Archive for July, 2017

-

IBM Saves the Dow

Eddy Elfenbein, July 26th, 2017 at 11:31 amThe Dow Industrials is a price-weighted index. That means it’s calculated by adding up all 30 stocks in the index and dividing by a divisor. The divisor is carried each day in the Wall Street Journal.

The current divisor is 0.14602128057775. To make it easier, every $1 in a Dow stock works out to about 6.848 Dow points.

This morning, Boeing (BA), a Dow stock, is up about 8% which is around $16 per share. At the time I checked, BA was responsible for 115 points in today’s 117-point Dow rally. Boeing is now the highest-priced stock in the Dow which means it has the largest weighting.

But Boeing is far from being the largest stock in the index by market cap. At last check, BA comes in 21st out of 30 in terms of market value. The Dow Industrials gets a lot of attention from the media, but it’s an anachronism. That’s why I prefer to follow the S&P 500.

-

Morning News: July 26, 2017

Eddy Elfenbein, July 26th, 2017 at 7:07 amThe Brexit Slowdown Continues — Britain’s Economy Grew Just 0.3% In The Second Quarter

U.K. to Ban Fossil-Fuel Cars by 2040 as Automakers Race to Adapt

Dollar Rises From 13-Month Low Before Fed Decision

US Regulators Just Dealt a Blow to the Most-Hyped Area in Tech Investing Right Now

AMD Earnings Give Investors What They Wanted — Now It Must Deliver on Servers

Uber’s Latest Bid to Win Over Drivers: 24/7 Phone Support

Hyundai Saw Its Net Profit Slashed, and it Has The US and China to Blame

AT&T’s TV Drain Reveals Its Merger Motive

Viacom CEO Considers Costly Scripps Networks Acquisition

Taco Bell is Launching a Brilliant New Lyft Feature Called ‘Taco Mode’

Snopes, in Heated Legal Battle, Asks Readers for Money to Survive

Joshua Brown: You Have Five Choices

Jeff Carter: Bitcoin Is A Teeny Market

Howard Lindzon: Buying Time and the Road Kills

Be sure to follow me on Twitter.

-

Express Scripts Earns $1.73 per Share

Eddy Elfenbein, July 25th, 2017 at 4:11 pmAfter the closing bell, Express Scripts (ESRX) reported Q2 earnings of $1.73 per share. That beat Wall Street’s consensus by two cents per share. Earlier Express told us to expect Q2 results to range between $1.70 and $1.74 per share.

Here are some highlights:

Adjusted claims of 350.0 million, flat

GAAP net income of $801.8 million, up 11%

GAAP earnings per diluted share of $1.37, up 21%

EBITDA of $1,824.1 million, up 1%

EBITDA per adjusted claim of $5.21, up 1%

Adjusted net income of $1,011.6 million, up 1%

Adjusted earnings per diluted share of $1.73, up 10%

Net cash flow provided by operating activities of $1,081.2 million, up 146%“We leverage the power and potential of our independent model to succeed in the areas of healthcare that patients and clients value most,” said Tim Wentworth, President and CEO, Express Scripts. “In just the past quarter, we launched two new ways to deliver more value directly to members at the point of sale, increased our ability to lower drug prices via a new group purchasing organization agreement, acquired a leading workers’ compensation benefits company, and introduced novel SafeGuardRx solutions to address complex, expensive illnesses. These are just a few highlights, but they underline the unique value of our flexibility, innovation and independence: only Express Scripts can partner with anyone in the supply chain at any time to deliver better value to patients, clients and shareholders.”

“We are currently developing a multi-year, enterprise-wide initiative to transform our organization by the end of 2021,” added Eric Slusser, Chief Financial Officer. “We are investing to deliver an improved experience with better engagement and greater efficiency, which will evolve the way we do business with patients, providers and our clients. Based on our work to date, we estimate the initiative will deliver savings of approximately $550 million to $600 million annually by 2021. This initiative will also allow us to continue tackling the challenges plan sponsors face in an increasingly complex healthcare environment with an industry-leading cost position,” said Slusser.

And now for guidance:

The Company increased its guidance for 2017 adjusted earnings per diluted share from a range of $6.90 to $7.04 to a range of $6.95 to $7.05, which represents growth of 10% over 2016 adjusted earnings per diluted share results at the mid-point of the range.

The Company expects total adjusted claims for the third quarter of 2017 to be in the range of 340 million to 350 million. Adjusted earnings per diluted share for the third quarter of 2017 is estimated to be in the range of $1.88 to $1.92, which represents growth of 8% to 10% over the third quarter of 2016.

Wall Street had been expecting $1.89 per share for Q3, and $6.97 per share for all of 2017.

-

Is it Time for Bitcoin?

Eddy Elfenbein, July 25th, 2017 at 12:40 pmFrom MarketWatch:

Cullen Roche of Orcam Financial Group echoed much of Richter’s view.

“As a speculative instrument it’s an interesting bet on its widespread acceptance as a medium of exchange, but we should be very clear that we are speculating when we buy bitcoin,” he said. “In this sense it is more akin to something you might gamble on as opposed to something you prudently invest in. Not an inappropriate endeavor, but probably not one that should be an excessive portion of anyone’s asset allocation.”

Eddy Elfenbein of the Crossing Wall Street blog agreed on the idea of rolling the dice, and actually didn’t rule it out for himself.

“I’d buy bitcoin as a fun bet, but it still has a long way to go,” he said. “If a currency moves 15% a day, then it’s not a currency.”

-

Wabtec Misses and Guides Lower

Eddy Elfenbein, July 25th, 2017 at 10:33 amThis morning, Wabtec (WAB) became our latest stock to report earnings and it turned out to be our latest disappointment. For Q2, the freight services company earned 75 cents per share which included five cents per share due to the “net effect of the restructuring and transaction expenses and the interest expense benefit.” Wall Street had been expecting 94 cents per share.

For all of 2017, Wabtec now expects sales of $3.85 billion and EPS between $3.55 and $3.70. That’s a reduction from their April forecast of $3.95 to $4.15 per share.

Raymond T. Betler, Wabtec’s president and chief executive officer, said: “We remain confident in our future growth opportunities, even as we manage aggressively through our short-term challenges. In transit, we have a record and growing backlog, with significant projects in all major markets around the world, and we are making meaningful progress in the Faiveley integration, with margins improving during the year. In freight, our backlog has now increased for three consecutive quarters, and demand appears to be stable in our key markets. Finally, we continue to invest in our balanced growth strategies, including new products and acquisitions, around the world.”

The shares are down about 11% this morning.

-

Morning News: July 25, 2017

Eddy Elfenbein, July 25th, 2017 at 7:04 amFor China’s Global Ambitions, ‘Iran Is at the Center of Everything’

German Business Climate Hits Record as Economy Proves Robust

Alphabet Shares Tank as Wall Street Freaks Over Rising Traffic Costs

Michael Kors to Buy Jimmy Choo in $1.2 Billion Deal

LedgerX Just Gave Us Another Way to Bet Against Bitcoin

Halliburton Sees Drillers `Tap the Brakes’ on Shale Boom

SoftBank Reportedly Seeking Uber Stake Valued at Billions

Bill Gates Backs Uber Freight Rival

Johnson & Johnson’s Pricey Best-Selling Drug Will Have to Face a 35% Cheaper Rival

Sports Retailer Stocks Fall as Hibbett Posts Gloomy Outlook

The Chipotle Corporate Sabotage Theory Returns

Stada Board Recommends Acceptance of Improved Takeover Bid

DuPont Beats on Strong Demand in Agriculture Business

Michael Batnick: The Topic Is Gold

Roger Nusbaum: Markets Continue to Melt (Higher!)

Be sure to follow me on Twitter.

-

RPM International Earned $1.02 per Share

Eddy Elfenbein, July 24th, 2017 at 1:04 pmThis morning, RPM International (RPM) had a dud of an earnings report. The company made $1.02 per share for its fiscal Q4 which was 16 cents below Wall Street’s consensus. Quarterly net sales rose 4.6% to $1.49 billion.

“We took additional cost reduction measures in the fourth quarter to position RPM to a return to double-digit earnings growth in fiscal 2018. We were pleased with solid organic growth in both our industrial and specialty segments during the fourth quarter, which we expect to continue as we enter into fiscal 2018. Organic growth across our consumer businesses was down 1.0%, principally due to lower results at our Kirker nail enamel business, the negative impact of a very rainy start to the spring season for home improvement sales and a difficult comparison to our prior-year quarter in which organic growth across RPM’s core consumer product lines increased 9.9%,” stated Frank C. Sullivan, RPM chairman and chief executive officer.

“The consolidated revenue increase, particularly in a growth-challenged economic environment, was mitigated somewhat on leverage to the bottom line as a result of higher raw material costs during the quarter, including shortages and availability issues in a couple of key product lines. Also, a significantly higher tax rate in the fourth quarter this year versus last year reduced earnings per share on a comparative basis by $0.12.

Now for guidance:

“Based upon the growth expectations above, we anticipate earnings per share for fiscal 2018 to be in the range of $2.85 to $2.95 per share. Throughout the year, it will be important to keep in mind the variability of our year-over-year quarterly comparisons, in particular, our tax rate is estimated to be in line with fiscal 2017, but may fluctuate quarter-to-quarter. Related to this, in the first quarter of last year we had a very favorable tax adjustment, which is not expected to repeat, and which will negatively impact the first quarter of fiscal 2018 by approximately $0.03 per share. As outlined above, in the fiscal 2017 third quarter we identified, but did not adjust out, roughly $0.08 per share of non-operating, one-time items. These items should be added back to the fiscal 2017 base results for our fiscal 2018 third quarter. Given the higher-than-normal tax rate in the fiscal 2017 fourth quarter, we would anticipate $0.05 per share benefit in the fiscal 2018 fourth quarter.

“For the first quarter of fiscal 2018, in addition to the higher tax rate mentioned above, we expect higher raw material costs experienced in the fourth quarter to continue through the first quarter, as well as continued foreign currency headwinds, both translational and transactional. Also, most of our operating groups were on plan in the first quarter of fiscal 2017, before their results began to weaken, and our Brazilian operation benefited in the first quarter last year when Brazil hosted the summer Olympics. As a result, our EPS estimate for the first quarter of fiscal 2018 is $0.83 per share to $0.85 per share.

Wall Street had been expecting 89 cents per share for this quarter, and $3.00 per share for the year. Shares of RPM are down about 7% today.

-

Morning News: July 24, 2017

Eddy Elfenbein, July 24th, 2017 at 7:08 amTraders Fear Hard Landing in Emerging Markets

Oil Rises as Saudi Arabia Pledges Deep Cut to August Exports

Euro Zone Business Growth Slows at Start of Second Half

IMF Cuts U.K. Forecast as Brexit Inflation Knocks Consumers

IMF Sees U.S. Fading as Global Growth Engine

U.S. Inflation Remains Low, and That’s a Problem

U.S. Foresaw Better Return in Seizing Fannie and Freddie Profits

Sensing Weakness, Uber’s Asian Rivals Make $2.5 Billion Play

Blackstone Mortgage 7.9% Dividend Yield Is Not Good Enough

Quest for AI Leadership Pushes Microsoft Further Into Chip Development

Samsung Takes Aim at TSMC with Plans to Triple Chip Foundry Market Share

Direct Lending Funds’ Fading All-Weather Appeal

Howard Lindzon: StockTwits Adds Streams and Symbology for 100+ Cryptocurrencies and Tokens

Joshua Brown: Upside Surprises Hit a Five Year High

Ben Carlson: The Game Beyond the Game

Be sure to follow me on Twitter.

-

Three Quick Charts

Eddy Elfenbein, July 22nd, 2017 at 11:15 pmHere are some charts I wanted to show you.

First up, is Moody’s (MCO) recent performance. We got a nice response from the earnings report.

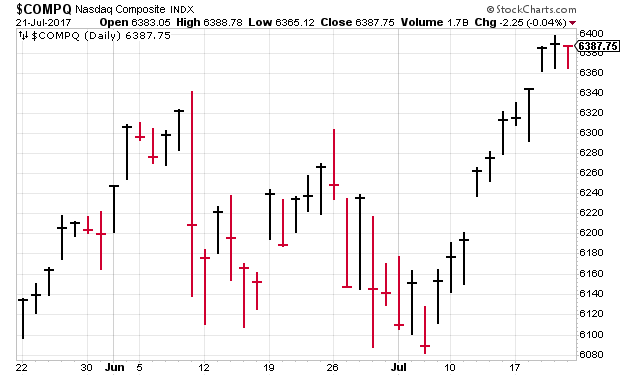

Second up, the Nasdaq Composite just snapped a 10-day winning streak.

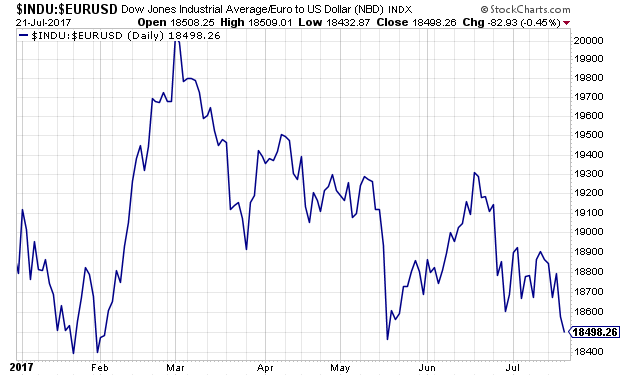

Om CNBC, I mentioned that the Dow is down for the year priced in euros. Here’s the chart:

-

Healthcare Breakout?

Eddy Elfenbein, July 21st, 2017 at 6:27 pm

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His