Archive for June, 2017

-

Morning News: June 12, 2017

Eddy Elfenbein, June 12th, 2017 at 6:53 amPreparing for `Brexit,’ Britons Face Economic Pinch at Home

This Guy Is Trying to Cure Hong Kong’s Meat Addiction

Tech Selloff Spreads After Friday’s Rout

America’s Stubborn Oil-Supply Glut Catches Funds Off Guard

Apple Is Making Old iPhones New Again to Win India

German Grocery Chain Aldi to Invest $3.4 Billion to Expand U.S. Stores

Culture Clash at a Chinese-Owned Plant in Ohio

JLR Unit Invests $25 Million in Lyft to Help Develop Self-Driving Cars

Uber Board Adopts All Recommendations From Eric Holder Investigation

Uber Weighs Leave of Absence for Chief Executive

Musk’s SpaceX Joins the Military

Fujifilm-Xerox Venture Ousts Executives Over Accounting Trouble

Takata Recommends Re-Electing Board as Search For Rescue Deal Drags On

Cullen Roche: Your Best Investment

Jeff Miller: Is It Time For New Leadership?

Be sure to follow me on Twitter.

-

CWS Market Review – June 9, 2017

Eddy Elfenbein, June 9th, 2017 at 5:08 am“It’s human nature to find patterns where there are none and to find skill where luck is a more likely explanation.” – William Bernstein

Next week is the big Federal Reserve meeting. Wall Street has already convinced itself that the central bank will again raise interest rates. I’m afraid they’re right. As I’ve said for the past few weeks, I think a rate hike now is a mistake. How big of a mistake is still to be determined. In this issue, I’ll discuss what the Fed’s move means for us and our portfolios.

The good news for us is that the low-volatility rally continues to roll on. In the last 15 trading sessions, the S&P 500 has risen 11 times. The index’s single biggest decline was a mere 0.28% drop. That’s barely a nick. Here’s a great stat I saw from Callie Bost. She noted that since 1990, there have been 15 trading days where the difference between the daily high and low was less than 0.28%. Four of those have come in the last month.

There seems to be an odd paradox. The world appears to grow more volatile while the stock market grows more serene. Or, perhaps this isn’t the paradox it seems. Maybe investors are retreating from news of terrorism and missile tests for the relative comfort of stock investing. Whatever the cause, my top concern is an overly zealous Federal Reserve that looks to contain inflation, which is hardly a problem.

We got a nice earnings report this week from JM Smucker. The jelly people handily beat Wall Street’s estimates thanks to cost-cutting. I’ll have all the details in a bit. I’ll also give you some updates on our Buy List. But first, let’s look at the rate hike that’s almost certainly coming our way next week.

Get Ready for a Fed Rate Hike

On Tuesday and Wednesday of next week, the Federal Reserve gets together for another policy meeting. The two-day affair usually gets a lot of attention because it’s followed by a press conference from Fed Chairwoman Janet Yellen.

Much of Wall Street has this meeting circled on their calendars. They figure that if the Fed is going to strike, it’ll do it in June. At this two-day meeting, the Fed also updates its economic projections. These are more often referred to as “the blue dots” in honor of the Fed’s scatter plots.

Earlier this year, the consensus on the Fed was that it would raise interest rates three times this year plus three more times in 2018 and 2019. I thought this was nuts. I reassured readers that the Fed always starts out sounding as hawkish as it can but then gradually gives way. This time, it hasn’t.

During this cycle, the Fed first raised rates in December 2015. They followed that up with another raise in December 2016, and again in March 2017. Traders in the futures market think there’s a 93.5% chance that the Fed will hike next week. If they’re right, that would move the target for the Fed funds rates from 1% to 1.25%.

What about after that? Traders see the Fed standing pat for a few months. I think that’s right. But by the December meeting, another rate hike is in play. Right now, the odds are very nearly even money for a December hike.

I’ll briefly restate my opposition. The Fed should only move once there are signs that inflation is heating up. Those signs aren’t here yet. The commodity markets aren’t rallying. Oil has been falling lately. The latest CPI reports have been very tame. We’ll get the May CPI report on Wednesday, the morning of the Fed’s announcement.

Last week’s employment report was not terribly strong. The U.S. economy created just 138,000 net new jobs. Economists had been expecting 185,000. The numbers for March and April were revised lower. The growth in wages is actually decelerating slightly. The yearly growth number fell from 2.51% in April to 2.46% for May.

I don’t want to sound overly alarmist. There have been improvements in the economy. The last earnings season was quite decent. But as far as interest rates go, I think the Fed needs more time. I’m particularly concerned to see long-term interest fall. After the election, long-term yields soared on the prospects of greater economic growth. To be fair, yields at the long end had been rising since the summer.

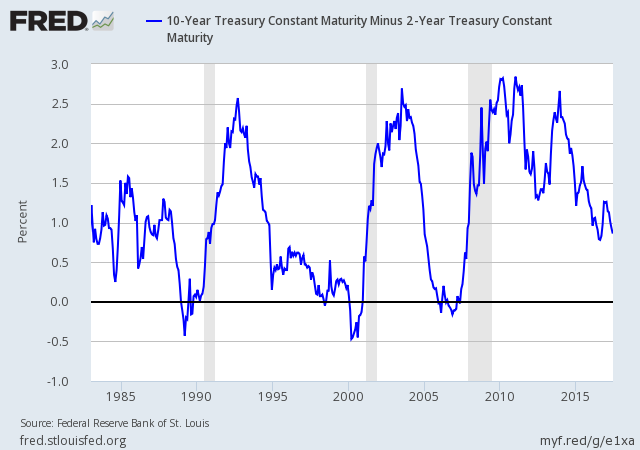

We heard a lot about the Trump Trade, but that started to unravel in December. Three months ago, the 10-year Treasury was yielding over 2.6%. Lately, it’s gotten close to 2.1%. If the Fed follows through with its rate hike, the famous Two/Ten Spread will probably fall below 70 basis points. That would be a nine-year low. That’s still not in the danger zone, which is 0.00, but it’s getting close. The hidden story here is that the Fed’s “ceiling” for rate increases is probably a lot lower than folks want to admit.

What effect will the Fed have? Higher short-term rates would come as a relief to many financial stocks. In fact, we saw a nice bounce in Signature Bank (SBNY) on Thursday. At the opposite end, dividend stocks will lose some of their luster. A stock that yields 3% is a wonderful thing in a 0% interest rate world. It becomes gradually less impressive as interest rates climb higher. Now let’s look at our most recent Buy List earnings report.

Smucker Beats Earnings Thanks to Cost-Cutting

On Thursday morning, JM Smucker (SJM) reported fiscal Q4 earnings of $1.80 per share. That was eight cents more than expectations. For the whole fiscal year (ending in April), Smucker made $7.72 per share. Their previous guidance had been for $7.60 to $7.70 per share. In February, the company lowered the top end of its full-year forecast by five cents per share. As it turned out, the original guidance was pretty close to the mark.

“In fiscal 2017, we grew adjusted EPS by 7 percent over the prior year,” said Mark Smucker, Chief Executive Officer. “In the new fiscal year, we continue to execute our strategic plan for sustainable, long-term growth by capitalizing on changes in consumer preferences and the retail environment. We will fuel the momentum of our growth brands like Smucker’s® Uncrustables®, Nature’s Recipe®, and Café Bustelo®, while supporting our base businesses in coffee, peanut butter, pet food, and pet snacks. Accelerated cost savings and expanded capabilities are key components of our multi-dimensional strategy to deliver top- and bottom-line growth and increase shareholder value.”

Now for guidance. For fiscal 2018, Smucker said they expect earnings to range between $7.85 and $8.05 per share. That’s pretty good. Wall Street had been expecting $7.93 per share. They also said they expect net sales to rise by 1%. SJM pegs this year’s free cash flow at $775 million and capital expenditures at $310 million.

This was a good quarter for Smucker, but a lot of the earnings beat was thanks to cost-cutting. Don’t get me wrong—that still counts, but I would have liked to see more top-line growth. You can only cut costs so much.

The shares of SJM gapped up more than 2% at the open, but that didn’t last. By the closing bell, SJM closed at $128.51, for a loss of 1.81%. I should add that there’s a remote possibility that someone big will come along and try to buy SJM out. Smucker remains a buy up to $128 per share.

This earnings report will be our only Buy List earnings report until Q2 earnings season gets going in another five weeks. One outlier is RPM International (RPM). The company ended its fiscal year in May, but it won’t report its Q4 earnings until late July. Now let’s look at some recent news from our Buy List stocks.

Buy List Updates

We’re coming up on the midpoint of the year. In early July, I’ll have a more thorough breakdown of our Buy List’s first-half performance, but for now, I can say that it’s shaping up to be a pretty decent year for us.

Through Thursday, our Buy List is up 10.43% for the year, while the S&P 500 is up by 8.71%. Those numbers don’t include dividends (the Buy List yields a bit less than the S&P 500, but it’s not very much). I’ll include the dividend numbers in our first-half summary.

Our best performer on the year is Cerner (CERN), which is up by 43.78%. Second place is CR Bard (BCR), with a gain of 39.71%. We now have 11 Buy List stocks that are up more than 13% on the year. Six of our stocks are in the red. The biggest loser is Express Scripts (ESRX), which is down 12.25%.

This week, Sherwin-Williams (SHW) finally completed its $11.3 billion acquisition of Valspar. The deal was first announced 15 months ago. The problem was clearing some of the anti-trust hurdles. This is where another one of our Buy List stocks, Axalta Coating Systems (AXTA), came to the rescue. The companies decided to sell off Valspar’s North American Industrial Wood Coatings to Axalta for $420 million in cash. The regulators were cool with that, and it was a done deal.

The combined company will have revenues of about $16 billion. Sherwin said they’ll announce their Q2 earnings on July 20. At that time, they’ll provide guidance for the combined company for Q3 and all of 2017. This week, I’m lifting my Buy Below on Sherwin-Williams to $350 per share.

Intercontinental Exchange (ICE), is holding its first analyst day today, and the stock has been rallying, perhaps in anticipation. This is a good time for ICE to explain itself to the world, because too many investors see ICE as simply a trade-volume based business. In reality, ICE is becoming more dependent on data sales and technology fees. The company, for example, recently bought Bank of America’s index platform. Barron’s rightly said that Intercontinental Exchange is “misunderstood, underappreciated and underowned.” This week, I’m raising my Buy Below on ICE to $66 per share.

Earlier I mentioned that CR Bard (BCR) is our second-biggest gainer this year. As I’m sure you recall, Bard is in the process of being bought out by Becton, Dickinson (BDX). The deal calls for BCR shareholders to get $222.93 per share in cash plus 0.5077 shares of BDX.

The good news is that shares of BDX have been rallying. They’re even higher now than when the deal was announced in April. Going by Thursday’s close, Bard is valued at $320.32 per share. Bard’s actual shares are going for 2% below that. That’s quite natural since there’s a chance the deal could fall apart. I doubt it will happen, but we have to aware of the possibility.

The sizable cash portion of the deal protects Bard shareholders from large swings in BDX’s share price. It’s a relief to see that the market hasn’t turned against BDX for proposing such a large deal. The deal is expected to close this fall. If all goes well, you can expect to see that 2% discount for Bard gradually close.

That’s all for now. The big news next week will be the Federal Reserve meeting on Tuesday and Wednesday. The Fed’s decision will come out at 2 p.m. Wednesday afternoon, and it will be followed by a press conference by Fed Chairwoman Janet Yellen. The Fed will also update its economic projections (i.e. the “blue dots”). That morning, we’ll also get the CPI report for May. I doubt we had much in the way of inflation last month. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 9, 2017

Eddy Elfenbein, June 9th, 2017 at 5:07 amDollar Cleans Up as UK Election Shocks Sterling

Treasuries-Bund Trade Is About to Get Interesting

House Votes to Roll Back Post-2008 Financial Rules

Labor Department’s Fiduciary Rule Takes Effect

SoftBank to Buy Boston Dynamics, Maker of Animal-Like Robots

Verizon’s Oath Isn’t a Big Threat to Google and Facebook, but It Can Still Pay Off

Alibaba Adds $42 Billion in Market Cap on Strong Sales Forecast

Valeant: Another Divestiture At A Fair Price, Situation Remains Uncertain But Not Hopeless

Initial Claims, Unemployment Claims, Remain At US Historical Lows

Not So Fast: Pandora Puts KKR Investment On Hold

Pandora Has Reportedly Closed a Minority Investment Deal With Sirius XM

Matt Zames to Leave JPMorgan Chase, Seeking to Run His Own Business

Saks Owner Hudson’s Bay to Cut 2,000 Jobs as Loss Widens More Than Expected

Joshua Brown: The Most Important 24 Minutes of Your Year

Jeff Miller: Stock Exchange: Buy the Dip (VOYA) or Buy the RIP (DPZ)?

Be sure to follow me on Twitter.

-

Morning News: June 8, 2017

Eddy Elfenbein, June 8th, 2017 at 6:50 amDigging the Graveyard of Oil’s Past

China May Imports, Exports Unexpectedly Speed Up But Seen Fading

Tokyo Nights May Soon Be Lit Up by a Country 1,700 Miles Away

European Central Bank Meeting Focuses on `Forward Guidance’

Rising Industry Output Points To German Economic Upswing

House Poised to Pass Bill Taking Aim at Dodd-Frank Regulations

Senators Challenge Trump Plan to Privatize Air Traffic Control

‘Prime Is The Gateway Drug’: Amazon’s Most Puzzling Move Yet Could Be One Of Its Most Brilliant

Boeing Barrels Ahead on 787 and 777 Cost Reductions

Toshiba Shares Up After Sources Say It Aims to Name Chip Ops Buyer on June 15

Traders Are Cranking Up Their Bets Against Snap

No One Has Ever Made a Corruption Machine Like This One

Howard Lindzon: The Airling Index and 9/11

Michael Batnick: Satisfaction Yield

Ben Carlson: The Pension Fund Private Equity Hail Mary

Be sure to follow me on Twitter.

-

Morning News: June 7, 2017

Eddy Elfenbein, June 7th, 2017 at 7:10 amOECD Warns Protectionist Rhetoric Undermining Investment Rebound

Spain’s Santander Rescues Banco Popular From Collapse

Oil Drops as Industry Data Shows Surge in U.S. Gasoline Supplies

The Head of the U.S. Patent Office Has Abruptly Resigned

Forced Finally To A Binary Labor Interpretation

U.S. Justice Department Opposes Wells Fargo on Whistle-Blower Suit

Electric Car Sales Are Surging, IEA Reports

When Companies Lead on Infrastructure, Taxpayers Often Bear the Costs

Developers Lure Buyers to Cities, Even as Prices Stall

Goldman Sachs Boost Rates For Savers In Bid To Attract Deposits

Pinterest Raises Valuation to $12.3 Billion With New Funding

Uber Fires 20 Amid Investigation Into Workplace Culture

Dish Is Fined $280 Million After Its Telemarketers Called People On ‘Do Not Call’ List

Michael Batnick: Greatest Hits From Michael Mauboussin & Meir Statman

Cullen Roche: 1,000 Years Worth of Market Data

Be sure to follow me on Twitter.

-

Morning News: June 6, 2017

Eddy Elfenbein, June 6th, 2017 at 6:30 amThe World’s $100 Trillion Question: Why Is Inflation So Low?

U.S. Extends Sugar Talks With Mexico as Both Countries Near Deal

White House Formally Backs Plan To Transfer Air Traffic Control System To Private Corporation

Supreme Court Disgorges the SEC

Trump’s Paris Pull-Out Can’t Stop The Renewables Revolution

Trump Organization to Go Budget Friendly With `American Idea’ Hotel Chain

Amazon Offers Prime Discount To Those On Government Benefits

Hedge Fund Guys Think They’re Smart. Let’s See.

J.Crew’s Mickey Drexler Confesses: I Underestimated How Tech Would Upend Retail

Alphabet Shares Follow in Amazon’s Footsteps and Top $1,000

The Video Game Business Is Finally Adopting The Netflix Model

Led by Rachel Maddow, MSNBC Surges to Unfamiliar Spot: No. 1 in Prime Time

Josh Brown: QOTD: You Will Always Find What You Need

Roger Nusbaum: We’ll Always Have Paris

Jeff Carter: One Bad Pitch Doesn’t Mean The End

Be sure to follow me on Twitter.

-

Morning News: June 5, 2017

Eddy Elfenbein, June 5th, 2017 at 7:00 amSaudi-Led Alliance Cuts Ties With Qatar

World Bank Still Sees Global Growth Picking Up Amid Policy Risks

JPMorgan’s Dimon Aiming for China Venture With Full Control

Solar Energy Boom Turns to Bust for Indian Manufacturers

The Bloody Fight for ETF Scraps Is About to Get Even Worse

Toyota Sold All Its Tesla Stock, And Plans To Ignite 2020 Games By Flying Car

Uber’s Surge Pricing Tactic During London Bridge Terror Attack Ignites Social Media Outrage

G.M. Wants to Drive the Future of Cars That Drive Themselves

Apple Services Unlikely To Offset Soft iPhone Sales

Apple Piles On the Features, and Users Say `Enough!’

Herbalife: Approaching Record Highs, But Should It Be?

Oculus Founder Plots a Comeback With a Virtual Border Wall

Blackstone Offers $2 Billion for Finnish Real Estate Firm Sponda

Jeff Miller: Is the Bond Market Sending a Message for Stocks?

Michael Batnick: These Are The Goods

Be sure to follow me on Twitter.

-

My NFP +138,000

Eddy Elfenbein, June 2nd, 2017 at 8:32 amThe May jobs report is out. The U.S. economy created 138,000 net new jobs last month. The unemployment rate is down to 4.3%.

The numbers for March and April were revised lower. March by 29,000 and April by 66,000.

The unemployment rate is now at its lowest since March 2001. The unemployment rate is lower now than at any time from March 1970 to Feb 1999.

-

Morning News: June 2, 2017

Eddy Elfenbein, June 2nd, 2017 at 7:12 amBrazil Exits Recession With Fastest Growth Rate Since 2013

Trump’s Paris Exit Leaves Him Isolated From C-Suites to Capitals

Oil Slides as U.S. Climate Withdrawal Compounds Glut Concerns

Mnuchin and Mulvaney at Odds as Trump Confronts Debt Default

Dollar Gains as ADP Suggests Strength Before May Jobs Report

Trump Talks Tough on Trade, But His Team Is Treading Lightly

Goldman Sachs Applies for Saudi Equities Trading License

Walmart is Asking Employees to Deliver Packages on Their Way Home From Work

Uber’s CFO Search May Prove Difficult

British Airways I.T. Outage Caused By Contractor Who Switched Off Power

Blue Apron, a Meal Delivery Service, Files for Public Offering

Linde Shares Seen Up After Boards Agree Praxair Merger

The Doughnut Dilemma: What The Office Pastry Teaches About Behavioral Economics

Howard Lindzon: Nasdaq 10,000 and What Could Go Wrong?

Jeff Miller: How to Deal With a Losing Trade

Be sure to follow me on Twitter.

-

Update from Manila

Eddy Elfenbein, June 1st, 2017 at 4:08 pmI decided to head off to the Philippines for a few days of vacation. By now, you’ve probably heard of the awful attack at Resorts World Manila. That’s a big complex right next to the airport which is about five miles from where I am. Let me assure you that I’m safe and sound. I didn’t even know about the attack until I heard about it on Twitter.

The island of Mindanao in the southern Philippines has been under attack from ISIS. Manila is a long way from there but it seems ISIS wants to cause as much mayhem as possible.

Posting will be light but I wanted to let everyone know that I’m doing fine.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His