Archive for July, 2016

-

Tech Stocks Hit Multi-Year Highs

Eddy Elfenbein, July 30th, 2016 at 8:33 pm -

Do Stocks Need an Oil Rebound?

Eddy Elfenbein, July 30th, 2016 at 11:31 am -

Navigating Calm Markets

Eddy Elfenbein, July 29th, 2016 at 6:16 pm -

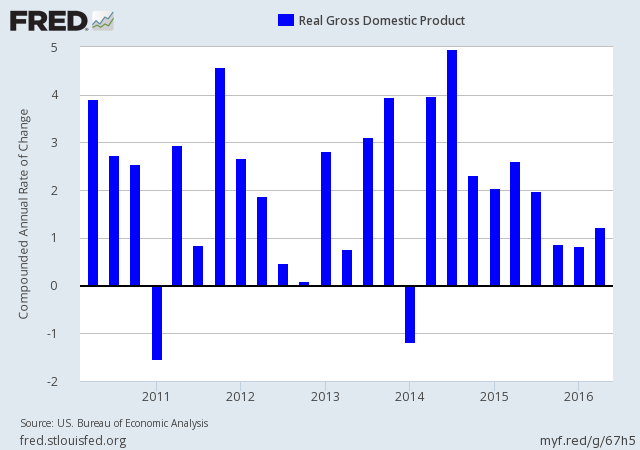

Q2 GDP = 1.2%

Eddy Elfenbein, July 29th, 2016 at 11:27 amThis morning, the government reported that the U.S. economy grew by just 1.2% last quarter. That’s not a good performance. It was less than half of expectations.

In the second quarter, consumer spending rose strongly. Personal consumption, which accounts for more than two-thirds of economic output, expanded at a 4.2% rate, the best gain since late 2014. Outlays on goods advanced 6.8%. Spending on services climbed 3%.

But nonresidential fixed investment, a measure of business spending, declined at a 2.2% pace, the third straight quarterly drop. Companies spent less on buildings and equipment.

Firms also pared back inventories sharply. The change in private inventories subtracted 1.16 percentage points from overall growth. That was the category’s fifth-straight decline and the largest drag from inventories in two years.

Weak business investment could suggest firms don’t have confidence in the global economy. Manufacturers especially have been challenged by a strong dollar, which makes U.S.-made goods more expensive overseas. The energy industry has also been constrained with relatively low oil and natural gas prices curtailing investments in mining and wells.

The economy has grown by less than 2.7% annualized for the last seven quarters in a row. In the seven quarters prior to that, it topped 2.7% in five quarters.

-

CWS Market Review – July 29, 2016

Eddy Elfenbein, July 29th, 2016 at 7:08 am“If markets were rational, I’d be waiting tables for a living.” – Warren Buffett

Fortunately for us and for Warren, the market ain’t so rational. In fact, sometimes I think it’s defiantly anti-rational.

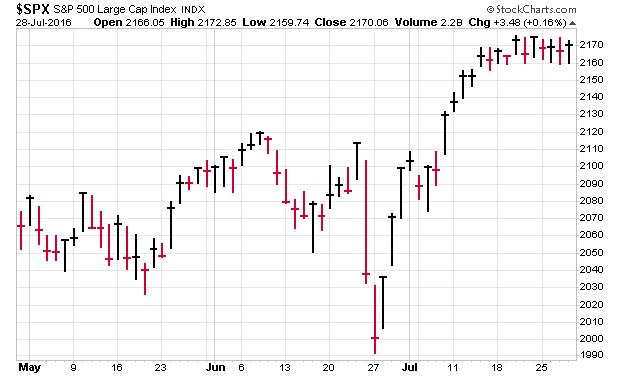

Consider that for the last 11 days, the stock market has closed up, down, up, down, up, down, up, down, up, down and up. I can almost sense a trend. This is one of the longest “alternating” streaks on record.

Not only that, but the market has reverted to its pre-Brexit somnolence. The daily spread between highs and lows has nearly vanished. Ryan Detrick notes that over the last 11 days, the S&P 500 has traded within a tiny range of just 0.92%. For 11 days, that’s one of the narrowest ranges in decades.

Most of the headlines this week have been dominated by the Democrats’ convention in Philadelphia, but it’s been an eventful one for Wall Street as well. We had six more Buy List earnings reports. I’ll go over all of them in a bit. We also had a Federal Reserve meeting. The central bank decided, again, to forego raising interest rates. I’ll also preview three more Buy List earnings reports for next week. But first, let’s look at this week’s batch of earnings.

Wabtec Guides Lower, Express Scripts Guides Higher

On Monday morning, Wabtec (WAB) reported Q3 earnings of $1.05 per share. That was three cents below Wall Street’s consensus. This was a tough quarter for the railroad-services company. Quarterly revenue came in at $723.6 million, which was below estimates of $806.48 million. WAB’s overall business is doing well, but their freight business is under some pressure.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “Our Transit business is performing well, with revenue growth, improved profitability and a strong backlog. Our Freight business, however, continues to be affected by overall rail-industry conditions and the sluggish global economy. In this environment we are focused on controlling what we can by aggressively reducing costs, generating cash and investing in our growth opportunities, including acquisitions. As demonstrated by our first-half operating margin of 18.4 percent and cash from operations at 14 percent of revenues, we are managing the business well in these market conditions.”

Wabtec lowered its full-year guidance range to $4 to $4.20 per share. The previous range was $4.30 to $4.50 per share. The stock dropped below $66 during Monday’s trading, but it has since gained back some lost ground. This is a disappointing report from Wabtec, but I’m not ready to throw in the towel. This is a solid company. This week, I’m lowering my Buy Below on Wabtec to $75 per share.

After the closing bell on Monday, Express Scripts (ESRX) reported Q2 earnings of $1.57 per share. That matched Wall Street’s consensus on the nose. It was also in the dead center of Express’s own range of $1.55 to $1.59 per share. The company didn’t have an update on its acrimonious lawsuit against Anthem.

I was pleased to see optimistic guidance from Express. For Q3, they expect earnings between $1.72 and $1.76 per share. Wall Street was at $1.72. Express also bumped up the low end of its full-year forecast by two pennies. True, it’s not much, but we’ll take it. The pharmacy-benefits manager now expects 2016 earnings to range between $6.33 and $6.43 per share. That means the stock is going for about 12 times this year’s earnings. That’s not a bad deal. I’m raising my Buy Below on Express Scripts to $81 per share.

CR Bard Raises Guidance but Ford Disappoints

CR Bard (BCR) gave us another very good earnings report. For Q2, the medical-devices company made $2.54 per share. That beat the Street by seven cents per share. They also topped their own guidance which was for $2.43 to $2.47 per share. Quarterly sales rose 8% to $931.5 million. Not including forex, sales were up 9%.

Timothy M. Ring, chairman and chief executive officer, commented, “We continue to see strong results as we prioritize product leadership across the globe. Our commitment to innovation and product differentiation, along with a focus on delivering economic benefits to the healthcare system, have driven global demand for our products, and our targeted investments in emerging markets continue to expand our presence internationally. We believe this investment approach positions us well to continue to provide attractive returns to our shareholders.”

Now for guidance. For Q3, Bard sees earnings between $2.51 and $2.55 per share. They see full-year earnings coming in between $10.10 and $10.20 per share. That’s an increase from the previous guidance of $10.05 to $10.18 per share. Bard is clearly moving in the right direction. I’m keeping my Buy Below on Bard at $231 per share.

On Thursday, we had a big disappointment from Ford Motor (F). For Q3, the company earned 52 cents per share which was eight cents below Wall Street’s forecast. The automaker also warned that the second half of this year might be weak.

To its credit, Ford is standing by its previous forecast, which is to beat last year’s pre-tax profit of $10.8 billion. To be fair, this quarter wasn’t so bad, but it was helped by generous incentives. That’s a useful short-term strategy, but it’s not a long-term fix.

“We’re committed to meeting our guidance, but it is at risk,” Chief Financial Officer Bob Shanks told reporters Thursday. The company now says it’s unlikely that U.S. vehicle sales will break last year’s record, and Shanks predicted further contraction in 2017. “We don’t see growth, at least in the near term.”

After a record streak of six-straight years of annual U.S. auto-sales growth, Ford is joining analysts who are skeptical that the record set in 2015 will be topped this year. Consumer demand has gone slack, forcing automakers to dial up deals to lure buyers to showrooms. For the first six months, industry-wide light-vehicle sales rose just 1.5 percent, while incentives jumped 13 percent, according to researcher Autodata Corp.

(…)

The U.S. auto market slowed sooner than Ford anticipated, Shanks said. The automaker now sees U.S. auto sales of 17.4 million to 17.9 million vehicles, down from an earlier forecast of about 18 million. Excluding medium and heavy trucks, the new projection translates to a light-vehicle market of 17.1 million to 17.6 million, compared with last year’s record 17.5 million.

“We do think the U.S. is coming down from what we expected,” Shanks said. “We saw higher U.S. incentives — that was for the industry and for us. The industry increased, and we increased in line with the industry.”

On Thursday, shares of Ford dropped 8.2% to close at $12.71. Frankly, this was a bad showing from Ford. I’m going to drop my Buy Below price on Ford down to $14. Don’t worry that the dividend is at risk. The stock currently yields 4.7%.

The Strong Yen Lifts AFLAC

I’m happy to see that AFLAC (AFL) had another strong quarter. For Q2, the duck stock earned $1.71 per share in operating earnings. (Remember, with insurance companies, it’s often better to look at operating earnings rather than net earnings.) That beat estimates by three cents per share.

Once again, the stronger yen helped AFLAC’s bottom line, which is a welcome change from what we’ve experienced the last few years. Last quarter, the strong yen added nine cents to AFLAC’s operating earnings. Not counting currency, operating EPS rose by 8% last quarter.

AFLAC stood by its full-year operating EPS guidance of $6.17 to $6.41, but that’s based on last year’s average yen, which was 120.99 to the dollar. The yen is now at 104! The company said that if the yen stays between 100 and 110, they see Q3 coming in between $1.58 and $1.86 per share. That’s a very large range.

AFLAC is usually a straight shooter (or quacker?) when it comes to their guidance, so maybe they’re as confused as the rest of the currency market. Either way, this is a good company. I’m lifting my Buy Below on AFLAC to $75 per share.

After the bell on Thursday, Stericycle (SRCL) reported Q2 earnings of $1.18 per share. The medical-waste company matched Wall Street’s estimate. Revenues came in light, and the stock took a dive in the after-hours market.

Frankly, I haven’t had enough time to scrutinize the earnings. Their press release doesn’t contain a lot of information, and I’d rather listen to the earnings call before I offer more specifics. But I’ll say that the numbers are largely what I expected from Stericycle. I promise to have more info on SRCL next week.

Three Buy List Earnings Reports Next Week

This year looks to be Fiserv’s (FISV) 30th-straight year of double-digit earnings growth. The company made $3.87 per share last year, and they see 2016 coming in between $4.32 and $4.44 per share. That works out to a growth rate of 11.6% to 14.7%. Fiserv reports after the close on Tuesday, August 2. Wall Street’s consensus is for $1.07 per share.

Cerner (CERN) didn’t start off as a strong performer for us this year, but it has rallied in the last few weeks. For Q2, the healthcare IT company said it expects earnings between 56 and 59 cents per share. For all of 2016, Cerner’s guidance is $2.30 to $2.40 per share. TheStreet said that Cerner might be an acquisition target for IBM. Cerner also reports on Tuesday afternoon. Wall Street expects 57 cents per share.

Cognizant Technology Solutions (CTSH) will be our final Buy List stock to report this earnings season. Q2 earnings are due out on Friday morning, August 5. Cognizant said they expect Q2 earnings of 80 to 82 cents per share. Wall Street expects 82 cents per share. For all of 2016, CTSH expects $3.32 to $3.44 per share.

That’s all for now. Our first look at Q2 GDP comes later today. Next week, earnings season for our Buy List wraps up. We’ll also get some of the key turn-of-the-month econ reports. The July ISM report comes out on Monday. Personal income and spending are on Tuesday. Then on Friday, we’ll get the jobs report for July. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: July 29, 2016

Eddy Elfenbein, July 29th, 2016 at 7:03 amWhat We Know, and Don’t, About the Bank of Japan’s Review

China Finally Make Ride-Hailing Legal In a Way That Could Destroy Uber’s Business Model

Terrorism Scares Away the Tourists Europe Was Counting On

Google Profits Surge on Strong Ad Demand

Ford’s 2Q Profit Falls on Trouble in US, China

Amazon’s Profits Grow More Than 800%, Lifted By Cloud Services

NextEra to Buy Energy Future’s Oncor in $18.4 Billion Deal

CBS Tops Estimates as ‘Star Trek’ Deals Counter Dip in Ads

Eni Misses Estimates as Bigger Tax Burden Leads to Loss

Barclays Rises as Cost Cuts, Trading Gain Trumps Profit Fall

Daimler to Invest $1.1 Billion in Hungarian Plant

ArcelorMittal Earnings Beat Expectations

The Unraveling of Harvard’s Star Trading Desk

Josh Brown: Citi Economic Surprise Index Breaks Out, Stocks Follow

Cullen Roche: Everyone Has a Home Bias & No One Should

Be sure to follow me on Twitter.

-

Ford Earns 52 Cents per Share for Q2

Eddy Elfenbein, July 28th, 2016 at 10:54 amFord Motor (F) had a disappointing earnings report for Q2. The automaker earned 52 cents per share which was eight cents below expectations.

But what really troubles investors was Ford’s cautious outlook for the rest of the year. Officially, the company is standing by its previous guidance for this year, but it now notes that there are risks.

“We’re committed to meeting our guidance, but it is at risk,” Chief Financial Officer Bob Shanks told reporters Thursday. The company now says it’s unlikely that U.S. vehicle sales will break last year’s record, and Shanks predicted further contraction in 2017. “We don’t see growth, at least in the near term.”

After a record streak of six straight years of annual U.S. auto-sales growth, Ford is joining analysts who are skeptical that the record set in 2015 will be topped this year. Consumer demand has gone slack, forcing automakers to dial up deals to lure buyers to showrooms. For the first six months, industrywide light vehicle sales rose just 1.5 percent while incentives jumped 13 percent, according to researcher Autodata Corp.

(…)

The U.S. auto market slowed sooner than Ford anticipated, Shanks said. The automaker now sees U.S. auto sales of 17.4 million to 17.9 million vehicles, down from an earlier forecast of about 18 million. Excluding medium and heavy trucks, the new projection translates to a light-vehicle market of 17.1 million to 17.6 million, compared with last year’s record 17.5 million.

“We do think the U.S. is coming down from what we expected,” Shanks said. “We saw higher U.S. incentives — that was for the industry and for us. The industry increased and we increased in line with the industry.”

The shares are currently down over 9%.

-

Morning News: July 28, 2016

Eddy Elfenbein, July 28th, 2016 at 7:06 amBrexit Bulletin: Confidence Crumbles as Lloyds Bank Cuts Jobs

China Confirms Legal Status of Ride-Hailing Industry

Fed Caution Hits Dollar as Japan Anticipation Builds

Facebook Profit Nearly Triples on Mobile Ad Sales and New Users

Mark Zuckerberg Denies That Facebook is Trapping its Users in ‘Filter Bubbles’

Credit Suisse Posts Surprise Profit, Boosts Capital Under Thiam

Shell Earnings Tumble to 11-Year Low on Oil, Weaker Refining

LG Electronics’ Profit Up on TV, Appliance but Mobile in Red

AstraZeneca Posts $3 Million Loss

Teva Wins U.S. Nod for Actavis After Divestiture of 79 Drugs

Volkswagen Reports 56% Drop in After-Tax Profit

Coca-Cola Tops 2Q Profit Forecasts

Forrest Mars Jr., Former Co-President of Food Giant, Dies at 84

Roger Nusbaum: Time For Something Adventurous

Josh Brown: Anything Can Happen

Be sure to follow me on Twitter.

-

Today’s FOMC Statement

Eddy Elfenbein, July 27th, 2016 at 2:01 pmHere’s today’s statement:

Information received since the Federal Open Market Committee met in June indicates that the labor market strengthened and that economic activity has been expanding at a moderate rate. Job gains were strong in June following weak growth in May. On balance, payrolls and other labor market indicators point to some increase in labor utilization in recent months. Household spending has been growing strongly but business fixed investment has been soft. Inflation has continued to run below the Committee’s 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will strengthen. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of past declines in energy and import prices dissipate and the labor market strengthens further. Near-term risks to the economic outlook have diminished. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; James Bullard; Stanley Fischer; Loretta J. Mester; Jerome H. Powell; Eric Rosengren; and Daniel K. Tarullo. Voting against the action was Esther L. George, who preferred at this meeting to raise the target range for the federal funds rate to 1/2 to 3/4 percent.

-

Durable Goods Drops 4%

Eddy Elfenbein, July 27th, 2016 at 10:11 amThe Federal Reserve winds up its two-day meeting today. Look for the policy announcement at 2 pm. I don’t expect a rate cut but it will be interesting to see what the central bank has to say. I’ll be especially curious to hear how they describe the labor markets.

In Japan, Prime Minister Shinzo Abe has unveiled a truly massive stimulus program. The price tag comes to 28 trillion yen which is about $265.30 billion. That’s about 6% of Japan’s economy and it exceeds the estimates of 20 trillion yen.

In our bond market, the yield on the 10-year Treasury is now 78 basis points higher than the British 10-year bond. That’s the widest gap since 2000.

I assume that’s because our economy is doing well, but this morning’s durable goods report was terrible. It showed a 4% drop for June.

New orders fell most sharply for commercial airplanes and expensive military hardware such as ships, tanks and fighter jets. Passenger plane bookings dove nearly 60% and orders for defense capital good dropped 21%.

Stripping out the volatile transportation sector, orders fell a smaller 0.5%, the Commerce Department said Wednesday.

Still, bookings declined for makers of primary metals, fabricated parts and machinery used in a wide variety of consumer and commercial products.

One small bright spot: Orders for core capital goods, viewed as a proxy for business investment, edged up 0.2% in June after falling in the prior two months. It’s only the second increase of the year, however.

Core orders are also 3.8% lower through the first half of the year compared to the same period in 2015.

The S&P 500 is currently up by 0.06%.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His