Archive for February, 2017

-

Morning News: February 8, 2017

Eddy Elfenbein, February 8th, 2017 at 7:09 amIMF Revives Greek Euro-Exit Warning Amid Deadlocked Bailout Talks

Bonds Face Worst Loss Since 2013 as India Signals End to Easing

Chinese FX Reserve Crosses Risky Line in Sand

Oil Prices Fall On Bloated U.S. Fuel Inventories, Stalling China Demand

Saudi Aramco Picks Moelis to Advise on Biggest IPO

Dodd-Frank Rollback May Fall Short of G.O.P. Hopes

Why Silicon Valley Wouldn’t Work Without Immigrants

German Automakers Step Up to Silicon Valley Challenge

Why Some Investors May Boycott Snapchat’s IPO

Maersk Slumps as It Unveils Second Loss Since World War II

Japan’s Sharp May Begin Construction on $7 Billion Plant Before June 30

This Japanese Billionaire CEO Expects to Benefit from Trump’s Deregulation

Oreo Maker Mondelez’s Sales, Profit Miss Estimates

Jeff Carter: The Series B Investor

Howard Lindzon: The White House is Spamming Me and Apple is Planning on Leaving Planet Earth

Be sure to follow me on Twitter.

-

Should the S&P’s Quiet Streak Affect Your Investing Strategy?

Eddy Elfenbein, February 7th, 2017 at 7:09 pm -

Apple Surges to Two-Year High

Eddy Elfenbein, February 7th, 2017 at 3:54 pmI was on CNBC’s “Trading Nation” this afternoon. True story. I was in the green room at the DC studio. I heard a voice behind me say, “nice tie.” It was Howard Dean.

I said, “it’s from Vermont!”

He said, “really?”

I told him I was kidding. He said it didn’t look like a Vermont tie.

Anyway, here’s my tie and me on Apple.

-

IntercontinentalExchange Beats and Raises Dividend

Eddy Elfenbein, February 7th, 2017 at 11:21 amGood news this morning from IntercontinentalExchange (ICE). The stock exchange operator reported Q4 earnings of 71 cents per share, which was two cents better than estimates. Revenues rose 30.1% to $1.14 billion, which matched estimates.

“Amidst a volatile and dynamic environment, we delivered our eleventh consecutive year of record revenue,” said ICE Chairman and CEO Jeffrey C. Sprecher. “Despite the challenges of market volatility driven by geopolitics, we achieved our objectives by working closely with our customers across trading, risk management and data to again deliver strong revenue growth, margin expansion and double-digit profit increases. We are excited about collaborating with our customers in 2017 given the range of ways we are working to serve their evolving trading, listing, data and risk management needs.”

Scott A. Hill, ICE CFO, added: “In the first year of our integration of Interactive Data, we surpassed our synergy target and met our ambitious revenue growth target while expanding margins. We also generated record operating cash flow of $2.1 billion in 2016, which enabled us to reduce our debt by approximately $1 billion, announce our third double digit increase in our dividend, and increase our share repurchases for 2017. Our strategy, execution, and disciplined capital allocation has led to significant value creation and future growth opportunities.”

ICE also raised their quarterly dividend from 17 to 20 cents per share. For 2017, ICE sees revenues adjusted for currency rising by 6%.

-

Morning News: February 7, 2017

Eddy Elfenbein, February 7th, 2017 at 6:57 amEuropean Central Bank to Trump: ‘We Are Not Currency Manipulators’

Greek Two-Year Yields Approach 10% Amid IMF Standoff With EU

Euro, European Bonds Unnerved By French Political Jitters

China Jan FX Reserves Fall Below $3 Trillion For First Time In Nearly 6 Years

Wall Street Is Confused By President Trump’s Memo on the Broker Advice Rule

Trump’s H1-B Visa Crackdown Threatens Cutting-Edge U.S. Medicine

Offshore Wind Moves Into Energy’s Mainstream

Honda and Hitachi Are Forming an Electric Vehicle Motor Company

BP Misses Fourth Quarter Profit Estimate as Refining Margins Offset Higher Oil Prices

Tyson Reveals Subpoena Linked To Alleged Price Fixing

Rio Gifts India Diamond Mine to Madhya Pradesh Government

Uber Hires Veteran NASA Engineer to Develop Flying Cars

Snapchat Thinks Its Ads Are Better Than TV’s — Here’s Why

Josh Brown: The Riskalyze Report: The Untold Story of 2017 So Far

Roger Nusbaum: A Job Report For Everybody!

Be sure to follow me on Twitter.

-

HBO’s Warren Buffett Documentary

Eddy Elfenbein, February 6th, 2017 at 3:32 pm -

34 Day Streak of Less than 1% Ranges

Eddy Elfenbein, February 6th, 2017 at 12:00 pmThe S&P 500 has gone 34 days in a row with the distance between the daily high and low being less than 1%.

This looks to be the longest such streak in 40 years.

-

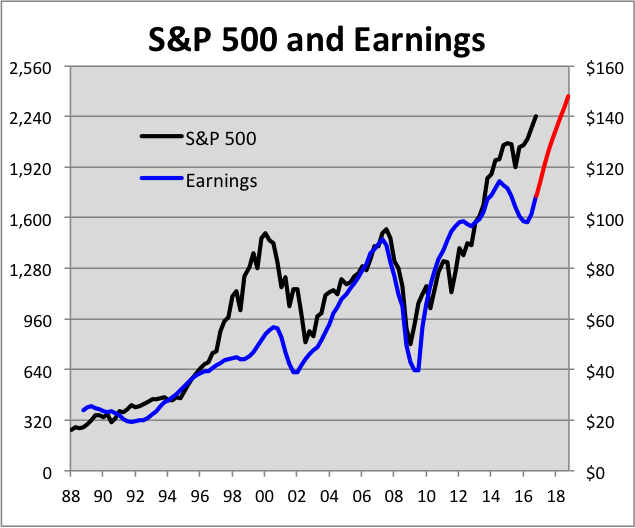

2018 Earnings Estimate = $147.98

Eddy Elfenbein, February 6th, 2017 at 11:18 amI see that S&P has posted its first operating earnings estimate for 2018. The figure is $147.98. That’s adjusted to the index so the S&P 500 is currently going for about 15.5 times next year’s earnings estimate.

That estimate is almost certainly too high, and I expect to see it come down over the next two years. How far it will fall is still an open question.

Here’s a look at the S&P 500 (in black, left scale), along with its operating earnings (in blue, right scale). I’ve put the estimated part in red. The two lines are scaled at a ratio of 16-to-1. That means whenever the lines cross, the S&P 500 is going for 16 times earnings. Please note that I’m not saying 16 P/E is fair value. It’s just that the chart looks best that way.

You can see that the “earnings recession” of 2014-15 doesn’t appear to be that big even though it scared a lot of folks at the time. The stock market, rightly, wasn’t fazed. What’s interesting is that the estimates foresee a robust earnings recovery this year and next. In fact, the stock market has already priced much of that in.

If the stock market were to hit 16 times 2018 earnings (meaning, the black line meets the red line by year-end 2018), that’s growth of about 3% over nearly two years.

-

“How One Blogger Blew Up the Way ETFs Work”

Eddy Elfenbein, February 6th, 2017 at 9:28 amVery nice article about me by Jeff Reeves, Executive Editor of InvestorPlace.com.

———————————————————

Last September, Eddy Elfenbein made a remarkable transformation. He went from being a blogger over at his site Crossing Wall Street to being a real-life portfolio manager.

“I never even thought it was possible. I guess there were more people out there who felt betrayed by traditional Wall Street,” Elfenbein told me earlier this week.

I’ve known Eddy for almost a decade now, and I’ve always respected his long-term investing approach and down-to earth writing style. He’s always been an advocate for the little guy.

But what’s really interesting about his new exchange-traded fund, the AdvisorShares Focused Equity ETF (NYSEARCA:CWS), is how it looks to upend how Americans go about investing altogether.

For one, CWS uses an innovative “fulcrum fee.” So far, it’s the only ETF among several thousands that uses one. A fulcrum fee means that Elfenbein gets a bonus if CWS beats the S&P 500, but if he loses to the market, then the fund’s investors get a savings. “Wall Street really wants my scalp for that one,” Elfenbein laughs. “It breaks the unspoken rule, ‘you win or lose, we always win,’ that’s standard operating procedure on the Street.”

Elfenbein said he was influenced by Nassim Taleb’s concept of having “skin in the game.”

“I feel that people who invest in CWS are my partners, and they should be treated as such. If we do well, then we all do well,” he said.

That’s an idea long overdue.

As the “Focused Equity” name suggests, CWS is kept impressively lean, with a portfolio of just 25 stocks. CWS also has radical approach to trading—it doesn’t do any. The 25 stocks are bought at the start of each year, and they’re held for the next 12 months. Elfenbein explains, “unless there’s a merger, our rule is no trading. Period.”

The fund’s strategy is simple—buy and hold smaller, overlooked companies that have well-defined market niches. For example, CWS owns Heico Corp (NYSE:HEI), a small-cap firm that makes hard-to-find replacement parts for the aircraft industry. Elfenbein says, “HEICO has a great business. The FAA regs say you have to own some very particular part. Well, HEICO can probably make a cheaper version for you.”

Elfenbein has an enviable track record. Since he started blogging at Crossing Wall Street in 2005, his yearly Buy List has gained nearly 170%, well ahead of the S&P 500. The new ETF is designed to track the Buy List step for step. “So many people asked me how they could invest in the Buy List, so we thought, ‘hey, let’s build an ETF around it.’ ”

Elfenbein was one of the first to break onto the scene of stock blogging. Over the years, he’s built an impressive following on his blog and on Twitter (@EddyElfenbein). In fact, in what most certainly must be a Wall Street first, the fund’s sticker symbol (CWS) is based of the name of Elfenbein’s blog, Crossing Wall Street. “I never had to choose a ticker symbol before. Thankfully, the Chicago White Sox hadn’t beaten me to the punch.”

Baseball aside, what makes CWS truly revolutionary is that you can easily follow the portfolio manager’s thoughts on the market. Where hedge funds zealously keep their portfolio moves secret, Elfenbein’s are perfectly transparent. “You’re flying along next to me in the captain’s chair, and you can see exactly what’s going in.”

I have high hopes for Elfenbein’s fund, and expect to see more like it in the near future. My reasoning is simple. Since the financial crisis roiled the global economy, there’s been an erosion of investor confidence in Wall Street as an institution. The public is suspicious of both big banks and big government.

As a result, investors are taking back control. They’re demanding transparency. They’re demanding “skin in the game.” They’re demanding accountability. Funds like CWS fit the bill.

I asked Elfenbein if he has any reservations about going from a lowly blogger to an actual Wall Street portfolio manager. “Not really, but my dad told me that it’s a good thing I never blogged about MMA.”

-

14 Stocks Have Created 20% of the Stock Market’s Gain Since 1924

Eddy Elfenbein, February 6th, 2017 at 9:20 amThis is an amazing stat I found via Lee Jackson. Just 14 stocks have created 20% of the stock market’s gain since 1924. The 14 stocks are:

1. Exxon Mobil Corp. (XOM)

2. Apple Inc. (AAPL)

3. General Electric Co. (GE)

4. Microsoft Corp. (MSFT)

5. International Business Machines Corp. (IBM)

6. Altria Inc. (MO)

7. General Motors Co. (GM)

8. Johnson & Johnson (JNJ)

9. Wal-Mart Stores Inc. (WMT)

10. Procter & Gamble Co. (PG)

11. Chevron Inc. (CVX)

12. Coca-Cola Co. (KO)

13. AT&T Inc. (T)

14. Amazon.com Inc. (AMZN)

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His