Archive for November, 2016

-

Morning News: November 28, 2016

Eddy Elfenbein, November 28th, 2016 at 6:45 amOil Slip Sends Dollar, Bond Yields Skidding

How Iran, Russia Could Derail Oil-Production Deal

Baker Hughes Shares Set To Rise On GE Deal

In India, Black Money Makes for Bad Policy

What Will Italy’s Referendum Mean for the Euro?

Portuguese Bank Bosses Quit Ahead of $5.4 Billion Rescue

Turkmenistan, Afghanistan Inaugurate New Rail Link

Lufthansa Headed for Worst Pilot Strike on Hard-Line Pay Stance

Samsung to Unveil Shareholder Return Plans Amid Calls To Split Company

Mobile Looms Larger With Holiday Shoppers

Actelion and J&J Are in Talks About Takeover of Swiss Drugmaker

In Europe, Is Uber a Transportation Service or a Digital Platform?

Nintendo’s New Console May Feed Your Nostalgia, If You Can Get One

Cullen Roche: Did the Failure of Orthodox Economics Contribute to Trump’s Win?

Jeff Miller: Are Stocks Ready for Stronger Economic News?

Be sure to follow me on Twitter.

-

Morning News: November 25, 2016

Eddy Elfenbein, November 25th, 2016 at 7:12 amAsia Stocks Post Best Week in Two Months as Weak Yen Buoys Japan

Oil Tanker Analysts Waiting on OPEC Plot Cuts of Their Own

Japan’s MHI U.S. Army Vehicle Suspension May Mark Milestone For Defense Exports

Retailers Vie for Black Friday Dollars

How Britons Are Chasing Black Friday Bargains Online

No Credit History? No Problem. Lenders Are Looking at Your Phone Data

Overtime Rule Is But The Latest Obama Initiative to End in Texas Court

Lufthansa Grounds Long-Haul Flights as Strike Drags On

J&J Makes Takeover Approach for Swiss Drugmaker Actelion

Wells Fargo Asks Court to Force Customers to Arbitration in Fake Accounts Cases

Perils of Climate Change Could Swamp Coastal Real Estate

The Most Expensive Spice In The World

Fake News, Trump and the Pressure on Facebook

Roger Nusbaum: The Art of Doing Nothing

Howard Lindzon: Alt Common Sense…Financial Thinking That May Extend Beyond Markets

Be sure to follow me on Twitter.

-

Morning News: November 24, 2016

Eddy Elfenbein, November 24th, 2016 at 6:30 amAusterity Rules Brexit Britain as Hammond Refuses to Splurge

German Business Confidence Holds at Highest Level Since 2014

Russia to OPEC: Oil Freeze Is All You Get

Rupee Sinks to Record as Foreign Funds Dump Indian Assets on Fed

Latest Fed Discussion Reflects More Confidence in Raising Rates

U.S. Jobless Claims Rose Last Week From Multidecade Low

Mortgage Rates’ Rise Catches Home Buyers – and Lenders – Off Guard

5 Things Retailers and Shoppers Should Expect from Black Friday Weekend

Chinese Travel Giant Snaps Up Skyscanner

Lufthansa Pilot Strike Grounds Hundreds of Flights for Second Day

Deere Shares Leap After Earnings Beat on Pricing, Costs

Eli Lilly’s Experimental Alzheimer’s Drug Fails in Large Trial

Jury Awards Wal-Mart Truck Drivers $55 Million in Backpay

Jeff Carter: The Upstarts Are Coming

Be sure to follow me on Twitter.

-

The Latest Fed Minutes

Eddy Elfenbein, November 23rd, 2016 at 2:31 pmThe Federal Reserve just released the minutes from their November 1-2 meeting. Here’s the most important part.

In their discussion of monetary policy for the period ahead, members judged that the information received since the Committee met in September indicated that the labor market had continued to strengthen and that growth of economic activity had picked up from the modest pace seen in the first half of this year. Although the unemployment rate was little changed in recent months, job gains had been solid. Household spending had been rising moderately but business fixed investment had remained soft. Inflation had increased somewhat since earlier this year but was still below the Committee’s 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation had moved up but remained low; most survey-based measures of longer-term inflation expectations were little changed, on balance, in recent months.

With respect to the economic outlook and its implications for monetary policy, members continued to expect that, with gradual adjustments in the stance of monetary policy, economic activity would expand at a moderate pace and labor market conditions would strengthen somewhat further. Almost all of them continued to judge that near-term risks to the economic outlook were roughly balanced. Members generally observed that labor market conditions had improved appreciably over the past year, a development that was particularly evident in the solid pace of monthly payroll employment gains and the increase in the labor force participation rate. It was noted that allowing the unemployment rate to modestly undershoot its longer-run normal level could foster the return of inflation to the FOMC’s 2 percent objective over the medium term. A few members, however, were concerned that a sizable undershooting of the longer-run normal unemployment rate could necessitate a steep subsequent rise in policy rates, undermining the Committee’s prior communications about its expectations for a gradually rising policy rate or even posing risks to the economic expansion.

Members continued to expect inflation to remain low in the near term, but most anticipated that, with gradual adjustments in the stance of monetary policy, inflation would rise to the Committee’s 2 percent objective over the medium term. Some members observed that the increases in inflation and inflation compensation in recent months were welcome, although a couple of them noted that inflation was still running below the Committee’s objective. Against this backdrop and in light of the current shortfall of inflation from 2 percent, members agreed that they would continue to carefully monitor actual and expected progress toward the Committee’s inflation goal.

After assessing the outlook for economic activity, the labor market, and inflation, as well as the risks around that outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent at this meeting. Members generally agreed that the case for an increase in the policy rate had continued to strengthen. But a majority of members judged that the Committee should, for the time being, await some further evidence of progress toward its objectives of maximum employment and 2 percent inflation before increasing the target range for the federal funds rate. A few members emphasized that a cautious approach to removing accommodation was warranted given the proximity of policy rates to the effective lower bound, as the Committee had more scope to increase policy rates, if necessary, than to reduce them. Two members preferred to raise the target range for the federal funds rate by 25 basis points at this meeting. They saw inflation as close to the 2 percent objective and viewed an increase in the federal funds rate as appropriate at this meeting because they judged that the economy was essentially at maximum employment and that monetary policy was unable to contribute to a permanent further improvement in labor market conditions in these circumstances.

The Committee agreed that, in determining the timing and size of future adjustments to the target range for the federal funds rate, it would assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee expected that economic conditions would evolve in a manner that would warrant only gradual increases in the federal funds rate and that the federal funds rate was likely to remain, for some time, below levels that are expected to prevail in the longer run. However, members emphasized that the actual path of the federal funds rate would depend on the economic outlook as informed by incoming data.

-

Morning News: November 23, 2016

Eddy Elfenbein, November 23rd, 2016 at 7:01 amEurozone PMI Survey Shows Stronger-Than-Expected Business Activity

U.K. Spending Plan, First Since ‘Brexit’ Vote, Is Expected to Shelve Austerity

Fed Minutes to Be Parsed for Insight on Inflation, Jobs

Donald Trump Basically Says Conflicts Of Interest Aren’t Illegal If The President Has Them

Judge Suspends Rule Expanding Overtime for Millions of Workers

A Blade Strikes Steel, and the Blast Shocks a Nation’s Energy System

Samsung Offices Raided by South Korean Prosecutors

Lufthansa Cancels Flights as Pilot Strike Begins

Dr. Pepper, Pepsi Snap Up Alternative Beverage Makers

Hewlett Packard Enterprise Misses its Q4 Revenue Expectations But Beats on Profit

Dollar Tree Gives Upbeat Guidance

Here’s How Bank Regulators May Harden Sanctions After Wells Fargo Scandal

Boeing’s Big Push Into Services Should Bolster Revenues And Returns, Reduce Cyclicality

Q&A With Jack Bogle: ‘We’re in the Middle of a Revolution’

Josh Brown: Chart o’ the Day: The Big Breakout

Be sure to follow me on Twitter.

-

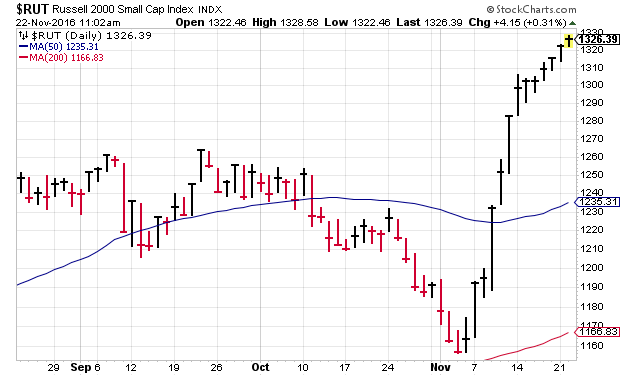

Russell 2000 Up 13 Days in a Row

Eddy Elfenbein, November 22nd, 2016 at 11:10 amThe small-cap Russell 2000 has risen for the last 12 days in a row, and we’re going for #13 today.

From its high in May 2015 to its low in February 2016, the Russell 2000 dropped 27.2%. It’s at a new all-time high.

-

New All-Time High

Eddy Elfenbein, November 22nd, 2016 at 10:46 amThe stock market broke out to a new all-time high this morning. The S&P 500 is above 2,200. The Dow Jones cracked 19,000.

-

Looking at Renaissance Technologies

Eddy Elfenbein, November 22nd, 2016 at 10:05 amKatherine Burton has a fascinating article at Bloomberg looking at Renaissance Technologies, the large hedge fund company which runs the Medallion Fund.

Medallion is open only to Renaissance’s roughly 300 employees, about 90 of whom are Ph.D.s, as well as a select few individuals with deep-rooted connections to the firm.

The fabled fund, known for its intense secrecy, has produced about $55 billion in profit over the last 28 years, according to data compiled by Bloomberg, making it about $10 billion more profitable than funds run by billionaires Ray Dalio and George Soros. What’s more, it did so in a shorter time and with fewer assets under management. The fund almost never loses money. Its biggest drawdown in one five-year period was half a percent.

“Renaissance is the commercial version of the Manhattan Project,” says Andrew Lo, a finance professor at MIT’s Sloan School of Management and chairman of AlphaSimplex, a quant research firm. Lo credits Jim Simons, the 78-year-old mathematician who founded Renaissance in 1982, for bringing so many scientists together. “They are the pinnacle of quant investing. No one else is even close.”

Read the whole thing.

-

Hormel Raises Dividend for 51st Year in a Row

Eddy Elfenbein, November 22nd, 2016 at 9:37 amIn addition to Hormel’s (HRL) earnings report, the company raised its quarterly dividend for the 51st year in a row. The quarterly payout will rise 17% from 14.5 cents to 17 cents per share. That brings the annual dividend to 68 cents per share. Based on Monday’s close, that works out to a yield of nearly 2% exactly.

-

Hormel Foods Earns 45 Cents per Share

Eddy Elfenbein, November 22nd, 2016 at 9:28 amThis morning Hormel Foods (HRL) reported fiscal Q4 earnings of 45 cents per share. That matched Wall Street’s estimates. That’s up 22% over last year. Quarterly revenues rose 9% to $2.63 billion which just barely beat estimates.

“We had a strong finish to fiscal 2016, achieving record earnings for the fourteenth consecutive quarter,” said Jim Snee, president and chief executive officer. “Three of our five business segments delivered sales, volume, and earnings growth, again demonstrating our balanced business model. Refrigerated Foods and Jennie-O Turkey Store both had excellent quarters with growth coming from value-added, branded products and improved market conditions. Grocery Products enjoyed a strong quarter aided by the inclusion of the JUSTIN’S® specialty nut butter business in addition to strong results from SPAM® luncheon meat and SKIPPY® peanut butter,” Snee said.

“Specialty Foods sales declined, primarily due to the divestiture of Diamond Crystal Brands in May, while sales of MUSCLE MILK® protein products were strong,” mentioned Snee. “Specialty Foods earnings decreased primarily due to increased advertising. Our International segment had a tough quarter as the team continues to work through challenging market conditions in China.”

For the year, Hormel earned $1.64 per share compared with $1.32 last year. Hormel also gave 2017 guidance of $1.68 to $1.74 per share. Wall Street had been expecting $1.68 per share.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His