—but again, below the company’s earlier guidance of $1.45 billion to $1.55 billion. The drop in Cerner’s price/earnings ratio to the low 20s from an average P/E above 30 is deserved.

Nevertheless, the company’s still-robust earnings visibility, a hefty $14.2 billion backlog, and ongoing demand to reduce the country’s rampaging health-care costs suggest that Cerner could turn out to be a quiet winner for long-term-oriented investors.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His