Archive for October, 2016

-

WSJ: “How a Blogger Started His Own ETF”

Eddy Elfenbein, October 10th, 2016 at 9:26 amFrom today’s WSJ:

How a Blogger Started His Own ETF

The decision by a blogger who has criticized ETF fees to start an ETF himself gave him insight into the process

By Simon ConstableLike a Broadway critic deciding to write a play, a blogger who complained about fund fees decided to start an exchange-traded fund. He discovered that keeping expenses low isn’t as easy as it seems.

Eddy Elfenbein decided last year to launch a fund based on the stock picks from his more than decade-old Crossing Wall Street blog, written from Washington, D.C. Mr. Elfenbein recommends 20 stocks on his buy list and then sticks with them through the next 12 months. Each year, he changes just five of the holdings for the next year.

Because of the success of his choices—he posts returns on his blog—he built up a Twitter following of around 25,000, many of whom asked over the years if he managed money.

His fund, AdvisorShares Focused Equity ETF, launched Sept. 21, 2016, under the ticker CWS, for Crossing Wall Street.

It isn’t just the Twitter-led impetus that makes the fund unusual; the fee structure is as well. Mr. Elfenbein has to beat the benchmark index or else give back part of his fee. If he exceeds it, he gets more.

He spoke with The Wall Street Journal about his experience setting up the fund. Edited excerpts of the conversation follow:

WSJ: When and why did you decide to do this?

MR. ELFENBEIN: I built a following based on what I recommended. If Twitter wasn’t around, I don’t know if this could have happened.

As the years passed, I had more people asking if I managed money, which I didn’t. So late last year I met with AdvisorShares [an actively managed ETF sponsor] to see if it was possible to develop a product that tracked the buy list.

WSJ: What surprised you about the process of starting an ETF?

MR. ELFENBEIN: I always complain about the fees for ETFs and mutual funds.

But when you are on the other end of the process creating a fund—with so many fees, lawyer fees, exchange fees, etc.—the question is how can we get them so low. [Currently the fund has annual expenses of 0.75%. That compares with an average expense ratio of 0.86% for actively managed U.S. stock ETFs, according to Morningstar Inc. data.]

I was also surprised by how little capital the fund needs to be viable. Advisor Shares points out that the patient is alive on the table if you have $20 million in the fund. Ideally, you would want to have more. With $50 million under management, then you’d have something that is chugging along.

WSJ: Will having an ETF get in the way of the blog?

MR. ELFENBEIN: No. I can write about the stocks I recommend, but I have to steer clear of anything that smacks of marketing the fund.

The ETF is going to track the buy list as closely as possible, with the picks equally weighted as much as SEC regulations allow. The positions will be rebalanced once a year. We have to keep a small cash position due to the mechanics of the fund; we’ll start with 2%.

WSJ: You’ve done something different in terms of the way you are going to be paid. Please explain.

MR. ELFENBEIN: There will be a fulcrum fee for me. My pay will be based on performance relative to the S&P 500. If the fund beats the benchmark, I get a bonus; if not, then I get a penalty. The size of the penalty is a based on a sliding scale and would result in a reduction in the fund’s expenses.

The hedge funds just get bonuses. If they miss their benchmark they don’t get penalized.

WSJ: Why an ETF instead of a mutual fund?

MR. ELFENBEIN: It just seems that investors are voting with their dollars. We are moving from the world of mutual funds to ETFs. There are tax benefits with the ETFs. [They are less subject to capital-gains taxes than mutual funds, for example.] I also like the fact that you can track the value during the day, whereas you can’t with a mutual fund.

Plus, a lot of funds are very secretive about what they own. I’m the opposite. My buy list is completely free. So you get the complete transparency that you get with ETFs.

Here’s an odd comparison: Years ago bands were trying to clamp down on bootleg tapes of concerts. The one group that was the opposite was the Grateful Dead, who reserved spaces for the people taping.

I don’t see how the transparency hurts me at all.

-

Morning News: October 10, 2016

Eddy Elfenbein, October 10th, 2016 at 7:05 amNobel in Economics Awarded to Oliver Hart and Bengt Holmstrom

China Unveils Plan to Cut Corporate Debt With Stock Swaps

Far From Stepping Back, Top Central Banks Are Set to Double Down

Titans of Finance Gather and Sulk Over Low Rates, Deutsche Bank

OPEC’s Quiet Man Is at Center of Cuts Deal Nobody Saw Coming

Twitter Shares Fall in Frankfurt After Deal Interest Cools

Inside Steven Spielberg and Jack Ma’s Strange Partnership Announcement

Sign of Thaw With Iran: American Cellphones Ringing in Tehran

Noble Group Surges as U.S. Energy Unit Sold to Calpine

Facebook Accused of ‘Picking and Choosing’ Tax Rules After Paying Just $5 Million in UK

Samsung Halts Production of Note 7 as Battery Problems Linger

Russian PM Signs Order Selling Bashneft to Rosneft

Elon Musk’s Magnificent Seven: How Dream Deal May Test Boardroom

Jeff Miller: Is This The End of the Earnings Recession?

Roger Nusbaum: Can You Rationally Process Market Events?

Be sure to follow me on Twitter.

-

A Look at Plunging ETF Fees

Eddy Elfenbein, October 7th, 2016 at 11:59 amFrom Jason Zweig at the WSJ:

This past week, BlackRock, the world’s largest asset manager, cut management fees on some of its iShares exchange-traded funds to as low as 0.04%, or $4 on a $10,000 investment. Charles Schwab quickly followed suit.

But why stop there? Cambria Global Asset Allocation ETF, run by Cambria Investment Management of El Segundo, Calif., assesses a management fee of zero (although the funds it holds charge 0.25%). At least two ETFs in Europe have total expenses of zero, says Deborah Fuhr, managing partner of ETFGI, a research firm in London.

And why stop at zero? Why, my colleague Paul Vigna asked recently, can’t funds pay you to invest?

“Will someone leapfrog us and go to negative management fees?” asks Mebane Faber, manager of the Cambria ETF. “I’d love to see it. There’s a lot of room to wring out the excess fees in the fund industry.”

(…)

There’s another way to reduce the costs of ownership — although not to zero.

Federal mutual-fund regulations permit managers to charge higher fees when they beat the market if, but only if, they also charge lower fees when they underperform.

So how common are these so-called fulcrum fees? Thomson Reuters Lipper tracks 9,908 mutual funds; only 213, or 2.1%, charge them.

Advisor Shares Focused Equity ETF, a fund that launched on Sept. 21, charges 0.75%, which rises to as much as 0.85% if it outperforms its benchmark and goes as low as 0.65% if it falls behind. “If I beat the market, I get a bonus,” says the manager, Eddy Elfenbein. “If I don’t, you get a savings.”

-

September NFP +156,000

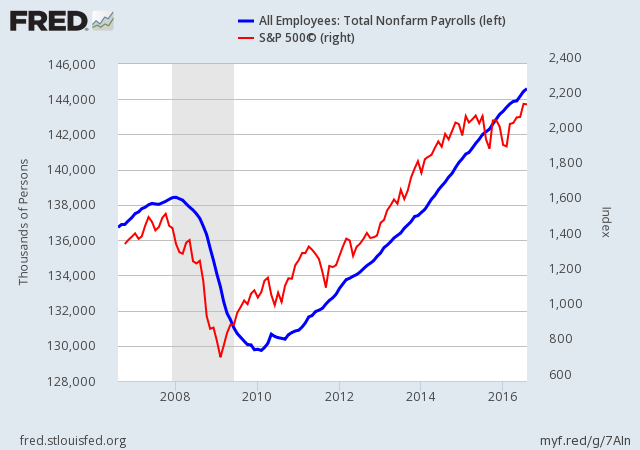

Eddy Elfenbein, October 7th, 2016 at 8:59 amToday’s job report showed that the U.S. economy created 156,000 net new jobs last month. The number for July was revised down by 23,000 and August was lowered by 7,000.

Meanwhile, growth in workers’ wages accelerated last month. Private-sector workers earned, on average, $25.79 an hour in September, up 6 cents, or 0.2%, from a month earlier. The average paycheck grew 2.6% over the past year.

The report provides one of the final major snapshots of the economy before the Nov. 8 presidential election. Steady job growth has boosted the approval rating of President Barack Obama and has been cited by Hillary Clinton as she urges voters to keep Democrats in control of the White House. Her Republican challenger, Donald Trump, has pointed to high underemployment and modest economic gains among blue-collar workers in arguing for change.

The unemployment rate rose to 5.0%. In the last six years, the U.S. economy has created 14.375 million jobs.

This report is on the weak side but I don’t believe it will deter the Fed.

-

CWS Market Review – October 7, 2016

Eddy Elfenbein, October 7th, 2016 at 7:08 am“You can get in way more trouble with a good idea than a bad idea,

because you forget that the good idea has limits.” ― Ben GrahamThis week will go down as the week when the interest-rate doves finally surrendered. It’s now clear to anyone paying attention that the Federal Reserve is going ahead with a rate increase in December.

In this issue of CWS Market Review, I’ll tell you why it’s happening and what it means for the market and our portfolios. We also have Q3 earnings season starting next week. Next Friday, Wells Fargo, the naughty boy of the banking industry, will be our first Buy List stock to report. I’ll tell you what to expect.

Also in this issue, I’ll cover the recent drop on the part of Cognizant Technology Solutions (preview: don’t fret about it). I’ll also run down some of the other news impacting our Buy List stocks. But first, let’s look at why Wall Street is now convinced the Fed will soon strike.

Oh, It’s On! Expect a December Rate Hike from the Fed

The first week of every month is an exciting time for all econo-stat nerds. This is when we get several economic reports, and the thrills end on Friday when the government releases the all-important jobs report for the previous month.

What I’m calling the jobs report is actually a few different reports, but the key stats are Non-Farm Payrolls (or NFP, as the cool kids say), the Unemployment Rate, the Workforce Participation Rate and Average Hourly Earnings. The September report will be coming out later today.

Goldman Sachs says they expect to see an increase of 190,000 jobs and the unemployment rate drop to 4.8%. That sounds about right. But unless the report is absolutely dire, I strongly doubt it will deter the Fed’s plans for raising rates in December. Earlier this year, the Fed had been looking for any excuse to keep rates unchanged. (Brexit! China!) After the last meeting, it became clear that they’ve now locked in a course of hiking rates.

The Fed is serious. There were three dissents at the last meeting, and those no-votes wanted interest rates to go up immediately. There’s clearly a growing chorus of rate-hikers inside the FOMC, and the news this week has aided their cause.

In the Fed’s eyes, the key to today’s jobs report will be average hourly earnings. That number has been slowly creeping higher (finally). The equation is simple: More income means more buying. That means higher prices and more profits. It’s interesting to see how well oil has been doing lately. Oil just closed above $50 per barrel for the first time since June. Since the February low, the 36 energy stocks in the S&P 500 have added over $310 billion in market value.

Let’s take a step back and look at the news we got this week. On the first business day of each month, we get the ISM Manufacturing report. To be technical, this is called a “diffusion index.” That’s a fancy way of saying that any number above 50 is good, and below 50 is bad.

We got a bit of a surprise this week when the ISM number for September came in at 51.5. That was a very nice rebound from 49.4 for August. Wall Street had been expecting 50.4. This signals that the factory sector is gaining strength. This is important because manufacturing had been hurt for several months thanks to lower energy prices. This report is almost certainly more ammo for the hawks inside the Fed.

More evidence has been mounting. Last week, we learned that consumer confidence rose to a nine-year high. On Wednesday, the ISM services index jumped to 57.1. That’s an 11-month high. Wall Street had been expecting 53.1.

The Doves Are Throwing in the Towel

To me, the clearest sign that the interest-rate doves are throwing in the towel (I think I’m mixing metaphors, but bear with me) is the move in gold. On Tuesday, the yellow metal plunged over 3% for its worst day in nearly three years. I thought it was interesting that on Thursday, gold closed just barely below its 200-day moving average. Gold had been above its 200-DMA for eight straight months. Trust me, commodity traders do not mess around with these technical levels. Higher real rates are bad for gold.

On Thursday, we got more optimistic news on the jobs front when initial jobless claims came in at 249,000. That came very close to breaking a 43-year low. In April, there had been a report of 248,000, but I think we’ll dip below that soon. Since the jobless-claims number tends to bounce around, economists prefer to look at the four-week average. Sure enough, that’s at another 43-year low.

Futures traders currently pin the odds of a November hike at 15.5%. Let me be clear: I strongly doubt the Fed will raise rates a few days before the election. But traders see the odds of a December hike at 63.9%. I think that’s roughly 35% too low, but aside from that, it’s basically accurate.

We should also look at the internals within the market. The U.S. dollar, for example, continues to do well. In fact, the British pound just dropped to a 31-year low. Prime Minister Theresa May said she’s going ahead with plans for Brexit. Some folks thought she might take a soft approach. Apparently not.

You may remember that utility stocks got off to a great start this year. By the middle of the year, the utility sector had gained 21%. Not bad for “boring” stocks. What happened is that investors realized that the Fed wasn’t about to follow up its December 2015 rate hike with another so quickly. That led investors back into higher-yielding stocks. Well, those days are gone, and utes have been feeling the pain. The Utility ETF (XLU) has lagged the S&P 500 for the last eight days in a row.

The mirror image of that trade was the poor performance of banking stocks. Remember that banks do well in a relative sense when short-term rates rise. Banks got clobbered at the start of the year, but lately, they’ve staggered to their feet.

Let me add that I really like Signature Bank (SBNY) below $125 per share. The bank will probably earn about $8 per share this year, and $9 and change next year. Barclay’s recently raised its rating on SBNY. Obviously, the medallion loans are a problem, but it won’t last. Look for a good earnings report from SBNY later this month, along with more medallion losses.

Don’t be too concerned that higher rates will sink the market. Historically, the stock market usually does well as rates start to rise. It’s not that higher rates are good–rather that both the market and the Fed are responding to the same thing, an improving economy. The danger isn’t rising rates—it’s excessive rates, and we’re still a long way from that. The two-year Treasury is at just 0.85%.

What to expect from here? Going forward, I think we’ll see continued strength in cyclical stocks. Generally, that means commodities, energy and heavy-industry stocks. On our Buy List, HEICO (HEI) and Wabtec (WAB) are good examples of cyclicals. This is part of a larger trend of investors warming up to riskier sectors. Tech stocks, for example, did very well during Q3. High-yield bonds have also been popular, as have High-Beta ETFs (SPHB).

The key for investors is to focus on high-quality names, and not to let any market breaks rattle you. This is a good time to be in the market. Now let’s look at some news from the Buy List.

Cognizant Technology Solutions Drops—and Gains Some Back

Last Friday, Cognizant Technology Solutions (CTSH) said that an internal investigation revealed that the company may have violated the U.S. Foreign Corrupt Practices Act. Reading between the lines, I assume that means bribes to facilities in India. Cognizant notified the SEC and DOJ. The same day, the company’s president resigned.

In Friday’s trading, the stock got a super-atomic wedgie from traders. At one point, CTSH was down 17.4% for the day. By the closing bell, the stock had shed 13.3%. I was surprised it had fallen so much. After all, the company caught itself and did the right thing. There’s no evidence that this is a major scandal.

We know all too well that Wall Street likes to sell first and ask questions later. Fortunately, the shares have recovered some lost ground. From last Friday’s low to yesterday’s close, CTSH gained 12.7%. Until we know more, I’m siding with Cognizant. Remember that the last earnings report was quite good. I’m expecting more good news when the Q3 report comes out. For now, I’m lowering my Buy Below Price on Cognizant Technology Solutions to $56 per share.

In last week’s issue, I talked about how Wabtec (WAB) apparently had approval for its merger with Faiveley. This week, the EU made it official. That’s very good to see. Shares of WAB have been trending higher since the summer. This week, I’m lifting my Buy Below on Wabtec to $87 per share.

Bed Bath & Beyond (BBBY) is apparently trying to move beyond the coupon. The home-furnishings stock is well known for its coupons, but that’s been squeezing margins in recent quarters. BBBY has started testing a program where, for $29 a year, shoppers get a 20% discount, plus free shipping. If this sounds a bit like Amazon Prime, that’s not a coincidence. The new program is called Beyond+. I expect to see it rolled out for everyone soon.

Next Friday, Wells Fargo (WFC) is due to report Q3 earnings. Obviously, any announcement will be overshadowed by the terrible cross-selling scandal. I’ll repeat my desire to see John Stumpf step down. As bad as the fine is, it’s barely a speck in WFC’s overall profits. For the last 13 quarters, Wells has reported a profit between 97 cents and $1.05 per share. In all likelihood, they’ll run that to 14 quarters. Wall Street’s consensus is for $1.01 per share. That’s probably on the light side, but not by much. Any report will be bad news for Wells. If they beat earnings, they’re filthy rich. If they miss, they’re incompetent. The good news for investors is that the recent selloff has dropped WFC to a favorable price.

That’s all for now. Earnings season begins next week. Alcoa will be the first to report on Wednesday. Well Fargo reports on Friday. Also on Wednesday, the Fed will release the minutes of its last meeting. This may give us clues as to how many hawks there are inside the FOMC. Then on Friday, we’ll get the retail-sales report for September. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: October 7, 2016

Eddy Elfenbein, October 7th, 2016 at 7:04 amRussia Becomes a Grain Superpower as Wheat Exports Explode

German Industry Output Rises More Than Expected in August

Europe May Finally End Its Painful Embrace of Austerity

Sterling Recoups Some Losses After 10% Plunge

Britain’s Brexit Confusion Abounds as IMF Huddles in Washington

Fed’s Leaning Dovish Again Ahead Of Elections

US Jobs Report Is Expected to Show Solid Gain For September

Snapchat Parent Working on IPO Valuing Firm at $25 Billion or More

After 91 Years, Ford’s Australian Car Production Line Ends

Mars to Buy Out Buffett to Take Full Control of Wrigley

Samsung Shareholders Shrug Off Galaxy Note 7 Smartphone Recall

VW Has No Plans to Sell Brands, Raise Capital: Boersen-Zeitung

Roger Nusbaum: Can You Rationally Process Market Events?

Jeff Miller: Stock Exchange: BBD, TAN, FSLR, APD, and AAP All Deserve Consideration

Be sure to follow me on Twitter.

-

Morning News: October 6, 2016

Eddy Elfenbein, October 6th, 2016 at 7:14 amUK Treasury Chief to Reassure NY Bankers Over London Future

Morocco Puts Itself at Vanguard of Solar Revolution

Venezuela Is Pawning Pieces of Iconic American Brand Citgo to Survive

Gold Loses Shine as Fed Feeling Lift Dollar

What Is A ‘Personal Benefit’ From Insider Trading? Justices Hear Arguments

A Record Number Of The U.S. Billionaires Are Immigrants

Deutsche Bank’s $14 Billion Scare

Twitter’s Fate: Marc Benioff of Salesforce Addresses Acquisition Talk

Uber Slayer: How China’s Didi Beat the Ride-Hailing Superpower

Wal-Mart’s Next Move Against Amazon: More Warehouses, Faster Shipping

Theranos Retreats From Blood Tests

EasyJet Shares Dive as Profits Are Hammered by Brexit and Terrorism Fears

Monsanto, Being Bought by Bayer, Reports Better-Than-Seen Results

Jeff Carter: Barriers to Entry

Be sure to follow me on Twitter.

-

7 Ways to Avoid Financial Stress Over the Holidays

Eddy Elfenbein, October 5th, 2016 at 2:08 pmIn US News and World Report, Simon Constable lists some ways to save cash over the holidays. Here’s a sample:

Leave your credit card at home.

“Spend actual physical cash,” says Eddy Elfenbein, author of the Crossing Wall Street financial blog. “When you are turning over something you can touch, it sends a message to your brain,” he says. “It might sound ridiculous, but it works.” Better still, when the cash is spent, it is spent. It becomes very clear when you have reached your limit. If you allocate $500 for gifts and knick-knacks, call it a day when your stash gets close to zero.

Set a time deadline.

Elfenbein also advocates having a deadline by which point all the shopping should be complete. “Think of gift buying as akin to stock investing, as a business,” he says. “You need a clinical approach.” Setting a time limit is part of that business-like tactic, and helps avoid last-minute impulse purchases. To some people, that method might seem to take the joy out of the season. But when it comes down to it, doing otherwise might cause financial hardship, taking the pleasure out of other parts of your life.

-

Dividend Growth Was Steady in Q3

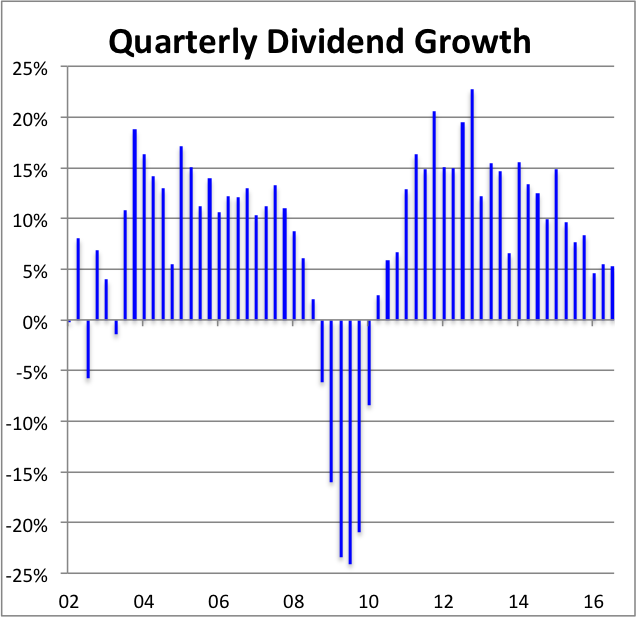

Eddy Elfenbein, October 5th, 2016 at 12:52 pmNow that Q3 is on the books, we can see that dividends continued to grow. Dividends for the S&P 500 rose by 5.24% last quarter. That was the 26th quarter in a row of dividend growth.

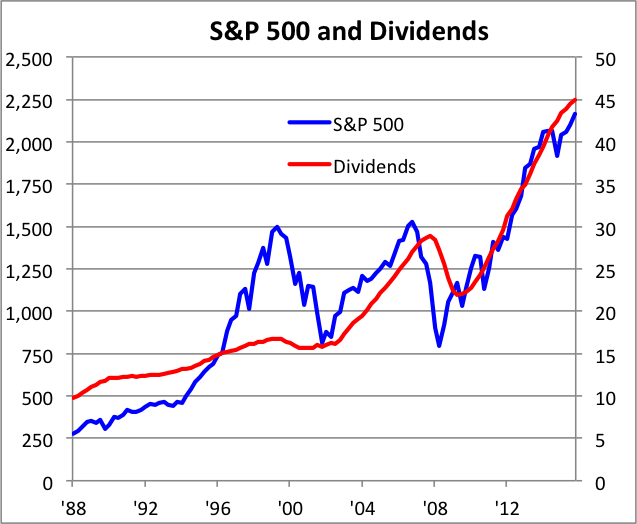

The chart below shows the S&P 500 in blue (left scale) and the trailing four-quarter dividends in red (right scale). I scaled the two lines at a ratio of 50-to-1, which means that whenever the lines cross, the dividend yield is exactly 2%.

Notice how much steadier the red line is compared with the blue. That’s the essence of stock investing — fundamentals are far more rational than prices.

Also notice how closely the market has followed a 2% yield. No, it’s not perfect but over time, it’s done a pretty good job of telling us where stocks ought to be. Considering how simple the dividend yield is as a metric, it’s not too bad.

Here’s a look at the growth rate of dividends. As you can see, dividend growth has decelerated (the rate of growth has slowed).

-

Morning News: October 5, 2016

Eddy Elfenbein, October 5th, 2016 at 7:03 amThreat of ‘Hard Brexit’ Pulls Down Wall Street

Switzerland Asks Malaysia Again for Help With 1MDB

After Report on Yahoo, Tech Firms Deny Scanning Emails for U.S. Government

Prepaid Debit Cards Users Will Get New Federal Protections

Alaska Oil Known Reserves May Have Just Grown 80% on Discovery

Corporate Profits Take Permanent Vacation In Caymans And Bermuda

Twitter Is Expected to Field Bids This Week

AT&T Turns to Media Acquisitions as Its Video Ambitions Grow

Sompo-Endurance: Japan’s Insurance Shopping Spree Restarts With a Bang

Jack Dorsey Is Losing Control of Twitter

Toys “R” Us Sells FAO Schwarz to ThreeSixty Group

McDonald’s Set To Sell Singapore, Malaysian Franchise To Saudi Company

Micron Technology Warns of Tight Memory-Chip Supplies

Howard Lindzon: Stocktoberfest…Flying Stocks but No Flying Cars

Josh Brown: Lincoln and Roosevelt On the Need For a Federal Income Tax

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His